29 December Daily market report

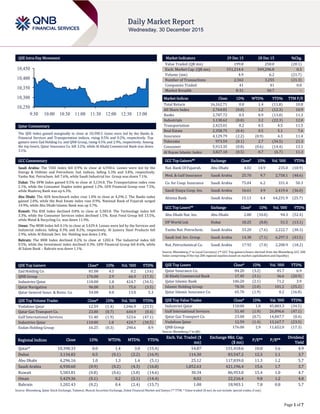

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index gained marginally to close at 10,398.3. Gains were led by the Banks & Financial Services and Transportation indices, rising 0.5% and 0.2%, respectively. Top gainers were Zad Holding Co. and QNB Group, rising 4.5% and 2.9%, respectively. Among the top losers, Qatar Insurance Co. fell 3.2%, while Al Khalij Commercial Bank was down 3.1%. GCC Commentary Saudi Arabia: The TASI Index fell 0.9% to close at 6,930.6. Losses were led by the Energy & Utilities and Petrochem. Ind. indices, falling 5.3% and 3.8%, respectively. Yanbu Nat. Petrochem. fell 7.6%, while Saudi Industrial Inv. Group was down 7.1%. Dubai: The DFM Index gained 0.5% to close at 3,134.8. The Transportation index rose 2.1%, while the Consumer Staples index gained 1.2%. GFH Financial Group rose 7.5%, while Mashreq Bank was up 6.3%. Abu Dhabi: The ADX benchmark index rose 1.0% to close at 4,296.2. The Banks index gained 2.0%, while the Real Estate index rose 0.9%. National Bank of Fujairah surged 14.9%, while Abu Dhabi Islamic Bank was up 3.7%. Kuwait: The KSE Index declined 0.8% to close at 5,583.8. The Technology index fell 3.3%, while the Consumer Services index declined 1.5%. Kout Food Group fell 13.5%, while Metal & Recycling Co. was down 11.9%. Oman: The MSM Index fell 0.1% to close at 5,429.4. Losses were led by the Services and Industrial indices, falling 0.3% and 0.2%, respectively. Al Jazeera Steel Products fell 2.9%, while Al Batinah Dev. Inv. Holding was down 2.4%. Bahrain: The BHB Index declined 0.2% to close at 1202.4. The Industrial index fell 0.5%, while the Investment index declined 0.3%. GFH Financial Group fell 8.6%, while Al Salam Bank – Bahrain was down 1.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Zad Holding Co. 81.00 4.5 0.2 (3.6) QNB Group 176.00 2.9 66.9 (17.3) Industries Qatar 110.00 1.8 424.7 (34.5) Qatar Navigation 96.00 1.5 75.6 (3.5) Qatar General Insur. & Reins. Co. 54.00 0.8 13.0 5.3 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 12.59 (1.4) 1,046.9 (23.5) Qatar Gas Transport Co. 23.00 (0.7) 644.9 (0.4) Gulf International Services 51.40 (1.9) 523.6 (47.1) Industries Qatar 110.00 1.8 424.7 (34.5) Ezdan Holding Group 16.25 (0.3) 290.6 8.9 Market Indicators 29 Dec 15 28 Dec 15 %Chg. Value Traded (QR mn) 199.8 250.0 (20.1) Exch. Market Cap. (QR mn) 551,214.4 549,296.8 0.3 Volume (mn) 4.9 6.2 (21.7) Number of Transactions 2,562 3,255 (21.3) Companies Traded 41 41 0.0 Market Breadth 8:31 30:7 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,162.71 0.0 1.4 (11.8) 10.8 All Share Index 2,764.81 (0.0) 1.2 (12.3) 10.9 Banks 2,787.72 0.5 0.9 (13.0) 11.3 Industrials 3,138.62 (0.0) 3.2 (22.3) 12.0 Transportation 2,423.01 0.2 0.5 4.5 11.5 Real Estate 2,358.75 (0.4) 0.5 5.1 7.6 Insurance 4,129.79 (2.2) (0.9) 4.3 11.4 Telecoms 973.59 (0.1) 2.7 (34.5) 21.3 Consumer 5,913.35 (0.8) (0.6) (14.4) 13.1 Al Rayan Islamic Index 3,827.10 (0.5) 0.7 (6.7) 11.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Bank Of Fujairah Abu Dhabi 4.02 14.9 235.0 (10.9) Med. & Gulf Insurance Saudi Arabia 25.70 9.7 2,758.1 (48.6) Co. for Coop. Insurance Saudi Arabia 75.04 6.2 331.4 50.3 Saudi Enaya Coop. Ins. Saudi Arabia 16.61 4.9 2,419.4 (36.0) Alinma Bank Saudi Arabia 15.13 4.4 64,231.9 (25.7) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Ins. Abu Dhabi 2.88 (10.0) 94.3 (52.4) DP World Ltd. Dubai 18.25 (8.8) 51.5 (13.1) Yanbu Nat. Petrochem. Saudi Arabia 33.20 (7.6) 2,222.7 (30.3) Saudi Ind. Inv. Group Saudi Arabia 14.38 (7.1) 6,297.3 (43.5) Nat. Petrochemical Co. Saudi Arabia 17.92 (7.0) 2,200.9 (18.2) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Insurance Co. 84.20 (3.2) 45.7 6.9 Al Khalij Commercial Bank 17.45 (3.1) 36.6 (20.9) Qatar Islamic Bank 106.20 (2.1) 71.2 3.9 Islamic Holding Group 78.30 (2.0) 101.2 (25.2) Qatar Islamic Insurance Co. 65.70 (1.9) 0.2 (16.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 110.00 1.8 45,883.3 (34.5) Gulf International Services 51.40 (1.9) 26,896.6 (47.1) Qatar Gas Transport Co. 23.00 (0.7) 14,847.7 (0.4) Vodafone Qatar 12.59 (1.4) 13,167.7 (23.5) QNB Group 176.00 2.9 11,652.0 (17.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,398.33 0.0 1.4 3.0 (15.4) 54.87 151,418.6 10.8 1.6 4.9 Dubai 3,134.82 0.5 (0.1) (2.2) (16.9) 114.30 83,547.2 12.3 1.1 3.7 Abu Dhabi 4,296.16 1.0 1.3 1.4 (5.1) 25.12 117,839.0 11.3 1.2 5.7 Saudi Arabia 6,930.60 (0.9) (0.2) (4.3) (16.8) 1,852.63 421,196.4 15.6 1.7 3.7 Kuwait 5,583.81 (0.8) (0.6) (3.8) (14.6) 30.34 86,953.0 15.4 1.0 4.7 Oman 5,429.36 (0.1) 0.2 (2.1) (14.4) 8.02 22,216.4 9.8 1.2 4.8 Bahrain 1,202.43 (0.2) 0.4 (2.4) (15.7) 1.08 18,903.1 7.8 0.8 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,250 10,300 10,350 10,400 10,450 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index gained marginally to close at 10,398.3. The Banks & Financial Services and Transportation indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Zad Holding Co. and QNB Group were the top gainers, rising 4.5% and 2.9%, respectively. Among the top losers, Qatar Insurance Co. fell 3.2%, while Al Khalij Commercial Bank was down 3.1%. Volume of shares traded on Tuesday fell by 21.7% to 4.9mn from 6.2mn on Monday. Further, as compared to the 30-day moving average of 7.4mn, volume for the day was 34.3% lower. Vodafone Qatar and Qatar Gas Transport Co. were the most active stocks, contributing 21.6% and 13.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 12/29 US Census Bureau Advance Goods Trade Balance November -$60.500b -$60.720b -$61.276b 12/29 US S&P/Case-Shiller S&P/CS 20 City MoM SA October 0.84% 0.60% 0.50% 12/29 US S&P/Case-Shiller S&P/CS Composite-20 YoY October 5.54% 5.60% 5.36% 12/29 US S&P/Case-Shiller S&P/CaseShiller 20-City Index NSA October 182.8 183.3 182.7 12/29 US S&P/Case-Shiller S&P/Case-Shiller US HPI MoM October 0.88% – 0.77% 12/29 US S&P/Case-Shiller S&P/Case-Shiller US HPI YoY October 5.17% – 4.85% 12/29 US S&P/Case-Shiller S&P/Case-Shiller US HPI NSA October 175.7 – 175.5 12/29 US Conference Board Consumer Confidence Index December 96.5 93.5 92.6 12/29 Spain INE Retail Sales YoY November 4.20% – 5.00% 12/29 Spain INE Retail Sales SA YoY November 3.30% 4.60% 6.00% 12/29 Italy ISTAT Consumer Confidence Index December 117.6 117.0 118.4 12/29 Italy ISTAT Business Confidence December 104.1 104.4 104.4 12/29 Italy ISTAT Economic Sentiment December 105.8 – 107.1 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individual 33.50% 39.49% (11,976,819.40) Qatari Institutions 28.41% 23.36% 10,096,186.29 Qatar 61.91% 62.85% (1,880,633.11) GCC Individuals 0.99% 5.96% (9,935,906.96) GCC Institutions 3.76% 5.30% (3,086,731.76) GCC 4.75% 11.26% (13,022,638.72) Non-Qatari Individuals 13.28% 16.02% (5,492,430.56) Non-Qatari Institutions 20.07% 9.86% 20,395,702.39 Non-Qatari 33.35% 25.88% 14,903,271.83

- 3. Page 3 of 7 News Qatar ABQK BoD meeting on January 14 – Ahli Bank’s (ABQK) board of directors (BoD) will meet on January 14, 2016 to approve the budget & discuss the proposal of profit distribution for the financial year ended 2015. (QSE) QSE suspends trading of WDAM shares on December 30 – The Qatar Stock Exchange (QSE) has announced the trading suspension of Widam Food Company’s (WDAM) shares on December 30, 2015 due to its EGM being held on that day. (QSE) MDPS: Qatar’s population grows 8.5% YoY in November – According to figures released by the Ministry of Development Planning & Statistics (MDPS), Qatar’s population registered an impressive annual increase of 8.5% in November 2015 breaching the 2.46mn mark. MDPS, in its 23rd Monthly Bulletin issued for November 2015, said the population in November 2014 was a little over 2.27mn. In the 11 months, from January to November- end this year, 22,927 births were registered in the country which worked out to 8.7 people added to every 1,000 people of the country’s population. The number of people who died in the 11 months of 2015 was 2,102. (Peninsula Qatar) OPEC: Qatar 2016 oil demand to firm up on transportation, industrial demand – According to a recent OPEC report, oil demand is expected to grow firmly in Qatar in 2016 with transportation fuels, especially gasoline and industrial fuels such as diesel & residual fuel oil playing a "significant part" in the overall oil demand growth. Oil demand growth in the region is projected to reach 0.19mn bpd in 2015, while in 2016 it is anticipated to record around 0.21mn barrels per day of growth. The ‘Monthly oil market report’ revealed that oil demand grew strongly in Qatar and the UAE in 2015. In both countries, transportation fuels – notably gasoline – dominated the increases. Elsewhere in the Middle East, solid demand was witnessed in October with oil demand growth in Saudi Arabia hitting the highest level in 2015. Oil demand in Saudi Arabia continued its positive momentum, growing by around 0.34mn bpd, or 15% YoY. All products recorded positive gains during the month, without exception. Direct crude burning recorded the highest gains in both percentage and volumetric basis. Transportation, industrial fuels and direct crude burning were the contributing elements in rising Saudi Arabian demand in 2015, which continues to be the pattern of consumption during October 2015. Demand also grew solidly in Kuwait, particularly lifting road transportation & industrial fuels, gasoline & gas diesel oil. Iraqi oil demand continued its positive growth trend which started in June, with most gains being observed in fuel oil and gasoline. However, the report said the Middle East oil demand growth may be challenged in 2016 by some downside risks, which relate to the continuing geopolitical turbulence in some countries. (Gulf-Times.com) Qatari banks’ assets touch QR1.11tn in November – Qatar banks’ assets (and liabilities) increased QR27.9bn, or 2.6%, to QR1.11tn in November 2015, as compared to QR1,077.9bn recorded in October 2015. The government and public sector deposits touched QR220.7bn, a decline of QR11.4bn, in November. Qatar’s total domestic public debt increased by QR9.1bn to QR356bn. The market liquidity analysis revealed that the month witnessed high credit for the domestic private sector, reflecting an increase by QR5.5bn to QR408.6bn. Local private sector deposits rose by QR2.5bn to QR337.1bn. In November, the banks’ combined deposits at QCB stabilized at QR33.7bn. A breakdown of the figure showed that the banks’ mandatory reserve stood at QR30.1bn at the rate of 4.75% of the total customer deposits at each bank as set by the QCB. Government and public sector deposits increased around QR3bn to reach the QR220.7bn level. The breakdown showed QR66.3bn from government, QR120bn from government institutions and QR34.4bn for the quasi-governmental institutions. The government and public sector total loans increased to around QR6.8bn to reach QR235.7bn. (Peninsula Qatar) EY: Islamic banking assets up 16% in 2015; Qatar among key markets – According to a report released by Ernst & Young (EY), Islamic retail and commercial banking assets continued to grow at 16% in 2015, at the same rate as they did in 2014. The recently issued World Islamic Banking Competitiveness Report 2016 revealed that Islamic banking assets in six main markets are set to exceed $801bn in 2015. Those markets are Qatar, Indonesia, Saudi Arabia, Malaysia, the UAE and Turkey, where around 80% of international banking assets are being held. Altogether, the global Islamic banking assets are expected to reach or cross $1tn in 2015 and by 2020 to reach a profit pool of approximately $30.3bn. Gulf Cooperation Council (GCC) countries added $91bn in Shari’ah- compliant assets in 2015, representing a growth of 18% YoY. If Bahrain, Kuwait and Pakistan are added to the core markets, altogether they account for 93% of the global industry assets in Islamic banking, which are estimated to exceed $920bn in 2015. The study also forecast the development of the industry up to 2020. By that year, the total Islamic banking assets of commercial banks in the six core markets are expected to reach $1.6tn and their overall profit pool is expected to reach $27.8bn. In terms of Islamic banking market share, Saudi Arabia, Kuwait, Bahrain and Qatar are expected to be the major players by 2020, with the GCC providing additional acceleration for future growth of the industry. Turkey is expected to recover from the current temporary setback due to the political volatility. Looking specifically at Qatar, the report says that while the national market share of Islamic banking plateaued in the recent past, this changed during 2014 when it achieved a noticeable increase and became the third largest contributor toward global growth in Islamic banking. Shari’ah-compliant assets of Qatar’s banks grew three times higher than conventional banking. However, the supply-side initiatives or the launch of new Islamic banks would be needed if Islamic banking in Qatar wishes to go mainstream. In total, Qatar had a national market share of Islamic banking assets of 20.8%, or $72bn in 2014, and a global share of 8.1%. (Gulf-Times.com) Qatar private sector may feel heat if QCB responds to Fed liftoff – According to experts, Qatar which has not yet responded to the liftoff of interest rate by the US Federal Reserve, can afford to wait in the short term, but will have to eventually reciprocate, which may slowdown the private sector that is increasingly becoming a growth engine for the country. A banking source said given that consumer price index inflation is benign and strong growth has to emerge, especially from the non-hydrocarbon sector, conventional wisdom suggests continuing with an expansionary monetary policy over the short-term. Highlighting that the 2016 budget has itself spelt out the need for raising finance from domestic markets to plug the more than 26% decline in expected revenues, he said an interest hike in such a scenario would put additional burden on the exchequer. Saudi Arabia, the UAE, Kuwait and Bahrain had increased interest rates, following the Fed’s decision to hike the rate by 25 basis points, after keeping it near zero for the last seven years. Qatar Central Bank (QCB) Governor HE Sheikh Abdulla bin Saoud al-Thani had said in October that Qatar might not need to increase the interest rates based on the liquidity and looking at the domestic environment. QCB’s policy rates such as QMR deposit rate stands at 0.75%, QMR lending rate at 4.5% and repo rate at 4.5%. The deposit and lending rates are announced by the QCB on overnight deposit and loan deals between it and local banks through the Qatar Money Market Rate Standing Facility (QMR), respectively. The Federal Open Market Committee projections

- 4. Page 4 of 7 suggest that the rate is expected to rise to about 1.4% by 2016- end, suggesting four more increases over the coming 12 months. Qatar banking sources said in the long term, it will eventually prompt the QCB, whose monetary policies are linked to riyal’s fixed peg with the dollar, to reciprocate. The Ministry of Development Planning & Statistics (MDPS), in its Qatar Economic Outlook 2015-17 Update, had said domestic interest rates in Qatar are likely to rise during 2015-17 on rising funding needs of government and commercial banks and “accentuated” by the Fed liftoff. (Gulf-Times.com) Waseela opens new Qatar office to tap priority market – Integrated ICT system and service solutions provider Waseela has launched its Qatar office as its continues its regional expansion. Through its new branch in Doha’s Gate Building Tower 2, Waseela taps into growing demand for integrated ICT systems in Qatar as the country’s construction boom gathers momentum. Waseela’s Qatar office offers clients in the country a full spectrum of solutions and services provided by its subsidiary companies, with smart solutions for mega construction projects a key area of focus. The firm is also undertaking specialized projects in the country such as deploying broadband wireless networks for public security surveillance, creating public safety wireless systems in underground tunnels, installing 3G and 4G systems, and delivering turnkey integrated solutions combining ICT with Extremely Low Voltage (ELV) and Building Management Systems (BMS). (AmeInfo.com) International US home prices rise slightly in October 2015 – Annualized US single-family home prices rose in October 2015 at a slightly faster pace than in September and above market expectations. The S&P/Case Shiller composite index of 20 metropolitan areas gained 5.5% in October on a YoY basis compared with 5.4% in the year to September 2015. It was just above the 5.4% estimate from a Reuters poll of economists. S&P Dow Jones Indices Managing Director and Chairman of the index committee, David M. Blitzer said the generally good economic conditions continue to support gains in home prices. Among the positive factors are consumers’ expectations of low inflation and further economic growth as well as recent increases in residential construction including single family housing starts. Inventories of existing homes have averaged around a five month supply for last year, a level that suggests a fairly tight market with limited supplies. (Reuters) Barclays in $13.75mn US settlement over mutual funds – Barclays Plc will pay more than $13.75mn to settle US regulatory charges that it let retail brokerage customers make unsuitable mutual fund transactions, including more than 6,100 fund switches, over a five- year period. The Financial Industry Regulatory Authority(FINRA) said the London-based bank's Barclays Capital Inc unit will pay more than $10mn in restitution, including interest, to affected customers, and was fined $3.75mn. Barclays did not admit or deny wrongdoing in agreeing to the settlement, which includes a censure. FINRA said that from January 2010 to June 2015, Barclays' inadequate supervisory procedures failed to stop many customers from swapping one mutual fund for another when the benefits of switching might be undermined by the transaction costs. This caused $8.63mn of harm to customers, most of whom were not warned of such costs. (Reuters) PBOC to launch new macro-prudential regime to curb risks – Chinese central bank, People's Bank of China (PBOC), said it will introduce a new system to assess macro-prudential risks in the financial system in 2016 as the country's banking assets become more diversified. The Macro-Prudential Assessment (MPA) system will replace the current regime of "dynamic adjustments in differentiated reserve requirements and desirable loan management" that has been in place since 2011. Under the existing assessment system, the PBOC uses window guidance and applies different reserve requirement ratios to different banks to get lenders to issue loans at a pace that is appropriate to their respective sizes. The new assessment system will cover banks' capital adequacy and leverage ratios, assets and liabilities, liquidity and foreign debt risks. It will also monitor banks' pricing of interest rates to prevent them from engaging in "vicious competition". Meanwhile, preliminary data from State Administration of Foreign Exchange (SAFE) showed a $63.4bn current account surplus and a $63.4bn deficit on the capital and financial account in 3Q2015. (Reuters) Ukraine central bank expects next tranche of IMF funds in January – Ukraine central bank Governor Valeriya Gontareva said the country expects at least one tranche of funding, its third, from the International Monetary Fund (IMF) in January as Kiev has fulfilled all preconditions. Ukraine had expected the third tranche, worth $1.7bn, by the end of 2015. Gontareva said it might now receive the fourth tranche, also of $1.7bn, at the same time as the third. Meanwhile, she said the country’s inflation this year had hit 44%, up from 24.9% in 2014 and foreign exchange reserves had remained roughly stable at $13.3bn from $13.1bn as of December 01, 2015. The Parliament approved a budget for 2016, a major condition to secure the next tranche of financial aid under a $17.5bn IMF loan package as the country teeters on the edge of bankruptcy. The Parliament backed the government's proposal to adopt the budget with the deficit at 3.7% of GDP, the figure agreed with the IMF. Ukraine has already received about $11bn in 2015 from the IMF and other international lenders to shore up its finances, which were crippled by separatist conflict and years of economic mismanagement and corruption. (Reuters) Regional SASCO BoD recommends 5% cash dividend for 2015 – Saudi Automotive Services Company’s (SASCO) board of directors (BoD) has recommended the distribution of 5% (SR0.5 per share) cash dividend for the fiscal year 2015, amounting to SR27mn. The eligibility of dividend shall be for shareholders registered in the registers of the Securities Depository Center (Tadawul) on the general assembly meeting day, which will be announced later. Meanwhile, SASCO said that financial impact of increment in the electricity, fuel and water prices in the Kingdom will reflect on its financial statements starting from 1Q2016, while the actual value of this impact cannot be determined currently. (Tadawul) SCC updates on second sanitary ware plant project – Saudi Ceramic Company (SCC) announced that it had completed the majority of stages of the second sanitary ware plant. The remaining part of the project is related to final installation of certain machinery to start trial production. SCC expects to complete installation of the remaining machinery of the project and start the trial production by 1Q2016-end. Meanwhile, SCC said that due to the recent increase in power supply prices, there will be a material impact on its operating costs during 2016 and the company will make efforts to deal with these changes and reduce their impact on its financial results. (Tadawul) SFG BoD proposes 4.5% dividend for 2H2015 – Samba Financial Group’s (SFG) board of directors (BoD) has proposed the distribution of 4.5% (45 halalas per share) dividend for 2H2015 amounting to SR1,134mn. The eligibility of dividend shall be for the shareholders registered in the registers of the Securities Depository Center (Tadawul) as at the end of trading hours on the general assembly meeting day, to be held during 1Q2016. (Tadawul) Bank Aljazira shareholders ratify convention signed with AlJazira Takaful Taawuni – Bank AlJazira’s extraordinary general assembly

- 5. Page 5 of 7 has ratified the convention signed with AlJazira Takaful Taawuni Company (related party) to provide collective insurance services for the bank’s financing portfolios amounting to SR12.95mn. The shareholders also ratified another convention signed with AlJazira Takaful on the renewal of the convention of the bank’s collective insurance personal finance portfolios amounting to SR16.9mn. (Tadawul) Saudi Aramco to build $2.1bn gas industrial complex – Saudi Arabian Oil Company (Saudi Aramco) is planning to build the world’s largest industrial gas complex at a total cost of $2.1bn. The project will be built, owned and operated by Arabian Company for Water & Power Development (ACWA) and US-based Air Products & Chemicals. The venture will supply Saudi Aramco with 18,500 metric tons (MT) of oxygen per day and 56,000 MT of nitrogen that will go to its new oil refinery, whose output is expected to be 400,000 barrels per day. Part of the complex’s nitrogen production will go to a natural gas-fired power station currently being built in Jazan with a capacity of 3,700 megawatts (MW). Saudi Fransi bank, Samba Financial Group, Al-Inma Bank, Saudi British Bank (SABB), National Commercial Bank, Mizuho Bank, Societe Generale, Bank Sumitomo Mitsui, Bank of Tokyo-Mitsubishi UFJ and First Gulf Bank are co-funding the investment evenly. (Ameinfo.com) SPC: Higher gas prices to impact 2016 financials – Sahara Petrochemicals Company (SPC) has said that the impact of increase in gas prices, coupled with hike in electricity charges, will be reflected in the financial statements for 2016. The company said it is working on the calculation of the financial impact, and will announce the expected figure as soon as possible. (Tadawul) Saudi Cement suffers SR66.15mn loss from non-operational kilns – Saudi Cement Company has incurred SR66.15mn impairment loss for the net book values of kilns 4 and 5 at the Hofuf factory as at December 31, 2015. The loss has been recognized due to the continuation of high clinker inventory and continued export ban, which together has reduced the possibility of the kilns’ operation in the foreseeable future to a great extent. It is to be noted that kilns are not in operation since the completion of rehabilitation works in September 2014. The profit of the company for 4Q2015 as well as financial year 2015 will be reduced by the amount of the aforementioned loss. (Tadawul) Chemanol estimates impact of increase in gas prices at SR30mn – Methanol Chemical Company (Chemanol) has said that the expected financial impact due to the incremental increase in gas will be around SR30mn annually. Gas prices were increased to $1.25 per million British thermal units (MMBTU) from $0.75 per MMBTU, along with an increase in electricity tariff. Such impact will be reflected in the financial results of 2016 and will represent an additional cost of production of around 5% as compared to 2015. The company said it will make all possible efforts to contain these changes, especially amid decline in its products that were impacted by falling oil prices and global economic fluctuations. (GulfBase.com) KSA to cut reliance on foreign workers – Saudi Arabia has announced plans to reduce its reliance on expat workers by recruiting only workers with technical skills and monitoring investments closely. Finance Minister Ibrahim Al-Assaf said the Kingdom will now be more selective in hiring foreign workers. Dismissing rumors and allaying fears of expatriates, he said the Kingdom has no plans to impose taxes on the income of expatriates. (GulfBase.com) NCB wins approval for derivatives unit – National Commercial Bank (NCB) has received the regulatory approval to set up a subsidiary to engage in derivatives trading and repo activities. The Cayman Islands-based unit, Saudi National Commercial Bank Markets Limited will be 100% owned by NCB and will have a paid-up capital of $50,000. The bank said there would be no financial impact on NCB’s current financial statements due to the establishment of the company. (Bloomberg) Mobily agrees with majority of lenders to waive breach – Etihad Etisalat Company (Mobily) has agreed with the majority of its lenders to waive the breach of covenant under several loan facilities totaling SR12.1bn. Mobily said it is still in negotiations with others lenders relating to its export credit agency facilities and other bilateral facilities to reach a similar waiver agreement. The company had revealed in February 2015 that it was in breach of the terms of loans from various lenders after issuing a drastically reduced restatement of previously announced profit. It had hoped to reach an agreement with lenders to set new covenants for some outstanding loans by 2015-end. (Reuters) Saudi listed companies assess financial impact resulting from fuel, energy price hike – Several Saudi Arabian-listed companies have informed that their financials will be impacted in 2016 and afterwards due to the recent increase in fuel and energy prices by Saudi government. The companies, namely, Saudi Cable Company, Almarai Company, Northern Region Cement Company, Abdullah A. M. Al-Khodari Sons Company and Saudi Arabian Mining Company (Ma’aden) have said they are currently working to assess the extent of financial impact and will announce the results of this study upon its completion. (Tadawul) Economic shake-up shows KSA bracing for cheap oil – Saudi Arabia’s planned cuts in spending and energy subsidies is signaling that the world’s largest crude exporter is bracing for a prolonged period of low oil prices. The OPEC heavyweight shows no signs of wavering in the long-term oil strategy it has been orchestrating since 2014. Instead, it appears willing to continue tolerating cheap crude to defend market share and wait for the market to balance without cutting supplies and oil sources. Saudi Aramco Chairman Khalid Al Falih said the Kingdom expects the market to balance sometime in 2016. Analysts said the plans announced on December 28 to shrink the record state budget deficit with spending cuts, reforms to energy subsidies and a drive to raise revenues from taxes and privatization showed Riyadh was expecting lower revenues. (Reuters) Etisalat Group launches first 4K IPTV service in MEA – Emirates Telecommunications Group Company (Etisalat Group) has partnered with Huawei to introduce an ultra HD 4K IPTV service in the Middle East and Africa (MEA), which will be available exclusively for Etisalat’s eLife customers in the UAE starting in 1Q2016. Etisalat Group’s eLife customers can now enjoy access to a 4K linear channel and VoD service through Etisalat’s new 4K set- top box. (Ameinfo.com) Cybergun opens second center of recreational shooting in Abu Dhabi – Cybergun SA has opened its second center of recreational shooting in Abu Dhabi in the UAE. Cybergun said this launching is done within the relaunching of the soft air battle zone concept together with the new associate Tasleeh Entertainment. (Reuters) GHC appoints CDO – Gulf Holding Company (GHC) has appointed Laith Yousif Al Memar as its Chief Development Officer (CDO). In his new role, Al Memar will oversee GHC’s real estate projects across the region. (GulfBase.com) NBK: Kuwait’s credit growth up 6.6% YoY in October 2015 – According to a report by the National Bank of Kuwait (NBK), credit had grown at the most rapid pace in over a year in October 2015, rising 6.6% YoY, despite a small decline of KD22mn MoM. The report noted that the Central Bank of Kuwait (CBK) increased its discount rate by 25 basis points (bps) to 2.25% in December 2015, following the policy rate hike by the US Federal Reserve. The rate had remained unchanged at 2% for over three years. NBK said that the country’s household debt had increased 13.1% YoY to

- 6. Page 6 of 7 KD107mn in October. Non-bank financial companies resumed their net reduction of bank credit, with a decline of KD27mn. As per the report, private deposits had kept their decline in October 2015, registering a relatively large drop of KD776mn. Government deposits with domestic banks had soared by KD219mn in October and were up by KD527mn since July 2015. The ratio of government deposits to bank assets had risen to 10% in October 2015 from 9% in July 2015. System liquidity is still relatively comfortable, though it has come under some pressure recently. Banks’ core liquid assets had stood at KD5.1bn in October 2015 or 9% of total bank assets, down from 10-11% before the summer. (GulfBase.com) Ominvest establishes new subsidiary – Oman International Development & Investment Company’s (Ominvest) board of directors has approved the establishment of a new subsidiary, ONIC SAOC with an authorized capital of OMR50mn and a paid-up capital of OMR20mn. The new company’s capital will be 98% owned by Ominvest, 1% by Oman Investment Services and 1% by Salalah Resorts. To enable it to have a greater focus in managing its financial investments, Ominvest’s non-strategic financial investments (public and private) will be transferred to its new subsidiary ONIC. This will lead to realizing efficiencies in the investment decision making process. Such transfers will have no bearing on Ominvest’s consolidated (group level) financials, including the earning per share and book value per share as these transfers are essentially inter-group transactions. (MSM) Omantel launches SIP Trunking service for corporate customers – Oman Telecommunications Company (Omantel) has launched the Session Initiation Protocol (SIP) Trunking service for its corporate customers, enabling a large number of enterprises to benefit from the internet protocol and value added services provided by SIP. (GulfBase.com) Bank Sohar to fund OMR40mn for Omran’s JW Marriot Hotel – Bank Sohar will fund OMR39.68mn for building JW Marriott Hotel by Oman Tourism Development Company (Omran), which is coming up at the Oman Convention & Exhibition Centre (OCEC) precincts and is a part of the emerging Al-Irfan City developed by Omran. The new five-star hotel will be operated under the JW Marriott brand. The hotel, currently under construction, includes state-of- the-art food and beverage outlets, meeting facilities and a health & leisure club. Once completed, it will add an additional 304 keys to hotel offerings in the Sultanate. (GulfBase.com) Batelco appoints Group CEO – Bahrain Telecommunications Company (Batelco) has appointed Ihab Hinnawi as its Group CEO. Ihab has been holding the post of Acting Group CEO since February 2015 and has shown excellent leadership skills in directing operations across the group’s 14 geographies since. (Bahrain Bourse) GFH reveals reason for reconsidering delisting from KSE – GFH Financial Group has said that the latest amendments to the implementing regulations of Kuwait’s Capital Markets Authority (CMA) have made its board of directors (BoD) reconsider their earlier decision of delisting from the Kuwait Stock Exchange (KSE). GFH said the new regulations have resolved many shortfalls of the preceding regulations on disclosure and transparency, including those which conflicted with GFH’s other regulators’ requirements. The company noted that the new amendments would allow listed firms to postpone the disclosure of material information without getting the CMA’s prior approval, until a binding agreement has been reached in respect of the transaction or process, if such information might cause harm to the confidentiality of the negotiations or initial procedures for the transaction to be carried out. (Bahrain Bourse) TRA: Key broadband services cheaper in Bahrain – The Telecommunications Regulatory Authority’s (TRA) latest retail price benchmark study of telecommunication services in Arab countries has revealed that fixed and mobile broadband prices in Bahrain are lower than the Organization of Economic Cooperation and Development average. As per the study, mobile broadband services in Bahrain have become cheaper by up to 55% and fixed services by up to 85% between 2010 and 2015. The study also showed customers in Bahrain have benefited from a wide range of retail telecom services and more data at lower prices. (GulfBase.com)

- 7. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Nov-11 Nov-12 Nov-13 Nov-14 Nov-15 QSE Index S&P Pan Arab S&P GCC (0.9%) 0.0% (0.8%) (0.2%) (0.1%) 1.0% 0.5% (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,069.10 (0.0) (0.6) (9.8) MSCI World Index 1,685.62 0.9 0.7 (1.4) Silver/Ounce 13.96 0.2 (2.8) (11.1) DJ Industrial 17,720.98 1.1 1.0 (0.6) Crude Oil (Brent)/Barrel (FM Future) 37.79 3.2 (0.3) (34.1) S&P 500 2,078.36 1.1 0.8 0.9 Crude Oil (WTI)/Barrel (FM Future) 37.87 2.9 (0.6) (28.9) NASDAQ 100 5,107.94 1.3 1.2 7.9 Natural Gas (Henry Hub)/MMBtu 2.37 13.6 54.9 (21.0) STOXX 600 369.68 1.0 0.7 (2.5) LPG Propane (Arab Gulf)/Ton 39.25 3.3 1.6 (19.9) DAX 10,860.14 1.5 1.7 (0.4) LPG Butane (Arab Gulf)/Ton 55.00 3.0 0.9 (12.4) FTSE 100 6,314.57 0.1 0.1 (8.6) Euro 1.09 (0.4) (0.4) (9.7) CAC 40 4,701.36 1.4 0.6 (0.6) Yen 120.46 0.0 0.1 0.6 Nikkei 18,982.23 0.5 1.1 7.9 GBP 1.48 (0.4) (0.6) (4.9) MSCI EM 799.69 (0.1) (0.6) (16.4) CHF 1.01 (0.5) (0.5) 0.1 SHANGHAI SE Composite 3,563.74 0.9 (2.1) 5.5 AUD 0.73 0.6 0.2 (10.8) HANG SENG 21,999.62 0.4 (0.6) (6.8) USD Index 98.10 0.2 0.3 8.7 BSE SENSEX 26,079.48 (0.1) 0.6 (9.5) RUB 72.31 0.1 2.3 19.0 Bovespa 43,653.97 (1.0) 1.0 (40.6) BRL 0.26 (0.2) 2.1 (31.4) RTS 769.64 1.8 (0.4) (2.7) 121.9 104.6 102.8