28 October Daily market report

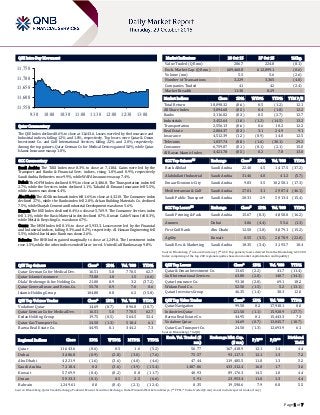

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.6% to close at 11,643.6. Losses were led by the Insurance and Industrial indices, falling 1.2% and 1.0%, respectively. Top losers were Qatar & Oman Investment Co. and Gulf International Services, falling 2.2% and 2.0%, respectively. Among the top gainers, Qatar German Co for Medical Devices gained 5.0%, while Qatar Islamic Insurance was up 1.0%. GCC Commentary Saudi Arabia: The TASI Index rose 0.3% to close at 7,118.4. Gains were led by the Transport and Banks & Financial Serv. indices, rising 1.0% and 0.9%, respectively. Saudi Arabia Refineries rose 9.9%, while WAFA Insurance was up 7.4%. Dubai: The DFM Index declined 0.9% to close at 3,486.8. The Transportation index fell 2.7%, while the Services index declined 1.1%. Takaful Al-Emarat Insurance fell 5.5%, while Aramex was down 4.4%. Abu Dhabi: The ADX benchmark index fell 1.6% to close at 4,321.9. The Consumer index declined 2.7%, while the Banks index fell 2.0%. Arkan Building Materials Co. declined 7.5%, while Sharjah Cement and Industrial Development was down 5.6%. Kuwait: The KSE Index declined 0.4% to close at 5,769.9. The Consumer Services index fell 1.1%, while the Basic Material index declined 0.7%. Kuwait Cable Vision fell 8.3%, while Metal & Recycling Co. was down 6.7%. Oman: The MSM Index fell 0.1% to close at 5,933.3. Losses were led by the Financial and Industrial indices, falling 0.3% and 0.2%, respectively. Al Hassan Engineering fell 5.5%, while Alizz Islamic Bank was down 2.6%. Bahrain: The BHB Index gained marginally to close at 1,249.6. The Investment index rose 1.5%, while the other indices ended flat or in red. United Gulf Bank was up 9.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar German Co for Medical Dev. 16.51 5.0 770.5 62.7 Qatar Islamic Insurance 73.80 1.0 1.5 (6.6) Dlala' Brokerage & Inv Holding Co. 21.00 0.9 3.2 (37.2) Qatar General Insur. and Reins. Co. 55.70 0.9 7.6 8.6 Islamic Holding Group 104.80 0.8 6.2 (15.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.69 (0.7) 896.0 (10.7) Qatar German Co for Medical Dev. 16.51 5.0 770.5 62.7 Ezdan Holding Group 19.75 (0.5) 564.5 32.4 Qatar Gas Transport Co. 24.50 (1.3) 518.4 6.1 Barwa Real Estate Co. 44.95 0.1 344.2 7.3 Market Indicators 28 Oct 15 27 Oct 15 %Chg. Value Traded (QR mn) 206.7 224.8 (8.1) Exch. Market Cap. (QR mn) 609,460.8 612,899.1 (0.6) Volume (mn) 5.5 5.6 (2.6) Number of Transactions 3,229 3,365 (4.0) Companies Traded 41 42 (2.4) Market Breadth 11:30 8:29 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,098.32 (0.6) 0.5 (1.2) 12.1 All Share Index 3,094.60 (0.5) 0.4 (1.8) 12.2 Banks 3,116.82 (0.3) 0.5 (2.7) 12.7 Industrials 3,452.64 (1.0) (1.2) (14.5) 13.2 Transportation 2,556.13 (0.6) 0.6 10.2 12.2 Real Estate 2,804.37 (0.3) 3.1 24.9 9.1 Insurance 4,512.39 (1.2) (0.9) 14.0 12.5 Telecoms 1,037.74 (0.8) (1.6) (30.1) 29.2 Consumer 6,759.87 (0.1) (0.1) (2.1) 15.0 Al Rayan Islamic Index 4,421.78 (0.5) 0.2 7.8 13.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Bank Albilad Saudi Arabia 22.40 4.5 1,417.5 (37.2) Alabdullatif Industrial Saudi Arabia 31.46 4.0 41.2 (5.7) Emaar Economic City Saudi Arabia 9.83 3.5 10,250.1 (17.3) Mediterranean & Gulf Saudi Arabia 27.01 3.1 2,907.4 (46.1) Saudi Public Transport Saudi Arabia 20.31 2.9 5,913.4 (15.4) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Printing & Pack Saudi Arabia 15.67 (8.3) 4,858.0 (16.2) Aramex Dubai 3.06 (4.4) 55.6 (1.3) First Gulf Bank Abu Dhabi 12.50 (3.8) 3,079.1 (15.2) Agility Kuwait 0.55 (3.5) 2,078.9 (22.0) Saudi Res. & Marketing Saudi Arabia 18.35 (3.4) 3,193.7 10.4 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar & Oman Investment Co. 13.65 (2.2) 41.7 (11.4) Gulf International Services 63.80 (2.0) 140.7 (34.3) Qatar Insurance Co. 93.10 (2.0) 69.1 18.2 Widam Food Co. 52.50 (1.5) 5.2 (13.1) Qatari Investors Group 46.35 (1.4) 38.3 12.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Navigation 99.50 0.2 17,918.1 0.0 Industries Qatar 121.50 (1.1) 15,928.9 (27.7) Barwa Real Estate Co. 44.95 0.1 15,443.3 7.3 Vodafone Qatar 14.69 (0.7) 13,045.7 (10.7) Qatar Gas Transport Co. 24.50 (1.3) 12,693.9 6.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,643.6 (0.6) 0.5 1.6 (5.2) 56.77 167,418.9 12.1 1.4 4.4 Dubai 3,486.8 (0.9) (2.8) (3.0) (7.6) 75.57 93,117.3 12.1 1.3 7.2 Abu Dhabi 4,321.9 (1.6) (3.6) (4.0) (4.6) 47.44 119,485.5 11.8 1.3 5.2 Saudi Arabia 7,118.4 0.3 (3.6) (3.9) (15.4) 1,487.06 433,312.4 16.0 1.7 3.6 Kuwait 5,769.9 (0.4) (0.2) 0.8 (11.7) 40.93 89,176.3 14.5 1.0 4.4 Oman 5,933.3 (0.1) 0.5 2.5 (6.6) 5.91 23,953.4 11.0 1.3 4.4 Bahrain 1,249.61 0.0 (0.4) (2.1) (12.4) 0.35 19,590.6 7.9 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,550 11,600 11,650 11,700 11,750 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.6% to close at 11,643.6. The Insurance and Industrials indices led the losses. The index fell on the back of selling pressure from GCC shareholders despite buying support from Qatari and non-Qatari shareholders. Qatar & Oman Investment Co. and Gulf International Services were the top losers, falling 2.2% and 2.0%, respectively. Among the top gainers, Qatar German Co for Medical Devices gained 5.0%, while Qatar Islamic Insurance was up 1.0%. Volume of shares traded on Wednesday fell by 2.6% to 5.5mn from 5.6mn on Tuesday. Further, as compared to the 30-day moving average of 7.6mn, volume for the day was 28.5% lower. Vodafone Qatar and Qatar German Co for Medical Devices were the most active stocks, contributing 16.4% and 14.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Aramex Dubai AED 937.5 1.8% 89.2 7.6% 74.6 7.3% Emaar Malls Group (EMG) Dubai AED 728.0 12.0% 605.0 15.9% 376.0 17.1% Dubai Investments Dubai AED 701.1 12.5% – – 246.1 30.1% Emirates Insurance Co. (EIC) Abu Dhabi AED 98.3 5.3% -2.8 NA -6.5 NA Emirates Telecommunications Group Co. (Etisalat Group) Abu Dhabi AED 12,989.3 -1.0% 2,693.9 -20.3% 2,285.2 -12.4% Global Financial Investment Holding Co. (GFIH)* Oman OMR 2.8 -12.9% – – 0.8 20.9% Al Maha Petroleum Products Marketing Co. * Oman OMR 262.4 -4.0% – – 8.0 -9.7% Source: Company data, DFM, ADX, MSM (*9M2015 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/28 US Mortgage Bankers Association MBA Mortgage Applications 23-October -3.50% – 11.80% 10/28 US Advance Goods Trade Balance September -$58.633b -$64.300b -$66.600b 10/28 France INSEE National Statistics Offi Consumer Confidence October 96.0 97.0 97.0 10/28 Germany German Federal Statistical Off Import Price Index MoM September -0.70% -0.20% -1.50% 10/28 Germany German Federal Statistical Off Import Price Index YoY September -4.00% -3.50% -3.10% 10/28 Germany GfK AG GfK Consumer Confidence November 9.4 9.4 9.6 10/28 Italy ISTAT Consumer Confidence Index October 116.9 112.2 113.0 10/28 Italy ISTAT Business Confidence October 105.9 103.9 104.4 10/28 Italy ISTAT Economic Sentiment October 107.5 – 106.1 10/28 China Deutsche Boerse AG Westpac-MNI Consumer Sentiment October 109.7 – 118.2 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 54.45% 50.57% 7,995,450.11 GCC 5.28% 14.29% (18,635,695.31) Non-Qatari 40.28% 35.13% 10,640,245.20

- 3. Page 3 of 7 Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Reported ABQK Al Ahli Bank 14-Oct-15 - Reported MRDS Mazaya Qatar 14-Oct-15 - Reported MCCS Mannai Corp. 16-Oct-15 - Reported CBQK Commercial Bank 18-Oct-15 - Reported QIGD Qatari Investors Group 19-Oct-15 - Reported DBIS Dlala Brokerage & Investment Holding Company 19-Oct-15 - Reported KCBK Al Khaliji 20-Oct-15 - Reported DOHI Doha Insurance 20-Oct-15 - Reported QEWS Qatar Electricity & Water Company 20-Oct-15 - Reported SIIS Salam International Investment 20-Oct-15 - Reported AKHI Al Khaleej Takaful Insurance 20-Oct-15 - Reported IHGS Islamic Holding Group 20-Oct-15 - Reported QIIK Qatar International Islamic Bank 20-Oct-15 - Reported GWCS Gulf Warehousing Company 21-Oct-15 - Reported QGTS Qatar Gas Transport Company (Nakilat) 21-Oct-15 - Reported QNCD Qatar National Cement Company 21-Oct-15 - Reported QCFS Qatar Cinema & Film Distribution Company 21-Oct-15 - Reported QIMD Qatar Industrial Manufacturing Company 22-Oct-15 - Reported WDAM Widam Food Company 22-Oct-15 - Reported QNNS Qatar Navigation (Milaha) 24-Oct-15 - Reported QATI Qatar Insurance Company 25-Oct-15 - Reported MARK Masraf Al Rayan 25-Oct-15 - Reported DHBK Doha Bank 25-Oct-15 - Reported QISI Qatar Islamic Insurance 25-Oct-15 - Reported QGRI Qatar General Insurance & Reinsurance 25-Oct-15 - Reported QOIS Qatar & Oman Investment 25-Oct-15 - Reported MCGS Medicare Group 25-Oct-15 - Reported GISS Gulf International Services 25-Oct-15 - Reported QGMD Qatar German Company for Medical Devices 25-Oct-15 - Reported UDCD United Development Company 26-Oct-15 - Reported QFLS Qatar Fuel Company 26-Oct-15 - Reported ERES Ezdan Real Estate Company 26-Oct-15 - Reported MERS Al Meera Consumer Goods Company 27-Oct-15 - Reported MPHC Mesaieed Petrochemical Holding Company 27-Oct-15 - Reported BRES Barwa Real Estate Company 27-Oct-15 - Reported ORDS Ooredoo 28-Oct-15 - Reported IQCD Industries Qatar 28-Oct-15 - Reported ZHCD Zad Holding Company 29-Oct-15 0 Reported AHCS Aamal Company 29-Oct-15 0 Due NLCS National Leasing (Alijarah) 29-Oct-15 0 Due VFQS Vodafone Qatar 12-Nov-15 14 Due Source: QSE

- 4. Page 4 of 7 News Qatar ORDS net income soars 50.8% QoQ in 3Q2015 – Ooredoo (ORDS) recorded a 50.8% QoQ (101.6% YoY) surge in its 3Q2015 net profit to QR755.8mn. The solid net profit gain primarily resulted from a higher revenue (+1.9% QoQ to QR8.2bn) along with a lower selling, general & administrative expenses (-7.6% QoQ to QR1.8bn) and income tax (-59.5% QoQ to QR32.9mn). EBITDA climbed 9.4% QoQ to QR3.6bn. EBITDA margin rose to 44% in 3Q2015 vs. 41% in 2Q2015. EPS rose to QR2.36 in 3Q2015 from QR1.56 in 2Q2015. ORDS Chairman, Sheikh Abdulla bin Mohammed bin Saud Al Thani said the company showed healthy growth in customer numbers adding nearly 19mn net new customers in the last 12 months. (QSE, QNBFS Research, Company Financials, Peninsula Qatar)1.25 IQCD net income slips 4.4% QoQ in 3Q2015, beats estimate – Industries Qatar’s (IQCD) net income slipped 4.4% QoQ (-25.2% YoY) in 3Q2015 to QR1.4bn. However, the bottom-line exceeded our estimate and Reuters consensus of QR1.1bn. EPS declined to QR2.32 in 3Q2015 vs. QR2.44 in 2Q2015. Results were driven by higher utilization levels (104.7% YTD 2015 vs. 98.4% YTD 2014). Prices continued to remain depressed, led by petrochemical realizations. Liquidity across the group remains strong with cash of ~QR9bn. (QNBFS Research, QSE) GWCS rights issue last trading day today – The Qatar Stock Exchange (QSE) has announced that the last trading day of Gulf Warehousing Company’s (GWCS) rights issue will be on October 29, 2015. (QSE) QIA, Brookfield ink $8.6bn JV for Manhattan project – Brookfield Property Partners LP, one of the world’s largest commercial real estate companies, said that one of its subsidiaries has signed a joint venture with Qatar Investment Authority (QIA) for the mixed-use Manhattan West development project in New York City. In the transaction, Brookfield sold a 44% interest in the development to QIA. The total value of the development upon completion and stabilization is around $8.6bn. Manhattan West is a five-building, 7mn square foot development project on the west side of Manhattan, bounded by 31st and 33rd Streets and 9th and 10th Avenues. The project consists of six different phases, including five phases in Manhattan West and Central Plaza / Retail. (Peninsula Qatar) Qatargas: Long-term fundamentals for natural gas and LNG look bright – Qatargas COO (Commercial & Shipping) Alaa Abujbara said the long-term fundamentals for natural gas and LNG looked bright amid new market dynamics and price volatility. He said the global market in the LNG sector has been adjusting in 2015 to a number of factors, including lower oil price, lack of short-term demand from the traditional Far East markets, new markets appearing in the Middle East and ample supply from existing & new producers, all of which have led to an uneven market where each region was attempting to balance local supply and demand. He said that global gas demand will grow about 2% a year over the next five years, which is slightly lower than the previous forecasts. The slower growth is attributed to lower electricity demand growth in Asia and lower oil prices leading to less infrastructure development in the Middle East. However, Qatargas believes that a strong political will for ‘clean air policies’ is expected to spur gas demand. (Gulf-Times.com) QNB Group wins 2 awards from Global Investor – QNB Group has secured two recognitions at the Global Investor/ISF Middle East Summit Awards 2015 ceremony recently held in Dubai. QNB Asset Management was the recipient of “Asset Manager of the Year in Qatar” award, while QNB Financial Services (QNBFS), a subsidiary of QNB Group specializing in the provision of brokerage services, won “The Best Broker in Qatar” award. In 2014, the Group’s Asset Management Department had won “Best Regional Asset Manager,’ award while QNBFS won “The Best Broker in Qatar” award. (Gulf- Times.com) RasGas awards two major deals for Helium 3 project – RasGas Company Limited (RasGas) for the Helium 3 Project has awarded sales & purchase agreement (SPA) and engineering, procurement & construction (EPC) agreement, to Air Products and Chiyoda AlMana, respectively. This milestone reasserts Qatar’s position as one of the world’s leading helium producers and exporters. The new Helium 3 plant, which is expected to produce up to 0.4bn standard cubic feet of liquid helium per annum, will be located in Qatar’s Ras Laffan Industrial City and is expected to become operational in early 2018. In addition to being awarded the SPA contract for the long-term helium supply, Air Products was also awarded the technology license to supply the helium licensor package equipment for the new Helium 3 plant. (Peninsula Qatar) Kahramaa: Renewable energy technologies gaining ground globally – Qatar General Electricity and Water Corporation (Kahramaa) Manager (conservation & energy) Abdulaziz Al Hammadi said renewable energy technologies are rapidly gaining ground across the globe on the back of global subsidies that amounted to an estimated $120bn. With rapid cost reductions and continued support, renewable energy will account for around half of the increase in total electricity generation by 2040. (Gulfbase.com) International Fed puts December rate hike firmly on agenda – The US Federal Reserve kept interest rates unchanged on October 29, 2015 and in a direct reference to its next policy meeting put a December 2015 rate hike firmly in play. Investors had expected the Fed to remain pat on rates, but the overt reference to December came as a surprise. The central bank also downplayed the recent global financial market turmoil and said the US labor market was still healing despite a slower pace of job growth. The Fed said in determining whether it will be appropriate to raise the target range at its next meeting, the committee will assess progress - both realized and expected - toward its objectives of maximum employment and 2% inflation. (Reuters) CBO: US budget deal cuts 10-year deficits by $80bn – The Congressional Budget Office (CBO) said the US budget deal under consideration by the House would reduce deficits by nearly $80bn over 10 years due to increases in revenues and lower expenditures on healthcare, pension guarantees and Social Security. According to the CBO analysis, the legislation, which would ease automatic spending caps to increase discretionary spending by $80bn over the next two fiscal years, would produce larger savings in later years. The budget plan would show a net deficit increase of $4.6bn in FY2016 and $53mn in FY2017. However, this swings to annual deficit reductions of $4.9bn to $9bn between FY2018 and FY2025. The deal would add $32.3bn in revenues over the 10-year period, chiefly from tax compliance, healthcare and pension provisions, while reducing estimated outlays by $47.6bn. (Reuters) Top ECB policy makers reinforce case for fresh stimulus – The European Central Bank’s (ECB) three key policy makers said the bank will keep printing money until price growth picks up and has a duty to use all instruments in its toolbox, including a deposit rate cut, to achieve its inflation target. Their messages reinforced expectations for fresh policy action from the ECB after President Mario Draghi said the bank was considering new stimulus measures and would decide on the matter when it gets updated inflation forecasts from its staff in December 2015. ECB Executive Board member Benoit Coeure said the bank might need to reduce its deposit rate if it sees a risk of price growth rebounding more

- 5. Page 5 of 7 slowly than previously expected. The ECB's deposit rate is currently -0.20%, effectively making banks pay to park funds overnight at the central bank. Vice President Vitor Constancio said the ECB will maintain low interest rates and keep expanding its balance sheet via asset-purchases until inflation significantly picks up. (Reuters) Japan output rebounded in September, eased pressure on BoJ – Japanese factory output rose 1.0% in September 2015 after two straight months of declines and manufacturers expect further gains in October - suggesting the economy is emerging from the doldrums as the effects of China's slowdown begin to abate. The turnaround reduces pressure on the Bank of Japan (BoJ) to expand its already massive stimulus program as early as October 30, 2015, although it is expected to slash its rosy economic and price growth forecasts. The strong result from the Ministry of Economy, Trade and Industry confounded the median market forecast for a 0.5% drop and followed a 1.2% slide in August. Manufacturers' surveyed by the ministry expect the output to rise 4.1% in October and slip 0.3% in November. (Reuters) Regional OIC & Comec: Islamic finance assets may reach $3.5tn by 2018 – According to a report by the Organization of Islamic Cooperation (OIC) and its Standing Committee for Economic & Commercial Cooperation (Comcec), the global asset value of Islamic finance, dominated by the Islamic banking sector and the global Sukuk market, would expand further at an average annual growth rate of around 17% with total assets projected to come close to $3.5tn by 2018. The report noted that Islamic finance assets are spread over most of the OIC’s 57 member states, but mainly concentrated in the Middle East and Southeast Asia. In 1H2014, shares of global Islamic banking assets were divided as follows among the top five: Iran (40.21%), Saudi Arabia (18.57%), Malaysia (9.56%), UAE (7.36%) and Kuwait (5.96%). Qatar follows sixth with an asset share of 4.47%. The report also points out that there has been a dramatic growth in the Sukuk market in recent years. In each of the last three years up to 2014, annual issuances exceeded $100bn and almost tripled from $45bn in 2011 to $118.8bn in 2014. As per the report, even though the industry has enjoyed impressive growth in the past, its sustainability and future growth will largely depend on how successful it is in addressing the challenges at both the macro and micro levels. (GulfBase.com) SACO signs MoU to acquire Medscan Terminal – Saudi Company for Hardware (SACO) has signed an MoU to acquire Medscan Terminal Company from its owners. Medscan Terminal is a Saudi limited liability company specializing in transporting goods, logistics, and warehousing located in Eastern Area. The validity of the MoU is six months and is extendable on parties’ agreement. Ernst & Young is acting as the financial advisor to SACO for the transaction. (Tadawul) ANB Insurance obtains company renewal qualification letter – MetLife AIG ANB Cooperative Insurance Company has obtained the company renewal qualification letter from the Council of Cooperative Health Insurance for one year starting from October 26, 2015. (Tadawul) NCB accepts medical insurance offer from Tawuniya – The National Commercial Bank (NCB) has accepted a medical insurance proposal submitted by Tawuniya Insurance Company. Tawuniya will provide health insurance services to the NCB staff at a price of SR133.34mn over 12 months commencing on January 1, 2016. NCB board member Abdulaziz Al-Zaid has a direct interest in this insurance policy, being a board member at Tawuniya. However, the NCB assets that the referred company has not been given any preferential benefits. The medical insurance contract shall be presented for approval in the next NCB general assembly, which will be announced later. (Tadawul) Coface: UAE likely to post strong growth of 3.1% – According to Coface, the UAE economy would post a strong growth of 3.1% in 2015, very close to the GCC GDP growth forecast of 3.2%. Saudi Arabia is expected to grow by 2.5%. Coface Chief Economist Julien Marcilly said that the UAE’s economy is one of the most diversified among the GCC countries. Hydrocarbon revenues account only for 25% of GDP and 20% of the total export revenues, and over 60% of the country’s budget revenues still depend to edge up on the back of non-oil sector development. As per the report, although the forecast for 2015 rates can still be considered high compared to many emerging and advanced economies, they remain below the region’s average growth rate of 5.8% between 2000 and 2011. The main reason for this slowdown is the decline in oil prices. Rising government spending, coupled with falling oil prices, may transform the region’s budget surplus of around 10% in 2013 into a significant deficit in 2015. (GulfBase.com) World Bank: UAE tops MENA region in ease of doing business ranking – According to the World Bank’s annual report ‘Doing Business 2016’, the UAE has ranked top in the Middle East and North Africa (Mena) region, while it is ranked 31st globally compared to a ranking of 22nd position in 2014. The report finds that 11 of the region’s 20 economies implemented a total of 21 reforms facilitating the ease of doing business. The UAE was the only economy in the region that reformed in the area of enforcing contracts. As a result, commercial disputes in the UAE are now resolved in 495 days, which is less than the average of 538 days in the high-income Organization for Economic Cooperation and Development (OECD) economies. (GulfBase.com) DIB’s 9M2015 net profit surges 36% YoY – Dubai Islamic Bank’s (DIB) reported a net profit of AED2.8bn in 9M2015, up 36% YoY as compared to AED2.06bn in 9M2014. Total income increased 20% YoY to AED5.53bn in 9M2015 as compared to AED4.61bn in 9M2014. Impairment losses declined to AED341mn in 9M2015 as compared with AED538mn for the same period of 2014. DIB’s total assets stood at AED147.5bn as of September 30, 2015 as compared to AED123.9bn at the end of December 31, 2014, representing an increase of 19% YoY. Customers’ deposits reached AED109bn as compared to AED92 billion at 2014-end, up by 18% YTD. Cost-to- income ratio improved to 34.1% from 34.8% for the same period of 2014. Capital adequacy ratio was at 16.5% versus 14.9% at end of 2014. EPS amounted to AED0.59 in 9M2015 versus AED0.44 in 9M2014. (DFM) Union Properties to form JV with Naif Alrajhi Investment – Union Properties has confirmed entering into a joint venture (JV) with Naif Alrajhi Investment Company to take on large real estate projects in Saudi Arabia, potentially opening up a new revenue stream for the company. Both the entities have reached an MoU to set up an operating company to handle future projects, with Riyadh being the key operational market. Naif Alrajhi Investment comes with a substantial land bank that the JV can develop. These will include options for both mixed-use communities, much like the ones that UP has delivered in Dubai such as the Green Community and Uptown Mirdiff, as well as high-rises. (Zawya) NBAD reports AED4.2bn net profit in 9M2015 – National Bank of Abu Dhabi (NBAD) reported a net profit of AED4.196bn in 9M2015 as compared to AED4.207bn in 9M2014, representing a decrease of 0.3%. The bank’s total revenue grew 4.5% YoY to AED8bn. NBAD’s total assets had stood at AED404.66bn at the end of September 30, 2015 as compared to AED376.1bn on December 31, 2014. Loans & advances had reached AED212.05bn, while customers’ account and other deposits had stood at AED235bn. EPS had remained flat at AED0.78 in 9M2015. (ADX)

- 6. Page 6 of 7 Bank of Sharjah reports 10% increase in 9M2015 net profit – Bank of Sharjah reported a net profit of AED297.67mn in 9M2015, up 10% as compared to AED272.27mn in 9M2014. Operating income reached to AED651.04mn in 9M2015 as compared to AED499.27mn in 9M2014. The bank’s total assets had stood at AED26.56bn at the end of September 30, 2015 as compared to AED25.05bn on December 31, 2014. Net loans & advances had reached AED15.76bn, while customers’ deposits had stood at AED18.15bn. EPS had amounted to AED0.14 in 9M2015 versus AED0.13 in 9M2014. Omani debut sovereign Sukuk issue oversubscribed 1.7 times – The Omani Ministry of Finance (MoF) has announced that its debut sovereign Sukuk issuance raised a total of OMR336mn in firm orders from a wide base of investors comprising both conventional and Islamic institutions. The five-year benchmark sovereign issuance was oversubscribed close to 1.7 times. Against this strong committed order book, the ministry has finally accepted bids up to OMR250mn at a cut-off yield of 3.5% per annum to meet one of its objectives of offering an investment avenue to Islamic institutions in Oman. The approval of the Capital Market Authority (CMA) has also been received for the final allocation. (GulfBase.com) AUB 9M2015 net profit surges 11.4% YoY – Ahli United Bank (AUB) reported a net profit of $419.2mn in 9M2015 as compared to $376.3mn in 9M2014, representing an increase of 11.4% YoY. Operating income reached $835.32mn in 9M2015 as compared to $778.6mn in 9M2014. Net interest income grew by 4.5% from $578.67mn to $604.8mn, while fee income grew by 6.0% from $111.47mn to $118.16mn. AUB’s total assets had stood at $33.8bn as of September 2015 as compared to $33.44bn on December 31, 2014. Loans & advances had reached at $19.01bn, while customers’ deposits $23.39bn. EPS had amounted to $6.5 in 9M2015 versus $6.0 in 9M2014. (Bahrain Bourse) BisB EGM approves capital decrease – Bahrain Islamic Bank’s (BisB) extra ordinary shareholders’ meeting (EGM) has agreed on decreasing both issued and paid-up capital, aiming to write off the accumulated losses of BHD27.4mn as of June 30, 2015. The EGM also approved the issuance of 200mn ordinary shares with a nominal value of BHD0.1 per share. Moreover, the EGM exempted any existing shareholder, whose ownership may grow up to 30% or more from making mandatory offer as prescribed in procedures by the Bahraini central bank. (Bahrain Bourse)

- 7. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Inde x S&P Pa n Ara b S&P GCC 0.3% (0.6%) (0.4%) 0.0% (0.1%) (1.6%) (0.9%) (2.4%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,156.10 (0.9) (0.7) (2.4) MSCI World Index 1,714.13 1.1 0.4 0.3 Silver/Ounce 15.94 0.4 0.7 1.5 DJ Industrial 17,779.52 1.1 0.8 (0.2) Crude Oil (Brent)/Barrel (FM Future) 49.05 4.8 2.2 (14.4) S&P 500 2,090.35 1.2 0.7 1.5 Crude Oil (WTI)/Barrel (FM Future) 45.94 6.3 3.0 (13.8) NASDAQ 100 5,095.69 1.3 1.3 7.6 Natural Gas (Henry Hub)/MMBtu 2.10 1.5 (7.4) (29.9) STOXX 600 375.83 1.3 0.0 0.3 LPG Propane (Arab Gulf)/Ton 41.13 0.0 (3.5) (16.1) DAX 10,831.96 1.6 0.8 0.5 LPG Butane (Arab Gulf)/Ton 57.75 0.0 (2.1) (11.8) FTSE 100 6,437.80 1.3 (0.2) (3.6) Euro 1.09 (1.2) (0.9) (9.7) CAC 40 4,890.58 1.1 (0.2) 4.7 Yen 121.09 0.5 (0.3) 1.1 Nikkei 18,903.02 0.6 1.1 7.4 GBP 1.53 (0.2) (0.3) (2.0) MSCI EM 860.30 (0.3) (1.0) (10.0) CHF 1.01 (0.7) (1.6) 0.0 SHANGHAI SE Composite 3,375.20 (1.8) (1.3) 1.9 AUD 0.71 (1.1) (1.4) (13.0) HANG SENG 22,956.57 (0.8) (0.8) (2.7) USD Index 97.78 0.9 0.7 8.3 BSE SENSEX 27,039.76 (0.5) (1.3) (4.2) RUB 63.92 (1.9) 2.5 5.2 Bovespa 46,740.85 0.4 (0.9) (36.0) BRL 0.26 (0.5) (0.7) (32.2) RTS 854.74 1.8 (2.1) 8.1 139.4 111.7 108.1