21 October Daily market report

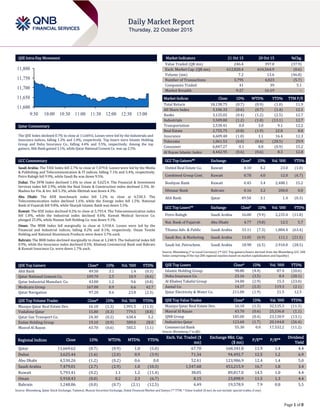

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.7% to close at 11,669.6. Losses were led by the Industrials and Insurance indices, falling 1.2% and 1.0%, respectively. Top losers were Islamic Holding Group and Doha Insurance Co., falling 4.4% and 3.5%, respectively. Among the top gainers, Ahli Bank gained 3.1%, while Qatar National Cement Co. was up 2.5%. GCC Commentary Saudi Arabia: The TASI Index fell 2.7% to close at 7,479.0. Losses were led by the Media & Publishing and Telecommunication & IT indices, falling 7.1% and 5.4%, respectively. Petro Rabigh fell 9.9%, while Saudi Re was down 9.5%. Dubai: The DFM Index declined 1.6% to close at 3,625.4. The Financial & Investment Services index fell 2.9%, while the Real Estate & Construction index declined 2.3%. Al- Madina for Fin. & Inv. fell 5.3%, while Ekttitab was down 4.3%. Abu Dhabi: The ADX benchmark index fell 1.2% to close at 4,530.3. The Telecommunication index declined 1.6%, while the Energy index fell 1.5%. National Bank of Fujairah fell 9.8%, while Sharjah Islamic Bank was down 5.5%. Kuwait: The KSE Index declined 0.2% to close at 5,793.4. The Telecommunication index fell 1.0%, while the Industrial index declined 0.6%. Kuwait Medical Services Co. plunged 25.0%, while Human Soft Holding Co. was down 9.1%. Oman: The MSM Index fell marginally to close at 5,918.4. Losses were led by the Financial and Industrial indices, falling 0.2% and 0.1%, respectively. Oman Textile Holding and National Aluminium Products were down 3.7% each. Bahrain: The BHB Index declined marginally to close at 1,248.9. The Industrial index fell 0.9%, while the Insurance index declined 0.5%. Khaleeji Commercial Bank and Bahrain & Kuwait Insurance Co. were down 1.7% each. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ahli Bank 49.50 3.1 1.4 (0.3) Qatar National Cement Co. 109.70 2.5 10.9 (8.6) Qatar Industrial Manufact. Co. 43.00 1.2 9.6 (0.8) Medicare Group 167.00 0.9 6.6 42.7 Qatar Navigation 97.20 0.6 23.8 (2.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 16.18 (1.3) 1,991.5 (11.3) Vodafone Qatar 15.00 (0.3) 779.5 (8.8) Qatar Gas Transport Co. 24.30 (0.2) 638.4 5.2 Ezdan Holding Group 19.10 (0.9) 589.0 28.0 Masraf Al Rayan 43.70 (0.6) 585.5 (1.1) Market Indicators 21 Oct 15 20 Oct 15 %Chg. Value Traded (QR mn) 246.4 397.0 (37.9) Exch. Market Cap. (QR mn) 612,820.4 616,564.9 (0.6) Volume (mn) 7.2 13.6 (46.8) Number of Transactions 3,795 4,023 (5.7) Companies Traded 41 39 5.1 Market Breadth 9:27 16:19 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,138.75 (0.7) (0.9) (1.0) 11.9 All Share Index 3,106.33 (0.6) (0.7) (1.4) 12.1 Banks 3,125.02 (0.4) (1.2) (2.5) 12.7 Industrials 3,509.80 (1.2) (1.0) (13.1) 12.7 Transportation 2,530.41 0.0 3.0 9.1 12.2 Real Estate 2,755.75 (0.8) (1.9) 22.8 8.8 Insurance 4,609.48 (1.0) 1.1 16.4 12.3 Telecoms 1,061.53 (0.0) (0.4) (28.5) 29.9 Consumer 6,847.27 0.1 0.8 (0.9) 15.2 Al Rayan Islamic Index 4,442.95 (0.6) (0.6) 8.3 12.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% United Real Estate Co. Kuwait 0.10 4.2 23.0 (1.0) Combined Group Cont. Kuwait 0.78 4.0 12.0 (6.7) Boubyan Bank Kuwait 0.45 3.4 2,488.1 15.2 Ithmaar Bank Bahrain 0.16 3.2 200.0 0.0 Ahli Bank Qatar 49.50 3.1 1.4 (0.3) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Petro Rabigh Saudi Arabia 16.00 (9.9) 2,235.4 (11.8) Nat. Bank of Fujairah Abu Dhabi 4.77 (9.8) 12.5 5.7 Tihama Adv. & Public Saudi Arabia 33.11 (7.3) 1,884.4 (63.4) Saudi Res. & Marketing Saudi Arabia 13.05 (6.9) 111.1 (21.5) Saudi Int. Petrochem. Saudi Arabia 18.98 (6.5) 2,910.0 (28.5) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 98.80 (4.4) 87.4 (20.6) Doha Insurance Co. 23.16 (3.5) 8.4 (20.1) Al Khaleej Takaful Group 34.00 (2.9) 15.3 (23.0) Aamal Co. 14.17 (2.3) 119.3 (2.1) Qatar Electricity & Water Co. 211.00 (1.9) 21.5 12.5 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Mazaya Qatar Real Estate Dev. 16.18 (1.3) 32,135.3 (11.3) Masraf Al Rayan 43.70 (0.6) 25,536.8 (1.1) QNB Group 185.00 (0.4) 23,130.9 (13.1) Industries Qatar 123.60 (1.7) 20,144.8 (26.4) Commercial Bank 55.30 0.0 17,532.2 (11.2) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,669.62 (0.7) (0.9) 1.8 (5.0) 67.70 168,341.8 11.9 1.4 4.4 Dubai 3,625.44 (1.6) (2.0) 0.9 (3.9) 71.34 94,492.7 12.5 1.2 6.9 Abu Dhabi 4,530.26 (1.2) (0.2) 0.6 0.0 52.41 123,986.9 12.4 1.4 5.0 Saudi Arabia 7,479.01 (2.7) (2.9) 1.0 (10.3) 1,547.68 453,215.9 16.7 1.8 3.4 Kuwait 5,793.41 (0.2) 1.1 1.2 (11.4) 38.05 89,817.0 14.5 1.0 4.4 Oman 5,918.43 (0.0) 0.2 2.3 (6.7) 8.15 23,898.9 11.5 1.3 4.4 Bahrain 1,248.86 (0.0) (0.7) (2.1) (12.5) 4.49 19,578.9 7.9 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,600 11,650 11,700 11,750 11,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index declined 0.7% to close at 11,669.6. The Industrials and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Islamic Holding Group and Doha Insurance Co. were the top losers, falling 4.4% and 3.5%, respectively. Among the top gainers, Ahli Bank gained 3.1%, while Qatar National Cement Co. was up 2.5%. Volume of shares traded on Wednesday fell by 46.8% to 7.2mn from 13.6mn on Tuesday. Further, as compared to the 30-day moving average of 7.8mn, volume for the day was 7.6% lower. Mazaya Qatar Real Estate Development and Vodafone Qatar were the most active stocks, contributing 27.5% and 10.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Red Sea Housing Services Co. Saudi Arabia SR – – 6.6 -85.6% 1.9 -95.6% Kingdom Holding Co. (KHC) Saudi Arabia SR – – 400.1 15.9% 291.6 10.0% United Electronics Co. (eXtra) Saudi Arabia SR – – 11.8 -61.1% 12.2 -58.9% Al Jouf Cement Co. Saudi Arabia SR – – 22.3 78.4% 18.6 116.6% Saudi Electricity Co. (SEC) Saudi Arabia SR – – 2,855.0 10.4% 2,921.0 9.5% Saudi Ground Services Co. (SGS) Saudi Arabia SR – – 171.3 -5.2% 167.1 -5.5% Abdullah Al Othaim Markets Co. Saudi Arabia SR – – 32.3 -12.4% 37.1 -12.3% Saudi Research and Marketing Group (SRMG) Saudi Arabia SR – – -4.5 NA -6.7 NA Tabuk Cement Co. Saudi Arabia SR – – 8.8 -60.4% 9.2 -57.4% Rabigh Refining & Petrochemical Co. (Petro Rabigh) Saudi Arabia SR – – -463.0 NA -460.0 NA Saudi Industrial Services Co. (SISCO) Saudi Arabia SR – – 43.2 -15.9% 24.8 -2.9% Middle East Specialized Cables Co. (MESC) Saudi Arabia SR – – 1.3 NA -3.2 NA Saudi Fisheries Co. Saudi Arabia SR – – -15.0 NA -16.9 NA Saudi Cable Co. Saudi Arabia SR – – -20.2 NA -2.9 NA National Agriculture Marketing Co. (Thimar) Saudi Arabia SR – – 1.3 -34.9% 1.4 -59.4% Saudi Indian Company for Co- operative Insurance (WAFA Insurance) Saudi Arabia SR 74.4 495.7% – – -13.5 NA Saudi Paper Manufacturing Co. (SPMC) Saudi Arabia SR – – -29.6 NA -71.1 NA Salama Cooperative Insurance Co. Saudi Arabia SR – – 79.3 12.1% 1.4 89.1% Al Babtain Power & Telecommunication Co. Saudi Arabia SR – – 41.8 -12.9% 32.5 118.1% Etihad Atheeb Telecommunications Co. Saudi Arabia SR – – -71.5 NA 3.6 NA Qassim Agricultural Co. (GACO) Saudi Arabia SR – – -4.2 NA -4.2 NA Mobile Telecommunications Company Saudi Arabia (Zain KSA) Saudi Arabia SR – – -1.0 NA -223.0 NA Etihad Etisalat Co. (Mobily) Saudi Arabia SR – – -50.0 NA -158.0 NA Mohammad Al Mojil Group Co. (MMG) Saudi Arabia SR – – -55.6 NA -63.7 NA Nakheel Dubai AED – – – – 780.0 4.0% National Hospitality Institute (NHI) Oman OMR 0.6 -16.6% – – 0.0 NA Gulf Hotels Group Bahrain BHD 7.4 12.3% 2.8 13.6% 1.8 -6.3% Esterad Investment Co. Bahrain BHD 0.5 -49.7% – – 0.2 -72.4% Source: Company data, DFM, ADX, MSM Overall Activity Buy %* Sell %* Net (QR) Qatari 51.66% 55.22% (8,777,796.81) GCC 2.58% 14.75% (29,992,378.33) Non-Qatari 45.76% 30.03% 38,770,175.14

- 3. Page 3 of 8 Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/21 US Mortgage Bankers Association MBA Mortgage Applications 16-October 11.80% – -27.60% 10/21 EU Eurostat Govt Debt/GDP Ratio 6-July 92.10% – 91.90% 10/21 UK ONS Public Finances (PSNCR) September 17.9bn – 0.7bn 10/21 UK ONS Central Government NCR September 21.5bn – 0.2bn 10/21 UK ONS Public Sector Net Borrowing September 8.6bn 9.6bn 10.8bn 10/21 UK ONS PSNB ex Banking Groups September 9.4bn 10.1bn 11.6bn Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Reported ABQK Al Ahli Bank 14-Oct-15 - Reported MRDS Mazaya Qatar 14-Oct-15 - Reported MCCS Mannai Corp. 16-Oct-15 - Reported CBQK Commercial Bank 18-Oct-15 - Reported QIGD Qatari Investors Group 19-Oct-15 - Reported DBIS Dlala Brokerage & Investment Holding Company 19-Oct-15 - Reported KCBK Al Khaliji 20-Oct-15 - Reported DOHI Doha Insurance 20-Oct-15 - Reported QEWS Qatar Electricity & Water Company 20-Oct-15 - Reported SIIS Salam International Investment 20-Oct-15 - Reported AKHI Al Khaleej Takaful Insurance 20-Oct-15 - Reported IHGS Islamic Holding Group 20-Oct-15 - Reported QIIK Qatar International Islamic Bank 20-Oct-15 - Reported GWCS Gulf Warehousing Company 21-Oct-15 - Reported QGTS Qatar Gas Transport Company (Nakilat) 21-Oct-15 - Reported QNCD Qatar National Cement Company 21-Oct-15 - Reported QCFS Qatar Cinema & Film Distribution Company 21-Oct-15 - Reported QIMD Qatar Industrial Manufacturing Company 22-Oct-15 0 Reported WDAM Widam Food Company 22-Oct-15 0 Due QNNS Qatar Navigation (Milaha) 24-Oct-15 2 Due QATI Qatar Insurance Company 25-Oct-15 3 Due MARK Masraf Al Rayan 25-Oct-15 3 Due DHBK Doha Bank 25-Oct-15 3 Due QISI Qatar Islamic Insurance 25-Oct-15 3 Due QGRI Qatar General Insurance & Reinsurance 25-Oct-15 3 Due QOIS Qatar & Oman Investment 25-Oct-15 3 Due MCGS Medicare Group 25-Oct-15 3 Due GISS Gulf International Services 25-Oct-15 3 Due QGMD Qatar German Company for Medical Devices 25-Oct-15 3 Due UDCD United Development Company 26-Oct-15 4 Due QFLS Qatar Fuel Company 26-Oct-15 4 Due ERES Ezdan Real Estate Company 26-Oct-15 4 Due MERS Al Meera Consumer Goods Company 27-Oct-15 5 Due MPHC Mesaieed Petrochemical Holding Company 27-Oct-15 5 Due BRES Barwa Real Estate Company 27-Oct-15 5 Due ORDS Ooredoo 28-Oct-15 6 Due IQCD Industries Qatar 28-Oct-15 6 Due AHCS Aamal Company 29-Oct-15 7 Due NLCS National Leasing (Alijarah) 29-Oct-15 7 Due ZHCD Zad Holding Company 29-Oct-15 7 Due VFQS Vodafone Qatar 12-Nov-15 21 Due Source: QSE

- 4. Page 4 of 8 News Qatar GWCS profitability stagnant QoQ in 3Q2015 – Gulf Warehousing Company’s (GWCS) 3Q2015 net profit in-line with our estimate of QR44.5mn (+6.3% variation), as it remained flat at QR47.3mn in 3Q2015 as compared to 2Q2015. Revenue inched down 3.4% QoQ to QR202.3mn (positive 6.1% variation from our estimate). Finance costs dipped 34.6% QoQ to QR6.6mn, which aided the bottom-line although operating profit fell to QR53.9mn in 3Q2015 from QR57.4mn in 2Q2015. GWCS said that Bu Sulba Logistics Park has finalized the leveling and compaction stage, with design and construction in the mobilization stage, and the features and designs for individual buildings being finalized. The company is also continuing its expansion plans steadily with the Logistics Village Qatar (LVQ) Phase 5 expansion, on schedule at 60% completion rate. GWCS added that the construction of the additional 15,000 square meters warehouse at the Ras Laffan Industrial City with specialized ‘Hazmat’ logistics specifications and capabilities are 90% complete, and is expected to be operational in 1Q2016. (QNBFS Research, QSE, Gulf-Times.com) Nakilat profit slips marginally QoQ in 3Q2015; in line with our estimate with a 3% variation – Qatar Gas Transport Company (Nakilat) recorded QR266.1mn net profit in 3Q2015 as compared to QR267.8mn in 2Q2015, reflecting a QoQ dip of 0.6% (up 7.7% YoY). Nakilat’s earnings were largely in line with our estimate of QR274.8mn. EPS in 3Q2015 amounted to QR0.48 versus QR0.49 in 2Q2015. Nakilat’s Managing Director, Abdullah al-Sulaiti said the company has lowered its operating costs, and the financing costs are decreasing as the company has repaid a suitable amount of its loans. Nakilat has also seen increased profits from its joint ventures, particularly since the launch of two new vessels during the year, along with an additional five vessels that became fully operational. We continue to rate Nakilat an Accumulate with QR24.70 price target (QNBFS Research, QSE, Gulf-Times.com) QIMD profitability improves from 2Q2015 to QR49.6mn – Qatar Industrial Manufacturing Company’s (QIMD) net profit advanced 6.9% from 2Q2015 (down 19.0% from 3Q2014) to QR49.6mn. Increase in net profit was aided by healthy rise in revenue (up 17.9% QoQ to QR109.9mn) and net share of results from equity- accounted investees (+29.3% QoQ to QR46.6mn) even as cost of sales jumped 30.9% QoQ to QR96.9mn. EPS rose to QR1.05 in 3Q2015 from QR0.97 in 2Q2015. (QSE, QNBFS Research) QCFS bottom-line advances in 3Q2015 on higher operating income – Qatar Cinema & Film Distribution Company (QCFS) 3Q2015 net income rose 3.2% QoQ to QR2.3mn, on the back of a 7.9% QoQ increase in its operating income to QR4.4mn. EPS improved to QR0.38 in 3Q2015 from QR0.29 in 2Q2015. (QSE, QNBFS Research) StanChart: Qatar economy expected to grow by 5.4% in 2015 – Standard Chartered (StanChart), in its recent report, said Qatar’s economy is expected to grow by 5.4% in 2015 on the back of mega infrastructure projects related to the 2022 FIFA World Cup and Qatar National Vision 2030. The report places its economic outlook for Qatar at the high-end of the bank’s growth forecasts for Gulf Cooperation Council (GCC) countries. Government investments in Qatar’s numerous long-term projects are driving growth. Citing government forecasts, the report said Qatar’s population could rise to 3.8mn by 2030 from around 2mn currently, adding that population growth is a key driver of Qatar’s long-term infrastructure investment. The report noted that the global slump in liquefied natural gas (LNG) prices is starting to affect the long-term outlook for Qatar’s LNG sector. (Gulf- Times.com) Ashghal: Work on state-of-the-art hospital at Al Khor to start by mid-2017 – The Public Works Authority (Ashghal) said work on a QR3.6bn, 500-bed state-of-the-art hospital is set to start by mid- 2017 at Al Khor in Qatar's north, which would also witness the commissioning of a major health center and many school buildings in the next two years. The work on many projects, mainly in and around Al Khor, are in full swing and their completion on schedule will give a remarkable fillip to the infrastructural development of the region. The designing of the QR3.6bn hospital is underway and it will have operation theatres, an emergency medical center and external clinics among its facilities. Meanwhile, Ashghal officials also added that top priority would be accorded to the development of Al Khor since it is the second largest city of the country, housing a large population on its outskirts. (Gulf-Times.com) Tawar Mall in Duhail to open in 2016 – Tawar Mall General Manager, Pedro Ribeiro said the under-construction mall, located opposite to the Dahl Al Hamam Park in Al Duhail, will be operational from 4Q2016. Tawar Mall will have 272 retail units with over 90,000 square meters (sqm) leasable area. It will have four floors and two basements. There will be a four-star boutique hotel with 122 rooms and a 6,201sqm hypermarket. There will also be a car showroom, a cinema with 12 screens and a kids area. In addition, there will be many fine dining restaurants. (Gulf- Times.com) Qatar to reinforce construction quality – The quality standards used in Qatar’s construction sector is set to get a boost with globally reputed ASTM International further bolstering its partnership with the Ministry of Environment. ASTM will launch the Qatar Construction Specifications 2014 (QCS 2014) in ASTM Compass in November 2015. QCS 2014 is a mandatory Qatari technical regulation to be followed in the construction sector. (Peninsula Qatar) International Citigroup: Emerging economy growth excluding China trails developed nations – According to Citigroup Inc., economic expansion in most emerging markets lagged behind developed nations for the first time in 14 years in 2Q2015 as slowing world trade, heavy debt burdens and a pending increase in US interest rates sapped growth. Citigroup said developing economies, excluding China, expanded 1.8% in 2Q2015, as compared to 2% for advanced nations. The slower growth was a reversal of the trend since 2001 that saw emerging-market growth exceeding developed markets by 2.6 percentage points on average. Citigroup’s economists said that China itself, the driver for many emerging nations, is probably in worse shape than the official data suggest in part because the government may have overestimated the growth in the service sector. China’s “true” growth rate in 2Q2015 is probably between 4-5%, rather than the 6.9% recorded by the government. Citigroup lowered its forecast for global growth in 2016 to 2.8% from the 2.9% projected in September, marking the fifth consecutive reduction this year. It kept its estimate for 2015 at 2.6%. (Bloomberg) China signs £6bn British nuclear deal in return for own project – China has agreed to invest £6bn in EDF’s Hinkley Point nuclear project, Britain’s first new nuclear plant in a generation, in return for help to bring its own nuclear technology to the West in a subsequent project. Chinese nuclear company CGN will finance 33.5% of the £18bn project, one of the world’s costliest nuclear power stations, which Britain said it needs to replace ageing reactors and polluting coal plants to ensure the lights stay on. As part of the agreement, EDF will help CGN gain a license to build its own nuclear reactor, Hualong, in Britain, whose nuclear regulatory regime is seen as one of the most stringent in the world. CGN has

- 5. Page 5 of 8 also agreed to take a 20% stake in EDF’s Sizewell nuclear project in eastern England. The deal, announced during Chinese President Xi Jinping’s state visit to Britain, is a boost for French nuclear plant operator EDF and reactor maker Areva, which are under pressure to prove their reactors can be built on time and on budget after other projects in Europe were over budget and years behind schedule. (Reuters) Brazil holds interest rates to avoid deepening recession – Brazil’s central bank kept interest rates on hold on Wednesday, standing pat for a second straight meeting despite a jump in inflation expectations to avoid doing more harm to an economy mired in its worst recession in decades. In a unanimous vote, the central bank’s monetary policy committee, known as Copom, kept the benchmark Selic rate at 14.25%, a nine-year high and still the highest among the world’s top 10 economies. The bank reiterated that rates will remain on hold for some time, but removed reference to a self-imposed goal of bringing inflation back to the 4.5% official target in late 2016. The decision not to raise rates will give a breather to President Dilma Rousseff, who is fighting for her political survival amid the country’s worst economic and political crisis in 25 years. (Reuters) National Treasury: South Africa debt levels, bond sales set to climb – South Africa’s debt levels and bond sales are set to climb as the government struggles to meet its revenue-collection targets. The National Treasury, in its mid-term budget release, said that gross government debt will probably increase to 49% of GDP in the year through March 2016, higher than the 47.3% forecasted in February 2015. The Treasury said net debt will increase to 45.4% of GDP in 2018, from 43.5% in 2015. The government is set to borrow 519.5bn rand in the three years through March 2018, or 47bn rand more than was targeted in February. Domestic bond sales will increase to 175bn rand in the year through March 2016 and 180.5bn rand next year, up from a February projection of 172.5bn rand for each of the two years. The Treasury cut projected tax revenue for the period by 35bn rand as power shortages and an anemic global economic expansion constrain growth. South Africa’s debt is rated at one level above junk by Standard & Poor’s. Moody’s Investors Service and Fitch Ratings rate the nation one level higher. The Treasury said further rating downgrades could induce a sudden outflow of foreign capital and sharply higher interest rates. (Bloomberg) Regional APICORP: MENA set to become international oil products hub – According to a report released by Arab Petroleum Investments Corporation (APICORP), the planned refinery expansions and greenfield projects across the MENA region, led by 830k barrels per day (bpd) of new capacity from the GCC by 2020, could make the region an international products hub with national oil companies’ trading arms playing a key role. The rapid increase in domestic oil demand driven by factors such as high population growth rates, rising income levels and low energy prices has prompted many governments in the MENA region to build new refineries and expand the capacity of existing ones. The completion of Yasref and Satorp, two Saudi refineries and the Ruwais facility in the UAE in the past three years added approximately 1.2mn bpd of new refining capacity. The impact on the products trade balance has been substantial. For instance, gross exports of gasoline increased from 44,000 bpd in 2012 to 173k bpd in June 2015 in Saudi Arabia, while that of diesel more than tripled from 98k bpd to 308k bpd during the same period. (GulfBase.com) Sadara starts trial operations at Butanol plant – Sadara Chemical Company (Sadara) said the butanol production plant of Saudi Butanol Company (Sabuco) has commenced initial production. Such a trial run is expected to continue for a period of three to six months, until confirmation of the plant capacity for commercial production. The produced butanol will be supplied to the chemicals project of Sadara, located at Jubail Industrial City II in the Eastern Province of KSA. Sabuco is a special purpose joint venture company established by Sadara, Saudi Kayan Petrochemical Company and Saudi Acrylic Acid Company for the purpose of owning and funding a butanol production plant. (Tadawul) Al Watania picks HSBC as listing advisor – According to sources, Al Watania Poultry has selected HSBC’s Saudi Arabian unit as the financial advisor for its planned stock market flotation on the Saudi Stock Exchange (Tadawul). The company produces 1mn eggs and 575,000 chickens per day, which are sold in Saudi Arabia and six other countries in the region. (Reuters) CMA may relax investor rules to join world indices – Saudi Capital Market Authority (CMA) Chairman Mohammed Aljadaan said that the Kingdom may relax its rules on foreigners investing directly in its stock market to help it get included in global indices. On June 15, 2015, the Saudi Stock Exchange (Tadawul) became one of the last major emerging markets to let foreigners buy shares directly. But licenses are granted only to vetted professional investors, who must have $5bn of assets under management and a five-year investment track record. The limitations on market access are frowned upon by index compliers such as MSCI and FTSE, whose indices are tracked by trillions of dollars of institutional wealth globally. The CMA is also studying with Tadawul about starting a second exchange, promoting the listing of small and medium-sized enterprises and family-owned businesses. (GulfBase.com) SACC BoD recommends SR143.5mn dividend for 3Q2015 – Saudi Airlines Catering Company (SACC) board of directors (BoD) has recommended the distribution of 17.5% dividend (SR1.75 per share) amounting to SR143.5mn for 3Q2015. Shareholders, who are registered in the registers of the Securities Depository Center (Tadawul) on October 29, 2014, will be eligible to receive the dividend. The dividend will be distributed on November 12, 2015 through Saudi British Bank (SABB) branches. (Tadawul) Saudi Arabia appoints new ambassador to Washington – Saudi Arabia has appointed Prince Abdullah Bin Faisal bin Turki Al Saud as its ambassador to the US. Previously, he worked as Governor of the Saudi Arabian General Investment Authority (SAGIA) from 2000-2004 and had overseen the development of Saudi Arabia’s two main industrial cities as Secretary General of the Royal Commission for Jubail and Yanbu from 1985. (Reuters) HMG appoints Jadwa Investment as financial adviser ahead of IPO – According to sources, Saudi Arabia’s Jadwa Investment has been added as joint financial adviser on the planned initial public offering of Sulaiman Al Habib Medical Group (HMG). The company is considering the sale of a 30% stake that could raise more than $2bn. The offering will probably take place early in 2016. This share sale would make HMG the second-biggest IPO in the Middle East in the past five years. (Bloomberg) Air Berlin tie-up with EA in doubt as code-share talks stall – Air Berlin’s code-sharing partnership with Etihad Airways (EA) is in doubt after Germany’s Transport Ministry said talks with the UAE on an aviation agreement have failed to produce results. The German ministry said current flight-rights accords between the two countries do not cover code-sharing and the UAE negotiators have not come up with a solution. The two airlines were granted temporary permission a year ago for code-sharing on more than 30 flights, which enables them to book seats on each other’s planes and split revenue. (Bloomberg) Nakheel awards AED353.75mn contract to DSI’s subsidiary – Nakheel has awarded an AED353.75mn contract to Gulf Technical

- 6. Page 6 of 8 Construction Company (GTCC), a subsidiary of Drake & Scull International (DSI). Under the terms of the contract, GTCC will build the Circle Mall located between Sheikh Mohammed Bin Zayed Road, Al Khail Road and Hessa Street in the Jumeirah Village Circle. The mall will comprise 235 shops, a multi-screen cinema, a health clinic, cafes, restaurants and a food court, spanning more than 432,000 square feet in total built-up area. (DFM) Du partners with Omantel for IPTV service platform – Emirates Integrated Telecommunications Company (Du) has signed a partnership agreement with Oman Telecommunications Company (Omantel) for its IPTV service platform. Through this partnership, Omantel will be able to launch IPTV service in their local market using Du’s IPTV platform, thereby reducing their time-to-market and offering their customers a world-class IPTV experience. The partnership agreement provides an opportunity for Du to expand the regional reach of its IPTV platform. (GulfBase.com) Mashreq Bank reports AED1.85bn net profit in 9M2015 – Mashreq Bank reported a net profit of AED1.85bn in 9M2015 as compared to AED1.76bn in 9M2015, representing a 5.1% YoY increase. Total operating income for 9M2015 was AED4.46bn, a YoY increase of 3% as compared to 9M2014 operating income of AED4.33bn. Net Interest Income was up by 10% YoY, on the back of a 1.9% YoY increase in loan volume, while net fee & commission income increased by 1.1% YoY. The bank’s total assets stood at AED111.38bn as of September 30, 2015 as compared to AED105.84bn at the end of December 31, 2014. Loans & advances reached AED58.39bn, while customers’ deposits stood at AED73.07bn. Capital adequacy ratio and Tier 1 capital ratio continued to be significantly higher than the regulatory limit and stood at 16.7% and 15.6%, respectively. Loan-to-deposit ratio remained robust at 79.9% at the end of September 2015. EPS strengthened to AED10.4 in 9M2015 versus AED9.9 in 9M2014. Abu Dhabi's tax-free financial zone opens for business – The Middle East's newest financial center opened for business on Wednesday as the Abu Dhabi Global Market (ADGM) said it was ready to receive applications from financial institutions for operating licenses. Aiming to diversify its economy beyond oil, Abu Dhabi is creating a financial free zone with its own administration, court system and zero tax incentives designed to lure banks and companies from around the world. (Reuters) Etisalat signs MoU with Intel to improve network – Emirates Telecommunication Corporation (Etisalat) has signed a MoU with Intel to help networks cope with the new era of Network Function Virtualization (NFV) and Software-Defined Networking (SDN). The collaboration will foster both parties to utilize Intel technology in the telecom cloud infrastructure deployment. Etisalat NFV/SDN deployment is aimed at enhancing user experience and increasing service agility and innovation. (GulfBase.com) NBF’s 9M2015 net profit surges 22.9% YoY – National Bank of Fujairah (NBF) has reported a net profit of AED453.84mn in 9M2015 as compared to AED369.25mn in 9M2014, representing an increase of 22.9% YoY. The bank recorded an operating profit of AED586.10mn in 9M2015, up 25.9% as compared to AED465.38mn in 9M2014. Net interest income grew by 21.9%, net fees & commission income by 27.9% and foreign exchange & derivatives income marked a growth of 32.2% as compared to 9M2014. The bank’s total assets stood at AED28.63bn as of September 30, 2015 as compared to AED24.59bn at the end of December 31, 2014. Loans & advances reached AED19.42bn, while customers’ deposits stood at AED20.23bn. EPS amounted to AED0.34 in 9M2015 versus AED0.28 in 9M2014. (ADX) Agility expects revenue to more than double by 2020 – Agility CEO Tarek Sultan said the company is expecting to more than double its revenue in the next five years as it focuses on the emerging markets. He said Agility expects to be anywhere from $10-$15bn in revenue, with EBITDA of $1bn by 2020. Agility’s annual revenue is currently around $5bn, with Asia accounting for $1.5bn, the Middle East and Africa $1bn and the rest coming from Europe and the Americas. Tarek said though the plunge in crude oil prices has weighed on Agility's core markets, lower fuel prices have brought significant reduction in its global fuel costs. (GulfBase.com) NBK: Consumer sector robust despite some moderation – According to National Bank of Kuwait’s (NBK) economic report, the consumer sector continued to grow more rapidly than the rest of Kuwait’s economy despite some slowdown in growth. Household’s debt growth stood at 12.5% YoY in July 2015, mostly unchanged from July 2014. Personal facilities, excluding credit for the purchase of securities, rose to KD10.2bn. Installment loans, which largely finance home acquisition, grew by 15% YoY in July, with the pace picking up slightly from a year ago. This most likely reflects the role strong demand for housing plays in driving household debt growth. Consumer spending remained relatively robust, though it has begun to moderate in 2015. While growth in the value of point-of-sale transactions (POS) in 2Q15 stood at a healthy 12% YoY, it was still the slowest in over three years. If consumers’ ATM cash withdrawals are also included, spending softened to 8%. Employment among Kuwaiti nationals has been picking up slightly over the last 12 months, providing some additional support to the sector. As per the report, the consumer sector is expected to maintain healthy growth, supported by robust hiring and healthy consumer sentiment. Employment growth among Kuwaitis, combined with strong housing demand, is likely to continue driving strong household debt growth. The weaker hiring trend among skilled expats could hurt growth slightly, though the impact is expected to be relatively small. (GulfBase.com) Kuwait Airways expects to turn profitable in 2-3 years – Kuwait Airways CEO Abdullah Al Sharhan said the airline is expecting to make a profit within the next two to three years, as it aims to cut costs and improve its operational efficiency. The airline’s losses for 2015 will be less than KD20mn as compared to KD33mn in 2014. (GulfBase.com) Bank Sohar implements new management structure – Bank Sohar has announced the implementation of a new management structure, with 12 senior management members promoted to key leadership positions. Bank Sohar’s acting CEO, Rashad Ali al Musafir said in order to efficiently support the growth, the bank has streamlined its senior management structure with an enhanced focus on strategy, business growth, operational efficiency and people development. (GulfBase.com) OPWP predicts peak power demand to double by 2020 – Oman Power & Water Procurement Company (OPWP) is predicting that peak power demand will double to 9,133 megawatts (MW) in 2020 from 4,455 MW in 2013, adding significant pressure on Oman’s already tight natural gas resources used to fire local power stations, feed industries such as petrochemicals, as well as for export in liquefied form. (GulfBase.com) NCSI: Oman total exports fell 32.6% in 1H2015 – According to latest data released by the National Centre for Statistics & Information (NCSI), Oman’s total exports for 1H2015 declined by 32.61% to OMR6.81bn from OMR10.11bn in 1H2014. The fall in export revenue was mainly on account of a plunge in oil & gas prices in international markets and re-exports. The average prices of Oman crude dipped by 43.5% to $59.8 per barrel in 9M2015 from $105.81 per barrel in 9M2014. As a result, exports of crude oil, petroleum products and liquefied natural gas plunged by 39% to OMR4.09bn in 1H2015 from OMR6.71bn in 1H2014. Of this, crude oil exports showed a 40.3% fall, while liquefied natural gas exports

- 7. Page 7 of 8 were down by 27.5%. Likewise, non-oil exports plunged by 9.8% to OMR1.663bn from OMR1.845bn. Among various product segments, plastics and rubber products plummeted by 25.6% to OMR130.6mn. Oman’s export promotion agency is targeting a 15% growth in non-oil exports. Re-exports also showed a drastic fall of 32.1% to OMR1.057bn from OMR1.557bn during 1H2015. The Public Authority for Investment Promotion & Export Development is taking several initiatives to enhance non-oil exports. These programs include visits of trade delegation, participation in international exhibitions, conducting business-to-business meetings and market studies of potential export markets. (GulfBase.com) AUB to acquire remaining 50% stake in LGG from LG Group – Ahli United Bank (AUB) has agreed to acquire the remaining 50% stake in Legal & General Gulf (LGG) from UK-based Legal & General Group (LG Group). LGG is an insurance joint venture between AUB and LG Group. Following the acquisition, Ahli United Bank will hold a 100% stake in Legal & General Gulf. (Bahrain Bourse) NBB net profit edged up to BHD43.36mn in 9M2015 – National Bank of Bahrain (NBB) recorded a net profit of BHD43.36mn in 9M2015 as compared to BHD42.16mn in 9M2014, representing an increase of 2.8%. Net Interest Income for 9M2015 was BHD43.89mn as compared to BHD45.31mn in 9M2014. The decrease was mainly on account of drop in the average yield rate on assets due to softer market interest rates. NBB took a loan loss provision of BHD7.26mn during 2015 based on an assessment of the loan portfolio and to further strengthen the overall financial position. The bank’s total assets stood at BHD2.96bn as of September 30, 2015 as compared to BHD2.89bn on September 30, 2014. Loans & advances reached BHD990.93mn, while customers’ deposits stood at BHD2.28bn. Cost to income ratio improved to 30.62% from 32.48%. EPS amounted to 41.8 fils in 9M2015 versus 40.7 fils in 9M2014. (Bahrain Bourse) Batelco reaches out to potential bidders for Jordan sale – According to sources, Bahrain Telecommunications Company (Batelco) has reached out to potential buyers including Emirates Telecommunications Group and Qatar’s Ooredoo (ORDS) regarding sale of its Jordanian mobile operator. Batelco has also approached other companies and private-equity firms about a possible sale of Umniah Mobile Company, nearly a year after appointing Citigroup as an adviser on the disposal. Umniah had more than 3mn customers in Jordan and a market share of about 32% in 2014, according to its website. Umniah sale may fetch around $500-600mn. (Bloomberg)

- 8. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns; #Market closed on October 22, 2015 ) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE In dex S&P Pan Arab S&P GCC (2.7%) (0.7%) (0.2%) (0.0%) (0.0%) (1.2%) (1.6%) (3.2%) (2.4%) (1.6%) (0.8%) 0.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,167.18 (0.8) (0.9) (1.5) MSCI World Index 1,672.87 (0.3) (0.6) (2.2) Silver/Ounce 15.70 (1.3) (2.2) 0.0 DJ Industrial 17,168.61 (0.3) (0.3) (3.7) Crude Oil (Brent)/Barrel (FM Future) 47.85 (1.8) (5.2) (16.5) S&P 500 2,018.94 (0.6) (0.7) (1.9) Crude Oil (WTI)/Barrel (FM Future) 45.20 (0.8) (4.4) (15.1) NASDAQ 100 4,840.12 (0.8) (1.0) 2.2 Natural Gas (Henry Hub)/MMBtu 2.36 (3.7) (0.9) (21.2) STOXX 600 362.64 (0.1) (0.4) (0.7) LPG Propane (Arab Gulf)/Ton 42.25 0.3 (4.5) (13.8) DAX 10,238.10 0.8 1.0 (2.6) LPG Butane (Arab Gulf)/Ton 56.50 (1.7) (6.6) (10.0) FTSE 100 6,348.42 (0.1) (0.5) (4.2) Euro 1.13 (0.1) (0.1) (6.3) CAC 40 4,695.10 0.4 (0.5) 3.0 Yen 119.93 0.1 0.4 0.1 Nikkei 18,554.28 1.8 1.0 5.9 GBP 1.54 (0.2) (0.1) (1.0) MSCI EM 859.10 (0.6) (0.7) (10.2) CHF 1.04 (0.4) (0.6) 3.6 SHANGHAI SE Composite 3,320.68 (3.1) (2.0) 0.4 AUD 0.72 (0.7) (0.7) (11.8) HANG SENG# 22,989.22 0.0 (0.3) (2.6) USD Index 95.04 0.1 0.5 5.3 BSE SENSEX 27,287.66 (0.4) (0.4) (3.8) RUB 63.01 1.4 2.8 3.7 Bovespa 47,025.87 (1.2) (2.9) (36.8) BRL 0.25 (0.9) (0.4) (32.8) RTS 856.88 (2.1) (2.8) 8.4 139.7 115.9 111.9