20161228 IPC產業

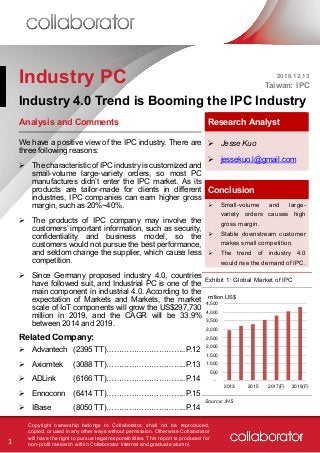

- 1. 1 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Industry PC 2016.12.13 Taiwan: IPC Industry 4.0 Trend is Booming the IPC Industry Analysis and Comments Research Analyst Jesse Kuo jessekuo.l@gmail.com Conclusion Small-volume and large- variety orders causes high gross margin. Stable downstream customer makes small competition. The trend of industry 4.0 would rise the demand of IPC. We have a positive view of the IPC industry. There are three following reasons: The characteristic of IPC industry is customized and small-volume large-variety orders, so most PC manufactures didn’t enter the IPC market. As its products are tailor-made for clients in different industries, IPC companies can earn higher gross margin, such as 20%~40%. The products of IPC company may involve the customers’ important information, such as security, confidentiality and business model, so the customers would not pursue the best performance, and seldom change the supplier, which cause less competition. Since Germany proposed industry 4.0, countries have followed suit, and Industrial PC is one of the main component in industrial 4.0. According to the expectation of Markets and Markets, the market scale of IoT components will grow the US$297,730 million in 2019, and the CAGR will be 33.9% between 2014 and 2019. Exhibit 1: Global Market of IPC Related Company: Advantech Axiomtek ADLink Ennoconn IBase (2395 TT)…………………………..P.12 (3088 TT)…………………………..P.13 (6166 TT)…………………………..P.14 (6414 TT)…………………………..P.15 (8050 TT)…………………………..P.14 Source: IHS - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2013 2015 2017(F) 2019(F) million US$

- 2. 2 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Basic Introduction Different with the high homogeneity of PC, most IPC company have to satisfy customers’ special requirement, such as customized functional specifications, design and services. Therefore, the design and testing of new products may take one or two years. In addition, the solution may involve the customers’ important information, such as security, confidentiality and business model, so the customers would not pursue the best performance, and seldom change the supplier. Once the supplier can satisfy customers’ request, the supplier could continue deliver the products stably, and the period may be 5 year or even more. As its products are tailor-made for clients in different industries, IPC companies can earn higher gross margin, such as 20%~40%. However, in order to deliver the products stably, IPC companies have to prepare lots of inventory, and may even cause overstocked. Because IPC must links and controls the peripherals systems, compatibility and scalability are necessary for IPC. Besides, the application environment may be extreme temperature, humidity, long-term vibration, outdoor and other conditions, so IPC should also be stable and reliable. IPC products usually related to customers’ corporate secretes, so the supplier could continue deliver the products stably. In addition, IPC products are tailor-made. Thus, IPC companies can earn higher gross margin. Exhibit 2: Gross Margin of IPC Companies Source: TEJ 0 5 10 15 20 25 30 35 40 45 50 2011/12/1 2012/12/1 2013/12/1 2014/12/1 2015/12/1 2395 TT (Advantech) 3088 TT (Axiomtek) 6166 TT (ADLink ) 6414 TT (Ennoconn) 8050 TT (IBase) (%)

- 3. 3 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Industry Characteristics Small Intra-industry Competition and High Gross Margin IPC is designed to meet the strict requirements of industrial automation, such as temperature, humidity, dust-proof, fault- tolerant, pressure, continuous power supply system and so on. In order to link many kinds of computer accessories and to fit various operating environment, IPC must be customized according to customer demand and customer orders are small- volume large-variety, which is different with the mass production of PC. In consideration of the economic scale, most PC manufactures didn’t enter the IPC market. Therefore, IPC manufactures could maintain flexible and customized production, and keep high gross margin. Small-volume and Large-variety Orders, Large Fluctuations in Revenue and Stable Chips The characteristic of IPC industry is customized and small- volume large-variety orders, so most PC manufactures didn’t enter the IPC market. Besides, IPC industries’ orders are open bid, so domestic IPC manufactures usually ship their products concentrated within six months, and this would cause larger fluctuations in revenue. Domestic IPC companies’ share capital are usually 500~700 million, and the chips are stable. IPC must be customized according to customer demand and customer orders are small-volume large-variety, which is different with the mass production of PC. Therefore, IPC manufactures could keep high gross margin.

- 4. 4 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Table 1: Difference between Industrial PC and Consumer/Commercial PC Difference Industrial PC Consumer/Commercial PC Market Scale Smaller market scale Larger market scale Price Sensitivity Lower price sensitivity Higher price sensitivity Operating Environment Often in extreme operating environment Often in stable operating environment Product Lifecycle Longer lifecycle Shorter lifecycle Design Patterns Mostly customized Mostly standardized Product Applications Non-commercial and special field Home and office Purchasing Decision Quality, stability, durability price–performance ratio Switching Cost Higher switching cost Lower switching cost Ordering Mode Small-volume Large-variety Large-volume Small-variety Service Quality Higher service quality requirements, and often communicating with customers Standardized product after-sales service Customer Retention Higher customer retention Lower customer retention

- 5. 5 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Product Categories In general, IPC products can be divided to 3 categories, board, subsystems and solutions. Board Board includes single-board computer, embedded computer and some other products. A single-board computer is a motherboard which already has all the feature of a computer, and it can link different peripherals and a variety of professional software. However, the size of single-board computer would be smaller than the size of the motherboard used in PC. Embedded computer can make IPC link more machines, so the size would be smaller. Subsystems Subsystem means a product that combine single-board computer, chassis, power suppliers and other peripheral systems in a workable system, such as industrial servers and workstations. Solutions Solution is an entire system focusing on specific field, including the necessary hardware, software and related peripheral systems. IPC products can be divided to 3 categories: 1. board, 2. subsystems and 3. solutions. Exhibit 3: Industrial Computer Categories Source: stockfeel

- 6. 6 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Upstream& Downstream Companies The supply chain of IPC industry can be divided into upstream, midstream and downstream industries. Except for chassis and some storage devices, most upstream industries are the same as the upstream industries of PC, such as semiconductor, printed circuit board, CPU, chip, hard disk drive, power supplier and other components. In addition, some supplier would establish special departments in order to meet the needs of IPC. The midstream industries are generally means IPC industries, and the products contain input/output devices, single-board computers, barebone computer products, industrial computer products and computer peripheral products. Finally, the downstream industries are System-Provider, dealers and end users. Because most terminal customers are companies and the applications of IPC are usually professional, the quality requirements of IPC are also higher. If exporting to foreign countries, manufactures have to face different habits, and usually entrust to local dealers in order to master demands. Besides, some dealers would increase some software of hardware, and then sell the value-added products to the system-providers or the terminal customers. Most upstream industries are the same as the upstream industries of PC. The midstream industries are generally means IPC industries. Finally, the downstream industries are System- Provider, dealers and end users. Exhibit 4: IPC Industry Chain Source: MIC

- 7. 7 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Future Perspectives - Industry 4.0 Industry 4.0 creates what has been called a "smart factory". In the smart factories, cyber-physical systems monitor physical processes, create a virtual copy of the physical world and make decentralized decisions. Over the IoT, cyber-physical systems communicate and cooperate with each other and with humans in real time. By the Internet of Services, both internal and cross- organizational services are offered and used by participants of the value chain. Four Design Principles in Industry 4.0 These principles support companies in identifying and implementing Industry 4.0 scenarios. Interoperability The ability of machines, devices, sensors, and people to connect and communicate with each other by the Internet of Things (IoT). Information Transparency The ability of information systems to create a virtual copy of the physical world by enriching digital plant models with sensor data. Technical Assistance First, the ability of assistance systems to support humans by aggregating and visualizing information comprehensibly for making informed decisions and solving urgent problems on short notice. Second, the ability of cyber physical systems to physically support humans by conducting a range of tasks that are unpleasant, too exhausting, or unsafe for human workers. Decentralized Decisions The ability of cyber physical systems to make decisions on their own and to perform their tasks as autonomously as possible. Following four principles support companies in identifying and implementing Industry 4.0 scenarios: interoperability, information transparency, technical assistance and decentralized decisions. Exhibit 5: The Industrial Revolution Source: wikipedia

- 8. 8 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Three Aspects form The Heart of Industry 4.0 Integrated Industrial Chain Because a company can combine every function and link the entire hierarchy by IoT, it can vertically integrate the industrial chain. Besides, a company can also link the suppliers, partners, and distributors in the value chain and transfer data among them seamlessly, and integrate the industrial chain horizontally. Full Automatic Processing The products and services to be embedded with custom- designed software, so that they become responsive and interactive, tracking their own activity and its results, along with the activity of other products around them. When captured and analyzed, the data generated by these products and services indicates how well they are functioning and how they are used. Zero Inventory Closer interaction with customers, enabled by these new processes, products, and services. Industry 4.0 makes the value chain more responsive, allowing industrial manufacturers to reach end customers more directly and tailor their business models accordingly. Industry 4.0 would cause integrated industrial chain, full automatic processing and zero inventory. Exhibit 6: Integration Topology for Industry 4.0 Source: WNIPT

- 9. 9 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Industrial Policy of Each Countries In 2011, Germany proposed the concept of industry 4.0 at Hannover Messe, the biggest industrial exposition. In addition, major industrial countries also promote manufacturing-upgrading policy in order to enhance national competition. Industry 4.0 intelligent manufacturing has become the major topic of exhibition in recent years, and the core concept of Hannover Messe in 2016 is it, too. Since Germany Proposed Industry 4.0, Countries have Followed Suit Korea Korea proposed “Strategy for Manufacturing Industry's Innovation 3.0” in June 2014 to encourage the transformation and development of Korean manufacturing industry. Korea government expects to invest about US$1 billion to help 10,000 small and medium-sized manufacturing company establishing intelligent and optimized production processes. The United States The United States proposed “AMP 2.0” in October 2014 to strengthen the U.S. industry competitiveness by promoting innovation, protecting the pipeline of human resources and improve the business environment. China China announced “Made in China 2025” in May 2015. The government expect to become a manufacturing power within 10 years. The strategies include developing IT industries, high-tech robot and machine tools, promoting the integration of information technology and industrialization, and establishing manufacturing industry innovation center. Japan Japan announced “FY 2015 the white paper on manufacturing industry” in June 2015. It said that Japanese industries need to develop the application of IoT and big data. Germany proposed the concept of industry 4.0 at Hannover Messe. Then, Major industrial countries also promote manufacturing-upgrading policy related to industry 4.0.

- 10. 10 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. IoT: The Next Motivation of IPC Industry According to the “Markets and Markets”, the market scale of IoT components in 2012 is US$41.38 billion, and the components contain RFID, network communication, data processing, security, preservation, related support and other technology components. In 2013, it grew to US$52.28 billion, and the growth rate was 26.3%. In 2014, it grew to US$68.4 billion, and the growth rate also grew to 30.8%. According to the expectation of Markets and Markets, the market scale of IoT components will grow the US$297.73 billion in 2019, and the CAGR will be 33.9% between 2014 and 2019. Exhibit 7: Market Scale of Global IoT Component Source: Markets and markets Global Corporate Capex Continues Growing Divided by the terminal application, more than 50% IPC productions are used in industrial applications, so the business and the capital expenditure are closely related. Semiconductor industry is related to most 3C products, and it also requires industrial PC to control the production equipment, so we take the semiconductor industry's capex as a reference. According the data from Gartner, global capex in both 2015 and 2016 is declined, but Gartner also expect that the global capex will continue growing in the future. Exhibit 8: Growth Rate of Global Semiconductor Industries’ Capex during 2015~2018 Source: Gartner 0 50 100 150 200 250 300 RFID Network Communication Data Processing Security & Defense Total 2012 2013 2014 2019(F) billion US$ CAGR = 29.9% CAGR = 36.4% CAGR = 34.6% CAGR = 35.8% CAGR = 33.9% -2 0 2 4 6 8 10 12 2015 2016(F) 2017(F) 2018(F) Semiconductor Wafer Fabrication Wafer Foundry Wafer Packaging %

- 11. 11 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. According to MIC’s statistics, the scale of global smart factory will be US$205.88 billion in 2016, and the yoy growth rate will be 10.2%. Industrial robots and automated production equipment are the largest part, accounted for 90%. Exhibit 9: Scale and Growth Rate of Global Smart Factory The scales of global smart factory and the market of industrial IoT are continuing growing. Source: MIC Governments promote IoT into manufacturing, cooperate management and expanding new business opportunities. These policies would cause the market of industrial IoT growth. According to Gartner’s estimation, manufacturing and health care will be the main application of the IoT market, and industrial IoT will grow at a compounded annual growth rate (CAGR) of 9.6% until 2020. Exhibit 10: Scale and Growth Rate of Industrial IoT Source: IEK 0 5 10 15 20 25 0 50 100 150 200 250 300 2012 2013 2014 2015 2016(F) 2017(F) 2018(F) Market scale(LHS) Growth rate(RHS) trillion US$ % 0% 5% 10% 15% 20% 25% 0 20 40 60 80 100 120 140 2015 2016(F) 2017(F) 2018(F) 2019(F) 2020(F) Market Scale(LHS) Growth Rate(RHS) billion US$

- 12. 12 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Advantech (2395 TT) Advantech is one of the top three IPC company in the world. It owns a brand and its products are sold worldwide. The application of the products covers medical, entertainment, transportation, security monitoring, gaming and other fields. However, the products and business can be approximately divided into five parts: industrial control, industrial computer, embedded board and case, industrial applied computer, after- sale service and other. Business Development Plan Deepening organizational Sector-Lead development Since the second half of 2015, the existing business units have been integrated and consolidated into three business groups, including “Embedded Design-In,” “Industrial-IoT,” and “Smart City Solutions” to aim at the markets of industrial equipment manufacturers, industry 4.0 and IoT, and Smart City services providers, respectively. Constructing WISE-PaaS and Wireless Sensor Technology In response to the need of the IoT generation for prompt and accurate data retrieving, Advantech grasps the advantages of Taiwan industry and leverages the existing core competencies to continue constructing a comprehensive IoT smart cloud platform in last year. Organic and M&A parallel growth strategy Advantech’s growth sources will be from the organic growth of the organization and M&A in parallel. The M&A strategy is executed in a disciplined manner to make up the insufficient key vertical area of Advantech and to refine Advantech’s M&A ability through a complete methodology. Exhibit 11: Proportion of Sales by Products in 2015 Source: Advantech Exhibit 12: Advantech IoT Platform Architecture Source: Adventech 15% industrial computer, 23% embedded board and case, 41% 10% 11% industrial control industrial computer embedded board and case industrial applied computer after-sale service and other

- 13. 13 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Axiomtek (3088 TT) Axiomtek is a subsidiary of Advantech, a large domestic IPC company. Axiomtek mainly produce embedded board and system (EBS), Ethernet products, design and manufacturing services products (DMS). Axiomtek Plans to Integrate the technology Transport and outdoor computers Axiomtek will integrate computer computing and industrial communication technology solutions to develop communication protocols, industrial converters and remote monitoring management system. These products will be used in rail transportation, equipment health clinic, Energy saving, public works, factory automation and remote monitoring systems. Factory automation Axiomtek provides Vision Control Motion solution. This solution combined hardware and software to achieve automated visual identification, which can be used in smart factories, heavy industry and robot applications. Process Automation Axiomtek develop smart equipment health diagnosis technology to assist in collecting large sensor data and monitoring the status of equipment. This would help reducing productivity ineffective working hours and improving the production process to enhance effectiveness. Exhibit 13: Proportion of Sales by Products in 2015 Source: Axiomtek Exhibit 14: Axiomtek Focus on Following Application of IoT Source: Axiomtek EMS 57% Ethernet products 20% DMS 16% others 7% EMS Ethernet products DMS others

- 14. 14 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. ADLink (6166 TT) ADLink start from designing embedded products, and its own brand ADLink sales worldwide nowadays. ADLink's embedded products focus on medical and control panels. Medical products have been sold to Europe, the United States and Japan. In addition, industrial products are mostly network security and telecommunications products. Business Development Plan Strengthen the design and manufacturing management ADLink imports FMEA (Failure Mode and Effect Analysis) risk management concept in order to rise the quality of product design. It also imports components management database to assist in electing materials in product design phase. Expand sales positions ADLink will increase service base in the EU, the United States and China to support and service customers nearby. Exhibit 15: Proportion of Sales by Products in 2015 Source: ADLink IBase (8050 TT) IBase is a leading IPC company, providing industrial computer OEM / ODM services, and also promote its own brand. The main product is board, followed by solutions. Business Development Plan IBase would strengthen the ability of RMA (Return Merchandise Authorization) and FAE (field application engineer) to provide intimate products after-sales service. IBase would set up more its own factory to strengthen the ODM/OEM orders capacity. IBase would promote CRM (customer relationship management) project to effectively grasp customer needs, to enhance customer satisfaction, and to build close partnership. Exhibit 16: Proportion of Sales by Products in 2015 Source: IBase MAPS 28% MCPS 33% ECPS 16% DMSC 16% DCPS 5% MAPS MCPS ECPS DMSC DCPS Others Industrial Motherboards 19% High- end system product s 73% Others 8% Industrial Motherboards High-end system products Others

- 15. 15 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Ennoconn (6414 TT) Ennoconn's products include POS (point of sale) systems, ATM systems, industrial control systems, automotive systems, human-computer interaction products and other peripherals such as processors, memory and so on. The largest shareholder is Foxconn Technology Group, and Foxconn hold 42% stocks. Recently, Ennoconn merged S&T and Kontron and they would form a "triangular alliance". Synergy of the M&A Based on cloud computing and the Internet of Things architecture, Ennoconn would cooperate with other manufacturers which have key technologies or components, and create innovative products and services. Now, Ennoconn has already merged S&T and Kontron. Ennoconn is good at servers and data center. It runs the biggest server farms globally. Kontron has strong customer base, and used to own the largest embedded market in the past. S&T focus on software. It Leads embedded software engineering, and owns 1800 East European engineers. Ennoconn hope that the alliance of Ennoconn, Kontron and S&T can be among the leaders in IoT, technology and market share wise, with estimated revenues of EUR 1,5~2 billion in 2018. Exhibit 17: Proportion of Sales by Products in 2015 Source: Ennoconn Exhibit 18: Synergy for Competitiveness Source: Ennoconn Industri al comput er, 99% Industrial computer After-sales service

- 16. 16 Copyright ownership belongs to Collaborator, shall not be reproduced, copied, or used in any other ways without permission. Otherwise Collaborator will have the right to pursue legal responsibilities. This report is produced for non-profit research within Collaborator internal and graduate alumni. Disclaimer These report contain certain forward-looking statements with respect to the results of operation, financial condition and current expectation about future events. By their nature, forward looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. In preparing the information herein, Collaborator have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to Collaborator or which was otherwise reviewed by Collaborator. Neither Collaborator nor its advisors have made any representation or warranty as to the accuracy or completeness of such information and nor so they assume any undertaking to supplement such information as further information becomes available or in light of changing circumstances. None of Collaborator, nor any of their respective affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with this presentation. Neither this presentation nor any of its contents may be reproduced to a third party without the prior written consent of Collaborator.