Outlook for Week of August 8, 2016

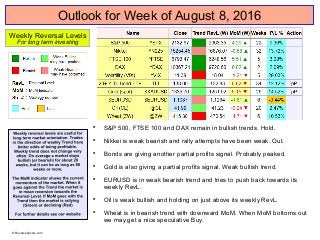

- 1. Outlook for Week of August 8, 2016 S&P 500, FTSE 100 and DAX remain in bullish trends. Hold. Nikkei is weak bearish and rally attempts have been weak. Out. Bonds are giving another partial profits signal. Probably peaked. Gold is also giving a partial profits signal. Weak bullish trend. EURUSD is in weak bearish trend and tries to push back towards its weekly RevL. Oil is weak bullish and holding on just above its weekly RevL. Wheat is in bearish trend with downward MoM. When MoM bottoms out we may get a nice speculative Buy. Weekly Reversal Levels For long term investing © Reversallevels.com

- 2. Follow us on Twitter where we post these reversal levels every day We see bullish continuation in S&P 500 and FTSE 100.DAX is still hesitating and stays in weak bullish mode. Nikkei has fallen into bearish mode last week. Bonds are giving a Sell signal. Starts bearish mode. Gold is weak bullish and struggling to stay above its daily RevL. $EURUSD is weak bullish and needs urgent follow through to stay above its RevL. Oil is weak bearish and tries to fight back after testing the $40 level. Wheat is weak bearish and survived a test of the 400 level. MoM is pointing up, so next objective is the RevL near 430. Daily Reversal Levels For swing trading © Reversallevels.com

- 3. Partial profits signal for Dow utilities. A 19% gain in 32 weeks. Partial profits signal for Gold stocks. A big 96% gain in 26 weeks. Another very stable week. Still a dominantly bullish situation in the world markets. We can only repeat what we have been saying for weeks: just staying the course until Sell signals appear. Over time you will be outflanking 90% of the investors out there if you can stick to that strategy. Most people cannot resist taking relatively small profits as soon as the media spreads some worry or fear. And they hold on to losing trades too long, hoping for an eventual come back. With reversal levels we do just the opposite. Weekly Reversal Levels for World markets For long term investing © Reversallevels.com

- 4. Partial profits signal for PFE and VZ. 25 stocks bullish, unchanged from 25 last week. Above 20 = bullish market. See article: Keeping an eye on the Dow stocks A few stocks see weekly MoM turn down. But the overall picture remains very positive until proven otherwise. Taking some partial profits never hurts and gives you some cash to use on a next opportunity. Weekly Reversal Levels for 30 Dow stocks For long term investing © Reversallevels.com The weekly reversal levels for over 2500 stocks and ETF can be picked up for free on Reversallevels.com every weekend The daily reversal levels for over 2500 stocks and ETF are available per monthly subscription: click here

- 5. More details about the reversal levels and how to use them in your trading can be found at Reversallevels.com On Facebook: https://www.facebook.com/Reversallevels/ On Twitter: http://twitter.com/lunatictrader1 On Scutify: https://www.scutify.com/profiles/LunaticTrader On Stocktwits: http://stocktwits.com/LunaticTrader For daily reversal levels, regular market commentary or questions you are also welcome to follow or contact us here: © Reversallevels.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. Reversallevels.com cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility. The weekly reversal levels for over 2500 stocks and ETF can be picked up for free on Reversallevels.com every weekend The daily reversal levels for over 2500 stocks and ETF are available per monthly subscription: click here