Real Estate Development - Financial Model

- 1. Real Estate Development Financial Model Author: Imran Almaleh Date: August 23, 2014 Jumeirah Village Circle, Dubai Phone: (971) 52 940 6601 Email: imranalmaleh@gmail.com Summary The purpose of this spreadsheet model is to determine the financial feasibility of a development project of the subject property for a 10 year holding period. The uncertainty in this model lies in the many construction & economic factors. The most important assumptions in this analysis are the Net Operating Income assumptions (Annual Gross Rent, Vacany, and Operating Expenses) and the Cap Rates. Special attention should be given to these assumptions. Keywords: Real Estate, Property Valuation, Dubai

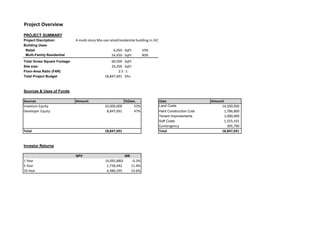

- 2. Project Overview PROJECT SUMMARY Project Discription: A multi-story Mix use retail/residential building in JVC Building Uses: Retail 6,050 SqFt 10% Multi-Family Residential 54,450 SqFt 90% Total Gross Square Footage: 60,500 SqFt Site size: 24,200 SqFt Floor-Area Ratio (FAR) 2.5 :1 Total Project Budget 18,847,691 Dhs Sources & Uses of Funds Sources Amount %Own. Uses Amount Investors Equity 10,000,000 53% Land Costs 14,200,000 Developer Equity 8,847,691 47% Hard Construction Cost 1,786,800 Tenant Improvements 1,000,000 Soft Costs 1,555,101 Contengency 305,790 Total 18,847,691 Total 18,847,691 Investor Returns NPV IRR 1 Year (4,095,880) -0.3% 5 Year 1,739,942 11.9% 10 Year 6,980,295 14.6%

- 3. Cash Flow Projection Model Formating Red Requires further attention Depreciation Period (whole project) 30 years Blue Input cells Green Cells linked to another sheet Black Cells containing a title or calculation on the same sheet Year number Design & Construction 1 Design & Construction 2 Design & Construction 3 1 2 3 4 5 6 7 8 9 10 Year 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Income Gross Operating Income 3,416,405 3,518,897 3,624,464 3,733,198 3,845,194 3,960,550 4,079,366 4,201,747 4,327,800 4,457,634 Operating Expences (Paid by tenents) Retail Tenents 88,580 90,352 92,159 94,002 95,882 97,800 99,756 101,751 103,786 105,862 Residential Tenents 2,001,332 2,041,358 2,082,186 2,123,829 2,166,306 2,209,632 2,253,825 2,298,901 2,344,879 2,391,777 Total - - - 5,506,317 5,650,607 5,798,809 5,951,029 6,107,382 6,267,981 6,432,947 6,602,399 6,776,465 6,955,272 Expenses Construction Costs (2,323,845) (1,394,307) (929,538) Land Cost (14,200,000) Operating Expenses (2,089,912) (2,131,710) (2,174,344) (2,217,831) (2,262,188) (2,307,432) (2,353,580) (2,400,652) (2,448,665) (2,497,638) Draw Against Investors Equity 10,000,000 Draw Against Developers Equity 6,523,845 1,394,307 929,538 Total - - - (2,089,912) (2,131,710) (2,174,344) (2,217,831) (2,262,188) (2,307,432) (2,353,580) (2,400,652) (2,448,665) (2,497,638) Net Cash Flow - - - 3,416,405 3,518,897 3,624,464 3,733,198 3,845,194 3,960,550 4,079,366 4,201,747 4,327,800 4,457,634 Depritiation (628,256) (628,256) (628,256) (628,256) (628,256) (628,256) (628,256) (628,256) (628,256) (628,256) Net Profit - - - 2,788,149 2,890,641 2,996,208 3,104,942 3,216,938 3,332,293 3,451,110 3,573,491 3,699,543 3,829,377

- 4. Building Mix Model Formating Red Requires further attention Blue Input cells Green Cells linked to another sheet Black Cells containing a title or calculation on the same sheet Retail area 6,050 SqFt Residential area 54,450 SqFt total 60,500 SqFt Retail Size (SqFt) % Allocation # of Shops Total Area Rent (Dhs) Total Rent Shop style A 500 45% 5 2,500 65,000 325,000 Shop style B 1100 55% 3 3,300 125,000 375,000 Total 100% 8 5,800 190,000 700,000 Aditional Area (SqFt) 250 Residential Size (SqFt) % Allocation # of Units Total Area Rent (Dhs) Total Rent Studio 500 15% 16 8,000 47,000 752,000 1 BHK 1 BR 800 20% 13 10,400 60,000 780,000 1 BHK 2 BR 850 10% 6 5,100 64,000 384,000 2 BHK 1 BR 950 25% 14 13,300 67,000 938,000 2 BHK 2 BR 1100 20% 9 9,900 71,000 639,000 3 BHK 2 BR 1600 10% 3 4,800 78,000 234,000 Total 100% 61 51,500 387,000 3,727,000 Aditional Area (SqFt) 2,950 Rent Per SqFt 77.26 Retail 115.70 Dhs Residential 68.45 Dhs

- 5. Investor Returns Model Formating Red Requires further attention Blue Input cells Green Cells linked to another sheet Black Cells containing a title or calculation on the same sheet Year Developers Equity Investors Equity Net Profit Total Profit - Sale at year 1 Total Profit - Sale at year 5 Total Profit - Sale at year 10 Design & Construction 1 (6,523,845) (10,000,000) - (16,523,845) (16,523,845) (16,523,845) Design & Construction 2 (1,394,307) - - (1,394,307) (1,394,307) (1,394,307) Design & Construction 3 (929,538) - - (929,538) (929,538) (929,538) 1 2,788,149 18,706,065 2,788,149 2,788,149 2 2,890,641 2,890,641 2,890,641 3 2,996,208 2,996,208 2,996,208 4 3,104,942 3,104,942 3,104,942 5 3,216,938 24,926,734 3,216,938 6 3,332,293 3,332,293 7 3,451,110 3,451,110 8 3,573,491 3,573,491 9 3,699,543 3,699,543 10 3,829,377 35,189,303 IRR and NPV Calculations IRR Sell at Year 1 -0.3% Sell at Year 5 11.9% Sell at Year 10 14.6% NPV at 10% Sell at Year 1 (4,095,880) Sell at Year 5 1,739,942 Sell at Year 10 6,980,295 Invester Return Assuming Sale At Year 1 At Year 5 At Year 10 Net Operating Income 1,326,493 1,583,006 1,959,995 Terminal Cap Rate 8.00% 7.0% 6.0% Fair Market Value 16,581,163 22,614,371 32,666,589 Cost of Sale 4% 663,247 904,575 1,306,664 Sale Price Realized 15,917,916 21,709,796 31,359,925 Project Equity 15,917,916 21,709,796 31,359,925 ROI Investors 84% 115% 166% Developers 84% 115% 166%

- 6. Operating Income Model Formating Red Requires further attention Blue Input cells Green Cells linked to another sheet Rentable SqFt Factor 85% Black Cells containing a title or calculation on the same sheet Retail Rent/SqFt Rentable SqFt Annual Rent 115.70 5142.5 595,000 Vacancy 5% (29,750) Gross Operating income 565,250 Residential Rent/SqFt Rentable SqFt Annual Rent 68.45 46282.5 3,167,950 Vacancy 10% (316,795) Gross Operating income 2,851,155 Total 3,416,405 Dhs Operating Income Forecast 1 2 3 4 5 6 7 8 9 10 Retail 595,000 612,850 631,236 650,173 669,678 689,768 710,461 731,775 753,728 776,340 Residential 3,167,950 3,262,989 3,360,878 3,461,704 3,565,556 3,672,522 3,782,698 3,896,179 4,013,064 4,133,456 Retail - Loss to Vacancy (29,750) (30,643) (31,562) (32,509) (33,484) (34,488) (35,523) (36,589) (37,686) (38,817) Residential - Loss to Vacancy (316,795) (326,299) (336,088) (346,170) (356,556) (367,252) (378,270) (389,618) (401,306) (413,346) Total 3,416,405 3,518,897 3,624,464 3,733,198 3,845,194 3,960,550 4,079,366 4,201,747 4,327,800 4,457,634 Rent Growth 3%

- 7. Retail Tenant Costs Model Formating Red Requires further attention Blue Input cells Green Cells linked to another sheet Black Cells containing a title or calculation on the same sheet Year Rent Utilities Other OpEx Total tenent costs Utilities + Othet OpEx 1 595,000 38,517 50,063 683,580 88,580 2 612,850 39,288 51,064 703,202 90,352 3 631,236 40,073 52,085 723,394 92,159 4 650,173 40,875 53,127 744,175 94,002 5 669,678 41,692 54,190 765,560 95,882 6 689,768 42,526 55,273 787,568 97,800 7 710,461 43,377 56,379 810,217 99,756 8 731,775 44,244 57,507 833,526 101,751 9 753,728 45,129 58,657 857,514 103,786 10 776,340 46,032 59,830 882,202 105,862 Total 7,790,937 969,928 NPV of Payments for 10 years (in year 0) 3,274,984 Retail tenent Discount Factor 11% Utilities Growth rate 2% Other Operating Expenses growth rate 2% Utilities & Operating Expences / Year / SqFt Energy 5.3 Water 0.65 Wastewater 0.56 Other Utilities 0.98 Total Utilities 7.49 Repairs & Maintenance 1.7 Security 0.5 Garage Operations 0.9 Management fee 0.4 Real Estate Taxes (5% of Rent) 5.79 Insurance 0.45 Total Operating Expenses 9.74 Total Costs 17.23

- 8. Residential Tenent Costs Model Formating Red Requires further attention Blue Input cells Green Cells linked to another sheet Black Cells containing a title or calculation on the same sheet Year Rent Utilities Other OpEx Total tenent costs Utilities + Othet OpEx 1 3,167,950 254,091 1,747,241 5,169,282 2,001,332 2 3,262,989 259,173 1,782,186 5,304,347 2,041,358 3 3,360,878 264,356 1,817,829 5,443,064 2,082,186 4 3,461,704 269,643 1,854,186 5,585,534 2,123,829 5 3,565,556 275,036 1,891,270 5,731,862 2,166,306 6 3,672,522 280,537 1,929,095 5,882,154 2,209,632 7 3,782,698 286,148 1,967,677 6,036,523 2,253,825 8 3,896,179 291,871 2,007,031 6,195,080 2,298,901 9 4,013,064 297,708 2,047,171 6,357,943 2,344,879 10 4,133,456 303,662 2,088,115 6,525,233 2,391,777 Total 58,231,021 21,914,025 NPV of Payments for 10 years (in year 0) 26,346,207 Residential tenent Discount Factor 10% Utilities Growth rate 2% Other Operating Expenses growth rate 2% Utilities & Operating Expences / Year / SqFt Energy 4.8 Water 0.15 Wastewater 0.06 Other Utilities 0.48 Total Utilities 5.49 Repairs & Maintenance 2.2 Security 1 Garage Operations 1.4 Management fee 0.9 Real Estate Taxes (5% of Rent) 31.30 Insurance 0.95 Total Operating Expenses 37.75 Total Costs 43.24

- 9. Costruction Costs Schedule Model Formating Red Requires further attention Blue Input cells Gross Development Value 39,182,000 Dhs Green Cells linked to another sheet Rental Value (/Year) 4,310,020 Dhs Black Cells containing a title or calculation on the same sheet Item Value Discription Land Value 14,200,000 Dhs Hard Costs Building Costs (/SqFt) 18.6 1,125,300 Dhs Landscaping 121,500 Dhs Other external costs 180,000 Dhs Site Clearance 120,000 Dhs Site Preparation 240,000 Dhs Total Hard Costs 1,786,800 Dhs Soft Costs Architects 10% 112,530 % of building cost Quantity Surveyors 5% 56,265 % of building cost Legal Fees on sale 2% 783,640 % of Gross Development Value Legal Fees on letting 2% 86,200.40 % of rent Letting Agents 2% 86,200.40 % of rent Civil Engineers 5% 56,265 % of building cost Planning Permission 60,000 Dhs Building Regulations 30,000 Total Soft Costs 1,271,101 Dhs Other Costs Contingencies 10% 305,790 % of Construction costs and fees Total Contingencies 305,790 Dhs Tenent Improvements 1,000,000 Dhs Legal Fees on site purchase 2% 284,000 % Land Value Total Costs 18,847,691 Dhs Year number Design & Construction 1 Design & Construction 2 Design & Construction 3 Year 2015 2016 2017 % Costs Allocation 50% 30% 20% Total construction Costs 2,323,845 1,394,307 929,538 4,647,691 Total

- 10. Risiduale Land Valuation Model Formating Red Requires further attention Blue Input cells Green Cells linked to another sheet Black Cells containing a title or calculation on the same sheet Cap Rate 12% Operating Income (1st Year) 3,416,405 Gross Development Value 28,470,042 Hard Costs Building Costs 1,125,300 Landscaping 121,500 Other external costs 180,000 Site Clearance 120,000 Site Preparation 240,000 Total Hard Costs 1,786,800 Soft Costs Architects 112,530 Quantity Surveyors 56,265 Legal Fees on sale 783,640 Legal Fees on letting 86,200 Letting Agents 86,200 Civil Engineers 56,265 Planning Permission 60,000 Building Regulations 30,000 Total Soft Costs 1,271,101 Other Costs Contingencies 305,790 Tenent Improvements 1,000,000 Total Other Costs 1,305,790 Develper Profit at 0.2 20% 5,694,008 Total Construction Costs 10,057,699 Availiable for land 18,412,342 Legal Fees on site purchase 284,000 Risidual Land Value 18,128,342 Dhs Land Selling Price 14,200,000 Dhs

- 11. Sensitivity analysis Model Formating Red Requires further attention Blue Input cells Green Cells linked to another sheet Black Cells containing a title or calculation on the same sheet Cap rate and Terminal CF impact on Equity Cost of Sale 4% Base Cap rate 6% 1,788,835 1,844,160 1,901,195 1,959,995 2,018,795 2,079,359 2,141,740 Base Terminal CF 1,959,995 5.5% 31,359,925 32,329,820 33,329,711 34,360,527 35,391,343 36,453,083 37,546,676 Change Factor 3% 5.6% 30,419,128 31,359,925 32,329,820 33,329,711 34,329,603 35,359,491 36,420,275 5.8% 29,506,554 30,419,128 31,359,925 32,329,820 33,299,714 34,298,706 35,327,667 6.0% 28,621,357 29,506,554 30,419,128 31,359,925 32,300,723 33,269,745 34,267,837 6.2% 27,787,725 28,647,139 29,533,133 30,446,529 31,359,925 32,300,723 33,269,745 6.4% 26,978,374 27,812,757 28,672,945 29,559,737 30,446,529 31,359,925 32,300,723 6.6% 26,192,596 27,002,676 27,837,811 28,698,774 29,559,737 30,446,529 31,359,925 Standard Deviation 2,700,457 Dhs Range 11,354,079 Dhs Equity Value Terminal Cash flow TerminalCapRate