McKinsey Survey: British consumer sentiment during the coronavirus crisis

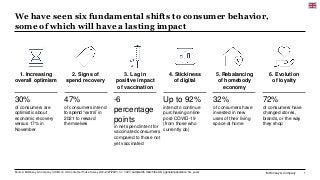

- 1. McKinsey & Company 1 We have seen six fundamental shifts to consumer behavior, some of which will have a lasting impact Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years 4. Stickiness of digital 2. Signs of spend recovery 5. Rebalancing of homebody economy 6. Evolution of loyalty 3. Lag in positive impact of vaccination 1. Increasing overall optimism Up to 92% intend to continue purchasing online post-COVID-19 (from those who currently do) 47% of consumers intend to spend “extra” in 2021 to reward themselves 72% of consumers have changed stores, brands, or the way they shop 32% of consumers have invested in new uses of their living space at home 30% of consumers are optimistic about economic recovery versus 17% in November -6 percentage points in net spend intent for vaccinated consumers compared to those not yet vaccinated

- 2. McKinsey & Company 2 Confidence in own country’s economic recovery after COVID-191 % of respondents Source: McKinsey & Company COVID-19 Consumer Pulse Survey The United Kingdom is the most optimistic about economic recovery, of the European countries surveyed Increasing overall optimism 1. Q: What is your overall confidence level surrounding economic conditions after the coronavirus (COVID-19) crisis subsides (i.e., once there is herd immunity)? Rated from 1 “very optimistic” to 6 “very pessimistic.” Bars may not sum to 100% due to rounding. 10 14 14 17 32 21 31 20 25 37 43 45 46 59 50 62 52 67 71 61 47 41 39 24 18 17 17 12 2 4 18 53 30 ‘Optimistic’ change vs November survey, percentage point 0 +9 +3 +6 +13 +7 +9 +4 +3 +5 +1 Mixed The economy will be impacted for 6–12 months or longer and will stagnate or show slow growth thereafter Pessimistic: COVID-19 will have lasting impact on the economy and show regression/ fall into lengthy recession Optimistic: The economy will rebound within 2–3 months and grow just as strong as or stronger than before COVID-19 Germany 2/23–27 Spain 2/23–27 Italy 2/23–27 France 2/23–27 Japan 2/24–27 US 2/18–22 India 2/20–3/3 China 2/20–3/8 Mexico 2/20–3/2 Brazil 2/20–3/1 UK 2/23–27

- 3. McKinsey & Company 3 Confidence in own country’s economic recovery after COVID-191 % of respondents Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027; 11/9–11/16/2020, n = 1,089; 9/24–9/27/2020, n = 1,053; 6/18–6/21/2020, n = 1,011; 5/21–5/24/2020, n = 1,008; 4/30–5/3/2020, n = 1,002; 4/16–4/19/2020, n = 1,005; 4/2–4/5/2020, n = 1,010; 3/28–3/29/2020, n = 1,002; 3/21–3/22/2020, n = 1,007, sampled to match UK’s general population 18+ years Mar 21–22 54% Apr 30–May 3 23% 24% 55% 24% 26% 31% Mar 28–29 15% 19% 16% 56% 27% Apr 2–5 59% 55% 25% 50% April 16–19 Sept 24–27 18% 58% 53% 15% 35% May 21–24 52% 30% June 18–21 17% Feb 23–27 17% 15% 47% 37% Nov 9–16 30% 18% Optimism regarding the United Kingdom’s economic recovery is at the highest recorded level, having almost doubled since November Increasing overall optimism 1. Q: What is your overall confidence level surrounding economic conditions after the coronavirus (COVID-19) crisis subsides (i.e., once there is herd immunity)? Rated from 1 “very optimistic” to 6 “very pessimistic.” Figures may not sum to 100% because of rounding. UK 2020 2021 Mixed: The economy will be impacted for 6–12 months or longer and will stagnate or show slow growth thereafter Pessimistic: COVID-19 will have lasting impact on the economy and show regression / fall into lengthy recession Optimistic: The economy will rebound within 2–3 months and grow just as strong as or stronger than before COVID-19

- 4. McKinsey & Company 4 Household income1 % of respondents Household spending1 % of respondents Household savings1 % of respondents Despite decreased household income and increased savings, optimism has also led to increased spending Increasing overall optimism Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1, 027; 11/9–11/16/2020, n = 1,089; 9/24–9/27/2020, n = 1,083, sampled to match the UK’s general population 18+ years 1. Q: How has the coronavirus (COVID-19) crisis affected your (household) income, overall household spending, and amount of income put away as savings over the past two weeks? Figures may not sum to 100% because of rounding. Reduce slightly/a lot About the same Increase slightly/a lot 5% Past 2 weeks 69% 26% 28% Past 2 weeks 68% 4% 6% 63% 32% Past 2 weeks Past 2 weeks 15% 15% Past 2 weeks 54% 31% 33% 52% 22% 44% 33% Past 2 weeks 34% 33% Past 2 weeks 14% 52% 15% 34% 52% Past 2 weeks 19% 46% Past 2 weeks Sept 24–27 Nov 16–19 Feb 23–27 Sept 24–27 Nov 16–19 Feb 23–27 Sept 24–27 Nov 16–19 Feb 23–27

- 5. McKinsey & Company 5 Consumers engaging in “normal” out-of-home activities1 % of respondents Engagement in ‘normal’ out-of-home activities has remained low given continued restrictions Increasing overall optimism 9 10 27 28 4 Feb 27 Sept 27 Nov 16 May 24 June 21 Overall 1. Q: Which best describes when you will regularly return to stores, restaurants, and other out-of-home activities? Chart shows those already participating in these activities. 2. Members of Gen Z were born from 1997–2012, millennials from 1981–1996, Gen X from 1965–1980, and baby boomers from 1946–1964. The traditionalist/silent generation is not included due to a low sample size. Vaccinated 5% Cautious Interested Unlikely 6% 14% 25% Medium (€25K–€50K) Low (<€25K) High (>€50K) 9% 7% 11% 13% 7% Gen Z Millennials 2% Gen X 20% Baby boomers By income By generation2 By vaccination adoption ~25% of those who are unlikely to get vaccinated ~20% of Gen Z are doing out-of-home activities ~11% of wealthier households are doing out-of-home activities Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n =1,027; 11/9–11/16/2020, n = 1,089; 9/24–9/27/2020, n = 1,083; 6/18–6/21/2020, n =1,001; 5/21–5/24/2020, n = 1,002, sampled to match the UK’s general population 18+ years

- 6. McKinsey & Company 6 34 24 25 17 Government lifts restrictions Vaccination coverage Government lifts restrictions + other requirements COVID-19 no longer spreading Consumers will return to out-of-home activities once1… % of respondents awaiting each milestone before engaging Most UK consumers are waiting for lifting of restrictions and wider vaccination coverage before reengaging with out-of-home activities Increasing overall optimism 91% of people are not currently engaging in “normal” out-of-home activities Vaccination coverage Government lifts restrictions and… 10% Medical authorities deem safe 8% Stores, restaurants, and other indoor places start taking safety measures 5% I see other people returning 10% Vaccine is widely distributed 10% I have been vaccinated 5% Family member(s) vaccinated Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years 1. Q: Which best describes when you will regularly return to stores, restaurants, and other out-of-home activities? Chart rebased to exclude those already participating in these activities and those who do not deem any of these items important.

- 7. McKinsey & Company 7 UK consumers are most eager to return to getting together with friends and family Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK's general population 18+ years 48% 9% Get together with friends 43% Go out for family entertainment Get together with family 25% Dine at a restaurant or bar Stay in a hotel Go to hair or nail salon 16% 15% 11% Travel by airplane 14% 12% Attend an outdoor event Go to the gym or fitness studio 11% Shop in person for non-necessities 1. Q: Did you leave your house for the following activities over the past two weeks? Top 2 most often-selected activities. Responder % is based on those who previously selected “Yes” to having done the activity once per year prior to the COVI19 crisis. 2. Q: Which of the following activities are you most eager to get back to on a regular basis? Please select the top 3 activities you miss the most. Top activities eager to get back to2 % of respondents for whom the activity is in their top 3 choices 75% Shop in-person for groceries, necessities 34% Work outside home Most prevalent activities consumers are engaging in1 % of respondents who did activity within last 2 weeks Increasing overall optimism

- 8. McKinsey & Company 8 29 26 22 39 29 29 14 55 49 UK consumers will prioritize socializing with family and friends, and shopping and dining out of home once COVID-19 subsides Get together with family Go out for family entertainment Dine at a restaurant or bar Attend an indoor cultural event Go to a hair or nail salon Attend an outdoor event Visit a crowded outdoor public place Go to the gym or fitness studio Get together with friends 7 3 3 4 3 12 3 10 6 Travel by airplane Work outside my home Shop for groceries/necessities Shop for non-necessities Travel more than 2 hrs by car Use a ride-sharing service Go to a shopping mall Use public transportation 6 75 Travel by train Stay in a hotel Rent a short-term home 34 26 10 6 22 18 2 8 3 18 39 46 31 22 6 22 23 31 34 14 Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years 1. Q: Did you leave your house for the following activities over the past two weeks? Responder % is based on those who previously selected “Yes” to having done the activity once per year prior to the COVID crisis 2. Q: Once the coronavirus (COVID-19) crisis subsides (i.e., once there is herd immunity), how do you think the amount of time you spend doing the following activities will change relative to how often you did them before COVID-19 began? Possible answers: “I will not do this at all”; “I will do this less often than I did before COVID-19 started”; “I will do this about the same as I did before COVID-19”; “I will do this more than I did before COVID-19.” Net intent is calculated from adding % of respondents stating they will do more or about the same, and subtracting % of respondents stating they will do less or not at all. Out-of-home activities done in the past two weeks1 % of respondents who did activity within last 2 weeks Net intent post- COVID-192 Net intent post- COVID-192 Work Shopping Transport/ Travel Social Personal care Entertain -ment Net intent: 1 -15 Net intent: 16 - 30 Net intent: 31 - 50 Increasing overall optimism

- 9. McKinsey & Company 9 Younger consumers, especially Gen Z, indicate higher intent to splurge Signs of spend recovery Expected leisure spend in 20211 % of respondents who plan to splurge or treat themselves 36% 55% 71% 29% 43% 58% 65% 35% 47% 64% 82%3 29% 1. Q: With regard to products and services you will spend money on, do you plan to splurge/treat yourself in 2021? Figures may not sum to 100% because of rounding. 2. Members of Gen Z were born from 1997–2012, millennials from 1981–1996, Gen X from 1965–1980, and baby boomers from 1946–1964. The traditionalist/silent generation is not included due to a low sample size. 3. Insufficient sample (n = < 50). Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years >70% <30% 50–70% 30–49% ~47% Plan to splurge or treat themselves Gen Z Millennials Gen X Generation2 Mid Low High Baby boomers Household income (£25k–£49K/year) (<£25K/year) (>£50K/year)

- 10. McKinsey & Company 10 Consumer spending is expected to be highest in travel and dining categories, once restrictions are lifted or spread of COVID-19 halts Signs of spend recovery 55 53 38 35 33 29 25 25 20 Fitness, sports, outdoors Travel, lodging, vacation Items for your home Restaurants, dining out, bars Apparel, shoes, accessories Household essentials Beauty & personal care Out-of-home entertainment Electronics 4 8 12 20 5 24 11 17 16 25 22 16 14 18 11 20 23 17 9 12 11 17 13 14 17 20 19 62 58 61 49 65 52 53 40 47 Anytime I am vaccinated Family is vaccinated Govt restrictions lifted/COVID-19 stops spreading Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Expected leisure categories on which people plan to splurge or treat themselves in 20211 % of respondents who plan to splurge or treat themselves Trigger for when people plan to splurge or treat themselves2 % of respondents who plan to splurge or treat themselves on that category 1. Q: You mentioned that you plan to splurge/treat yourself in 2021. Which categories do you intend to treat yourself to? Please select all that apply. 2. Q: Which best describes when you will most likely splurge/treat yourself? Figures may not sum to 100% because of rounding.

- 11. McKinsey & Company 11 Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Consumers mostly plan to use their available budget to splurge, though younger consumers are likelier to reduce other spending Signs of spend recovery 1. Q: For your future splurge on previously selected items, how do you intend to pay? Please select the answer that best represents your situation. Figures may not sum to 100% because of rounding and because respondents who answered “other” are not displayed here. 2. Members of Gen Z were born from 1997–2012, millennials from 1981–1996, Gen X from 1965–1980, and baby boomers from 1946–1964. The traditionalist/silent generation is not included due to a low sample size. 3. Total respondents, average of answers on all splurge categories. Financing source of splurge spend,1 % average of respondents who plan to spend, by generation 61% 57% 63% 54% 59% 52% 56% 33% 14% 42% 48% 40% 46% 54% 46% 24% 22% 13% 5% 17% Gen Z Millennials Gen X Baby boomers From available budget By reducing spend elsewhere From savings By using credit or a buy now, pay later option Avg. by financing source3 Generation2 >50% <20% 36–50% 21–35%

- 12. McKinsey & Company 12 Despite the current negative net intent, the majority of categories are showing an increased intent to spend since November Signs of spend recovery Net intent: Above +1 Net intent: -15 to 0 Net intent: Below -15 Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027; 11/9–11/16/2020, n = 1,089, sampled to match the UK’s general population 18+ years +2 +10 +9 +7 +18 +11 +8 +9 +15 +13 -15 +1 +5 +15 +19 N/A3 N/A3 N/A3 N/A3 N/A3 +8 +5 +3 +11 +3 +17 +12 +10 N/A3 -59 +33 +3 +14 +9 +14 +10 8 23 35 28 45 70 53 50 54 59 38 13 30 43 44 34 36 18 14 8 7 8 7 9 21 12 Personal-care products 4 10 Alcoholic beverages Groceries 12 Tobacco products Quick-service restaurant Toys & baby Food takeout & delivery 10 Restaurant 6 Footwear Apparel 4 Jewelry Home improvement & garden Accessories 11 Household supplies Skin care & makeup 10 Home & furniture 10 Sports & outdoors 7 Kitchen & dining Decrease Stay the same Increase -46 10 -28 -3 -33 -11 -22 -16 -35 -66 -47 -46 -52 -6 -21 -34 -13 -29 8 19 29 48 63 30 50 55 44 47 65 43 62 66 69 70 67 7 9 15 8 8 7 8 9 9 Out-of-home entertainment Domestic flights 6 International flights 12 Adventures & tours Pet food & supplies 11 Entertainment at home Vitamins & OTC medicine Consumer electronics 6 Books/magazines/newspapers Pet-care services 11 Fitness & wellness 6 Personal-care services Gasoline Vehicles Short-term home rentals Travel by car 11 Cruises 10 5 6 Hotel/resort stays -1 3 -21 -42 -55 -23 -39 -49 -36 -59 -34 -51 -56 -64 -64 -58 -10 -36 1. Q: Over the next two weeks, do you expect that you will spend more, about the same, or less money on these categories than usual? Figures may not sum to 100% because of rounding. 2. Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. 3. Data not available or insufficient sample (n = < 50) in November 2020 survey. Expected spending per category over the next two weeks compared to usual1 % of respondents Net intent2 Net intent2 Change since Nov 2020 Change since Nov 2020

- 13. McKinsey & Company 13 -80 -30 -70 -40 -60 0 -20 -50 -10 10 20 Nov 16 Sept 27 Mar 22 Mar 29 Apr 5 Apr 19 May 3 May 24 Jun 21 Feb 27 Expected spending per category over the next two weeks compared to usual1 Net intent2 Source: McKinsey & Company COVID-19 United Kingdom Consumer Pulse Survey 2/23–2/27/2021, n = 1,027; 11/9–11/16/2020, n = 1,089; 9/24–9/27/2020, n = 1,083; 6/18–6/21/2020, n =1001; 5/21–5/24/2020, n = 1,002; 4/30–5/3/2020, n = 1,003; 4/16–4/19/2020, n = 998; 4/2–4/5/2020, n = 1,005; 3/28–3/29/2020, n = 1,000; 3/20–3/22/2020, n = 1,007; sampled to match the UK’s general population 18+ years Increase in net intent to spend in discretionary categories is most pronounced in skin care, personal care, wellness, and flights Signs of spend recovery Out-of-home entertainment Groceries Household supplies Domestic flights Fitness & wellness Skin care & makeup Skin care & makeup Personal-care products Consumer electronics International flights 1. Q: Over the next two weeks, do you expect that you will spend more, about the same, or less money on these categories than usual? Figures may not sum to 100% because of rounding. 2. Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending.

- 14. McKinsey & Company 14 Consumers intend to spend significantly on discretionary categories such as travel, wellness, and apparel after COVID-19 subsides Signs of spend recovery Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027; sampled to match the UK’s general population 18+ years 1. Q: Over the next two weeks, do you expect that you will spend more, about the same, or less money on these categories than usual? 2. Q: Once the COVID-19 crisis subsides (i.e., once there is herd immunity), do you expect that you will spend more, about the same, or less money on these categories than during the COVID-19 pandemic? 3. Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. -15 to 0 Below -15 Above +1 Below 0 Above +25 +15 to +25 0 to +15 Net Intent3 Next 2 weeks Post COVID Evolution Pet food & supplies 0 -2 Vitamins & OTC medicine -10 -4 Domestic flights -58 6 Hotel/resort stays -64 20 Adventures & tours -56 19 Out-of-home entertainment -55 22 Pet-care services -23 -2 Fitness & wellness -39 13 Personal-care services -49 7 Gasoline -36 16 Short-term home rentals -59 19 Cruises -51 -1 Travel by car -34 13 International flights -65 10 Books/magazines/newspapers -22 -12 Consumer electronics -41 -13 Entertainment at home 3 -9 Vehicles -36 -6 Expected spending per category over the next two weeks1 compared to post COVID2 % of respondents Net Intent3 Post COVID Next 2 weeks Evolution Groceries 0 10 Toys & baby products -6 -28 Tobacco products -7 -11 Food takeout & delivery -19 -22 Alcoholic beverages -5 -16 Accessories -10 -52 Household supplies -3 -3 Apparel 0 -47 Quick-service restaurant -13 -35 Footwear -7 -47 Home improvement & gardening 4 -14 Restaurant 18 -66 Personal-care products -1 -6 Skin care & makeup 1 -22 Sports & outdoors -7 -34 Home & furniture -8 -33 Jewelry -18 -47 Kitchen & dining -8 -30

- 15. McKinsey & Company 15 Over-indexed on baby boomers (idx 177), low income (idx 113) and rural (idx 115) vs all respondents The majority of consumers who are vaccinated expect routines to return to normal by the end of 2021, and say finances are already back to normal Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Over-indexed on low income vs all respondents (idx 109) and urban vs all (idx 141) and Gen-Z vs all (idx 203) 1. Q: When do you expect your routines will return to normal? Figures may not sum to 100% because of rounding. 2. Q: When do you expect your personal/household finances will return to normal? Figures may not sum to 100% because of rounding. 3. Q: How likely are you to get the coronavirus vaccine once it is made available to you? Rated from 1 “Not at all likely” to 6 “Very likely,” including “I have received the first dose of the vaccine (partially vaccinated)” and “I have already received both doses of the vaccine (fully vaccinated).” Bars may not sum to 100% due to rounding. Respondents who stated “Very likely” (6) and “Likely” (5) are considered “interested”; respondents who stated “Somewhat likely” (4) or “Somewhat unlikely” (3) are considered “cautious”; respondents who stated “Unlikely” (2) or “Very unlikely” (1) are considered “unlikely.” Lag in positive impact of vaccination Expectations on routines returning to normal1,3 % of respondents Expectations on finances returning to normal2,3 % of respondents 51 37 16 24 33 37 60 55 79 84 74 76 4 4 7 12 66 64 74 57 69 Vaccinated 81 Cautious Interested 68 Unlikely 70 X% % of respondents 31% 44% 14% 11% Already back to normal By Dec 21

- 16. McKinsey & Company 16 Vaccination is not driving higher spend intention, likely due to overrepresentation of baby boomers in the vaccinated group Lag in positive impact of vaccination 1. Q: How likely are you to get the coronavirus vaccine once it is made available to you? Rated from 1 “not at all likely” to 6 “very likely,” including “I have received the first dose of the vaccine (partially vaccinated)” and “I have already received both doses of the vaccine (fully vaccinated).” Bars may not sum to 100% due to rounding. Respondents who stated “Very likely” (6) and “Likely” (5) are considered “interested”; respondents who stated “Somewhat likely” (4) or “Somewhat unlikely” (3) are considered “cautious”; respondents who stated “Unlikely” (2) or “Very unlikely” (1) are considered “unlikely.” 2. Q: Which best describes when you will regularly return to stores, restaurants, and other out-of-home activities? Chart shows those already participating in these activities. 3. Q: Over the next 2 weeks, do you expect that you will spend more, about the same or less money on these categories than usual? 4. Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. It is then multiplied by the % of people who respond as typically purchasing in that category, to effectively weight the average across categories. 5. Weighted average net intent for non-vaccinated respondents. Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years 31 44 14 11 Cautious Unlikely Vaccinated Interested 7% 36% 39% 38% 9% 13% 33% 13% Spend the same Spend Less Spend more 6% 5% 14% 25% -32 -29 -20 -23 Already engaging in out-of-home nactivity2 Likelihood of getting vaccinated once vaccine is available1 % of respondents Net spend intent next 2 weeks over usual3 Net intent4 -6 percentage point in net spend intent for vaccinated consumers vs non-vaccinated5

- 17. McKinsey & Company 17 Consumers expect the new digital behaviors they have developed during the pandemic to continue after the crisis subsides 3. In-home entertainment and wellness digital activities likely to stay 2. Many consumers adopted and expect to continue to use novel purchasing methods 1. Increased online purchases ~1 in every 2 categories, consumers intend to sustain their level of online buying post-COVID-19, especially in travel, entertainment, and personal care 72% of consumers currently using a wellness app intend to continue post-COVID-19 67% of consumers currently streaming online intend to continue post-COVID-19 Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years +49% growth in restaurant/ Store app download during COVID, 52% expect to continue using it Stickiness of digital

- 18. McKinsey & Company 18 Consumers show strongest intent in online purchasing of vitamins, OTC medicines, published content, and apparel post-COVID-19 68 61 57 77 65 53 48 58 24 34 66 68 77 Household supplies Footwear Groceries / food for home Personal-care products Food takeout & delivery Alcoholic beverages Vitamins and OTC medicine Quick-service restaurants Restaurants Travel by car Books, magazines, newspapers Skin care & makeup Apparel 19 28 15 22 20 20 19 -3 7 28 -12 21 41 59 61 39 40 35 61 60 47 60 40 60 64 40 48 65 42 52 53 36 44 56 39 64 36 58 30 96% currently purchasing online4 92% intend to continue purchasing online post-COVID-194 Purchase online after COVID-19 Net intent5 after COVID-19 % of online purchase during COVID-19 for most purchased categories 0 to 20 Above 50 21 to 50 Below 0 Net intent5 Since start of COVID-19 Decrease or stop Increase or stay the same Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years 1. Q: Before the coronavirus (COVID-19) situation started, what proportion of your purchases in this category were online vs from a physical store/in person? Includes respondents who chose “some online,” “most online,” and “all online.” 2. Q: Have you purchased the following categories online since the coronavirus (COVID-19) began? Please select “yes” or “no” for each category. Includes respondents who selected “Yes” for the category. 3. Q: Will you continue to purchase these categories online after the coronavirus (COVID-19) situation subsides (i.e., once there is herd immunity)?: “No, I will stop purchasing online altogether”; “buy less online”; “buy about the same amount online;” and “buy more online.” 4. Number indicates respondents who chose at least one category that they purchase online. 5. Net intent is calculated by subtracting the % of respondents stating they expect to decrease or stop use from the % of respondents stating they expect to increase or maintain use. Consumers’ use of online channel during, and after COVID-191,2,3 % of respondents Stickiness of digital

- 19. McKinsey & Company 19 Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/2372021, n = 1,027, sampled to match the UK’s general population 18+ years Travel, entertainment, and personal-care categories will see an increased spike in online purchases post-COVID-19 1. Q: Have you purchased the following categories online since the coronavirus (COVID-19) began? Please select yes or no for each category. Includes % respondents who selected “yes” for the category and currently buying the category. 2. Q: Will you continue to purchase these categories online after the coronavirus (COVID-19) situation subsides (i.e., once there is herd immunity)? Possible answers: “no I will stop purchasing online altogether”; “buy less online”; “buy about the same amount online”; “buy more online.” 3. Net intent is calculated among respondents currently buying online by subtracting the % of respondents stating they expect to decrease or stop use from the % of respondents stating they expect to increase or maintain use. 4. Low sample size (<50) 68 50 77 53 48 24 65 77 55 57 77 57 61 68 62 58 61 52 Groceries Tobacco products Apparel Footwear Food takeout & delivery Quick-service restaurant Alcoholic beverages Restaurant Jewelry Accessories Toys & baby Household supplies Personal-care products Skin care & makeup Home & furniture Sports & outdoors Home improvement & gardening Kitchen & dining 64 58 85 66 74 29 37 40 31 35 26 21 21 23 23 26 Entertainment out of home Pet food & supplies Vitamins & OTC medicine Entertainment at home Fitness & wellness Consumer electronics Books/magazines/newspapers Domestic flights Pet-care services Personal-care services Short-term home rentals Cruises Adventures & tours International flights Hotel / resort stays Vehicles Net intent3 post-COVID-19 9 414 38 28 28 43 62 34 54 19 13 474 65 62 61 46 Since COVID-19 began Net intent3 post-COVID-19 20 16 10 20 -3 7 19 -12 30 6 19 12 22 15 27 11 30 10 Consumers’ use of online channel during1 and after2 COVID-19 % of respondents buying this category Above 50 0 to 20 Below 0 21 to 50 Net intent3 Stickiness of digital

- 20. McKinsey & Company 20 6 -4 45 34 -2 20 8 4 0 16 40 2 30 10 12 35 50 14 55 18 20 22 80 28 24 5 32 26 65 30 52 36 75 15 38 44 42 25 46 48 50 54 10 Home decoration Fitness & wellness services Toys & baby supplies Household supplies Footwear Skin care Pet supplies Home improvement Apparel Alcoholic beverages Food takeout & delivery Personal care products Kitchen Personal-care services Sports & outdoors equipment Pet-care services Groceries Consumer electronics Entertainment out of home Travel by car Adventures & tours Books Tobacco products Vitamins & OTC medicine Jewelry 1. Q: Will you continue to purchase these categories online after the COVID-19 situation subsides (i.e., once there is herd immunity)? Possible answers: “no, I will stop purchasing online altogether”; “buy less online”; “buy about the same amount online”; and “buy more online.” Number indicates intent, calculated by subtracting % of respondents stating they expect to decrease or stop use from % of respondents stating they expect to increase or maintain use. 2. Q: Have you purchased the following categories online since the coronavirus (COVID-19) began? Please select yes or no for each category. Includes % respondents who selected “Yes” for the category. 3. Thresholds of categories are defined by the terciles. The 1st tercile of Intent occurs at 17%, and the 2nd occurs at 27%. Electronics and pet categories will see sustained online purchasing, unlike alcohol, tobacco, and home products Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/2372021, n = 1,027, sampled to match the UK’s general population 18+ years Intent to continue to purchase online after COVID-191 Percent of users who intend to keep doing activity after COVID-19 at same or higher level Penetration since COVID-19 2 Greater online presence Less-accelerated online shift Sustained shift to online Stickiness of digital

- 21. McKinsey & Company 21 11% 12% 3% 3% 4% 12% 13% 2% 7% 4% 10% 5% 3% 24% 24% 3% 3% 7% 12% 12% 4% 15% 3% 8% 9% 5% 6% 8% 13% 3% 2% 3% 3% 4% 3% 8% 5% 6% 3% 2% Pay more for same-day delivery Meal-kit delivery Restaurant delivery Grocery delivery Pay more for one-hour delivery Quick-serve restaurant drive-thru Restaurant curbside pickup In-store self-checkout Buy online for in-store pickup 1% Store curbside pickup Used a new store/restaurant app 1% Purchased pre-owned products Purchased directly from social media Used deal-finding plug-ins Using same/less Using more Just started using 39% 51% 57% 46% 75% 30% 51% 36% 52% 70% 58% 79% 40% 35% Consumers have continued adopting new restaurant and grocery delivery methods, but only about half plan to do so post-COVID-19 Intent to continue,2 % Have you used or done any of the following since COVID-19 started1 % of respondents currently using/doing 1. Q: Have you used or done any of the following since the coronavirus (COVID-19) crisis started? If yes, Q: Which best describes when you have done or used each of these items? Possible answers: “just started using since COVID-19 started”; “using more since COVID-19 started”; “using about the same since COVID-19 started”; “using less since COVID-19 started.” 2. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) ) crisis subsides (i.e., once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/2372021, n = 1,027, sampled to match the UK’s general population 18+ years Stickiness of digital

- 22. McKinsey & Company 22 15 35 50 25 45 30 55 50 40 0 45 60 65 70 75 5 80 10 20 25 30 35 40 In-store self-checkout Purchased from social media Deal-finding plug-ins Store curbside pickup Penetration Restaurant delivery Grocery delivery Meal-kit delivery Restaurant curbside pickup Quick-serve restaurant drive-thru Buy online for in-store pickup New store/restaurant app Purchased pre-owned products online ~50-80% of consumers expect to continue digital activities with COVID-19 acceleration Intent to use after COVID-191 Percent of new or increased users who intend to keep doing activity after COVID-19 1. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) ) crisis subsides (i.e., once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. 2. Q. Which best describes when you have done or used each of these items? Possible answers included: "Just started using since Coronavirus started", "Using more since Coronavirus started", "Using less since Coronavirus started" or "Using about the same since Coronavirus started". Possible answers not included: "Not Using.“ 3. User growth is calculated as % of respondents who replied that they are new users over % of respondents who replied that they were using the product/service pre-COVID-19 (using more, using the same, or using less). 4. Thresholds of categories are set at the median value. Penetration median = 19%, Intent to use median = 52%. New delivery method usage has grown, but novel purchasing methods are likely to sustain post-COVID-19 User growth3: 0-19% User growth: 20-39% User growth: 40-59% User growth: 60%+ Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Big surge during COVID-19, but lower intent to continue Disruptive growth COVID-19 acceleration Penetration since COVID-19 2 Stickiness of digital

- 23. McKinsey & Company 23 UK consumers are using online alternatives for entertainment, work, and education, but the intent to continue varies significantly 15% 2% 2% 2% 2% 25% 7% 5% 7% 22% 8% 41% 11% 14% 6% 5% 3% 6% 5% 2% 35% 11% 12% 12% 31% 12% 5% 11% 8% 6% 7% 3% 5% 4% 2% 2% 2% 7% 4% 7% Remote learning: my children Digital exercise machine Online streaming Remote learning: myself 1% 1% Watching e-sports Videoconferencing: professional Video chat: personal Telemedicine: mental 1% Telemedicine: physical Online fitness Wellness app TikTok 2% 1% 2% 1% Social media Playing online games 1% Cooked regularly for myself/my family Personal care/grooming at home Using same/less Using more Just started using 67% 42% 35% 42% 29% 51% 51% 72% 54% 59% 54% 85% 63% 46% 59% 47% 1. Q: Have you used or done any of the following since the coronavirus (COVID-19) crisis started? If yes, Q: Which best describes when you have done or used each of these items? Possible answers: “just started using since COVID-19 started”; “using more since COVID-19 started”; “using about the same since COVID-19 started”; “using less since COVID-19 started.” 2. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) crisis subsides (i.e., once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Have you used or done any of the following since COVID-19 started1 % of respondents currently using/doing Intent to continue2 % Stickiness of digital

- 24. McKinsey & Company 24 1. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) ) crisis subsides (i.e., once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. 2. Q. Which best describes when you have done or used each of these items? Possible answers included: "Just started using since Coronavirus started", "Using more since Coronavirus started", "Using less since Coronavirus started" or "Using about the same since Coronavirus started". Possible answers not included: "Not Using" 3. User growth is calculated as % of respondents who replied that they are new users over % of respondents who replied that they were using the product/service pre-COVID-19 (using more, using the same, or using less). 4. Thresholds of categories are set at the median value. Penetration median = 20%, Intent to use median = 53%. 55 20 54 46 28 50 38 30 40 40 34 45 32 70 36 60 30 84 44 42 48 64 50 65 86 52 66 56 58 60 62 10 68 72 15 74 78 80 82 0 5 25 35 Watching e-sports Telemedicine: Mental Personal care/grooming at home Penetration Playing online games Telemedicine: Physical Used social media Cooked regularly Video chat: Personal Online streaming Videoconferencing: Professional Remote learning: Myself Remote learning: My children Digital exercise machine Online fitness Wellness app TikTok Online wellness habits adopted during the crisis are likely to remain for the medium to long term Intent to use after COVID-191 Percent of new or increased users who intend to keep doing activity after COVID-19 ~60-70% of consumers expect to continue current level of digital wellness accelerated during COVID-19 Accelerated by COVID-19 ~30-55% of consumers expect to continue current level of remote communication, learning, health platforms with disruptive COVID-19 growth Limited shift with COVID-19 Disruptive growth Emphasized by COVID-19 Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years User growth3: 0-19% User growth: 20-39% User growth: 40-59% User growth: 60%+ Penetration since COVID-19 2 Stickiness of digital

- 25. McKinsey & Company 25 About one-third of consumers made major life changes involving their work setup and home renovation 1. Q: Which of the following have you done in the last 12 months as a result of the COVID-19 crisis? 36% answered “None of these.” 2. 29% of the survey respondents in the UK are millennials; 28% of the survey respondents have an income >£50K. Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Set-up a specific work from home space 3% Worked more from home Decided to change jobs Went back to school Renovated/remodeled my home 4% Set-up a gym at home Reassessed my investment portfolio Bought a car Bought a property Sold a property Moved into a bigger home 14% 6% Permanently moved the suburbs Permanently moved in with family Moved into a smaller home 29% Permanently moved to a new city 2% 7% Permanently moved to the countryside Got a new pet at home (e.g., dog, cat) 4% 16% 9% 8% 9% 4% 3% 3% 2% 2% Pet adoption 9% Work/study change 36% House move 10% Home renovation 32% Investments/ Divestments 18% Main life events done in the last 12 months as a result of COVID-191 % of respondents of which 41% are millennials (vs 29% of total sample2) of which 55% have income >£50K (vs 28% of total sample2) Rebalancing of homebody economy Details next x% Net % of respondents per category

- 26. McKinsey & Company 26 56% 44% 30% 50% 65% 49% 60% 52% 73% 54% 58% 82% 52% 63% 38% 24% Cooked regularly for myself/my family Watching e-sports Online fitness Videoconferencing: professional Video chat: personal Personal care/grooming at home Playing online games Telemedicine: physical Digital exercise machine Wellness app TikTok Remote learning: my children Social media Telemedicine: mental Online streaming Remote learning: myself 29% 54% 13% 2% One in three consumers expects to continue working from home, driving intent to continue or increase use of digital habits 31% will either work only from home or do so more than before COVID-19 Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Work only from home Work from home more Work from home the same Work outside home more Prior to COVID-19, 5% of the UK workforce worked mainly from home 19 15 15 14 10 7 5 4 1 0 -2 -10 -10 -13 -18 -20 Diff. with those who did not4, percentage point 1. Q: Once the COVID-19 crisis subsides (i.e., once there is herd immunity), how do you think the amount of time you spend doing the following activities will change relative to how often you did them before COVID-19 began? Asked to respondents who selected “Worked more from home" in the Q: Which of the following have you done in the last 12 months as a result of the COVID-19 crisis? Possible answers: "I will not do this at all“; "I will do this less often“; “I will do this about the same“; “I will do this more.“ 2. 2019 Office for National Statistics UK. 3. Q: Which of the following have you done in the last 12 months as a result of the COVID-19 crisis? Respondents who selected “Worked more from home.“ Q: Compared to now, will you do or use the following more, less or not at all, once the coronavirus (COVID-19) crisis subsides (i.e., once there is herd immunity)? Respondents who selected: “I will keep doing what I am doing now“ or “I will increase this.“ 4. Difference between respondents who selected “Worked more from home“ and those that didn’t. Diff. Above +9 Diff.: 5 to 9 Diff.: Below 0 Diff.: 0 to 4 Rebalancing of homebody economy Plan to work from home Use of digital services3 % respondents who worked more from home during the crisis Work from home after COVID-19 as compared to before COVID-19,1 % respondents

- 27. McKinsey & Company 27 Have you done any of the following since COVID-19 started1,2 % of respondents Almost three-quarters of consumers have tried a new shopping behavior, and the majority intend to continue 41% 39% 26% 25% 25% Different retailer/store/website Different brand New digital shopping method New shopping method3 Private label/store brand 72% of consumers have tried a new shopping behavior Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years 85% of millennials tried a new shopping behavior 1. Q: Since the coronavirus (COVID-19) crisis started, which of the following have you done? 28% consumers selected “none of these.” 2. Q: Which best describes whether or not you plan to continue with these shopping changes once the coronavirus (COVID-19) crisis has subsided (i.e., once there is herd immunity)? Possible answers: “will go back to what I did before coronavirus”; ”will keep doing both this and what I did before coronavirus”; ”will keep doing this and NOT go back to what I did before coronavirus.” 3. “New shopping method” includes curbside pickup and delivery apps. 4. Intent to continue includes respondents who selected “will keep doing both this and what I did before coronavirus” and “will keep doing this and NOT go back to what I did before coronavirus.” 80% 82% 84% 69% 87% Intent to continue4 Evolution of loyalty

- 28. McKinsey & Company 28 After convenience and value, purpose-driven reasons such as buying local are key drivers of decisions to change stores shopped Wanted variety/change from my normal routine 21% Offers good delivery/pickup options Cleaner/has better hygiene measures I can get all the items I need from one place Less crowded / has shorter lines More easily accessible from my home 3% 18% Better prices/promotions The company treats its employees well 24% 18% 5% Better value 18% 20% Supporting local businesses 10% 19% 7% Has more sustainable/environmentally friendly options 4% Wanted to treat myself Shares my values 24% Products are in-stock 14% 9% 13% Better quality 6% Offers natural/organic offerings Better shipping/delivery cost Reason for shopping at a new retailer/store/website since COVID-19 began1 % of respondents selecting reason in top three 1. Q: You mentioned you shopped from a new retailer/store/website since the coronavirus (COVID-19) crisis started. What were the main reasons you decided to try this new retailer/store/website? Select up to three. 2. 12% of the survey respondents in the UK are Gen Z. Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Net % of respondents per category Convenience 53% Value 47% Purpose-driven 28% Availability 24% Quality/organic 18% Personal choice 21% Health/hygiene 5% of which 24% are Gen Z (vs 12% of total sample2) X% Evolution of loyalty

- 29. McKinsey & Company 29 In addition to value, novelty and supporting local brands were key drivers for consumers trying a new brand 11% Better value Better quality 9% 29% 8% Better shipping/delivery cost Better prices/promotions 5% Larger package sizes 26% 31% Wanted to try a new brand I found Supporting local businesses 21% Wanted to try a type of product I’ve never tried before 24% Wanted to treat myself 17% 6% Wanted variety/a change from my normal routine 33% Products are in-stock 24% The company treats its employees well 12% Is more sustainable/better for the environment Shares my values Is available where I’m shopping (i.e., in-store or online) 35% Is natural/organic 25% 19% Is cleaner/safer Value 67% Purpose-driven 32% Novelty 38% Convenience 25% Personal choice 35% Reason for trying a new brand since COVID-19 began1 % of respondents selecting reason in top three Quality/organic 29% Health/hygiene 13% Availability 33% of which 16% are Gen Z (vs 12% of total sample2) of which 46% have income >£50K (vs 33% of total sample2) of which 19% are Gen Z (vs 12% of total sample2) of which 42% are from London (vs 14% of total sample2) 1. Q: You mentioned you tried a new/different brand than what you normally buy. What were the main reasons that drove this decision? Select all that apply. “Brand” includes different brand, new private label/store brand. 2. 12% of the survey respondents in the UK are Gen Z; 14% of the survey respondents are from London; 28% of the survey respondents have an income >£50K. Source: McKinsey & Company COVID-19 UK Consumer Pulse Survey 2/23–2/27/2021, n = 1,027, sampled to match the UK’s general population 18+ years Net % of respondents per category X% Evolution of loyalty

- 30. McKinsey & Company 30 Disclaimer McKinsey does not provide legal, medical, or other regulated advice or guarantee results. These materials reflect general insight and best practice based on information currently available and do not contain all of the information needed to determine a future course of action. Such information has not been generated or independently verified by McKinsey and is inherently uncertain and subject to change. McKinsey has no obligation to update these materials and makes no representation or warranty and expressly disclaims any liability with respect thereto.