Pursuing Growth in the Age of LoE

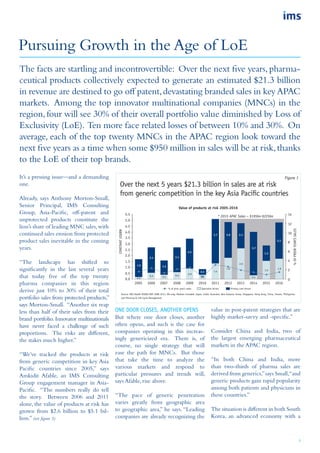

- 1. 5 It’s a pressing issue—and a demanding one. Already, says Anthony Morton-Small, Senior Principal, IMS Consulting Group, Asia-Pacific, off-patent and unprotected products constitute the lion’s share of leading MNC sales,with continued sales erosion from protected product sales inevitable in the coming years. “The landscape has shifted so significantly in the last several years that today five of the top twenty pharma companies in this region derive just 10% to 30% of their total portfolio sales from protected products,” says Morton-Small. “Another six reap less than half of their sales from their brand portfolio. Innovator multinationals have never faced a challenge of such proportions. The risks are different, the stakes much higher.” “We’ve tracked the products at risk from generic competition in key Asia Pacific countries since 2005,” says Amkidit Afable, an IMS Consulting Group engagement manager in Asia- Pacific. “The numbers really do tell the story. Between 2006 and 2011 alone, the value of products at risk has grown from $2.6 billion to $5.1 bil- lion.” (see figure 1) One door closes, another opens But where one door closes, another often opens, and such is the case for companies operating in this increas- ingly genericized era. There is, of course, no single strategy that will ease the path for MNCs. But those that take the time to analyze the various markets and respond to particular pressures and trends will, says Afable, rise above. “The pace of generic penetration varies greatly from geographic area to geographic area,” he says. “Leading companies are already recognizing the value in post-patent strategies that are highly market-savvy and -specific.” Consider China and India, two of the largest emerging pharmaceutical markets in the APAC region. “In both China and India, more than two-thirds of pharma sales are derived from generics,”says Small,“and generic products gain rapid popularity among both patients and physicians in these countries.” The situation is different in both South Korea, an advanced economy with a Pursuing Growth in the Age of LoE The facts are startling and incontrovertible: Over the next five years, pharma- ceutical products collectively expected to generate an estimated $21.3 billion in revenue are destined to go off patent,devastating branded sales in keyAPAC markets. Among the top innovator multinational companies (MNCs) in the region,four will see 30% of their overall portfolio value diminished by Loss of Exclusivity (LoE). Ten more face related losses of between 10% and 30%. On average, each of the top twenty MNCs in the APAC region look toward the next five years as a time when some $950 million in sales will be at risk,thanks to the LoE of their top brands. Constantus$BN %ofprioryear’ssales 2005 5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 0 2 4 6 8 10 12 14 1.5 1.0 0.5 0.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Source: IMS Health MIDAS MAT JUNE 2011, RX-only; Markets included: Japan, India, Australia, New Zealand, Korea, Singapore, Hong Kong, China, Taiwan, Philippines LoE Planning & Life Cycle Management Value of products at risk 2005-2016 Over the next 5 years $21.3 billion in sales are at risk from generic competition in the key Asia Pacific countries * 2015 APAC Sales ~ $195bn-$225bn 0.2 0.5 0.4 0.6 0.9 1.4 1.8 2.6 0.4 1.6 1.8 0.5 3.1 1.3 3.7 2.13.03.7 2.5 2.1 1.2 2.1 1.5 % of prior year’s sales Specialist driven Primary care driven 0.4 Figure 1CDF

- 2. 6 relatively large reimbursed market, and the Philippines, an emerging economy with a significant dependence on out- of-pocket sales. In Taiwan, Singapore, Australia, and New Zealand, mean- while, generic sales account for just a third of the pharma market, and in Japan, that number is even smaller. Every country—and, often, territories within countries—must be separately analyzed, assessed, and approached. “Numerous emerging APAC mar- kets with relatively higher generic penetration lag behind their peers in pharmaceutical spend per capita, im- plying significant growth opportuni- ties given their large population base,” says Morton-Small. “India, China, Indonesia, and the Philippines all represent important opportunities for post-LoE volume plays.” In Korea, a fascinating dynamic is playing out as traditional big phar- ma companies battle against well- entrenched local branded generic players for considerable potential pharma dollars. Australia and Japan, finally, offer significant absolute sales values (both at an overall and generic level) as well as a high pharmaceutical per capita spend. Gaining ground in the post-LoE era Success in the post-LoE era will, says Afable, hinge on the ability of the companies to ask and answer the right questions. “Companies need to be asking themselves what the likely performance of their key assets will be in the market,” he says. “They should also be asking themselves what strate- gies and tactics should be pursued to maximize the value of threatened assets.” Such questions,of course,lead to a more granular analysis—a process that enables companies to effectively segment—and respond to—the APAC market. “Baselines are geography-specific,” says Morton-Small. “In western phar- maceutical markets, branded products typically experience rapid sales erosions once they go off patent. That’s not the case in the APAC region, where brand- ed products have the ability to sustain growth, even after the patent expires, and where the life cycle of certain innovator drugs can be extended.” “We encourage our clients to take a close look not just at the reimburse- ment and macroeconomic conditions, but at the relevant healthcare infrastruc- ture,demographics,andchanneldemand,” says Afable. “We help them address the key questions: How can innate differ- ences between reimbursed and self-pay markets be leveraged? What impact will the growth of the middle class have on pharma sales in each country? How will channel structures influence post-LoE growth? What influence will the evolving healthcare structures have on pharma sales? A variety of external and internal drives must be factored into the LoE strategy. Risks must be balanced against potential rewards.” Sanofi-Aventis is one example of a com- pany that proactively addressed the loss of exclusivity of its platelet-lowering product, Plavix (Clopidrogel), by launching a second brand of Clopidrogel in Indonesia. “Sanofi-Aventis made the decision to market this second product separately from Plavix—pricing it in a way that the company hoped would maximize uptake without undermining existing Plavix sales,” says Morton-Small. The ultimate impact of this defense against the market-share erosion of Plavix post- LoE continues to be evaluated.(see figure 2) Sanofi-Aventisisnotalone.Infact,several organizations are considering new approaches to protect the value and volume of several key molecules across various therapy classes in theAPAC region. The probability of second-brand strategy success increases when the following components are put into place: • A clear marketing and sales strategy that disassociates the innovator brand (i.e. Plavix) from the second brand to avoid rapid cannibalization of the core product; • Sufficient investment in building brand equity among consumers; • A firm understanding of the key influencers in the market who could help drive the shift from other platelet- lowering brands to a company’s second brand; Source: IMS Health MIDAS data and analysis Both volume and value growth significantly expanded post-LoE, which is reflective of a broader trend of several key molecules across therapy classes in the APAC region ramping up in volume and value sales after LoE. Pharmaceutical companies who have a clear strategy and strong capabilities to leverage such growth are likely to emerge as winners Sanofi-Aventis recently launched a second brand of Clopidrogel to defend its market share against further generic erosion in Indonesia Representative USD Mn LoE LoELoE SU Mn Clopidrogel value sales in Indonesia (2006-10) Clopidrogel volume sales in Indonesia (2006-10) 2006 20062007 20072008 20082009 20092010 2010 0 0 2 4 6 8 10 12 14 16 18 2 4 6 8 10 35% 37% 6.7 3.9 48% 55% Others (10 cos) Big Pharma BGx Top 2 local BGx Top 1 local BGx Sanofi-Aventis (2nd Brand) Sanofi-Aventis (Plavix) 12 14 16 18 20 22 24 26 28 6.7 3.9 8.8 4.8 8.8 4.8 12.2 7.3 18.1 12.4 26.7 17.6 0.6 0.6 0.6 0.5 1.3 1.1 1.1 1.1 1.1 0.92.7 2.3 4.9 3.90.4 0.4 13.6 6.1 4.0 4.0 10.3 5.6 10.1 5.2 4.3 3.7 4.3 1.9 Figure 2

- 3. 7 • An optimal pricing strategy that maximixed volume uptake without negatively affecting the innovator brand (i.e. Plavix) sales; • A set of cost-effective resources that helped push second brand sales; and • A robust and effective second brand launch campaign. The Sanofi-Aventis second brand campaign is but one option available to multinational companies in the post-patent era. Companies can and should be look- ing at a variety of value boosters. No matter what alternatives companies pursue—product enhancements, de- fensive list price cuts, second brand strategies, broad regional emerging markets play, fortifying the company with an adjunct generics division, developing patient assistance pro- grams, or pursuing new licensing or merger/acquisition relationships— several commonalities will define suc- cess in the APAC region going for- ward. “Every company does its own analysis and makes its own decisions based on its existing infrastructure and long-term goals,” says Morton-Small. “Still, we see greatest success emerging from those clients with strong marketing and commercial capabilities, broad investments in brand equity, a good understanding of local markets and stakeholder decision drivers, a firm knowledge of pricing-volume trade- offs, steady on-the-ground resource management, and healthy launch readiness.” Consider the life cycle To all companies, Morton-Small and Afable recommend that careful asset-level evaluation and prioritization be applied to every strategic option. “Companies need to remember that every decision that is made has a potential impact on the many inter- locking components of the company,” says Afable. To help clients think through the ramifications of various possibilities, Segmenting the relevant LoE market appropriately helps a firm determine how to optimally allocate its assets across multiple geographic markets in the APAC region Post-LoE perfomance by relevant segment Effectively segmenting the APAC market based on LoE performance allows a firm to develop tailor-made/ cluster approaches to strategy development Illustrative, Non-exhaustive Reimbursement status How do post-LoE product performance differ in reimbursed versus semireimbursed versus out-of-pocket markets? How is post-LoE product performance influenced by broader macroeconomic factors (i.e. GDP, population, etc.)? How does healthcare infrastructure development influence post- LoE performance, especially in developing Asia? How influential is middle class growth on the performance of post-LoE products? Do channel structures play an integral role in driving post-LoE growth? Macroeconomic status Healthcare infrastructure Middle class growth Channel demand Figure 3

- 4. 8 IMS Health has generated an in-depth roadmap. What, for example, are the product performance teams supposed to be thinking about three years ahead of loss of exclusivity? What should the manufacturing team be consider- ing three years after patent loss? What pricing and contracting considerations should be assessed all along the way? As complex as the process is, it can and must be both determined and deliberate. (see figure 4) At the end of the day,loss of exclusivity should inspire pharmaceutical compa- nies to think through the overarching life cycle management of products— to undertake a transparent yet rigorous prioritization process that can ensure a healthy future for the brands and for the company. The benefits of such planning are proven and clear,both from a value perspective and from an organi- zational one. “We ask our clients facing loss of exclusivity to think about four primary things,” says Morton-Small. “How can they optimize their portfolio? Should they establish a competitive branded generics operation? Should they be exploring mergers and acquisitions? How can they balance regional ambitions with localized market strategies? It’s dy- namic,it’s interwoven,it’s new. But there are plenty of opportunities out there,and we’re helping clients find them.” Considerations for market participants Optimize portfolio, pinpoint growth oppportunities and execute Establish competitive branded generics arm Explore M&A growth but tread carefully Balance regional ambitions with localized market growth strategies Given key considerations, there are several growth avenues that market participants may consider for post-LoE growth Source: IMS Insights and analysis • Ensure that the portfolio and core capabilities are aligned to take advantage of growth - keeping in mind that optimal portfolios and core capabilities needed to succeed may differ from country to country. • Establishing generic brands in therapy areas that are distinct and do not compete with the core innovator product portfolio may increase the likelihood of success. • There have been no documented big pan-Asian success for branded generic companies, although several players have commanded high growth and market share in their home markets, M&A opportu- nities may exist but risks abound. • Establishing a balance with a regional / pan- Asian post-LoE growth strategy and geographic market specific strategies will be key to cornering post-LoE growth. Years to Loss of Exclusivity LoE Planning & Life Cycle Management Product Performance Product Strategy Options What generic erosion should I expect? What are the parallel import implications? How are competitors eroding my product? Pricing & Contracting Field Force/ Promotion Manufacturing IP/Legal Product Perfomance “What will happen?” LoE Strategies “What can we do?” -5yrs -3yrs -1yrs +1yrs +3yrsLoE What LCM options should be pursued? E.g., forms/ combos, purity, peds Should we invest in use trials for OTC switch? What’s our pricing strategy pre LoE e.g., increases? How should we optimize field force promo near LoE? How will manufacturing volumes change post LoE? How can we continue to close any patient loopholes? How can we enforce and monitor for breach of patents? What COGS reduction plans should we implement to optimize profits? Should we outsource manufacturing production? What should we do with our excess field force? Should we change our messaging? How much promotion should be continued post LoE? How and where should we readjust our promotion strategy? What contracts should we pursue? Can we drive market access with impending LoE? How should we drop price to optimize share? How are generic competitors pricing? What regional/formulation specific products enhancements should we launch pre/post LoE? Should we monetize our assets/out-license? Should we license a 2nd brand/ authorized generic? Are there additional product enhancements that should be pursued? Do we require a discontinuation plan? Critical decisions need to be made impacting many parts of the organization Figure 4 Know more about IMS Health.