Equity Research and Financial Modelling Report on BSRM Steels Ltd

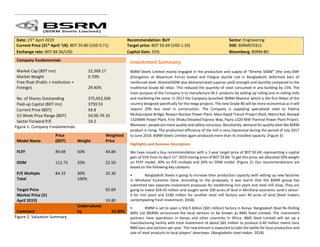

- 1. Company fundamentals Market Cap (BDT mn) 22,369.17 Market Weight 0.70% Free-float (Public + Institution + Foreign) 29.40% No. of Shares Outstanding 375,952,500 Paid-up Capital (BDT mn) 3759.53 Current Price (BDT) 59.8 52-Week Price Range (BDT) 54.00-79.10 Sector Forward P/E 19.2 Figure 1: Company Fundamentals Model Name Price (BDT) Weight Weighted Price FCFF 89.69 50% 44.84 DDM 112.73 20% 22.50 P/E Multiple 84.33 30% 25.30 Total 100% Target Price 92.69 Market Price (21 April 2019) 59.80 Comment Undervalued by 55.00% Figure 2: Valuation Summary Date: 23rd April 2019 Recommendation: BUY Sector: Engineering Current Price (21st April ’19): BDT 59.80 (USD 0.71) Target price: BDT 92.69 (USD 1.10) DSE: BSRMSTEELS Exchange rate: BDT 84.36/USD Capital Gain: 55% Bloomberg: BSRM:BD Investment Summary BSRM Steels Limited mainly engaged in the production and supply of “Xtreme 500W” (the only EMF (Elongation at Maximum Force) tested and Fatigue ductile rod in Bangladesh) deformed bars of reinforced steel. Xtreme500W also demonstrated superior yield strength and ductility compared to the traditional Grade 60 rebar. This reduced the quantity of steel consumed in any building by 15%. The main purpose of the Company is to manufacture M.S. products by setting up rolling and re-rolling mills and marketing the same. In 2017 the Company launched ‘BSRM Maxima’ which is the first Rebar of the country designed specifically for the mega projects. The new Grade 80 will be more economical as it will require 20% less steel in construction. The Company is supplying specialized steel to Padma Multipurpose Bridge, Roopur Nuclear Power Plant, Mass Rapid Transit Project (Rail), Metro Rail, Rampal 1320MW Power Plant, First Dhaka Elevated Express Way, Payra 1320 MW Thermal Power Plant Project. Moreover, people are more quality and safety conscious. Resultantly, demand for quality steel like BSRM product is rising. The production efficiency of the mill is very impressive during the period of July 2017 to June 2018. BSRM Steels Limited again produced more than its installed capacity. (Figure 3) Highlights and Business Description: We have issued a buy recommendation with a 1-year target price of BDT 92.69; representing a capital gain of 55% from its April 21st 2019 closing price of BDT 59.80. To get this price, we allocated 50% weight on FCFF model, 30% on P/E multiple and 20% on DDM model. (Figure 2). Our recommendations are based on the following key catalysts: • Bangladesh Steels is going to increase their production capacity with setting up new factories in Mirsharai Economic Zone. According to the proposals, it was learnt that the BSRM group has submitted two separate investment proposals for establishing iron plant and steel mill shop. They are going to invest $59.45 million and sought some 100 acres of land in Mirsharai economic zone’s sector- 4 for iron plant and $180 million for another steel mill factory over 40 acres of land (Steel makers contemplating fresh investment, 2018). • BSRM is set to open a Sh6.5 billion ($65 million) factory in Kenya. Bangladesh Steel Re-Rolling Mills Ltd (BSRM) announced the local venture to be known as BMS Steel Limited. The investment partners have operations in Kenya and other countries in Africa. BMS Steel Limited will set up a manufacturing facility with total investment of about $65 million to produce 0.40 million metric tons BMS bars and sections per year. The new entrant is expected to take the battle for local production and sale of steel products to local players’ doorsteps. (Bangladeshi steel maker, 2018).

- 2. Figure 3: Capacity, Production and Sales of BSRM Steels Figure 4: Price Volume Chart of BSRM Steels Key Financials 2019E 2020E 2021E 2022E 2023E Revenue Growth 12.07% 12.07% 12.07% 12.07% 12.07% EBITDA Margin 9.38% 9.47% 9.55% 9.63% 9.70% Net Profit Margin 4.96% 5.01% 5.06% 5.11% 5.14% ROE 20.03% 18.83% 17.87% 17.09% 16.44% EPS 8.63 9.78 11.06 12.51 14.12 Figure: 5 Key Financials Particulars Jun-18 Jun-17 Jun-16 Dec-15 Dec-14 Installed capacity (M.Ton) 700,000 700,000 700,000 700,000 60,000 Production (M.Ton) 727,034 681,061 362,254 602,832 623,918 Capacity Utilization (%) 103.86% 97.29% 103.50% 99.50% 104.00% Sales (M.ton) 710,995 692,504 373,747 604,513 679,803 • BSRM is set to open a Sh6.5 billion ($65 million) factory in Kenya. Bangladesh Steel Re-Rolling Mills Ltd (BSRM) announced the local venture to be known as BMS Steel Limited. The investment partners have operations in Kenya and other countries in Africa. BMS Steel Limited will set up a manufacturing facility with total investment of about $65 million to produce 0.40 million metric tons BMS bars and sections per year. The new entrant is expected to take the battle for local production and sale of steel products to local players’ doorsteps. (Bangladeshi steel maker, 2018). • BSRM Group is setting up a coal based 150 MW merchant power plant by investing BDT 1.0 billion, which is likely to commence operation by 2019. The plant will benefit the Company by providing smooth power supply at reduced cost. • The Company is supplying specialized reinforcing steel for construction of Padma Multi-purpose Bridge and Rooppur Nuclear Power plant and new Kanchpur Meghna Gumti bridges. • In 2016-17, the Company rolled out new grade reinforcing steel conforming to the US standard ASTM 706 Grade 80 which will be more economical as it will require 20% less steel in construction along with higher elongation than the older Grade 60. From the above 1 year price volume chart we can get an insight of the fluctuation of price and trading volume of the stock over the last year. BSRM Steels stock price comparatively fluctuated in small range over the last year on average the price was around 70. The 3 years price volume chart shows that the stock price has significantly decline over the last years. In 2016 the stock price was more than 100 and now it’s around 60. Moreover it also shows that the volume of trading has also decreased over the years. The BSRM Steels share price maintained stable price across the range of 80-60 BDT over the year. Since, he BSRM Steels has an below average industry P/E ratio so it is an undervalued share, which means it can be highly profitable to invest in this share during the normal periods and gain high profit by selling of during/after the dividend is announced. (Figure 4). • BSRM Group is the pioneer and leading the steel market from the front in the branded steel products with a market share of 27%. 1.63% 3.09% 1.24% 2.97% 1.67% 1.64% 1.62% 1.59% 1.56% 1.54% 0.00% 1.00% 2.00% 3.00% 4.00% 2014 2015 2016 2017 2018 2019E 2020E 2021E 2022E 2023E Dividend Yield

- 3. Figure 6: Year-wise Macro-economic factors and BSRM Steels growth Figure 7: Year-wise steel industry factors growth and BSRM steels CAGR -20.00% 0.00% 20.00% 40.00% 60.00% 2011 2012 2013 2014 2015 2016 2017 2018 Year-wise Growth GDP Growth GDP from Contruction Per capita steel consumption BD Population Real Estate BSRM Steels -50.00% 0.00% 50.00% 100.00% 150.00% 2011 2012 2013 2014 2015 2016 2017 2018 Year-wise Growth GDP Growth GDP from Contruction Real Estate Per capita steel consumption Import of iron Scrap'000MT BSRM Steels Industry overview & Competitive Positioning Macroeconomics Construction sector and infrastructure growth of the country: The construction sector is playing an increasingly strong role in the economy amid continued urbanization and an array of large infrastructure projects undertaken by the government. It is one of the 15 major sectors that contribute to the gross domestic product (GDP).The sector posted 9.92 percent growth in 2017-18, up from 8.77 percent in the previous fiscal year, according to the state-run Bangladesh Bureau of Statistics (BBS). The sector's share to the GDP increased to 7.50 percent in the last fiscal year, which was 7.36 percent in 2016-17. The value of the economic activities in the sector was Tk 73,595 crore in the last fiscal year. The mega projects taken by the government will boost up the growth of this sector even higher. (Figure 6 and 7) Stable economic growth and mega projects of the government: Bangladesh's economy has grown 8.13 per cent this fiscal year, the highest in its history, Finance Minister AHM Mustafa Kamal said while releasing a provisional estimate. (GDP growth 8.13%, breaks previous records, 2019)Bangladesh is likely to be the biggest mover in the global gross domestic product rankings in 2030, becoming the 26th largest economy in the world from 42nd now, according to the latest report of HSBC Global Research. HSBC's long-term growth model projections showed that the real GDP growth of Bangladesh would be 7.1 percent per year up to 2030, the highest among the 75 countries included in the report. The country is projected to grow 7.3 percent from 2018 to 2023, 7.0 percent from 2023 to 2028, and 7.2 percent from 2028 to 2033. Bangladesh will be a $700 billion economy in 2030 from $300 billion now, according to the report. (Bangladesh to be 26th largest economy, 2018). (Figure 4). Population growth, urbanization and stable unemployment rate: In addition to favorable demographics, rapid growth in urbanization will certainly contribute the steel industry to grow further. Bangladesh has a market of over 160 million people with a population growth of 1.04% (Source: CIA Factbook, 2017). The country’s urban population is growing faster than the growth of the total population which is favorable for the industry which is eventually causing potential rise in living standard and income level of the people. This will certainly help to propel the steel industry by generating more revenue through increasing sales volume. The population growth remained constant at 1.21% and the unemployment rate was around 4.20% which seems positive for a country with such large population. The literacy rate and male-to-female ratio also followed constant patterns. 8

- 4. Figure 9: Key players in Steel Industry Figure 10: Imports of Steel industry Figure 11: Import of Iron Scrap Steel industry overview Market players There are around 400 steel mills in Bangladesh with a total production capacity of around 8 Million MT. Currently major steel producers Abul Khair and BSRM plan on significantly raising their crude steel production. KSRM, GPH, Anwar, Rani, and SSRM are also expanding. According to a 2016 report by EBL, Abul Khair, BSRM, and KSRM account for more than 90% of total capacity in manufacturing billet, and more than 50% of the country’s annual demand. (Figure 9) Market Fundamentals The demand for steel in Bangladesh is mainly driven by infrastructure projects in commercial, housing, and public sector. The public sector can be further broken down to implementation of the government’s annual development plans and infrastructure projects. It’s estimated that the sector turns over around $3.6bn every year. In 2016, government projects amounted for almost 40% of total steel consumption. Bangladesh is heavily reliant on imports of semi-finished and finished steel products as well as flat products while being strategically positioned next to the top two steel producers in the world, China and India. The majority of imports are scraps, flat products, and semi-finished and finished steel products making up a total of 6.992 Million MT or over 93% of all imports. Given the nature of steel businesses as heavy manufacturing, cost of production for goods sold can be as great as 80-90% of revenue. The business mainly relies on importing billet, the main raw material required for production. Although the local market is capable of meeting over 90% of demand for billets, a considerable amount of imports are still required due to the majority of production is used as a backward linkage for producer’s own re- rolling mills. (Figure 10 and 11) The emerging market The global steel industry is going through a slowdown; however there are a few countries which have performed extremely well and Bangladesh is one of them. The steel sector in Bangladesh has recorded a 15 per cent growth in 2015 riding on infrastructure projects both housing and public utilities. The country is one of Asia’s most emerging steel markets and has a growing need for raw materials and steelmaking technologies. The growth trend will continue for the next 20 years to 25 years and the steel demand will also increase in line with development activities of the government and the booming housing sector in both urban and rural areas. The ongoing major projects like 'Padma Bridge', 'Dhaka- Chittagong Access Control Highway' and the upcoming major projects like 'Dhaka Elevated Expressway' and the 'Deep Sea Port' would be requiring huge quantity of quality construction materials. Historical data shows that consumption of steel has been increasing. The industry grew from producing a merge 47,000 MT in 1971 to 4.0 million Mt in 2016.The production of this sector expected to double about 8.0 million Mt on 2022 by the industrialists. (Steel industry review, 2018). Per capita steel consumption in Bangladesh is now 45 kilograms (kg). The country's per capita steel consumption is projected to increase to 73 kg by 2022. (Mega projects lift demands for steel, 2018). Iron Scrap is a major raw material for steel units based in Bangladesh. Only a small amount of required small materials are available from local source and the country needs to import significant volume of iron scrap materials from abroad. The import of iron scrap has increased significantly over the last few years. Increasing trend of the importing indicates future growth of the industry. (Figure 11)

- 5. Figure 12: FCFF Valuation Figure 13: P/E Multiple Valuation Figure 14: DDM Model FCFF Long-term FCF growth rate 7.50% Weighted average cost of capital (WACC) 12.45%% Enterprise value 53898469903 Cash 1019379483 Debt 28645869540 Equity value 26271979846 No of shares 375952500 Intrinsic value 89.69 Market price 21/04/2019 59.8 Undervalued by 49.98% P/E Multiple Industry PE 16.18 BSRM Steels PE 14.21 BSRM EPS 5.21 Intrinsic value 84.33 Price on 21/4/2019 59.80 Undervalued by 41.02% Dividend Discount Model (DDM) Average PE 18.92 Dividend payout ratio 41.33% Growth 13.16% WACC 12.45% Intrinsic value 112.4 Market price 59.8 Comment Undervalued Valuation: For the valuation we have use three different models name FCFF model, Dividend Discount Model and Market Multiplier model. FREE CASH FLOW TO FIRM (FCFF): FCFF model has been chosen for BSRM Steel’s valuation because, in the past years, the company have maintained consistent growth in free cash flow. According to our analysis, free cash flow is expected to increase in the upcoming years as well. FCFF reflects the overall fundamentals of a company. Hence FCFF was found to be much relevant model to determine the stock value of BSRM steels Ltd. For this model, we have first calculated the pro forma financial statements for the next five years (2019-2023). Based on the future growth we calculated the FCFFs. For the next five years the sales growth is 12.07% and that has been reflected in the FCFF as well. For the second phase, we have assumed a constant terminal growth rate for the rest of years till liquidation of the company. We fixed terminal growth as 7.5%. We assume that the growth rate will be closer to our GDP growth from the next five years. Therefore, we fixed a terminal rate which is very close to our gdp growth. Based on the growth rate we calculated the present value of the future cash flows and then we deducted net debt from the enterprise value to calculate the equity value. Furthermore, dividing the equity value by no of shares outstanding we calculated the intrinsic value per share. We have found the current market price of the company is less than the intrinsic value hence the company is undervalued. Our expected terminal growth rate is 7.5%. To determine this rate, we analyzed the growth potential of the industry and BSRM Steels Ltd. As the company still has a lot of scope to grow and its growth is aligned with the overall development of the country, we expect 7.5% terminal growth rate for the company. With the continuous development of the country there will rise in the construction sector in the country. Moreover, the population of Bangladesh is on the rise. There will be growth in the housing and construction sector in the future. Moreover the country has a constant GDP growth rate above 6%. Therefore, we assume that growth rate will be close to the GDP growth rate of the country. (Figure 12) Relative valuation (P/E Multiple): We have also done the valuation by using P/E multiple. We have considered seven company’s stocks in our valuation model. Then we calculated the average price to earnings ratio of the industry which is 16.18. The PE of BSRM steels Ltd is lower than industry average. Multiplying the company’s EPS with the Industry average PE we calculated the intrinsic value of 69.88 per share for BSRM Steels Ltd. The current market price per share of 59.8 indicates the company is now undervalued. (Figure 13) Dividend Discount Model: As the company has declared dividend over the last 5 years we used DDM method for the valuation of the company. In the valuation process we first identified the dividend ratio in each of previous five years. We the calculated the average dividend payout ratio over the last 5 years. Also we considered the geometric EPS growth of the company. We found that the geometric EPS growth exceeds the WACC. Therefore, instead of using constant growth rate model we followed multistage dividend growth for next five years. And to find out the terminal value we used last five years PE ratio of the company. After calculating we found the intrinsic value per share is 112.4 which is much higher than the current market price of the company. Therefore, the company is now undervalued. (Figure 14)

- 6. Figure 15: WACC Calculations Sensitivity Analysis Intrinsic value Change in WACC 89.69 10.45% 11.45% 12.45% 13.45% 14.45% 15.45% ChangeinGrowthRate 5.50% 99.47 70.14 49.35 33.65 21.54 11.87 6.50% 137.19 94.40 66.13 45.80 30.69 18.97 7.50% 200.48 130.95 89.69 62.04 42.47 27.84 8.50% 328.68 192.27 125.20 84.84 58.22 39.27 9.50% 726.78 316.49 184.82 119.18 80.33 54.55 Figure 16: Sensitivity analysis Required Rate of Return (Equity) Risk-Free Rate 4.95% Beta 1.210 Market Return 7.17% Equity risk premium 10.96% CAPM 18.21% Required Rate of Return (Debt) Risk free rate 6.44% Average credit spread 4.15% Tax rate 25.00% Required Rate of Return 7.94% WACC Name Value Weight Re and Rd Equity 22218792750.00 44.58% 18.33% Net Debt 27626490057.00 55.42% 7.80% Total 49845282807.00 100% WACC 12.49% Valuation summary: Combining all the three models we calculated the intrinsic value of per share of BSRM Steels Ltd. Based on their relevance in the valuation we fixed different weight for different valuation models. To our valuation FCFF model gets heights priority compare to the others. Therefore we gave 50% weight to this model. We gave lowest weight to DDM model. We have seen that the dividend payout ratio has decreased over time. Moreover, the company is expanding its capacity and focused on increasing retained earnings. It might be the case that the company might not declare dividend in the upcoming years. Therefore, we believe that the model should get lowest weight in the valuation. For the relative valuation we fixed the weight of 30%. The overall valuation gives us intrinsic price of 92.69 per share of the company. So the stock is undervalued by 55.00%. (Figure: 2). In order to determine our expected terminal growth we used a sensitivity analysis of change in terminal growth against change in WACC. (Figure 16). If WACC increases above 14.50% it will be a sell call, and if terminal growth falls below 6.50% it will be a sell call. Weighted Average Cost of Capital (WACC) To calculate the required rate of return of equity we followed the CAPM model. Here we calculated the beta of the stock and market return using last 6 years data. As the market return is too low we can’t find out appropriate risk premium. Therefore, we have used the equity risk premium directly that is calculated by Aswath Damodaran. To calculate the required rate of return of debt we first considered the risk free rate on 5 years debt. Then we considered the average credit spread in Bangladesh. According to Bangladesh Bank the average credit spread in the country is 4.15%. Since the company has high debt to equity ratio the weighted average cost of capital is comparatively lower than other companies who have more equity in the capital structure. Financial Analysis BSRM Steels Limited mainly engaged in the production and supply of “Xtreme 500W” (the only EMF (Elongation at Maximum Force) tested and Fatigue ductile rod in Bangladesh) deformed bars of reinforced steel. Xtreme500W also demonstrated superior yield strength and ductility compared to the traditional Grade 60 rebar. This reduced the quantity of steel consumed in any building by 15%. It was incorporated in July 2002, commenced its commercial operation from April 2008. The main purpose of the Company is to manufacture M.S. products by setting up rolling and re-rolling mills and marketing the same. The Company launched ‘BSRM Maxima’ which is the first Rebar of the country designed specifically for the mega projects. The company got listed on Dhaka Stock Exchange in 2009. The paid up capital of the company is 3,417.75 million. The current capacity is 700000 MT. (Figure 1, 3 and 19)

- 7. Figure 17: Distribution Plot Figure 18: 6-month’s regression against DSEX 0 200 400 600 800 1000 -0.237623762 -0.206753309 -0.175882855 -0.145012401 -0.114141948 -0.083271494 -0.05240104 -0.021530586 0.009339867 0.040210321 0.071080775 0.101951228 0.132821682 0.163692136 0.19456259 0.225433043 0.256303497 0.287173951 0.318044404 0.348914858 BSRM Steels Return Distribution Frequency Freq. Double y = 1.1581x + 0.0002 R² = 0.0325 -30.00% -20.00% -10.00% 0.00% 10.00% 20.00% 30.00% 40.00% -1.50% -1.00% -0.50% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 6 months Regression model BSRM Steels vs DSEX BSRM Steels v/s DSEX Linear (BSRM Steels v/s DSEX) BSRM Steels Skewness 2.509702849 Kurtosis 57.93837785 Count 1286 Max 34.89% Min -23.76% Range 0.58653862 Bin 19 Width per Bin 0.030870454 The average expected growth rate of 12.07% was calculated based on the multiple regression analysis of the several dependent and independent variables such as: GDP, per capita consumption of steel, population growth, GDP from construction, CAGR of BSRM Steels, Import of Iron scraps and Real Estate sector of Bangladesh. We found the relative growth average (with given weight 0.4 and 0.6) for the two multiple regression models 7.64% and 15.02%. We used the average of these two YoY average growth rates of relative variables and assumed our expected growth rate for BSRM Steels to be 12.07% over the next 5 years (2019-2023). Running regression of these major determining factors with the annual sales of BSRM gave an R^2 of around 90%. Kurtosis (distribution or volatility of skew): The kurtosis of BSRM Steels return distribution is 57.9384. The distribution is longer and the tails are flatter. The peak of the return distribution is higher than normal distribution, this means the returns are heavily tailed and there are a lot return outliers. The outliers stretch the horizontal axis so this makes the returns appear in a narrow and high vertical range, and the distribution can be addressed as a leptokurtic distribution. Skewness (measure of asymmetry in the distribution): The skewness for the return distribution of BSRM Steels is 2.5097, which means the return distribution is highly positively-skewed. The median will be greater than the mode as there is asymmetry in the return distribution. Thus, the BSRM Steels stocks will provide high returns to the investors. Figure: 19 Key Profitability ratios of BSRM Steels 0.00 5.00 10.00 15.00 0.00% 10.00% 20.00% 30.00% 2014 2015 2016 2017 2018 2019E 2020E 2021E 2022E 2023E Key Ratios Earnings Per Share (EPS) Operating Profit Margin Return On Equity (ROE) Net Profit Margin EBITDA margin to Sales

- 8. 0 20 40 60 80 100 120 140 0 11 22 33 44 55 66 77 88 99 110 121 132 143 154 165 176 187 198 209 220 231 242 Price Trading days/Time period Simulated 10 lognormal pathways of BSRM Steels stock price Path 1 Path 2 Path 3 Path 4 Path 5 Path 6 Path 7 Path 8 Path 9 Path 10 Risk factors and concerns 1. Business Risks Risks associated with sourcing of Raw Materials: Against their production capacity of 7,00,000 MT MS Rod, they have their billet manufacturing plant having capacity of 2,20,000 MT. On the other hand BSRM Steel Mills Limited, an associate company of BSRM Steels Limited can meet rest of the required billets of the company. BSRM Steels Limited is going to establish it’s another Melting Unit with a capacity of 430,000 MT per annum at Mirsarai, Chattogram which will start its commercial production during year 2019. So group will be self-sufficient for its basic raw materials of billet. Risks associated with Power Supply: Presently the primary constraint on the economic development of Bangladesh is the shortage of power for which new industrial investments proposal from home and aboard have failed to materialize.For ensuring uninterrupted power supply BSRM Group has made a deal with PGCB and installed a substation for tapping power from the 230 KV national grids. 2. Market Risks Interest rate risk: The business of BSRM Steels Limited requires huge working capital. Although the company closely monitors and manages requirement of capital investment, the actual capital requirement may deviate from the projected one due to factors beyond its control, thus potentially affecting the borrowing costs. Interest rate on working capital and term loan has increased during last six months of this year which also affected the net income of the company. Foreign Exchange Fluctuations: Foreign currency risk is the risk of changes in exchange rates that adversely affect the company’s earnings, equity, and competitiveness. They are hugely involved with Foreign Trade i.e. Import & Export and thus they are also exposed to Foreign Currency Risks. Exchange rate gains or losses related to foreign currency transactions are recognized as transaction gains and losses in our income statement as incurred. They also maintain foreign currency account in which export collection is directly deposited and they can meet foreign currency payment requirements. Competition and Economic conditions: Competition refers to the risks of decreasing present market share caused by new entrants. As it’s an oligopoly industry the industry is driven by few large companies. Actions of a large company has direct effect on others business. They try to mitigate this risk through active brand management and customer relationship and by ensuring timely supply of quality product. Initial price 59.08 Current market price of the stock on 16th April, 2019 Mean 3.29% Annualized mean return Sigma 35.29% Annualized standard deviation Delta_t 0.004 We considered 250 trading days a year To simulate 10 pathways for the stock price with lognormal distribution we used the Initial stock price to be 59 and multiplied it with the EXP(Mean*Delta_t+Sigma*SQRT(Delta_t)*NORM.S.INV(RAND())) Here we kept the probability as random because stock prices can take any random values. The lognormal distribution generates simulation of positive stock prices. This is more realistic and logical compared to the normal distribution simulation. We calculated the Delta_t by dividing 1 by 250, since we assumed 250 days in a year. The Lognormal simulation helps us to get an idea of the share price range in the future and we can see that the highest the price will go around 120 BDT and the lowest around 20 BDT.

- 9. Appendix BSRM Steels Limited SWOT Analysis Strengths. Weakness Large market share in the industry. Product like “Xtreme 500 and BSRM Maxima in the product line. Strong brand image in the industry. Integrated supply chain system. Most advanced technology in the industry. Heavily dependent on importing for raw materials. High debt/equity ratio. High cogs margin. Product price high compare to competitors. Opportunities Threats Going to launch billet manufacturing plant. Investing in new subsidiary in Kenya. Setting up a coal based 150 MW merchant power plant. Oligopoly industry. Future economic growth. Construction sector future growth. Increasing in interest will increase cost of debt. Exposure to foreign exchange rate risk. Strong rivalry in the industry may arise. Shipbuilding industry is shrinking.

- 10. Absolute value BSRM Steels Income statement 2014 2015 2016 2017 2018 Average 2014 2015 2016 2017 2018 Average Revenue Cost of sales -92.7% -86.5% -82.4% -90.4% -90.6% -88.5% 92.72% 86.48% 82.39% 90.35% 90.64% 88.52% Gross profit 7.3% 13.5% 17.6% 9.6% 9.4% 11.5% 7.28% 13.52% 17.61% 9.65% 9.36% 11.48% Selling and distribution costs -1.7% -2.7% -2.9% -2.9% -2.3% -2.5% 1.75% 2.66% 2.91% 2.91% 2.30% 2.50% Administrative costs -0.6% -0.8% -0.9% -1.0% -0.8% -0.8% 0.65% 0.83% 0.95% 1.00% 0.76% 0.84% Other operating income 0.0% 0.1% 0.0% 0.0% 0.0% 0.0% 0.02% 0.05% 0.01% 0.03% 0.03% 0.03% Profit from operating activities/EBIT 4.9% 10.1% 13.8% 5.8% 6.3% 8.2% 4.91% 10.08% 13.77% 5.77% 6.33% 8.17% Finance costs -1.3% -2.1% -1.2% -1.3% -4.6% -2.1% 1.26% 2.08% 1.19% 1.35% 4.64% 2.10% Finance income 0.5% 0.2% 0.2% 0.0% 2.5% 0.7% 0.49% 0.21% 0.23% 0.05% 2.51% 0.68% net finance cost 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Profit before WPPF and Welfare Fund 4.1% 8.2% 12.8% 4.4% 4.2% 6.7% 4.14% 8.20% 12.81% 4.38% 4.20% 6.74% Contribution to WPPF and Welfare fund-0.2% -0.4% -0.6% -0.4% -0.3% -0.4% 0.21% 0.41% 0.64% 0.37% 0.28% 0.38% Profit on bargain purchase 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00% 0.00% 0.00% 0.03% 0.00% 0.01% Share of profit/(loss) of associate (Net of tax)0.0% 0.2% -0.3% -0.4% 0.5% 0.0% 0.01% 0.23% 0.29% 0.36% 0.48% 0.01% Profit before income tax 3.9% 8.0% 11.9% 3.7% 4.4% 6.4% 3.92% 8.03% 11.88% 3.67% 4.40% 6.38% Income tax expenses: -1.1% -1.6% -4.0% -0.8% -1.0% -1.7% 1.10% 1.58% 4.04% 0.83% 1.05% 1.72% Current tax -1.0% -1.2% -3.9% -1.2% -1.1% -1.7% 0.96% 1.22% 3.86% 1.17% 1.07% 1.65% Deferred tax -0.1% -0.4% -0.2% 0.3% 0.0% -0.1% 0.14% 0.37% 0.19% 0.34% 0.02% 0.07% -0.1% -0.1% -0.9% -4.2% -0.8% -1.2% 0.06% 0.09% 0.87% 4.20% 0.82% 1.21% Profit aftertax 2.8% 6.4% 7.8% 2.8% 3.4% 4.7% 2.82% 6.44% 7.84% 2.84% 3.36% 4.66% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Other comprehensive income: 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Acturial (loss)/ gain on defined benefit plans0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00% 0.00% 0.00% 0.00% 0.01% 0.00% Total comprehensive income 2.8% 6.4% 7.8% 2.8% 3.4% 4.7% 2.82% 6.44% 7.84% 2.84% 3.35% 4.66% BSRM Steels Income statement

- 11. BSRM Steels Balance sheet 2014 2015 2016 2017 2018 Average ASSETS Non-current assets 22.16% 29.94% 31.03% 34.29% 26.69% 28.82% Property, plant and equipment 16.78% 21.76% 28.23% 39.31% 30.27% 27.27% Capital work in progress 0.13% 0.00% 0.00% 0.00% 0.00% 0.03% Accumulated depreciation 0.00% 0.00% -5.44% -8.68% -6.41% -4.11% Intangible assets 0.09% 0.09% 0.09% 0.08% 0.04% 0.08% Investment in subsidiary 2.71% 3.23% 3.38% 0.00% 0.00% 1.86% investment in associate 2.45% 4.86% 4.78% 3.58% 2.79% 3.69% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Current assets 48.27% 46.58% 77.48% 87.43% 68.53% 65.66% Short term investment 0.57% 0.83% 0.84% 0.75% 0.55% 0.71% Inventories 29.26% 21.32% 30.98% 36.00% 28.70% 29.25% Trade and other receivables 7.71% 6.96% 12.49% 16.61% 16.98% 12.15% Current account with related companies6.76% 8.13% 24.47% 27.70% 12.63% 15.94% Advances, deposits and prepayments 2.62% 7.90% 8.14% 5.03% 7.92% 6.32% Cash and cash equivalents 1.35% 1.45% 0.56% 1.34% 1.75% 1.29% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Total Assets 70.43% 76.53% 108.52% 121.72% 95.21% 94.48% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% EQUITY AND LIABILITIES 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Shareholders equity 19.45% 28.10% 33.87% 30.84% 22.71% 27.00% Share capital 8.87% 10.58% 11.04% 9.09% 6.44% 9.20% Retained earnings 5.04% 10.93% 16.00% 14.79% 11.81% 11.71% Revaluation reserve 5.55% 6.60% 6.84% 6.97% 4.47% 6.08% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Non currents liabilities 3.11% 4.44% 7.10% 6.27% 9.21% 6.03% Long term borrowings- non current portion1.12% 1.70% 4.04% 2.90% 6.98% 3.35% Retirement benefit obligations - Gratuity0.10% 0.17% 0.21% 0.30% 0.28% 0.21% Deferred tax liability 1.89% 2.57% 2.86% 3.08% 1.95% 2.47% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Current liabilities 47.87% 43.98% 67.54% 84.60% 63.29% 61.46% Trade payable 0.14% 0.10% 0.09% 7.29% 15.47% 4.62% Short term borrowings 44.18% 39.15% 55.20% 62.91% 40.91% 48.47% Current portion of long term borrowings0.59% 0.61% 1.76% 1.60% 1.18% 1.15% Current account with related companies0.00% 0.00% 0.00% 6.67% 0.47% 1.43% Liabilities for expenses 0.94% 0.73% 0.90% 0.90% 1.52% 1.00% Current tax liabilities 1.28% 1.73% 3.87% 1.63% 1.90% 2.08% Provision for WPPF and Welfare Fund 0.21% 0.41% 0.64% 0.37% 0.28% 0.38% Other liabilities 0.53% 1.25% 5.08% 3.24% 1.55% 2.33% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Total Liabilities 50.98% 48.43% 74.64% 90.88% 72.50% 67.49% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Total Equity and Liabilities 70.43% 76.53% 108.52% 121.72% 95.21% 94.48% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Depreciation 0.06% 0.09% 0.87% 4.20% 0.82% 1.21% CapEx 0.45% 1.85% 6.39% 20.27% 5.76% 6.94% EBITDA 4.98% 10.18% 14.64% 9.97% 7.15% 9.38% BSRM Steels Balance sheets, Income Statements and Ratios

- 12. BSRM Steels Balance sheet 2018 2019E 2020E 2021E 2022E 2023E ASSETS Non-current assets 15,576,744,606 17,368,248,243 19,348,938,468 21,553,019,861 24,005,174,656 26,732,732,321 Property, plant and equipment 17,668,362,090 19800642409 22190253846 24868252028 27869440487 31232822964 Capital work in progress Accumulated depreciation (3,743,335,312) (4,280,371,621) (4,909,237,763) (5,629,643,214) (6,454,912,661) (7,400,310,367) Intangible assets 25,484,116 25,484,116 25,484,116 25,484,116 25,484,116 25,484,116 Investment in subsidiary investment in associate 1,626,233,712 1822493338 2042438269 2288926931 2565162714 2874735607 Current assets 40,002,278,335 45,816,224,564 52,699,894,636 60,462,344,681 69,211,906,371 79,070,316,728 Short term investment 319,833,530 358432169.6 401689029.4 450166279.7 504493935.8 565378045.2 Inventories 16,753,099,378 18774922562 21040746506 23580018084 26425737921 29614889276 Trade and other receivables 9,911,646,856 11107819394 12448350257 13950661118 15634276158 17521075806 Current account with related companies 7,374,991,691 8265031727 9262484938 10380314324 11633047307 13036964529 Advances, deposits and prepayments 4,623,327,397 5181286871 5806582864 6507341786 7292670768 8172776025 Cash and cash equivalents 1,019,379,483 2,128,731,840 3,740,041,041 5,593,843,090 7,721,680,281 10,159,233,047 Total Assets 55,579,022,941 63,184,472,807 72,048,833,104 82,015,364,543 93,217,081,027 105,803,049,049 EQUITY AND LIABILITIES Shareholders equity 13,258,559,602 16,194,667,448 19,517,503,999 23,273,741,038 27,515,682,869 32,301,946,058 Share capital 3,759,525,000 3,759,525,000 3,759,525,000 3,759,525,000 3,759,525,000 3,759,525,000 Retained earnings 6,892,000,691 9,513,482,480 12,483,722,790 15,844,811,030 19,643,916,108 23,933,899,443 Revaluation reserve 2,607,033,911 2921659968 3274256209 3669405009 4112241761 4608521616 Non currents liabilities 5,376,120,480 6,004,941,685 6,709,651,254 7,499,407,661 8,384,474,660 9,376,354,669 Long term borrowings- non current portion 4,072,406,248 4,563,878,613 5,114,663,597 5,731,919,259 6,423,667,513 7,198,898,389 Retirement benefit obligations - Gratuity 165,623,229 165,623,229 165,623,229 165,623,229 165,623,229 165,623,229 Deferred tax liability 1,138,091,003 1275439844 1429364427 1601865173 1795183918 2011833051 Current liabilities 36,944,342,859 40,984,863,673 45,821,677,852 51,242,215,844 57,316,923,498 64,124,748,321 Trade payable 9,030,450,761 10120277443 11341628257 12710375999 14244309052 15963362561 Short term borrowings 23,882,556,282 26764787497 29994856552 33614741745 37671487463 42217815579 Current portion of long term borrowings 690,907,010 774288107.4 867731930 972452883 1089811930 1221334282 Current account with related companies 275,429,270 0 0 0 0 0 Liabilities for expenses 887,392,682 994486364 1114504490 1249006827 1399741380 1568667112 Current tax liabilities 1,109,937,984 1243889219 1394006162 1562239747 1750776356 1962066228 Provision for WPPF and Welfare Fund 161,299,331 180765504 202580923 227029104 254427778 285133020 Other liabilities 906,369,539 906,369,539 906,369,539 906,369,539 906,369,539 906,369,539 Total Liabilities 42,320,463,339 46,989,805,358 52,531,329,106 58,741,623,504 65,701,398,158 73,501,102,990 Total Equity and Liabilities 55,579,022,941 63,184,472,807 72,048,833,104 82,015,364,543 93,217,081,027 105,803,049,049 EFN 0 0 0 0 0 0 BSRM Steels ProForma Balance sheet

- 13. BSRM Steels Income statement 2018 2019E 2020E 2021E 2022E 2023E Revenue 58,372,407,184 65416995381 73311749354 82159270110 92074540910 103186421599 Cost of sales (52,911,534,499) (57,905,064,881) (64,893,252,558) (72,724,799,398) (81,501,484,962) (91,337,371,927) Gross profit 5,460,872,685 7511930500 8418496796 9434470712 10573055949 11849049671 Selling and distribution costs (1,344,485,740) (1,506,743,026) (1,688,582,094) (1,892,366,144) (2,120,743,571) (2,376,682,393) Administrative costs (442,821,958) (442,821,958) (442,821,958) (442,821,958) (442,821,958) (442,821,958) Otheroperating income 19,569,215 21,930,897 24,577,595 27,543,706 30,867,778 34,593,010 Profitfromoperating activities/EBIT 3,693,134,202 5584296413 6311670338 7126826317 8040358197 9064138330 Finance costs (2,705,588,387) (3,032,108,346) (3,398,033,887) (3,808,120,614) (4,267,698,055) (4,782,738,925) Finance income 1,462,311,066 1638787928 1836562642 2058205506 2306597013 2584965285 Profitbefore WPPF and Welfare Fund 2449856881 4190975995 4750199093 5376911209 6079257155 6866364690 Contribution to WPPF and Welfare fund (161,299,331) -180765504 -202580923 -227029104 -254427778 -285133020 Profit on bargain purchase - Share of profit/(loss) of associate (Net of tax) 281,267,990 315212404 353253350 395885212 443662037 497204738 Profitbefore income tax 2,569,825,540 4325422896 4900871520 5545767316 6268491414 7078436407 Income tax expenses: (610,873,085) -1081355724 -1225217880 -1386441829 -1567122853 -1769609102 Current tax (624,830,108) -1081355724 -1225217880 -1386441829 -1567122853 -1769609102 Deferred tax 13,957,023 0 0 0 0 0 Depreciation -537036309 -628866142 -720405451 -825269447 -945397706 Profitaftertax 1,958,952,455 3,244,067,172 3,675,653,640 4,159,325,487 4,701,368,560 5,308,827,306 Othercomprehensive income: Acturial (loss)/ gain on defined benefit plans (3,392,066) 0 0 0 0 0 Total comprehensive income 1,955,560,389 3,244,067,172 3,675,653,640 4,159,325,487 4,701,368,560 5,308,827,306 Dividends 622585382 705413330 798237247 902263482 1018843971 Retained Earnings 2621481789 2970240310 3361088240 3799105078 4289983335 Depreciation 479204248 537036309 601847746 674480857 755879589 847101806 Numberof shares 375952500 375952500 375952500 375952500 375952500 375952500 BSRM Steels ProForma Income statement

- 14. Year 2018 2019E 2020E 2021E 2022E 2023E Free cash flow calculation Profit after tax 3,244,067,172 3,675,653,640 4,159,325,487 4,701,368,560 5,308,827,306 Add back depreciation 537,036,309 628,866,142 720,405,451 825,269,447 945,397,706 Subtract increase in current assets (4,704,593,872) (5,272,360,871) (5,908,647,996) (6,621,724,498) (7,420,857,591) Add back increase in current liabilities 4040520814 4836814179 5420537991 6074707655 6807824823 Subtract increase in fixed assets at cost (2,132,280,319) (2,389,611,437) (2,677,998,182) (3,001,188,458) (3,363,382,478) Add back after-tax interest on debt 2,274,081,260 2,548,525,415 2,856,090,461 3,200,773,542 3,587,054,194 Subtract after-tax interest on cash and mkt. securities (1,229,090,946) (1,377,421,981) (1,543,654,129) (1,729,947,760) (1,938,723,964) Free cash flow 2,029,740,416 2,650,465,087 3,026,059,082 3,449,258,487 3,926,139,996 Current assest (without cash) 38,982,898,852 43,687,492,724 48,959,853,595 54,868,501,591 61,490,226,090 68,911,083,680 Current liabilities 36,944,342,859 40,984,863,673 45,821,677,852 51,242,215,844 57,316,923,498 64,124,748,321 Working capital 2,038,555,993 2,702,629,051 3,138,175,743 3,626,285,748 4,173,302,591 4,786,335,359 Working capital investment 664,073,058 435,546,692 488,110,005 547,016,844 613,032,768 Capex 2,669,316,628 2,991,459,183 3,352,479,040 3,757,068,047 4,210,484,284 BSRM Steels ProForma Cashflow Calculations Year-wise Growth GDP Growth GDP from Contruction Real Estate Per capita steel consumptionImport of iron Scrap'000MTBSRM Steels 2011 6.46% 6.13% 6.18% 8.33% 36.55% 41.93% 2012 6.52% 8.42% 3.92% 11.54% -36.92% 22.47% 2013 6.01% -2.02% 4.04% 3.45% 36.10% -5.29% 2014 6.06% 19.19% 4.25% 6.67% 64.52% 6.37% 2015 6.55% 8.60% 4.40% 5.31% 106.10% -16.14% 2016 7.10% 8.56% 4.47% 3.86% 112.58% -4.19% 2017 7.30% 8.79% 4.80% 28.57% 6.51% 21.48% 2018 7.86% 9.91% 4.98% 8.89% 38.75% 55.19% Avg. YoY growth 2 15.02% Year-wise Growth GDP Growth GDP from Contruction Per capita steel consumptionBD Population Real Estate BSRM Steels 2011 6.46% 6.13% 8.33% 1.19% 6.18% 41.93% 2012 6.52% 8.42% 11.54% 1.22% 3.92% 22.47% 2013 6.01% -2.02% 3.45% 1.22% 4.04% -5.29% 2014 6.06% 19.19% 6.67% 1.21% 4.25% 6.37% 2015 6.55% 8.60% 5.31% 1.20% 4.40% -16.14% 2016 7.10% 8.56% 3.86% 1.20% 4.47% -4.19% 2017 7.30% 8.79% 28.57% 1.20% 4.80% 21.48% 2018 7.86% 9.91% 8.89% 1.20% 4.98% 55.19% Avg. YoY growth 1 7.64% 12.07%Average expected growth based on multiple regression analysis

- 15. BSRMSteelsFinancial Ratios 2014 2015 2016 2017 2018 2019E 2020E 2021E 2022E 2023E CurrentRatio 1.01 1.06 1.15 1.03 1.08 1.12 1.15 1.18 1.21 1.23 QuickRatio 0.40 0.57 0.69 0.61 0.63 0.66 0.69 0.72 0.75 0.77 Cash(Coverage) Ratio 0.03 0.03 0.01 0.02 0.03 0.05 0.08 0.11 0.13 0.16 InventoryTurnover 3.17 4.06 2.66 2.51 3.16 3.08 3.08 3.08 3.08 3.08 Total AssetTurnover 1.42 1.31 0.92 0.82 1.05 1.04 1.02 1.00 0.99 0.98 FixedAssetTurnover 4.51 3.34 3.22 2.92 3.75 3.77 3.79 3.81 3.84 3.86 AccountReceivableTurnover 12.97 14.38 8.00 6.02 5.89 5.89 5.89 5.89 5.89 5.89 AverageCollectionPeriod(Days) 28.15 25.39 45.60 60.63 61.98 61.98 61.98 61.98 61.98 61.98 AveragePaymentPeriod(Days) 0.54 0.44 0.38 29.46 62.29 63.79 63.79 63.79 63.79 63.79 GrossProfitMargin 7.28% 13.52% 17.61% 9.65% 9.36% 11.48% 11.48% 11.48% 11.48% 11.48% OperatingProfitMargin 4.91% 10.08% 13.77% 5.77% 6.33% 8.54% 8.61% 8.67% 8.73% 8.78% NetProfitMargin 2.82% 6.44% 7.84% 2.84% 3.36% 4.96% 5.01% 5.06% 5.11% 5.14% BasicEarningPower(BEPratio) 0.07 0.13 0.13 0.05 0.07 0.09 0.09 0.09 0.09 0.09 ReturnOnAsset(ROA) 4.00% 8.42% 7.22% 2.34% 3.52% 5.13% 5.10% 5.07% 5.04% 5.02% ReturnOnEquity(ROE) 14.49% 22.93% 23.14% 9.22% 14.78% 20.03% 18.83% 17.87% 17.09% 16.44% NetAssetValuepershare(NAV) 21.93 26.57 30.69 33.94 35.27 43.08 51.91 61.91 73.19 85.92 Retentionratio 0.53 0.51 0.84 0.25 0.81 0.88 0.90 0.91 0.92 0.93 DividendPayoutRatio 0.47 0.49 0.16 0.75 0.19 0.12 0.10 0.09 0.08 0.07 Numberof shares 341775000 341775000 341775000 341775000 375952500 375952500 375952500 375952500 375952500 375952500 Marketpricepershare 91.8 97 93.9 78.5 59.9 60.9 61.9 62.9 63.9 64.9 DividendPerShare 1.5 3.0 1.2 2.3 1.0 1.0 1.0 1.0 1.0 1.0 EBITDAmargintoSales 4.98% 10.18% 14.64% 9.97% 7.15% 9.38% 9.47% 9.55% 9.63% 9.70% BookValuePerShare 21.93 26.57 30.69 33.94 35.27 43.08 51.91 61.91 73.19 85.92 EarningsPerShare(EPS) 3.18 6.09 7.10 3.13 5.21 8.63 9.78 11.06 12.51 14.12 Debt-to-AssetRatio 0.72 0.63 0.69 0.75 0.76 0.74 0.73 0.72 0.70 0.69 Debt-to-EquityRatio 2.62 1.72 2.20 2.95 3.19 2.90 2.69 2.52 2.39 2.28 Equitymultiplier 3.62 2.72 3.20 3.95 4.19 3.90 3.69 3.52 3.39 3.28 TimesInterestEarnedRatio(times) 3.89 4.84 11.61 4.28 1.37 1.84 1.86 1.87 1.88 1.90 P/ERatio 28.88 15.92 13.22 25.09 11.50 7.06 6.33 5.69 5.11 4.60 P/BRatio 4.19 3.65 3.06 2.31 1.70 1.41 1.19 1.02 0.87 0.76 P/SRatio 0.81 1.03 1.04 0.71 0.39 0.35 0.32 0.29 0.26 0.24 M/BRatio 4.19 3.65 3.06 2.31 1.70 2.15 1.79 1.50 1.27 1.08 Dividendyield 1.63% 3.09% 1.24% 2.97% 1.67% 1.64% 1.62% 1.59% 1.56% 1.54% MARKETValue RATIO DEBTMANAGEMENTRATIO BSRM Steels Financial Ratios PROFITABILITY RATIO ASSETMANAGEMENTRATIOS LIQUIDITY RATIO

- 16. Credit Rating: Credit Rating information and Services Limited (CRISL) assigned rating as below: Long term Short term AA+ ST-2 The entities rated “AA+” are adjudged to be of high quality, offer higher safety and have high credit quality. This level of rating indicates a corporate entity with a sound credit profile and without significant problems. Risks are modest and may vary slightly from time to time because of economic conditions. “ST-2” indicates high certainty of timely payment. Liquidity factors are strong and supported by good fundamental protection factors. Risk factors are very small. The Company in the evaluation of Credit Rating Company was also placed with “Stable Outlook”. Intercept(Alpha) -0.000099626 Slope(Beta) 1.210248472 R Square 0.132170923 Tslope 13.98406308 Tintercept -0.171691744 Avg Daily retun 0.01% Daily variance 0.05% Daily Standard deviation 2.23% Annualized Return 3.29% Annualized variance 12.45% Annualized Standard deviation 35.29% Covariance 0.00005440 CAPM, Re of BSRM Steels 4.74% Trading days 250 Risk-Free rate, Rf 4.95% Avg Daily retun 0.02% Daily Standard deviation 0.67% Annualized Return 4.78% Annualized Standard deviation 10.60% DSEX BSRM Steels v/s DSEX BSRM Steels Average monthly return 0.006 Average annualized return 7.2% Variance 0.00205 Standard deviation 0.04527 Annual standard deviation 0.15682 Beta 1 DSEX 6 Years annualized return Return and Sigma Calculations: We collected the daily trading close price and volume from January 2014 to 21st April 2019 of BSRM Steels in DSE, and the DSEX trade volume and price of the corresponding days, from the Dhaka Stock Exchange website. The daily average return was calculated using the average change in price for the each day over the 5 years period. The daily standard deviation was calculated using the =STDEV.S() function in excel, the y-variable was the BSRM Steel daily return % and the x-variable was the DSEX daily return %. We assumed the annual trading days to be 250 in a year, and multiplied it with the daily return to get the Annualized return. We multiplied the squared-root of 250 days with the daily standard deviation to get the annualized standard deviation. The Beta of the BSRM Steels stock price with DSEX index was calculated using the =Slope() function in excel and also using regression analysis. Calculating Return on Equity using regular CAPM formula gives a very low value which is not reliable and logical. So, in the WACC worksheet we found the Return on Equity through more integrated calculations.

- 17. Name Value Weight Re and Rd Equity 22218792750.00 44.58% 18.21% Net Debt 27626490057.00 55.42% 7.80% Total 49845282807.00 100% 12.45% Risk-Free Rate 4.95% Beta 1.2102 Market Return 7.17% Equity risk premium 10.96% CAPM 18.21% Risk free rate 6.44% Average credit spread 4.15% Tax rate 25% Required Rate of Return 7.94% Average of corporate tax rate and BSRMSteels YOY implied tax rate (Risk Free Rate +Credit Spread)*(1-Tax Rate); this is the cost of debt for BSRMSteels Calculated Average of DSEX Return ( 6years). It seemes very lower market return. Therefore we will directly use equity risk remium to calculate CAPM Required Rate of Return (Debt) Details T-bill 5year rate Bangladesh bank Country default spreads and risk premium by Aswath Damodaran This is the cost of equity for BSRMsteels Ltd BSRM STEELS Required Rate of Return (Equity) Details 1year T-bill rate WACC Shares outstanding 375952500 2014 2015 2016 2017 2018 Share price, 4th April 2019 59.1 Cash and cash equivalents 521092776 468886084 173417317 505247144 1019379483 Equity value, E 22218792750 Net debt, D 27,626,490,057 Short-term debt 17252850097 12847526725 17636668756 24262393500 24573463292 Tax rate, TC 25.64% Long-term debt 431897159 548388963 1251696088 1091223642 4072406248 Cost of debt, rD 7.67% Total debt 17684747256 13395915688 18888364844 25353617142 28645869540 Expected market return, E(rM) 7.17% Net debt 17163654480 12927029604 18714947527 24848369998 27626490057 Risk-free rate, rf 4.95% Equity beta, b 1.210248472 Interest expense -486981060 -673131697 -367244216 -507117525 -2705588387 Cost of debt, rD? 2.33% 10.31% Income before tax 1,510,680,374 2,593,948,797 3,678,512,777 1,381,719,934 2,569,825,540 Income tax expense -424,472,568 -512,071,634 -1,251,162,976 -312,281,861 -610,873,085 Implied tax rate 28.10% 19.74% 34.01% 22.60% 23.77% Average tax rate 25.64%

- 18. Skewness 2.509702849 Kurtosis 57.93837785 Count 1286 Max 34.89% Min -23.76% Range 0.58653862 Bin 19 Width per Bin 0.030870454 Bins Beginning Point Ending Point Midpoint Frequency Freq. Double 1 -24.00% -23.76% -0.22456 1 1 2 -23.76% -20.68% -0.22219 0 0 3 -20.68% -17.59% -0.19132 0 0 4 -17.59% -14.50% -0.16045 0 0 5 -14.50% -11.41% -0.12958 0 0 6 -11.41% -8.33% -0.09871 2 2 7 -8.33% -5.24% -0.06784 4 4 8 -5.24% -2.15% -0.03697 102 102 9 -2.15% 0.93% -0.0061 921 921 10 0.93% 4.02% 0.024775 211 211 11 4.02% 7.11% 0.055646 33 33 12 7.11% 10.20% 0.086516 11 11 13 10.20% 13.28% 0.117386 0 0 14 13.28% 16.37% 0.148257 0 0 15 16.37% 19.46% 0.179127 0 0 16 19.46% 22.54% 0.209998 0 0 17 22.54% 25.63% 0.240868 0 0 18 25.63% 28.72% 0.271739 0 0 19 28.72% 31.80% 0.302609 0 0 20 31.80% 34.89% 0.33348 1 1 BSRM Steels Return Distribution BSRM Steels

- 19. Regression Statistics Multiple R 0.967914171 R Square 0.936857843 Adjusted R Square 0.779002449 Standard Error 0.115998245 Observations 8 ANOVA df SS MS F Significance F Regression 5 0.399288788 0.079857758 5.934911823 0.150459199 Residual 2 0.026911186 0.013455593 Total 7 0.426199974 Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% Intercept -40.18380524 10.96677526 -3.664140487 0.067075493 -87.37003076 7.002420269 -87.37003076 7.002420269 GDP Growth 35.71808294 10.04938686 3.554254946 0.070849803 -7.520938854 78.95710473 -7.520938854 78.95710473 GDP from Contruction 1.172005069 0.806023963 1.454057351 0.283139803 -2.296036137 4.640046274 -2.296036137 4.640046274 Per capita steel consumption -0.329712167 0.621826099 -0.530232114 0.648933429 -3.005213929 2.345789595 -3.005213929 2.345789595 BD Population 2958.218498 840.2435081 3.52066808 0.072064727 -657.0575256 6573.494522 -657.0575256 6573.494522 Real Estate 47.26659932 10.56490185 4.473926971 0.046502716 1.809495545 92.7237031 1.809495545 92.7237031 -20.0% Regression Statistics Multiple R 0.983956431 R Square 0.968170259 Adjusted R Square 0.888595907 Standard Error 0.082358469 Observations 8 ANOVA df SS MS F Significance F Regression 5 0.412634139 0.082526828 12.16686318 0.077684847 Residual 2 0.013565835 0.006782917 Total 7 0.426199974 Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% Intercept -1.923839119 0.372730012 -5.161481654 0.035546904 -3.527566923 -0.32011 -3.527566923 -0.320111315 GDP Growth 20.42273438 5.691021047 3.588588798 0.069638213 -4.063752865 44.90922 -4.063752865 44.90922162 GDP from Contruction 1.124941474 0.567866617 1.980995961 0.186114297 -1.318391374 3.568274 -1.318391374 3.568274322 Real Estate 20.11064949 4.54908624 4.42081078 0.047547971 0.537511159 39.68379 0.537511159 39.68378781 Per capita steel consumption -1.398362891 0.537300275 -2.602572445 0.121343199 -3.710179386 0.913454 -3.710179386 0.913453605 Import of iron Scrap'000MT -0.420076497 0.08151641 -5.153275248 0.035654221 -0.7708133 -0.06934 -0.7708133 -0.069339694

- 20. Particulars 2013 2014 2015 2016 2017 2018 Revenue 36,229,050,933 38,535,936,754 32,316,100,562 30,961,724,880 37,613,575,605 58,372,407,184 Operating profit 2,314,398,453 1,892,833,850 3,257,931,547 4,262,604,320 2,171,622,735 3,693,134,202 Net profit 1,693,468,511 1,086,207,806 2,081,877,163 2,427,349,801 1,069,438,073 1,958,952,455 Revenue Growth 6.37% -16.14% -4.19% 21.48% 55.19% 106.37% 83.86% 95.81% 121.48% 155.19% Operating profit growth -18.21% 72.12% 30.84% -49.05% 70.06% 81.79% 172.12% 130.84% 50.95% 170.06% Net profit growth -35.86% 91.66% 16.59% -55.94% 83.18% 64.14% 191.66% 116.59% 44.06% 183.18% BSRM Steels Limited Market capitalization 21,466,888,000 Shareholder’s equity 13,258,559,602 Book value per share 35.27 P/B ratio 1.70 Forward P/E 15.7 EPS 5.21 P/E ratio 11.50 Price to sales 0.39 5 years CAGR earnings growth 12.52% 5 years CAGR revenue growth 8.66% Paid up capital 3,759,530,000 Last years revenue growth 55.19% Last 5 years revenue growth 10.01% Last years operating profit growth 70.06% Last 5 years operating profit growth 9.80% Last years net profit growth 83.18% Last 5 years net profit growth 2.96% ROE 14.78% ROA 3.52% Debt to equity 3.19 Stock Statistics Ratios Year Sponsor Govt. Instt. Foreign Public 31-Dec-18 70.57% 0.00% 17.98% 0.28% 11.17% 31-Dec-17 70.57% 0.00% 18.16% 0.36% 10.91% 31-Dec-16 70.87% 0.00% 16.06% 0.36% 12.71% 31-Dec-15 70.87% 0.00% 16.06% 0.36% 12.71% ShareholderscategoryofBSRMSteels

- 21. PE ratio EPS Revenue growth Operating profit growth ROA ROE BSRMLTD 13.91 12.95 40.55% 50.27% 13.47% 20.33% BSRMSTEEL 14.21 5.21 55% 9.58% 11.34% 15% GPHISPAT 18.76 1.97 25.18% 16.57% 2.83% 11.64% RSRMSTEEL 19.3 7.05 2.28% 0.19% 10.68% 15.75% SSSTEEL 14.74 1.2 45.00% 22.0% 13.26% 7.76% Apollo Ispat 18.3 0.5 -0.32% -106.00% 0.16% 0.27% Industry average 16.18 5.68 33.60% 19.72% 10.32% 14.05% Company average 14.21 5.21 55.00% 9.58% 11.34% 14.78% Bsrm steel is trading at lower p/E than industry average but has higher ROA and RO Therefore we think it is cheaper and also profitable Intrinsic value 84.33 Price price on 21/4/2019 59.8 Undervalued by 41.018% BSRM Steels https://www.dsebd.org/displayCompany.php?name Year EPS Dividend Div payout EPS growth PE ratio 2014 3.18 1.50 0.47 28.88 2015 6.09 3.00 0.49 91.7% 15.92 191.7% 2016 7.10 1.17 0.16 16.6% 13.22 116.6% 2017 3.13 2.33 0.75 -55.9% 25.09 44.1% 2018 5.21 1.00 0.19 66.5% 11.50 166.5% Average 18.92 18.9 Dividend pay out 41.33% Growth 13.16% Wacc 12.45% G>k so we cannot use the constant dividend growth model, we are using multistage dividend growth for 5 years and t Year Eps Div PV 1 2019 5.90 2.44 2.1670306 2 2020 6.67 2.76 2.180742883 3 2021 7.55 3.12 2.194541933 4 2022 8.54 3.53 2.208428299 5 2023 9.67 4.00 2.222402534 Terminal value ending eps * avg PE 5 Price 182.9177371 101.7548354 Intrinsic value 112.7279817 Market price 21/4/2019 59.8 Undervalued by 88.51% BSRM Steels limited