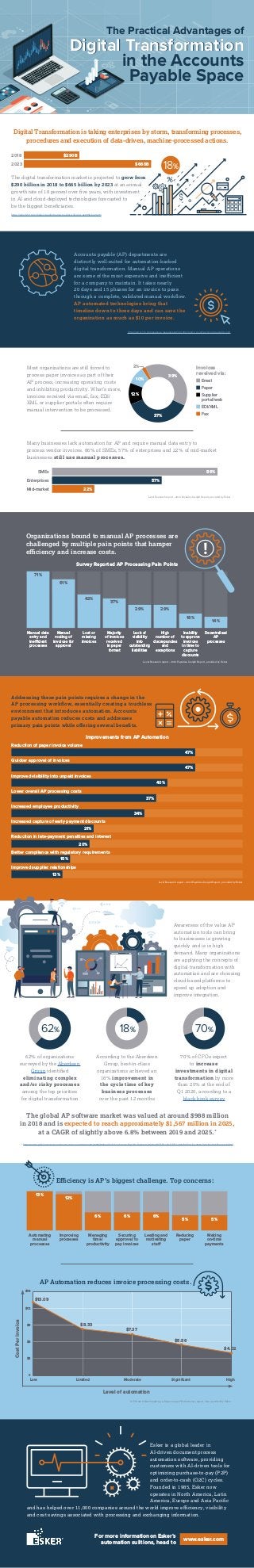

The Practical Advantages of Digital Transformation in the Accounts Payable Space

- 1. Digital Transformation AP Automation reduces invoice processing costs. Esker is a global leader in AI-driven document process automation software, providing customers with AI-driven tools for optimizing purchase-to-pay (P2P) and order-to-cash (O2C) cycles. Founded in 1985, Esker now operates in North America, Latin America, Europe and Asia Pacific and has helped over 11,000 companies around the world improve efficiency, visibility and cost savings associated with processing and exchanging information. Automating manual processes Improving processes Managing time/ productivity Securing approval to pay invoices Leading and motivating staff Reducing paper Making on-time payments Efficiency is AP’s biggest challenge. Top concerns: The digital transformation market is projected to grow from $290 billion in 2018 to $665 billion by 2023 at an annual growth rate of 18 percent over five years, with investment in AI and cloud-deployed technologies forecasted to be the biggest beneficiaries. https://which-50.com/digital-transformation-market-will-grow-us665b-by-2025/ Digital Transformation is taking enterprises by storm, transforming processes, procedures and execution of data-driven, machine-processed actions. Accounts payable (AP) departments are distinctly well-suited for automation-backed digital transformation. Manual AP operations are some of the most expensive and inefficient for a company to maintain. It takes nearly 20 days and 15 phases for an invoice to pass through a complete, validated manual workflow. AP automated technologies bring that timeline down to three days and can save the organization as much as $10 per invoice. https://www.cfo.com/expense-management/2018/02/metric-month-accounts-payable-cost/ Most organizations are still forced to process paper invoices as part of their AP process, increasing operating costs and inhibiting productivity. What’s more, invoices received via email, fax, EDI/ XML or supplier portals often require manual intervention to be processed. Many businesses lack automation for AP and require manual data entry to process vendor invoices. 86% of SMEs, 57% of enterprises and 22% of mid-market businesses still use manual processes. The global AP software market was valued at around $988 million in 2018 and is expected to reach approximately $1,567 million in 2025, at a CAGR of slightly above 6.8% between 2019 and 2025.* * https://www.globenewswire.com/news-releas e/2019/03/20/1757668/0/en/Global-Accounts-Payable-Software-Market-Will-Reach-USD-1-567-Million-by-2025-Zion-Market-Research.html 62% of organizations surveyed by the Aberdeen Group identified eliminating complex and/or risky processes among the top priorities for digital transformation According to the Aberdeen Group, best-in-class organizations achieved an 18% improvement in the cycle time of key business processes over the past 12 months 70% of CFOs expect to increase investments in digital transformation by more than 20% at the end of Q1 2020, according to a black book survey 2018 2023 $290B $665B 18% Invoices reveived via: ■ Email ■ Paper ■ Supplier portal/web ■ EDI/XML ■ Fax 2% 39% 37% 12% 10% Level Research report - 2019 Payables Insight Report, provided by Esker SMEs Enterprises Mid-market 86% 57% 22% Addressing these pain points requires a change in the AP processing workflow, essentially creating a touchless environment that introduces automation. Accounts payable automation reduces costs and addresses primary pain points while offering several benefits. Level Research report - 2019 Payables Insight Report, provided by Esker Improvements from AP Automation Reduction of paper invoice volume Quicker approval of invoices Improved visibility into unpaid invoices Lower overall AP processing costs Increased employee productivity Increased capture of early payment discounts Reduction in late-payment penalties and interest Better compliance with regulatory requirements Improved supplier relationships 47% 47% 40% 37% 34% 21% 20% 15% 13% Organizations bound to manual AP processes are challenged by multiple pain points that hamper efficiency and increase costs. Level Research report - 2019 Payables Insight Report, provided by Esker Survey Reported AP Processing Pain Points Manual data entry and inefficient processes Manual routing of invoices for approval Lost or missing invoices Majority of invoices received in paper format Lack of visibility into outstanding liabilities High number of discrepancies and exceptions Inability to approve invoices in time to capture discounts Decentralized AP processes 71% 61% 42% 37% 29% 29% 18% 14% The Practical Advantages of Digital Transformation in the Accounts Payable Space Awareness of the value AP automation tools can bring to businesses is growing quickly and is in high demand. Many organizations are applying the concepts of digital transformation with automation and are choosing cloud-based platforms to speed up adoption and improve integration. 62% 18% 70% 13% 12% 6% 6% 6% 5% 5% $15 $12 $9 $6 $3 0 CostPerInvoice Level of automation Low Limited Moderate Significant High IOFM 2019 Benchmarking Measuring AP Performance report, data provided by Esker $4.02 $7.37 $5.56 $13.09 $8.33 www.esker.com For more informationon Esker’s automation sulitions, head to