Marriott case

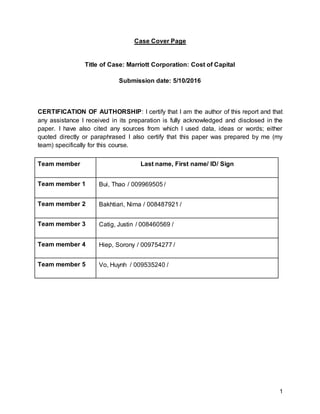

- 1. 1 Case Cover Page Title of Case: Marriott Corporation: Cost of Capital Submission date: 5/10/2016 CERTIFICATION OF AUTHORSHIP: I certify that I am the author of this report and that any assistance I received in its preparation is fully acknowledged and disclosed in the paper. I have also cited any sources from which I used data, ideas or words; either quoted directly or paraphrased I also certify that this paper was prepared by me (my team) specifically for this course. Team member Last name, First name/ ID/ Sign Team member 1 Bui, Thao / 009969505 / Team member 2 Bakhtiari, Nima / 008487921 / Team member 3 Catig, Justin / 008460569 / Team member 4 Hiep, Sorony / 009754277 / Team member 5 Vo, Huynh / 009535240 /

- 2. 2 Table of Contents Executive Summary 3 What is the weighted average cost of capital for Marriott 6 Corporation? What type of investments would you value using Marriott’s 8 WACC? If Marriott used a single corporate hurdle rate for evaluating 9 investment opportunities in each of its lines of business, what would happen to the company over time? What is the cost of capital for the lodging and restaurant 10 divisions of Marriott? What is the cost of capital for Marriott’s contract services 15 division? How can you estimate its equity costs without publicly traded comparable companies?

- 3. 3 Dan Cohrs, Vice-President of Marriott Corporation's project finance prepares the annual provisions for hurdle rates at each of the three key operations for the firm. Founder Willard Marriott started Marriott Corp in the late 1920s with stand alone root beer stand, expanding it over time into a biggest leader in providing lodging, contract services and food service with sales of over $6 billion by the late 1980s. In 1987, sales grew by 24% and return on equity remained at 22%. In addition, sales and earnings per share has doubled over the past few years, Marriott’s operating strategy was to sustain this direction. Marriott’s 1987 annual report stated: “We intend to remain a premier growth company. This means aggressively developing appropriate opportunities within our chosen lines of business—lodging, contract services, and related businesses. In each of these areas, our goal is to be the preferred employer, the preferred provider, and the most profitable company. According to Harvard Business School, Marriott had three main lines of business: lodging, contract services and restaurants. Each line of business is calculated as an independent company due to the different risk and business operations across the three divisions. The first key operation lodging generating close to 51% of company’s profits and 41% of company sales. Second key line of business contract service generating close to 33% of company profit and 46% of company sales.Third key operation of the company provided by restaurants adds 16% of company profits and 13% of sales. The four key elements of Marriott’s financial strategy were managing hotel assets as opposed to owning, goal of increasing shareholders’ value from investing in projects, optimizing the use of debt in capital structures, and repurchasing undervalued shares.

- 4. 4 The first financial strategy was managing hotel assets as opposed to owning. Marriott developed over $1 billion worth of hotel properties. After development, Marriott sold the hotel assets to limited partners while retaining operating control. In 1987, Marriott and Courtyard hotels were syndicated for $890 million, Marriott operated over $70 billion worth of syndicated hotels. The second financial strategy was investing in projects that increase shareholder value. Discounted cash flow methods were used to assess potential investments. According to a Marriott Executive, ”Our projects are like a lot of similar little boxes...managers still have discretion over unit-specific assumptions, but they must conform to the corporate templates.” The third strategy was optimizing the use of debt in capital structure. Marriott used an interest coverage target instead of a target debt-to-equity ratio, 59% of total capital. The final strategy was repurchasing undervalued shares. Marriott was focused on repurchasing stocks that fell under their “warranted equity value.” The company repurchased 13.6 million shares of common stock for $429 million. Marriott Corporation relied on measuring the opportunity cost of capital for investments by utilizing the concept of Weighted Average Cost of Capital (WACC). In April 1988, VP of project finance, Dan Cohrs suggested that the divisional hurdle rates at the company would have a key impact on their future financial and operating strategies. Marriott intended to continue its growth at a fast pace by relying on the best opportunities arising from their lodging, contract services and restaurants lines of businesses. To make the company managers more involved in its financial strategies, Marriott also considered using the hurdle rates for determining the incentive compensations.

- 5. 5 1. What is the weighted average cost of capital for Marriott Corporation? Marriott uses the Weighted Average Cost of Capital (WACC) as a metric for cost of capital. The formula for calculation below: WACC = (1 - T) * rd(D/V) + re * (E/V) Where: T Corporate tax rd Cost of debt D Market value of debt V Firm’s Enterprise Value (Market Value of Debt + Market Value of Equity) re Cost of equity E Market value of equity Calculations for Marriott Corporation: Value: Source: T 34.00% Provided rd 10.25% *See Calculations on p. 7 D 60% Given target debt ratio V 100% 40.00%+60.00%=100% re 20.72% *See Calculations on p. 16 E 40% 100%-60%=40% WACC = (1-.34)(.1025)(.60) + (.2072)(.40) = .12347 ≈ 12.35% a) What risk-free rate and risk premium did you use to calculate the cost of equity? Calculating Cost of Equity: Marriott Corp utilizes the Capital Asset Pricing Model (CAPM) to derive their cost of equity: re = Rf + Beta (Rm - Rf) Market risk-premium is calculated by rm - rf. The spread between S&P 500 Composite Returns and Long-Term U.S. Government bond returns for the year 1926-87 is 7.43%, given by Exhibit 5. Rf is constituted by the government bond rate of 8.95%. Using the highest and longest as the risk free interest rate provided by the U.S government in April 1988, given by Table B. Value Source

- 6. 6 Equity Beta = 1.1 See Exhibit 3 Asset Beta = .667 D/E = .4/.6 βL = βu (1 + (1 – τ) (D/E)) = 1.1 (1 + (1 – .34) (.4/.6)) = 1.584 re = 8.95% + 1.584 (7.43%) = 20.72% b) How did you measure Marriott’s cost of debt? Calculating Cost of Debt: Marriott risk free-rate is the government bond rate of 8.95%, obtained from Table B. Marriott’s Debt Rate Premium is found as the credit spread on Table A, 1.30%. Book definition: Cost of debt = Risk free rate +Spread Thus, Rd = government bond rate + credit spread= 8.95% + 1.30% = 10.25% *Spread is based on riskiness of company 2. What type of investments would you value using Marriott’s WACC? Since the WACC is 12.35%, any investments with a WACC equal or lower than 12.35% would be an investment to be considered of value by Marriott. The company will continue to look at other investments that will lower their WACC. The type of investment to be considered is issuing bonds to get the financing more cheaply. The firm is built upon lodging, contract services and restaurants as the three key operations. By continuing investments in their three key operations has created different WACC for each operation versus the whole company. Marriott can seek projects that will increase shareholders’ value by expanding its investment interests. In 1976, Marriott attempted this by opening two theme parks. Long term investments opportunities places Marriott in a predicament when attempting to optimize their debt.

- 7. 7 3. If Marriott used a single corporate hurdle rate for evaluating investment opportunities in each of its lines of business, what would happen to the company over time? Investopedia online defines a hurdle rate as the minimum rate of return on a project or investment required by a manager or investor. In order to compensate for risk, the riskier the project, the higher the hurdle rate. The main use of the hurdle rates is to assess investment decision in order to determine if it’s reasonable. Using different rates for different divisions can be advantageous as different projects amongst different divisions might have different risk and reward. Companies should be careful when applying a single cost of capital across various departments. The numbers below were calculated for Marriott and its different divisions. WACC for Marriott= 12.35% WACC for lodging division = 10.37% WACC for restaurant division =14.53% WACC for Marriott’s contract division = 14.31% Looking at the above WACC’s we can see that each division is different. The cost of capital for lodging is lowest. It is even lower than the WACC for the entire company. The cost of capital is often equated risk, therefore the risk in the lodging department is lower when compared with other departments that have a higher WACC. If Marriott was to use a single corporate hurdle rate then they would be using the 12.35% rate which is the WACC for the entire company. By breaking down WACC’s to each respective division it will prevent Marriott from using this rate for every project. This is beneficial or any project that arises out of the lodging division will be rejected since its cost of capital of 9.25% is lower than the cost of capital for the company. Using a higher rate will result in a negative NPV as well as a reduced cash flow. What would happen is eventually projects from the restaurant and contract service division will be approved since they are evaluated at a lower rate than the determined cost of these various divisions. Over time, Marriott will be approving more high risk project from the restaurant and contract service division by evaluating them at a lower rate, while they will be rejecting lower risk projects from the lodging division because they are using a higher rate. As this type of decision making continues Marriott will be assuming higher risk as it to approve riskier projects. 4. What is the cost of capital for the lodging and restaurant divisions of Marriott? Lodging Division Cost of Capital WACC = (1 - T) * rd(D/V) + re * (E/V) T = 34%

- 8. 8 rd = 10.05%, See part a D/V = 74%, Market-Value Target-Leverage Ratios and Credit Spreads for Marriott and Its Divisions in Table A page 4 E/V = 26%, 100%-D/V= 74% re = rf + Beta (RP) rf = 8.95% See part a RP = 7.43%, See part a Beta = 1.623, See part c re = .0895 + 1.623(.0743), re = .2101 WACC = (1-.34)*.1005(.74) + .2101*(.26) WACC of Lodging Division = .1037, 10.37% Restaurant Division Cost of Capital WACC = (1 - T) * rd(D/V) + re * (E/V) T = 34% rd = 8.70%, See part a D/V= 42%, Market-Value Target-Leverage Ratios and Credit Spreads for E/V= Marriott and Its Divisions in Table A page 4 58%, 100%-D/V= 58% re = rf + Beta (RP) rf = 6.90% See part a RP= 8.47%, See part a Beta= 1.653, See part c re = .0690 + 1.653(.0847), re = .2090 WACC = (1-.34)*(.0870)(.42) + .2090*(.58) WACC of Restaurant Division = .1453, 14.53% a. What risk-free rate and risk premium did you use in calculating the cost of equity for each division? Why did you choose these numbers? The risk-free rate used for Marriott’s lodging division is 8.95%, which used a long-term 30 year risk-free rate. Marriott’s restaurant division has a 6.90% risk-free rate, which used a short-term 1 year risk-free rate. The values for the risk-free rates are given in Table B on page 4. The risk premium for the lodging division is 7.43%. The risk premium for the restaurant division is 8.47%. We used the spread between using 1926- 1987 periods as the market risk premium in Exhibit 5 page 10. Since the lodging division is long term, we used the spread between S&P 500 Composite returns and long-term U.S. government bond returns. Since the restaurant division is short term, we

- 9. 9 used the spread between S&P 500 Composite returns and short-term U.S. Treasury bill returns. b. How did you measure the cost of debt for each division? Should the debt cost differ across divisions? Why? To measure the cost of debt for each division we used, cost of debt rd = rf + spread. The risk-free rates for the lodging and restaurant divisions are 8.95% and 6.90% respectively. The risk-free rate is given in Table B page 4 based on the maturity of U.S Government interest rates, 30-year and 1-year. The spread is the debt rate premium above government in Table A page 4. The spread for the lodging and restaurant divisions are 1.10% and 1.80% respectively. The pre-tax cost of debt for the lodging division is 10.05%, 8.95%(risk-free) + 1.10(debt rate premium above government). The pre-tax cost of debt for the restaurant division is 8.70%, 6.90%(risk-free) + 1.80%(debt rate premium above government). The tax rate used is 34%, the highest corporate tax between 1986-1992. The after-tax cost of debt is (1-t) x rd. The after-tax cost of debt for the lodging division is 6.63%, (1-.34) x 10.05%. The after-tax cost of debt for the restaurant division is 5.74%, (1-.34) x 8.70%. The cost of debt should be different across each division because each division is treated as an independent company. The maturity of U.S interest rates are different for the two divisions because the lodging division uses long-term 30-year and the restaurant division uses short-term 1-year. The spread between the debt rate and the government bond rate varied by division because of differences in risk c. How did you measure the beta of each division? To measure the beta of each division you need to collect the raw equity(levered) beta and D/E of other firms in the same industry. The equity(levered) beta and market leverage of comparable firms is found on Exhibit 3 page 8. To the unlevered beta use the following formula for each firm: Bu= BL / (1+ (D/E) * (1-T)). To find the D/E, divide market leverage by 1 minus market leverage, D/E = market leverage / (1-market leverage). Once you have the D/E you can plug it into the unlevered beta formula. Once you obtain the unlevered beta for each comparable firm, get the average. Next, re-lever beta by plugging the unlevered average beta into the following formula: BL = Bu(1+(D/E) * (1-T)). To find the D/E use the debt percentage in capital for the division found in Table A page 4. To get D/E from debt percentage in capital use the following formula: D/E= debt % / (1- debt %). Now the unlevered(asset) beta can be re- levered(equity) beta using: BL = Bu(1+(D/E) * (1-T)). Note the tax rate is 0 since there is no information of tax rates for other firms.

- 10. 10 Beta for Lodging Division Step 1) Gather raw equity beta of other firms Hilton Hotels Corporation Hilton Hotels Corporation La Quinta Motor Inns Ramada Inns, Inc. Levered(equity) beta .76 1.35 .89 1.36 Market leverage 14% 79% 69% 65% Step 2) Unlever the betas and convert Market leverage to D/E. Tax = 0 Hilton Hotels Corporation Hilton Hotels Corporation La Quinta Motor Inns Ramada Inns, Inc. D/E .14/(1-.14) = .163 .79/(1-.79) = 3.762 .69/(1-.69) = 2.226 .65/(1-.65) = 1.857 Unlevere d beta formula .76/(1+.163( 1-t)) = .653 1.35/(1+3.762 ) = .283 .89/(1+2.226) = .276 1.36/(1+1.857)= .476 Step 3) Compute the average of the asset betas Unlevered(asset) beta .653 .283 .276 .476 Average unlevered(asset) beta (.653+.283+.276+.476) / 4 = .422 Step 4) Re-lever the average asset beta BL = Bu(1+ (D/E) * (1-t)) Debt % in capital for lodging division = 74% D/E = debt % in capital / 1- debt % in capital = .74/(1-.74) = 2.846 BL = .422(1+2.846(1-0)) = .422(3.846) = 1.623 Re-levered(equity) beta of Marriott Lodging division = 1.623 Beta for Restaurant Division

- 11. 11 Step 1) Gather raw equity beta of other firms Church’s Fried Chicken Collins Food Int. Frisch’s Rest. Luby’s Cafe. McDonald’s Wendy’s Int. Levered (equity) beta 1.45 1.45 .57 .76 .94 1.32 Market Leverage 4% 10% 6% 1% 23% 21% Step 2) Unlever the betas and convert Market leverage to D/E. tax = 0 Church’s Fried Chicken Collins Food Int. Frisch’s Rest. Luby’s Cafe. McDonald’s Wendy’s Int. D/E .04/(1-.04)= .042 .10/(1- .10)= .111 .06/(1- .06)= .064 .01/(1- .01)= .010 .23/(1-.23) = .299 .21/(1-.21) = .266 Unlever ed beta formula 1.45/(1+.04 2(1-t)) = 1.392 1.45/(1+.1 11) = 1.305 .57/(1+.06 4) = .536 .76/(1+.01 0) = .752 .94/(1+.299) = .724 1.32/(1+.2 66) = 1.043 Step 3) Compute the average of the asset betas Unlevered (asset) beta 1.392 1.305 .536 .752 .724 1.043 Average unlevered (asset) beta (1.392+1.305+.536+.752+. 724+1.043)/6 = .959 Step 4) Re-lever the average asset beta BL = Bu(1+ (D/E) * (1-T)) Debt % in capital for Restaurant division = 42%

- 12. 12 D/E = debt % in capital / 1- debt % in capital, .42/(1-.42) = .724 BL = .959(1+.724(1-0))= .959(1.724) = 1.653 Re-levered(equity) beta of Marriott Restaurant division = 1.653 5. What is the cost of capital for Marriott’s contract services division? How can you estimate its equity costs without publicly traded comparable companies? To calculate the cost of capital for the contract services is more complex because there aren’t any publicly traded peer companies to compare against and privately held firms either do not report their results or do not report results compliant with the financial reporting requirements of publicly traded companies. Based on the projected mix of fixed and floating debt, the cost of debt for the contract services division is estimated at 10.07% To calculate the cost of capital for the contract services is more complex because there aren’t any publicly traded peer companies to compare against. Privately held companies do not report their results because they do not have to be compliant with the financial reporting requirements of publicly traded companies. What is the WACC for Marriott’s contract services division? βu for Marriott is the weighted average of the Divisional βu’s: Identifiable Assets Ratio Beta Unlevered Lodging $2,777.4 0.61 0.422 Restaurants $567.60 0.12 0.959 Contract Services $1,237.70 0.27 Marriott $4,582.70 1 0.667 .61(.422) + .12(.959) + .27(βu) = .667 βu = 1.0907 Cost of Debt rd = government bond rate + credit spread

- 13. 13 rd = 6.90% + 1.40% = 8.30% Cost of Equity for Contract Services: Using the target debt ratio of 40%: βcs = βu (1 + (1 – τ) (D/E)) = 1.0907 (1 + (1 – .34) (.4/.6)) = 1.571 Using CAPM: re = rf + βTs (rm – rf) = 6.9% + 1.571(8.47%) = 20.20% WACC = (1 - τ)rd(D/V) + re(E/V) = (1 - .34)(.083)(.4) + (.2020)(.6) = 14.31% Reference: Read more: Hurdle Rate Definition | Investopedia http://www.investopedia.com/terms/h/hurdlerate.asp#ixzz487TKypm4

- 14. 14