Shemaroo Entertainment IPO

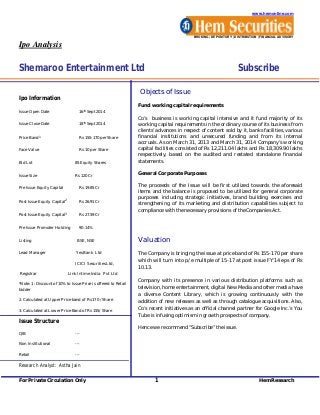

- 1. www.hemonline.com BROKING | DEPOSITORY | DISTRIBUTION | FINANCIAL ADVISORY Ipo Analysis Shemaroo Entertainment Ltd Subscribe Ipo Information Issue Open Date 16th Sept 2014 Issue Close Date 18th Sept 2014 Price Band1 Rs 155-170 per Share Face Value Rs 10 per Share Bid Lot 85 Equity Shares Issue Size Rs 120 Cr Pre Issue Equity Capital Rs 19.85 Cr Post Issue Equity Capital2 Rs 26.91 Cr Post Issue Equity Capital3 Rs 27.59 Cr Pre Issue Promoter Holding 90.14% Listing BSE, NSE Lead Manager Yes Bank Ltd ICICI Securities Ltd, Registrar Link Intime India Pvt Ltd *Note: 1: Discount of 10% to Issue Price is offered to Retail bidder 2. Calculated at Upper Price band of Rs 170 /Share 3. Calculated at Lower Price Band of Rs 155/Share Issue Structure QIB --- Non Institutional --- Retail --- Research Analyst: Astha Jain Objects of Issue Fund working capital requirements Co’s business is working capital intensive and it fund majority of its working capital requirements in the ordinary course of its business from clients’ advances in respect of content sold by it, banks facilities, various financial institutions and unsecured funding and from its internal accruals. As on March 31, 2013 and March 31, 2014 Company’s working capital facilities consisted of Rs 12,211.04 lakhs and Rs 18,309.90 lakhs respectively, based on the audited and restated standalone financial statements. General Corporate Purposes The proceeds of the Issue will be first utilized towards the aforesaid items and the balance is proposed to be utilized for general corporate purposes including strategic initiatives, brand building exercises and strengthening of its marketing and distribution capabilities subject to compliance with the necessary provisions of the Companies Act. Valuation The Company is bringing the issue at price band of Rs 155-170 per share which will turn into p/e multiple of 15-17 at post issue FY’14 eps of Rs 10.13. Company with its presence in various distribution platforms such as television, home entertainment, digital New Media and other media have a diverse Content Library, which is growing continuously with the addition of new releases as well as through catalogue acquisitions. Also, Co’s recent initiatives as an official channel partner for Google Inc.’s You Tube is infusing optimism in growth prospects of company. Hence we recommend ”Subscribe” the issue. For Private Circulation Only 1 HemResearch

- 2. www.hemonline.com Business Details Co was founded on October 29, 1962, in Mumbai, as a book circulating library. It is an established integrated media content house in India with activities across content acquisition, value addition to content and content distribution. In 1979, company set up India's first video rental business and thereafter in 1987, company forayed into distribution of content through the home video segment in the video home system (“VHS”) format. Over the years, company has successfully adapted to changing content consumption patterns by expanding into content aggregation and distribution for broadcasting on television platforms. Company is continuing the expansion into New Media platforms. Co’s Content Library consists of more than 2,900 titles spanning new Hindi films like Queen, Bhaag Milkha Bhaag, Dedh Ishqiya, The Dirty Picture, Kahaani, OMG: Oh My God!, Black, Ishqiya, Ajab Prem Ki Ghazab Kahani, Omkara, Dil Toh Baccha Hai, Bheja Fry 2, amongst others. Hindi films classics like Zanjeer, Beta, Dil, Disco Dancer, Mughal-e-Azam, Amar Akbar Anthony, Namak Halaal, Kaalia, Madhumati etc., titles in various other regional languages like Marathi, Gujarati, Punjabi, Bengali among others as well as non-film content. Company is one of the largest independent content aggregators in Bollywood. Currently, company distribute content over which company have either complete ownership rights or limited ownership rights. Titles over which company have complete ownership rights are referred to as “Perpetual Rights”, which allows it to distribute content worldwide for a perpetual period across all mediums. Titles over which company have limited ownership rights are referred to as “Aggregation Rights”. Aggregation Rights are restricted by either period of usage, distribution platforms, medium and geography or combination thereof. Titles where company have Perpetual Rights or Aggregation Rights are known as co’s “Content Library”. Company distribute its content through various mediums such as (i) television such as satellite, terrestrial and cable television; (ii) New Media platforms consisting of mobile, internet, direct to home (“DTH”) and other applications; (iii) home entertainment; and (iv) othermedia. Co’s recent initiatives include tying up as an official channel partner for Google Inc.’s You Tube where company is managing 32 channels. Company is also moving beyond providing just content, to providing content management solutions to partners including Reliance Communications Re1 WAP store and Airtel digital television in connection with an interactive devotional service, namely “iDarshan”. For New Media platforms, company have tied up with more than 100 labels or content providers who provide company with a range of content including music, videos, imagery content, games, applications, celebrity chats, text content, and voice based services etc. Co’s Content Library includes a mix of Hindi films, regional content, devotional content, and special interest content. The ongoing addition to co’s Content Library helps company generate diversified revenues and reduce its reliance on the success of a single film. The size, extent and diverse nature of co’s Content Library allow company to package and distribute a diverse portfolio of content together, such that company is able to maximize its return on an aggregate basis. For example, co’s television syndication strategy is driven by licensing a package of films to television channels. For Private Circulation Only 2 HemResearch

- 3. www.hemonline.com Sectoral Outlook Film- Industry Growth Drivers Distribution – Digital dominance is here Over the past few years the industry has steadily shifted from releasing films with physical prints to digital distribution. The share of the digital format has increased from roughly 50 percent in 2010 to around 80-90 percent in 2012. Digital distribution has enabled films to broaden their reach and do it far quicker than ever before. Distributors are now able to capture revenues in a shorter time frame by having same-day release across theatres and pre-selling C&S rights. Most films now garner about 60-80 percent of their revenue in the first week of release. Evolving production approach Production houses are now focusing on producing films which are based on strong content (storyline), small budgets and nonstar films with aggressive marketing and distribution spends. The success of Vicky Donor marks the change in the content strategy of the Indian film industry. The advent of organized funding Sourcing of film financing has been largely unorganized due to high risk nature of the business. However, with scaling up of revenues, Indian films are increasingly attracting private equity / venture capital funding from institutions directly. Cinema Capital, a venture capital fund focused on the film and entertainment sector has recently funded films like ‘Heroine’, ‘Bol Bachchan’, ‘Chakravyuh’ and ‘Dabangg2’. Highground Enterprises, Magus Entertainment and Springboard Ventures are some of the other venture capital firms investing in Indian films. After a lull in interest from film funds and other venture funds’ interest in the film business, 2012 saw a revival of interest. This indicates the growth of organized film financing for the film industry, and is expected to sustain and grow in the years ahead. For Private Circulation Only 3 HemResearch

- 4. www.hemonline.com Rationales Shemaroo, an Established Brand Name On October 2012 “Shemaroo” brand completed its 50th year of existence. From 1962 to date, the “Shemaroo” brand has been used by company in various media related activities including books and magazines rental business, a video rental business, content aggregation, content distribution, home video distribution and content creation. Over the years the “Shemaroo” brand has high consumer recall as being associated with quality entertainment. Co’s content appears regularly on several television channels and is widely available on New Media platforms such as mobile and internet and across a vast network of retail outlets. This gives the “Shemaroo” brand a considerable and constant media visibility. Vast, Diverse and Growing Content Library Company have a diverse Content Library, which is growing continuously with the addition of new releases as well as through catalogue acquisitions. This enables company to distribute to platforms catering to a wide range of audiences. Co’s Content Library consists of more than 2,900 titles spanning new Hindi films like Queen, Bhaag Milkha Bhaag, Dedh Ishqiya, The Dirty Picture, Kahaani, OMG: Oh My God!, Black, Ishqiya, Ajab Prem Ki Ghazab Kahani, Omkara, Dil Toh Baccha Hai, Bheja Fry 2, amongst others. Hindi films classics like Zanjeer, Beta, Dil, Disco Dancer, Mughal-e-Azam, Amar Akbar Anthony, Namak Halaal, Kaalia, Madhumati etc., titles in various other regional languages like Marathi, Gujarati, Punjabi, Bengali etc., as well as non-film content. Company have built a vast library of content ownership through Perpetual Rights and Aggregation Rights. As of July 31, 2014, Company has Perpetual Rights for 759 titles out of which 355 are Hindi films. Company have Perpetual Rights over content like Beta, Dil, Xcuse Me, Mann, Raja, Masti, Chal Mere Bhai, Dus, Shool, Aankhein, Love Ke Liye Kuch Bhi Karega and other classics like Anari, Jab Jab Phool Khile, Neel Kamal, Kaajal, and Shiva. Company have strong content identification and acquisition capability as a result of co’s experienced management team which is focused on commercial viability backed by stringent legal and technical processes. Diversified Distribution Platforms Company have a presence in various distribution platforms such as television, home entertainment, digital New Media and other media. Company have an extensive distribution network which is co’s key strength and sustainable competitive advantage. Company is one of the few companies within the Indian media and entertainment industry to have a comprehensive distribution capability backed by an in-house television syndication team, a New Media marketing team for mobile value added services (“MVAS”), internet, DTH and IPTV, and a nationwide home entertainment distribution network. For Private Circulation Only 4 HemResearch

- 5. www.hemonline.com Concerns Co’s revenues and profitability are directly linked to the exploitation and growth of co’s Content Library. Any failure to source content could adversely affect co’s profitability and business growth. Co earns revenues by exploiting content that it distribute through various distribution channels. Acquisition of content is an integral part of its business. Co’s ability to successfully acquire content depends on its ability to maintain existing relationships and form new ones, with industry participants. While company have benefited from long-standing relationships with certain industry participants in the past, there can be no assurance that it will be able to successfully maintain these relationships and continue to have access to content through such means. Co’s content Library includes content licensed from third parties on fixed term basis. There can be no assurance that, upon expiry or termination of these arrangements, content will be available to company at all or on acceptable financial or other terms. If any such relationship were to be adversely affected, or company is unable to form new relationships or renew these arrangements in a timely manner or at all, or co’s access to content otherwise deteriorates, or if any party fails to perform under its agreements or arrangements with company, it could have a material adverse effect on co’s business prospects, financial condition and results of operations. The distribution of content may not generate adequate revenues to recover associated costs. This could impact co’s growth plans and may adversely impact co’s profitability. Currently, company distribute its content through various mediums such as (i) broadcast syndication, (ii) New Media, (iii) home entertainment, and (iv) other media. Company invest significant amount of its working capital funds in acquisition of such content. Company acquire content based on its management estimates driven by certain assumptions. However, the actual performance of the content acquired by company may vary from estimates for factors which may be beyond its control. In certain contents, company may not be able to generate adequate or expected revenues to recover the costs associated with such contents. Further, company cannot give any assurance that all future contents would generate sufficient revenues to recover their cost involved. The aforementioned risks could adversely impact its profitability which could have a material adverse effect on co’s business, results of operations and financial condition. For Private Circulation Only 5 HemResearch

- 6. www.hemonline.com Restated Consolidated Financial Statements (Rs Cr) Particulars FY10 FY11 FY12 FY13 FY14 Total Income 101.68 158.24 182.01 214.74 264.61 Growth (%) --- 55.63 15.02 17.98 23.22 Total Expenditure(Cash) 84.16 124.04 135.46 157.38 200.27 EBITDA 17.52 34.20 46.55 57.36 64.34 Growth (%) --- 95.20 36.10 23.22 12.18 EBIDTAMARGIN 17.23 21.61 25.57 26.71 24.32 Other Income 1.96 1.18 5.11 1.35 1.34 Depreciation 2.69 2.71 2.95 2.98 2.96 EBIT 16.80 32.67 48.71 55.73 62.72 Interest 16.46 15.30 19.26 18.31 19.23 PBT 0.34 17.37 29.44 37.42 43.49 Tax 0.02 3.70 7.77 12.87 16.34 PAT 0.32 13.67 21.68 24.55 27.15 Minority Interest 0.00 -0.04 -0.74 -1.11 0.12 Adjusted PAT 0.32 13.63 20.94 23.44 27.27 Growth% --- 4206.51 53.56 11.96 16.32 NPM 0.31 8.62 11.50 10.92 10.31 Equity Capital 0.46 4.56 19.85 19.85 19.85 NetWorth 77.79 90.34 126.10 148.38 174.45 Ratio Analysis Particulars FY10 FY11 FY12 FY13 FY14 EPS 6.95 29.92 10.55 11.81 13.74 ROE 0.41 15.09 16.60 15.80 15.63 BV 1707.08 198.25 63.53 74.75 87.89 ROCE 9.1 17.5 22.3 21.6 19.3 Debt To Equity Ratio 1.37 1.06 0.74 0.74 0.87 For Private Circulation Only 6 HemResearch

- 7. www.hemonline.com www.hemonline.com research@hemonline.com HEM SECURITIES LIMITED MEMBER-BSE,CDSL, SEBI REGISTERED CATEGORY I MERCHANT BANKER MUMBAI OFFICE: 14/15, KHATAU BLDG., IST FLOOR, 40, BANK STREET, FORT, MUMBAI-400001 PHONE- 0091 22 2267 1000 FAX- 0091 22 2262 5991 JAIPUR OFFICE: 203-204, JAIPUR TOWERS, M I ROAD, JAIPUR-302001 PHONE- 0091 141 405 1000 FAX- 0091 141 510 1757 GROUP COMPANIES HEM FINLEASE PRIVATE LIMITED MEMBER-NSE HEM MULTI COMMODITIES PRIVATE LIMITED MEMBER-NCDEX,MCX HEM FINANCIAL SERVICES LIMITED NBFC REGISTERED WITH RBI For Private Circulation Only 7 HemResearch

- 8. www.hemonline.com Disclaimer & Disclosure: This document is prepared for our clients only, on the basis of publicly available information and other sources believed to be reliable. Whilst we are not soliciting any action based on this information, all care has been taken to ensure that the facts are accurate, fair and reasonable. This information is not intended as an offer or solicitation for the purchase or sell of any financial instrument and at any point should not be considered as an investment advise. Reader is requested to rely on his own decision and may take independent professional advise before investing. Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited, Directors and any of its employees shall not be responsible for the content. The person accessing this information specifically agrees to exempt Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and further agrees to hold Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The companies and its affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities there of, company (ies) mentioned here in and the same have acted upon or used the information prior to, or immediately following the publication. Disclosure of Interest Statement Company Name 1. Analyst Ownership of the Stock No 2. Hem & its Group Company Ownership of the Stock No 3. Hem & its Group Companies’ Director Ownership of the Stock No 4. Broking relationship with company covered No Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. For Private Circulation Only 8 HemResearch