Speculation: Will Gold Fall Further? The Classic Gold Bubble Question Answered

- 1. Resources for the Independent Trader Blog Speculation: Will Gold Fall Further? The Classic Gold Bubble Question Answered Dear Reader, This report is another collection from various well-respected writers, and would give you an insight what has happened to gold the last week or so. There are different views, and could be confusing for an investor/trader how to react towards gold, buy or sell. Download, read and act wisely. Please forward to your colleagues, friends, whom ever you know. Will Gold Fall Further? By: Street Authority

- 2. Imagine a bullet fired at the sky. It climbs higher and higher until gravity overcomes its upward momentum. The bullet begins to fall. Now, imagine small wings on the bullet that flap while it is falling. The wings are just enough to create a series of slight upswings while on the downward trajectory. Known as "bear flags," this wavelike cycle recurs until the momentum ends and the bullet drops to the ground. Bear flags are thought to signal additional downward moves to come. This is exactly what has happened with the price of gold since it hit its high near $1,900 per ounce in August 2011. More recently, this action has been exaggerated, with gold trending downward since striking highs in the $1,800 range back in October. Every investor's worries about government monetary easing and eurozone debt acted as the wings on the coasting bullet, temporarily lifting gold higher, only to have the price drift back into the downtrend. Finally, this brief upward trend ended this month with gold plunging nearly 30% since its October highs. In just two trading sessions, the price plummeted more than 230 points. Gold-mining stocks were also battered worldwide. Australia-based Kingsgate Consolidated and Beadell Resources both dove 15%, while China's Zhaojin Mining gave back more than 9%. Remember, the average cash production price for gold is around $1,200 per ounce. This means the closer the price gets to this number, the less profitable gold-mining companies become. Because of this, my reasoning is that the $900 to $1,200 range will be the low end for gold. It's basic supply and demand. As gold approaches parity with the cost of production, production will slow, reducing supply in the marketplace. If demand stays the same or increases, then the price will rise on the smaller supply. Why Gold Has Fallen The debate rages on as to what caused gold's rapid descent. Some analysts blame Cyprus banks being forced to dump gold to pay for a bailout. Some blame other central banks selling to large speculators winding down positions.

- 3. It really doesn't matter why the sell-off occurred. The only thing that matters is what is going to happen next. Knowing the fundamentals of why a move occurred gets you only so far when it comes it investing. The other half of the equation is the technical factor. Technical analysis deals with price itself and teaches that all the fundamental factors of a price move are already inherent in the price. It also teaches that by studying past price moves, an educated guess can be made about what the future holds. With that said, let's take a look at gold's technical picture. As you can see on the chart, there have been six bear-flag formations between November and the start of the massive sell-off last week. Every bear flag foretold another move lower. Now it appears we are witnessing the mother of all bear flags. The price has bounced from a low of $1,322 to $1,433 during the past seven days. Based on this technical formation, combined with the fundamental factor of gold approaching its production price, I think gold will not move above $1,475 an ounce. In fact, I think gold will fall below $1,200 before fundamental factors conspire to lift it higher.

- 4. Risks to Consider: Technical analysis is an inexact science and should be used only to provide general guidelines when it comes to investing. Always use stops and position size properly no matter how compelling an investment may be. Action to Take -- I think gold is going to drop lower before it takes out $1,450 an ounce on the upside. If $1,475 is taken out, my projection is void. Risk-embracing speculative investors can short the SPDR Gold Trust ETF (NYSE: GLD) or purchase put options on the same. More Accurate than Warren Buffett? Warren Buffett has beat the market 5 of the past 9 years. Since we started publishing our annual report, we've beat the market 7 of the past 9 years. And we're poised to do it again in 2013. One of our picks has raised dividends 463% since 2004. Another has returned 117% in just over 4 years. Click here for more about these stocks and even some ticker symbols. Article source: http://feedproxy.google.com/~r/StreetauthorityArticles/~3/T_oH- OC2P_E/will-gold-fall-further-technical-indicator-says-yes-466779m With the permission from MarketClub Comment “On the other hand, "everyone" thought after the 1987 crash when looking at the S&P chart, that it was the mother of all bear flags when it first rebounded. Same with other waterfall collapses. A good many of them simply developed uptrends, negating the flags that "everyone knew and saw." Gold's Plunge Ultimately Healthy for the Sector: Michael Gray The Gold Report: On April 15, gold dropped to a two-year low as panic selling set in across many mined commodities. Was this the larger players showing the retail market who is in control or was it inevitable? Michael Gray: Several firms have been predicting a mid-cycle correction for gold; it just happened faster and with more volatility than expected. It also seems to be a very well-

- 5. timed short-selling trade, especially on the back of the positive gold price correlation with quantitative easing (QE) breaking down and reversing post-QE3. In addition, there was no response in the gold price to the debt crisis in Cyprus or political concerns with North Korea. This was an opportunistic time for the shorts to come in, and they did, forcefully. TGR: Does this indicate that investors prefer equities to gold? MG: Not necessarily. The gold equities have moved sharply down and most are now pricing gold at an implied gold price of $1,0001,200/ounce ($1,0001,200/oz) or less. There is some fear that the gold bull run is over, which explains why many institutional investors have been abandoning their gold equity positions. "We think the volatility in the gold market is ultimately good for the bull market." TGR: Gold equities fell in lockstep with the fall in the gold price. Why? MG: Gold equities have had an inverse correlation of share price: net asset value (P/NAV) versus the gold price since late 2009. Historically the senior gold equities have traded +1.2x P/NAV. Now we are looking at an average of 0.65x P/NAV among our senior gold producers. Essentially, investors are pricing in a much lower gold price on the forward curve. As the gold price goes down, we believe investors will expect that the future gold price will drop as well. That is why the equities are trading in lockstep with the decline and have a much weaker response on the upside. TGR: Has the drop in precious metals prices fundamentally changed the market? MG: We have not seen this magnitude of volatility in this bull market up until now. It sets the stage for other big moves and for a more volatile market, perhaps including price upswings of similar magnitude. We think this volatility is ultimately good for the bull market. TGR: Will it result in less gold being produced? MG: The deferral of major capital projects and the number of projects that will be shelved because they cannot stand up to the stress test of a $1,200/oz gold price will limit growth among the senior companies. As that happens, we expect significantly less growth in the gold sector over the next five years if prices continue to lag or go sideways.

- 6. TGR: A JPMorgan Chase report dated April 16 said 10 years remain in the commodity supercycle and that the April 15 price drop was only a pause in the overall cycle. Do you agree, and what positives do you see as a result of the price drop? MG: In general, we concur that this is a pause in the supercycle for metals in general, including base and bulk metals. China's growth being lower than expected shocked the market, at least in the short term. The positives are that management teams are now less focused on growth and more focused on earnings and returns to shareholdersthis could instill more investor confidence. It will take a few years, but having CEOs whose interests are more aligned with shareholders will impose more discipline among the producers. TGR: In early April, Barrick Gold Corp. (ABX:TSX; ABX:NYSE) once again delayed development of its Pascua Lama gold project in Chile. What are the likely ripple effects for Barrick and the sector? MG: This is one of those situations where a company believed it had earned its social license after a long dialogue with the government and various nongovernmental organizations (NGOs). Barrick likely felt it was crossing the finish line. Barrick is not alone in this situation. "Management teams are now less focused on growth and more focused on earnings and returns to shareholders." For the gold sector it means management teams will have to look at large capital expense (capex) projects through a lens that captures extreme capex creep risk, in the case of Pascua Lama from less than $3 billion ($3B) to north of $8B. Going forward, project scale and social license risk will be key issues only the best projects will be built. TGR: Is Chile still on your list of preferred mining jurisdictions? MG: It was until recently. Canada, Mexico and the U.S. are at the top. Recent developments in Chile and elsewhere in South America with community relations and NGO protests are cause for concern. TGR: If Mexico, Canada and the U.S. are your top jurisdictions, what is the next tier?

- 7. MG: The next tier would include Chile, Peru and Turkey. In particular, Turkey is embracing foreign investment, has attracted a significant amount of capital and has a successful track record of mines being permitted and put into production. In South America, Brazil can be also be an attractive jurisdiction, depending on the state. In Central America, we like Nicaragua, where we cover B2Gold Corp. (BTO:TSX; BGLPF:OTCQX). Nicaragua has been very politically stable in the past decade and is one of the few countries in Central America that has a stable mining policy and royalty regime. In Africa, Namibia, Tanzania and Botswana would lead our list. TGR: Let's look at management teams. Cash is king for junior mining equities right now, yet some junior mining executives are collecting big cash salaries. Some shareholders think the C-suite is overcompensated. What do you consider a reasonable salary for a junior mining CEO? MG: Management compensation has been a blind spot for investors in the exploration sector during this bull market, given that many management teams have created tremendous value for shareholders. The compensation matrices among peer groups have been driven by market capitalization: The more you could grow your company, the more you could convince your compensation committee to pay you. "When companies are deeply discounted and you can buy them at what seem to be fire sale prices, you will be rewarded down the line." The problem is that juniors with undeveloped resources trading at $1B market caps in 2011 paid dearly to attract talent or retain talent. Their base salaries in some cases exceeded $400,000 ($400K) plus similar size annual cash bonuses. Now those same companies have market caps of $200300 million ($200300M), yet the compensation levels have not changed. The GA burn rate related to these salaries is significant. To evaluate compensation, we look at where the company is in the exploration cycle and how much skin management has in the game. The $80150K/year salary range has the right ring for a very early-stage explorer with no assets of retained value. Companies that have more advanced assets probably need to pay in the $200250K range, plus bonus. TGR: How do people find out that information? MG: It is all disclosed in the annual financial statements and in the Management Information Circular on www.SEDAR.com (System for Electronic Document Analysis and Retrieval).

- 8. TGR: A story in Canada's National Post reported that CEOs and company presidents are more often fired in good times than in tough times because expectations are higher. Does that apply in mining? MG: That comes back to investors focusing on returns and punishing the senior mining companies for poor leadership, including overpaying to acquire assets and the inability to control operating and capital costs. In the gold space, three CEOs have been fired in relatively good times for focusing too much on growth. The trend is now toward CEOs trying to focus on earnings, provide realistic guidance and, if possible, pay a dividend. Those are the leaders who will keep their jobs. TGR: A recent Macquarie research report said, "The producers will rapidly pursue MA of new 'grade A discoveries' if they emerge but are unlikely to pursue the large, capex- intensive B- and C-quality discoveries. In the meantime, the price will get lower and favor the producers that are patient and seeking smaller, strategic tuck-in acquisitions." What is a tuck-in acquisition? MG: I would like to start by making it clear that "rapidly pursuing 'grade A discoveries'" means that if a junior has found another Kupol or Eleonore deposit, the type of precious metal high grade/high margin deposits coveted by the seniors, it will garner a tremendous amount of attention and probably attract a takeover bid before a resource is defined. This is what happened with Virginia Gold Mines' Eleonore discovery, which is being developed by Goldcorp Inc. (G:TSX; GG:NYSE) in Qubec and for which Virginia Mines Inc. (VGQ:TSX) holds a royalty. That is what I mean by a rapid move on what are clearly high-grade/high-margin assets because they are so rare right now. TGR: And now, what is a tuck-in acquisition? MG: A tuck-in acquisition is one that the market views as a relatively small deal, say, under $500M. It either fills a gap in the producer's pipeline down the line, or is strategic in consolidating a district in which the producer is already active. TGR: If Kupol and Eleonore were grade-A discoveries, what are examples of tuck-in acquisitions? Would it be something like Grayd Resource Corp. (GYD:TSX.V) and Agnico- Eagle Mines Ltd. (AEM:TSX; AEM:NYSE)? MG: Yes, Grayd with Agnico in Mexico would qualify as a tuck-in acquisition. We would consider Goldcorp's purchase of Gold Eagle Mines Ltd. in the Red Lake Camp a tuck-in or bolt-on, albeit with a larger market cap. Extorre Gold Mines Ltd.'s acquisition by Yamana

- 9. Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) was a relatively small acquisition but meaningful to Yamana's growth pipeline. TGR: Are other juniors developing candidates for tuck-in acquisitions? MG: In our coverage list, we have published our views on MAG Silver Corp. (MAG:TSX; MVG:NYSE) as a prime example for potential of consolidation of the 44% joint venture interest it has with Fresnillo Plc (FRES:LSE) in the world-class Fresnillo Silver Trend. It is a high-grade, high-margin asset that we think Fresnillo would like to control. It would also help meet Fresnillo's goal for production of at least 65 million ounces (65 Moz) by 2018. TGR: How close is MAG Silver's Juanicipio to Fresnillo's operations? MG: It is within 1 kilometer of the mill and infrastructure, right in the heart of the Fresnillo district. In our view, as published in our research, it has great synergies with Fresnillo's existing operations.. TGR: Would Fresnillo buy just Juanicipio or buy MAG Silver outright? MG: Fresnillo owns a 17% interest in MAG Silver. Given the fairly significant discovery MAG Silver has made on an asset called Cinco de Mayo, we would expect that Fresnillo would want that as well. TGR: Regardless of a takeover bid, is MAG Silver poised to perform in 2013 even with lower silver prices? MG: The company will break ground in the next month or two for the decline at Juanicipio. But the real sizzle for MAG Silver is getting back to exploration drilling at Cinco de Mayo, probably in H2/13. Cinco de Mayo is a huge carbonate replacement deposit (CRD), a silver-zinc-lead deposit with an early resource estimate just over 50 Moz silver. It has a large footprint and an outstanding intersection at depth outside of the resource of 61.6 meters at 89 grams/tonne (89 g/t) silver, 7.4% zinc, 2.1% lead and 0.78 g/t gold. This is one of the best discoveries in Mexico in the cycle. Although early stage and the exploration to depth needs a lot of infill drilling, the anatomy of the system discovered so far suggests it could be very large. TGR: Does MAG Silver have the disciplined management team you like to see?

- 10. MG: Yes, the team performs its discovery role exceptionally well. To make two major discoveries over the past decade is impressive in itself, but it is also very disciplined. It maintained a very efficient capital structure, with fewer than 60M shares issued and outstanding. It has discovered best-of-breed assets with what we would consider best- of-breed talent. TGR: Which other juniors are developing possible tuck-in acquisitions? MG: In that category, we like Midas Gold Corp. (MAX:TSX). The company's Golden Meadows project in Idaho has more than 7 Moz gold in resources and a significant antimony credit. The company has issued a preliminary economic assessment (PEA) on the project. It is only trading with a market capitalization of $100M or so. This would be an excellent tuck-in acquisition for producers looking for a +400,000 oz/year production profile, starting in 2018 or 2019. We see Midas' Golden Meadows project as a Donlin Creek-type of setting, and published our belief that the potential endowment could ultimately exceed 20 Moz gold. Thus, in our view it is potentially a Tier 1 asset that already has 7 Moz documented, in a historic mining district, making it a brownfield site. The company is heavily discounted in value right now. TGR: What progress has Midas made since you started covering it 18 months ago? MG: The company has executed well the mandate to infill and expand the near-pit resources and establish resources that could be put into a PEA and eventually into a preliminary feasibility study. It has also conducted a lot of pragmatic consulting with the community and the NGOs. Stephen Quin, Midas' CEO, has the perfect skill set for permitting and advancing the economics of this project given his past experience with similar projects. The overhang is the perception that it will be tough to permit in Idaho and that production is a long way out in 2018. As a result, the stock has lagged over the last 12 months. TGR: How much does the antimony credit play in the project economics? MG: At the front end, the antimony credit is fairly important. I believe about 80% of the antimony currently documented will be produced in the first four years. This allows Midas

- 11. to achieve gold equivalent grades that exceed 2.4 g/t, whereas the average grade in the first pit to be mined is closer to 2.0 g/t for the gold only. Therefore, the antimony credit is fairly important. During World War II, Golden Meadows was mined for antimony needed to harden shell casings. Now antimony is used mainly as a fire retardant. About a year ago, antimony led the British Geological Survey list as the #1 commodity at risk. That is a compelling twist to the Midas story. TGR: Where does permitting stand? MG: The formal permitting process is called the Joint Review Process (JRP), which harmonizes the review activities of the state and federal governments. This process has not started yet; however, because Midas has completed a PEA study, it is able to start the informal process right now and consult with various stakeholders. We expect Midas may be in a position toward the end of 2013 to formally enter the JRP. On a separate front, it is unfortunate that the U.S. Forest Service pulled back some of its drill permits on non-patented lands. Having to re-apply for those will delay exploration on the outer reaches of the property. There is no question that permitting in Idaho can take time, but in our view it is a question of when, not if, providing responsible plans are put forward and the process is closely adhered to. We believe management has the right skill set to persist and earn the social license to permit Golden Meadows. This is a state with high unemployment and mining the brownfield site would actually clean it up. It is a good news story. TGR: To value companies, you use a sum-of-parts NAV valuation system based on a 5% discounted cash-flow model. Using this system, what companies are among your top picks? MG: We also use the forward curve and long-term commodity prices to value the companies where we are able to establish a discounted cash-flow model. When we see this much market volatility in the commodity prices, we tend to make more frequent adjustments to the forward curve we are using and to reset target prices accordingly. MAG Silver, Mirasol Resources Ltd. (MRZ:TSX.V), B2Gold and Tahoe Resources Inc. (THO:TSX; TAHO:NYSE) are our top picks among the companies we cover.

- 12. Mirasol Resources is a cash-rich junior that has emerged in a very strong position through discovery and monetizing its assets. We estimate it has approximately $50M in cash and investments. We like Mirasol because it has shifted its exploration focus to Chile and has identified what appears to be a large, high-sulphidation system. If Mirasol succeeds, this potentially large gold system will attract the seniors' interest. The project is very early and only trenched so farwe expect drilling in May and Junebut the markers suggest that Mirasol could be onto a fairly significant new belt in Chile. The company also has significant assets in Argentina, although they do not yet have resources. TGR: Is there less pressure in Chile on smaller companies? MG: As long as their programs are not huge, smaller companies are likely better able to fly under the radar. In the early stages, they do not have to negotiate for water rights or consult with the communities on a formal basis. That makes it easier. At the same time, they have to pave the way for the ultimate developers to earn their social licenses. It is important that they execute on the ground at an extremely early stage by developing good relationships and respecting the community. TGR: Access to water is one of the biggest issues in Chile. Does Mirasol have a clear path to water? MG: The company has been somewhat cryptic as to the exact project location and has yet to conduct an analyst site visit. Our understanding is that Mirasol is still acquiring strategic land positions within this new belt. TGR: When will that information be available? MG: We are confident in the management team's ability to conduct generative research using satellite and Advanced Spaceborne Thermal Emission and Reflection Radiometer (ASTER) imagery to identify large alteration signatures. The company has homed in on a specific area with nine targets. As it goes forward to drill the initial targets in the next few months, I expect more visibility on the actual location and setting. TGR: What other companies are on your top pick list?

- 13. MG: B2Gold is one. For an intermediate producer, B2Gold has a top management team. The company is a hybrid producer-explorer, and it does both well. It operates gold mines in Nicaragua, a new acquisition in the Philippines called the Masbate mine and a development project in Namibia. The company has a tremendous growth profile: from 150,000 oz (150 Koz) last year to what we estimate could exceed 500 Koz by 2015. It all comes at a fairly low capital expense. B2Gold also comes with tremendous exploration upside. In Nicaragua, it is executing a feed-the-mill strategy to extend mine life. By exploring the La Libertad gold belt and finding satellite deposits at twice the grade, it is able to feed its mill and grow organically. For example, we estimate that the Jabali satellite deposit will generate a 95% internal rate of return. B2Gold acquired Auryx Gold Corp. in December 2011. It did not overpay for an asset that will deliver 140 Koz/year by 2015, along with a tremendous exploration belt. This is the former Bema Gold team that discovered Refugio, Cerro Casale and created tremendous value at Kupol; Kinross Gold Corp. (K:TSX; KGC;NYSE) subsequently bought Bema for $3.6B. TGR: One of the more interesting projects in B2Gold's portfolio is the Gramalote joint venture in Colombia. What can you tell us about that project? MG: Gramalote is a strategic gold porphyry development project in Colombia and is operated by AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE). It is a 51/49 joint venture, 51 for AngloGold Ashanti. Gramalote is somewhat low grade0.65 g/t average gradeand would be a milling operation. It has good infrastructure and very good recoveries. The project is in the midst of a preliminary feasibility study, and we expect better visibility on the economics in the next few months. In our view, it is probably of less strategic interest to B2Gold, given the location and the probable high cost to build the project. However, in our view, Gramalote is very strategic to AngloGold Ashanti as development of this asset to production could pave the way for a separate 100%-owned project called La Colosa in a different part of Colombia that is reportedly in the 25+ Moz gold resource size. La Colosa is the ultimate prize in Colombia for AngloGold Ashanti. TGR: Can B2Gold achieve significant production increases at La Libertad and Masbate?

- 14. MG: Yes. Masbate brings in the range of 180200 Koz to B2Gold. It has not decided on an expansion, but we model a +50 Koz/year expansion in 2015. This becomes the flagship asset for B2Gold with its contribution to production and growth. At La Libertad, we see incremental production growth through 20132014, topping out near 150 Koz. TGR: Do you have another top pick that you would like to talk about? MG: Tahoe Resources has a best-of-breed silver asset in Guatemala and is run by Kevin McArthur, former CEO of Goldcorp and Glamis Gold Ltd., along with his very strong team. Tahoe has built an underground mine for less than $400M, on time and on budget. It should be completed by July 2013. What stands out about Tahoe's Escobal mine development project is its high grade and large size. It has more than 400 Moz in silver resources and will mine average grades of 400 g/t, with some gold, zinc and lead credits. Another key is that the veins are very thick, averaging 1015m in one zone, and over 15m in another. The company can, therefore, mine very efficiently and run the plant initially at 3,500 tons per day (3,500 tpd), moving up to 5,000 tpd and potentially to 7,000 tpd. You are looking at 20 Moz/year silver for at least the first eight years. TGR: That is an interesting point about scalability in projects, something offered by very few projects. MG: This is an asset built by a veteran team that contemplates that upside. The incremental expansion is more or less designed and factored in to get to 5,000 tpd. TGR: Kevin McArthur was on Canada's BNN, and he was grilled about some problems with the locals near its project after an incident. Is that a problem? MG: It is an ongoing issue. The company received its permita real endorsement from the government and a government presence on-site helps with security. This is a change to the local economy. It is an industrial site near the town of San Rafael, a community that we estimate will benefit from the new royalty regime to the tune of about $10M/year. Communities farther away also will feel the impact. Guatemala does not have a mining culture with a long history. There will be community relations and security issues to manage in the near and medium term.

- 15. TGR: According to your models, what sort of cash flow will Tahoe generate by Q4/13? MG: We show Tahoe being cash flow positive in Q4/13 and overall guidance of 5 Moz silver being produced into 2013. Looking out to 2014, and using a forward curve from Feb. 6, 2013, and a higher silver price ($32/oz silver), we are looking at $353M cash flow from operations in 2014 for $2.33/share. Another attraction with Tahoe is that management suggested last summer that it would pay a significant dividend. TGR: If you were a grief counselor for retail investors with positions in gold, how would you assuage them after the recent dramatic market events? MG: Being one of those investors who feel the pain, I can empathize. It comes back to volatility. If you are convinced that the best companies will come out of this, when they are deeply discounted and you can buy them at what seem to be fire sale prices, you will be rewarded down the line. It also comes back to the potential swings in volatility we could see to the upside. That is why you want exposure to the gold sector, especially in equities, despite its downtrodden reputation. TGR: Thank you for your insights. Michael Gray is a mining equity analyst with Macquarie Capital Markets and covers a range of precious metal explorers and producers with an emphasis on North and South America. He is an exploration geologist and holds a Bachelor of Science in geology from University of British Columbia and Master of Science in economic geology from Laurentian University. His career of over 25 years in the mineral exploration business started with senior mining companies including Falconbridge, Lac Minerals, Cominco and Minnova where he worked throughout Canada and the USA. He co-founded Rubicon Minerals in 1996 and helped navigate the company through a series of joint ventures and an asset portfolio build that was eventually centered on the Red Lake gold district in Canada. During this period, Gray was president of the 5,000 member British Columbia and Yukon Chamber of Mines for one year and on the executive committee for six years. Gray then joined the mining analyst world in 2005 where he brought to bear his technical skills to identify new precious metal opportunities at an early stage with outstanding exploration potential; he has covered a number of these opportunities that were subsequently taken over by gold producers. Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

- 16. DISCLOSURE: 1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None. 2) The following companies mentioned in the interview are sponsors of The Gold Report: B2Gold Corp., Goldcorp Inc., MAG Silver Corp. and Tahoe Resources Inc. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment. 3) Michael Gray: I or my family own shares of the following companies mentioned in this interview: Goldcorp Inc. and Barrick Gold Corp. I personally or my family am paid by the following companies mentioned in this interview: None. Macquarie Capital Markets disclosures are available here. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. 4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent. 5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. 6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise. Article source: http://feedproxy.google.com/~r/theaureport/Ajgh/~3/EqytVFVFUx0/15203 With the permission from MarketClub How Gold Prices Work in the Post-Crash Shortage - 1 May 2013 Spying direction is hard enough without confusing chocolate for cocoa...

- 17. WHAT'S your gold or silver really worth? asks Adrian Ash at BullionVault. Like anything, it's worth at best the most that somebody else will pay you for it. That's the simple truth, as last month's crash proved. There were no gold buyers in size on Friday 12th and Monday 15th April, not between $1550 and $1325 per ounce. But gold has found plenty of buyers since then, after finding a floor more than 30% below its peak of September 2011. The surge in demand for gold and silver provoked by mid-April's crash – the sharpest drop in 30 years – is phenomenal. Internet traffic to BullionVault has doubled from recent levels, and new account openings rose more than 40% from the previous 3- month average to reach the strongest level since January 2012. Traditional retail dealers in North America and Europe are also reporting strong demand, with some distributors hitting supply delays thanks to the real source of today's surge in global demand for small bar and coin – India and China, the world's top two markets gold consumers. Overwhelming the physical supply chain for kilobars and other "retail investor" products, dealers in Asia haven't been able to charge this much above international prices since late 2008. Yes, America's biggest retailers are starting to plug their gaps at home, with some hot items now "Back in Stock" at 10% over the wholesale bullion price. Silver buyers in the UK are meantime being asked up to 40% more than wholesale prices for a 1 kilo bar (that includes 20% VAT – a charge you don't pay on BullionVault unless you opt to take possession). German dealers also report tight supply in gold coins, although they don't yet seem to be capitalizing on any shortage. Does this gap between small bar and big bar prices represent some kind of paradigm shift? Large premia for retail units are in fact a common but unpredictable feature of the bullion industry. They typically hit when prices slump, inviting eager buying by private investors but leaving their retail suppliers with a sharp loss if they follow the wholesale price all the way down. Surging demand for coin and small bars emptied gold retailers across Europe and North America during the price crash of late 2008, for instance, when spot gold fell from $900 to $670 inside 3 weeks. Premiums leapt. They did the same in New Year 2011, when spot prices fell from $1410 to $1320 inside a month, catching the refiners with holiday staffing levels and hitting supply-chain bottlenecks in secure logistics. The shortages were then most acute in silver, which fell from $30.60 to $26.68 in the wholesale 'spot' market but couldn't be found at less than 10% mark-ups in the retail market (and even before UK and other European investors had to account for VAT sales tax of up to 20%). That wiped out any saving which new investors might have hoped to enjoy. But how does such tight supply come about? Like a chocolate bar starting life as cocoa beans, small gold bars and coins typically start life in the form of large Good Delivery bars, whose quality and provenance is warranted by the wholesale market, and whose production and logistics costs are lowest. So before a new coin or small bar can reach the investing public, armoured trucks first need to be booked, together with air freight if the metal is taking the #1 route – out of London, into Swiss refiners, and onto Asia in the form of kilobars. Vault staff then need to pack the large wholesale bars, ready for shipping. Once delivered to the refinery or mint, those big bars need to be melted down and recast or struck as small bars or coin. Those retail-sized products then need to be shipped back out to retail distributors, who will add a fourth layer of limits on order processing (office hours, staff levels, financial resources etc).

- 18. Make no mistake: this is not an "arbitrage" which holders of gold in one form can exploit simply by spotting it. The reason the kilobar premium in Singapore for instance has surged in the last two weeks (and it's fading as demand eases off) is the tight supply of production capacity, relative to dealer demand. Swiss refiners are booked solid until end- May for kilobars, we are told. So getting your metal into retail form would be hard. It is also something to which professional distributors already devote their operations. The answer then to "What is gold worth?" is more complex, but only a little. Like silver or any other physical good, it depends both on where it is and what form it takes. Coins and small bars are currently at a premium. So is metal in Hong Kong and Mumbai. Those mark-ups are highly variable however, and accessing them as a private investor is hard. First you need to have paid all those extra fabrication and logistics costs. Then you need to find a buyer willing to pay you the premium, rather than shopping around amongst retail dealers. Would that be the "real" price anyway? Only if you could achieve it. Yet the gap between retail-product and wholesale prices is feeding an idea popular with bloggers right now that professional "spot" prices are somehow divorced from "real gold" values. Such frustration is understandable perhaps. Last month's price-drop has cost a lot of long- term precious metal owners a lot of missed profit, and more recent buyers are out of pocket still worse. But as professionals in the physical market, we can assure you that the spot price is the price of physical gold and silver in large-bar form right now, just as always. We go on settling physical gold and silver bars daily, picking up real physical bullion and moving it to accredited storage outside the banking world. The quality of the bars, fully allocated to Bullion Vault clients at all times as the Daily Audit shows, is warranted by the Good Delivery standards. We also have inspection reports from independent experts which make clear that what belongs to BullionVault users is indeed warranted, high-quality gold. So the real price of physical gold right now? Go to Bullion Vault's Order Board, and you'll see firm bids and offers for Good Delivery metal, already delivered inside accredited vaults. In each location – London, New York, Zurich and Singapore – you'll enter a live peer-to-peer market, where buyers and sellers are meeting to agree their price in free competition, with instantaneous settlement inside the vault. One side wants to pay as little as possible. The other wants to get as much as they can. So whether you think the price is too high – or too low – depends on which side you're on. BullionVault lets you set your own bid or offer. Whether you get the price that you want depends on what the other side does. But that is how markets work. And different markets for different things shouldn't be confused. There's enough trouble trying to spy gold and silver's underlying direction right now without mistaking chocolate in one store for cocoa on the other side of the world. Adrian Ash, 01 May '13 Adrian Ash runs the research desk at BullionVault, the physical gold and silver market for private investors online. Formerly head of editorial at London's top publisher of private-investment advice, Adrian Ash was City correspondent for The Daily

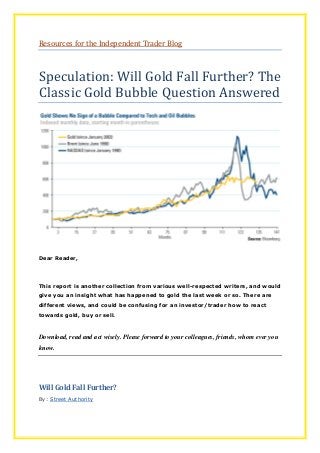

- 19. Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news. Adrian's views on the gold market have been sought by the Financial Times and Economist magazine in London; CNBC, Bloomberg and TheStreet.com in New York; Germany's Der Stern and FT Deutschland; Italy's Il Sole 24 Ore, and many other respected finance publications. The Classic Gold Bubble Question Answered - 2 May 2013 Comparing gold to oil and tech stocks... SINCE gold's bull run began a decade ago, many people have asked me whether the metal was in a bubble, despite the fact that there were many drivers in place for gold, writes Frank Holmes, CEO and chief investment officer at US Global Investors. Here's another comparison that answers this classic question. Research firm Commerzbank's strategists recently compared the price of gold starting in 2002 to the price of Brent crude oil starting in 1998 and the NASDAQ Composite from 1990. Immediately following each index's record highs, oil and tech stocks declined sharply. Within nine months, tech stocks had halved in price, while it took only three months for oil to lose half its price, says Commerzbank. You can see the dramatic rise and fall of each index on the chart below. In contrast to oil and tech, gold has been level-headed over the past decade. Nearly 20 months after its peak, gold has fallen only about 25 percent, and its path remains in line with Brent and the NASDAQ after their bubbles burst.

- 20. In Commerzbank's opinion, a comparison between the current situation in gold and the former bubbles is superfluous at best. Frank Holmes, 02 May '13 Frank Holmes is chief executive officer and chief investment officer of US Global Investors Inc., a registered investment adviser managing approximately $4.8 billion in 13 no-load mutual funds and for other advisory clients. A Toronto native, he bought a controlling interest in US Global Investors in 1989, after an accomplished career in Canada's capital markets. His specialized knowledge gives him expertise in resource- based industries and money management. Gold Market Speculation: Who, What and Why? - 30 April 2013 Making sense of the Comex... EVERY FRIDAY the Commodity Futures Trading Commission releases data that enable analysts to 'take the pulse' of various commodity markets, writes Ben Traynor at BullionVault. The Commitments of Traders (CoT) report gives the aggregate positions held by traders from the previous Tuesday, including the number of long contracts (that stand to benefit if prices rise) and short contracts (that benefit if they fall). Included in the CoT is positioning in gold and silver futures and options on the New York Comex. A futures contract is a standardized agreement to buy or sell a particular commodity at a particular date in the future. On the Comex, each gold futures contract is for 100 troy ounces, while each silver contract is an agreement to buy or sell 5,000 ounces. A Comex option meanwhile gives its owner the right, but not the obligation, to buy or sell a futures contract. The CoT breaks traders down into four categories: 1. Producer/Merchant/Processor/User 2. Swap Dealers 3. Managed Money 4. Other Reportables Other smaller traders are also accounted for separately as 'Nonreportables'. This CFTC document gives brief descriptions for the four categories above. In essence, the first, Producer/Merchant etc., is anyone who is in the relevant industry commercially and using the futures market to hedge the price of their inputs or outputs (e.g. mining companies, refiners, jewelry manufacturers in the case of gold). A Swap Dealer (usually a division of a major bank, see here for a list) may be dealing in swaps with speculative counterparties or with industry clients looking to hedge; the swap dealer may then be using the futures market to hedge their own book. Managed Money, as the name suggests, includes hedge funds and the like, while Other Reportables are traders large enough to report their positions but who are judged not to fit into any of the other three categories.

- 21. One closely-watched metric from the weekly CoT is the so-called speculative net long, which is calculated by taking the total number of open long contracts held by 'speculators' (we'll get to who they are in a moment) and subtracting the number of open short contracts. The spec net long is viewed by many as a useful gauge of how bullish or bearish the market is. If the spec net long goes up, the implication is that speculators are growing more bullish. If it goes down, they're getting less so. There is, however, a problem with the spec net long. There doesn't seem to be agreement on what exactly it is. Different analysts calculate it differently, depending on who they class as speculators and the types of contracts they look at. Who are the speculators? Until September 2009, the CoT used to break large traders down into two main camps: commercial and noncommercial (there was, as now, also a Nonreportables category to account for smaller players). Commercials comprised the first two categories mentioned above, Producer/Merchant etc. and Swap Dealers. The noncommercials were regarded as speculative money, and hence it was their positioning that was used to calculate the spec net long. Since September 2009, when the CFTC started publishing its disaggregated CoT, the picture has become more nuanced. Many analysts still lump Managed Money and Other Reportables together as the noncommercial, speculative end of the market. An example is Japanese trading house Mitsui, whose weekly report quotes the net long in broken down in terms of 'Large Specs' (i.e. Managed Money and Other reportable together) and 'Small Specs' (the Nonreportables), in terms of futures only, options, and the futures and options combined. South Africa's Standard Bank also lumps both types of noncommercial player together, calculating a net long figure based on the aggregate futures and options positioning of Managed Money and Other Reportables together. Others analysts prefer to look at Managed Money in isolation, viewing it as a purer measure of speculative sentiment. One example is Commerzbank, whose research notes quote the spec net long in terms of futures contracts held by Managed Money. Brokerage INTL FCStone also looks just at the managed Money category, but it differs from Commerzbank in that it uses futures and options combined to calculate the figures it quotes as the spec net long. Which classifications of traders you count as speculative can make a difference. As an illustration, here's what happened in the week ended Tuesday 16 April, a week in which gold saw its steepest price drop in three decades:

- 22. Managed Money responded to the price drop by cutting aggregate short positions and increasing long ones. Other Reportables did the exact opposite (as did Nonreportables). And this was far from the only week when the two camps of traders moved in different directions. It seems the positioning decisions of Managed Money and Other Reportables are driven by different motivations. There is no right or wrong answer when it comes to who to include as 'speculative' traders.In many cases it is a judgment call for the regulator, not an immutable fact. An important point to stress is that it is the trader that is categorized, not trades themselves. This means that an entity classified as 'speculative' (Managed Money or, for some analysts, Other Reportable) may still hold positions that have a nonspeculative motive (e.g. hedging a swap position) and vice versa. Yet those positions will be counted towards the grand total of such positions held by speculators. What contracts should be considered? For each commodity market the CFTC publishes two versions of the CoT each Friday. One is based only on positioning in futures contracts while the other also includes options. Most weeks, both reports tell a similar story in terms of changes in the spec net long. But this is not always so. The table below shows how the spec net long changed in the week ended April 16 2013, according to four different ways of calculating it: By the end of Tuesday 16 April gold was down more than 10% from a week earlier. As you can see from the table, this price drop was met by a large increase in the futures only net long position of Managed Money, whose futures and options net long also increased, though less dramatically.

- 23. If you include Other Reportables, however, then for the week in question it makes a difference whether or not you include options. On a futures only basis the net long of all noncommercials went up, but if you include options it fell. Why? Our guess is that this is in part explained by what's known as delta-weighting. When calculating traders' positions for its weekly report, the CFTC weights long and short option positions according to what's known as the 'delta', the sensitivity of the option's price to movements in the underlying, in this case the price of a gold futures contract. So if a $1 move in the price of the futures contract results in a $0.50 move in the price of the option, the option is said to have a delta factor of 0.5. Let's say a trader holds 100 identical call options (the right to buy at a given strike price). He is considered to be long since he stands to benefit from a rising price in the underlying. The CFTC converts the trader's option position into a futures contract equivalent by multiplying the number of contracts by the delta factor. If the option has a delta of 0.5 then the trader's option position appears in the futures and options CoT report as a long position of 50 futures contracts. By April 16, with gold having fallen so hard, many of the long options held a week earlier were now well out of the money. Those that had not been closed out will have seen their deltas fall dramatically. A call option to buy at $1800 an ounce isn't worth much once gold's fallen below $1350 – and it doesn't get much more valuable even if gold climbs $50 or $100 from there. The same dynamic works the other way with short positions – any well out-of-the- money puts on Tuesday April 9 that were still open a week later will have seen their deltas rise. This, we suspect, goes some way to explaining why the changes in futures and options spec net long cited above tell a different story from the futures only. On Tuesday 16 April, the biggest open interest for May call options was at the $1650 strike price, at 12,261 contracts. Yet these calls would have been given a lower weighting in the CoT for that day than they had been a week earlier. Of course, market-driven changes to delta weighting are not the whole story – no doubt a lot of long option positions were closed and short ones opened when the price started to fall. This aspect of the CoT is however worth bearing in mind when analyzing the numbers, especially at times when the price has moved a long way. Why are traders long or short? When trying to make sense of Comex positioning, the fundamental question is why traders are long or short. Are they hedging a commercial activity? A position in another market? Or are they taking an out-and-out speculative bet on price direction? The CoT does not provide enough information to answer these questions definitively. Classifying traders according to their typical trading activity, as the CFTC does, allows us to inferences, but always bear in mind that even professional analysts don't agree on who should be regarded as a speculator. Remember also that just because a trader may be classed in a 'speculative' category does not mean all their trading should be considered as such. As we have seen, it can make a significant difference who you regard as a speculator, as well as the types of contracts you take into consideration. These decisions are judgment calls. Often it makes little difference to the overall story whether you look at futures only

- 24. or futures and options, or whether or not you split out Managed Money. But occasionally it does – and as we saw in April 2013 this can be at times when sharp price moves have already created a confusing picture. Ben Traynor, 30 Apr '13 Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. Ben can be found on Gold Trading Resources: Get 100 Commission-Free Trades at OptionsHouse.com!

- 25. The Star of Binary Options is...We offer users 100% first deposit bonus upon a deposit greater than $1000 Spot Gold Trading Mobile Global Gold Trading Handeln Sie Gold und Silber online ohne Requotes 在线黄金,无重复报价 Интернет-торговля золотом реквот Trade smart, not with Greed Pierre A Pienaar Resources for the Independent Trader Blog http://sulia.com/pierreapienaar/ Pierre A Pienaar retired in 2011 from business. I would like to share my passion, my interests, knowledge & experiences in Forex, Options, Gold Investments, Futures, Stocks, Binary Options, Economics, Stamp Collection, Sports, Gardening, Reading, Photography, and Politics Substantial risk of loss

- 26. There is a substantial risk of loss of stocks, forex, commodities, futures, options, and foreign equities are substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. You should read, understand, and consider the Risk Disclosure Statement that is provided by your broker before you consider trading.