Customer Portfolio Segmentation for Finance

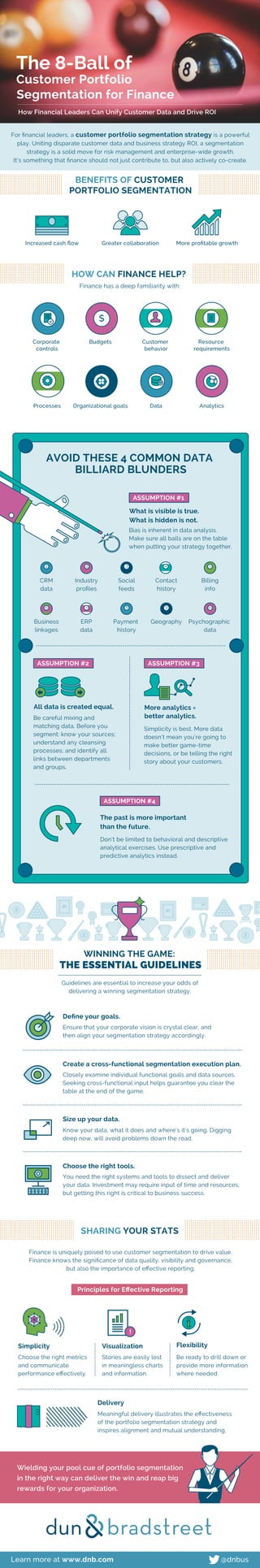

- 1. For financial leaders, a customer portfolio segmentation strategy is a powerful play. Uniting disparate customer data and business strategy ROI, a segmentation strategy is a solid move for risk management and enterprise-wide growth. It’s something that finance should not just contribute to, but also actively co-create. The 8-Ball of Customer Portfolio Segmentation for Finance How Financial Leaders Can Unify Customer Data and Drive ROI Increased cash flow Corporate controls Budgets Customer behavior Resource requirements Greater collaboration More profitable growth Processes Organizational goals Data Analytics ASSUMPTION #1 Bias is inherent in data analysis. Make sure all balls are on the table when putting your strategy together. BENEFITS OF CUSTOMER PORTFOLIO SEGMENTATION HOW CAN FINANCE HELP? WINNING THE GAME: THE ESSENTIAL GUIDELINES Guidelines are essential to increase your odds of delivering a winning segmentation strategy. Finance is uniquely poised to use customer segmentation to drive value. Finance knows the significance of data quality, visibility and governance, but also the importance of effective reporting. What is visible is true. What is hidden is not. ASSUMPTION #2 Be careful mixing and matching data. Before you segment: know your sources; understand any cleansing processes; and identify all links between departments and groups. All data is created equal. CRM data Industry profiles Social feeds Contact history Billing info Business linkages ERP data Payment history Geography Psychographic data ASSUMPTION #4 Don’t be limited to behavioral and descriptive analytical exercises. Use prescriptive and predictive analytics instead. The past is more important than the future. ASSUMPTION #3 Simplicity is best. More data doesn’t mean you’re going to make better game-time decisions, or be telling the right story about your customers. More analytics = better analytics. Ensure that your corporate vision is crystal clear, and then align your segmentation strategy accordingly. Define your goals. Closely examine individual functional goals and data sources. Seeking cross-functional input helps guarantee you clear the table at the end of the game. Create a cross-functional segmentation execution plan. Know your data, what it does and where’s it’s going. Digging deep now, will avoid problems down the road. Size up your data. You need the right systems and tools to dissect and deliver your data. Investment may require input of time and resources, but getting this right is critical to business success. Choose the right tools. #1 #1 1st 1st Choose the right metrics and communicate performance effectively. Simplicity Stories are easily lost in meaningless charts and information. Visualization SHARING YOUR STATS Principles for Effective Reporting Be ready to drill down or provide more information where needed. Flexibility Meaningful delivery illustrates the effectiveness of the portfolio segmentation strategy and inspires alignment and mutual understanding. Delivery ! 1 6 7 8 9 10 2 3 4 5 $ Finance has a deep familiarity with: AVOID THESE 4 COMMON DATA BILLIARD BLUNDERS Learn more at www.dnb.com @dnbus Wielding your pool cue of portfolio segmentation in the right way can deliver the win and reap big rewards for your organization.

- 2. For financial leaders, a customer portfolio segmentation strategy is a powerful play. Uniting disparate customer data and business strategy ROI, a segmentation strategy is a solid move for risk management and enterprise-wide growth. It’s something that finance should not just contribute to, but also actively co-create. The 8-Ball of Customer Portfolio Segmentation for Finance How Financial Leaders Can Unify Customer Data and Drive ROI Increased cash flow Corporate controls Budgets Customer behavior Resource requirements Greater collaboration More profitable growth Processes Organizational goals Data Analytics ASSUMPTION #1 Bias is inherent in data analysis. Make sure all balls are on the table when putting your strategy together. BENEFITS OF CUSTOMER PORTFOLIO SEGMENTATION HOW CAN FINANCE HELP? WINNING THE GAME: THE ESSENTIAL GUIDELINES Guidelines are essential to increase your odds of delivering a winning segmentation strategy. Finance is uniquely poised to use customer segmentation to drive value. Finance knows the significance of data quality, visibility and governance, but also the importance of effective reporting. What is visible is true. What is hidden is not. ASSUMPTION #2 Be careful mixing and matching data. Before you segment: know your sources; understand any cleansing processes; and identify all links between departments and groups. All data is created equal. CRM data Industry profiles Social feeds Contact history Billing info Business linkages ERP data Payment history Geography Psychographic data ASSUMPTION #4 Don’t be limited to behavioral and descriptive analytical exercises. Use prescriptive and predictive analytics instead. The past is more important than the future. ASSUMPTION #3 Simplicity is best. More data doesn’t mean you’re going to make better game-time decisions, or be telling the right story about your customers. More analytics = better analytics. Ensure that your corporate vision is crystal clear, and then align your segmentation strategy accordingly. Define your goals. Closely examine individual functional goals and data sources. Seeking cross-functional input helps guarantee you clear the table at the end of the game. Create a cross-functional segmentation execution plan. Know your data, what it does and where’s it’s going. Digging deep now, will avoid problems down the road. Size up your data. You need the right systems and tools to dissect and deliver your data. Investment may require input of time and resources, but getting this right is critical to business success. Choose the right tools. #1 #1 1st 1st Choose the right metrics and communicate performance effectively. Simplicity Stories are easily lost in meaningless charts and information. Visualization SHARING YOUR STATS Principles for Effective Reporting Be ready to drill down or provide more information where needed. Flexibility Meaningful delivery illustrates the effectiveness of the portfolio segmentation strategy and inspires alignment and mutual understanding. Delivery ! 1 6 7 8 9 10 2 3 4 5 $ Finance has a deep familiarity with: AVOID THESE 4 COMMON DATA BILLIARD BLUNDERS Learn more at www.dnb.com @dnbus Wielding your pool cue of portfolio segmentation in the right way can deliver the win and reap big rewards for your organization.