Uranium Spotlight: Three Catalysts for Rebound

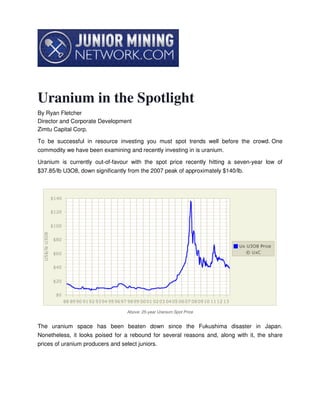

- 1. Uranium in the Spotlight By Ryan Fletcher Director and Corporate Development Zimtu Capital Corp. To be successful in resource investing you must spot trends well before the crowd. One commodity we have been examining and recently investing in is uranium. Uranium is currently out-of-favour with the spot price recently hitting a seven-year low of $37.85/lb U3O8, down significantly from the 2007 peak of approximately $140/lb. Above: 25-year Uranium Spot Price The uranium space has been beaten down since the Fukushima disaster in Japan. Nonetheless, it looks poised for a rebound for several reasons and, along with it, the share prices of uranium producers and select juniors.

- 2. Uranium demand is intimately tied to energy demand. Today, the world has 432 nuclear plants operating in 30 countries. Nuclear power provides approximately 13% of the world’s electricity, and 13 countries rely on nuclear for at least one-quarter of their electricity. Specific to this year, however, there are three significant catalysts for investors to take note of: Restart of Japanese reactors: After the events of Fukushima, the Japanese government immediately put the brakes on their nuclear industry, the third largest in the world, shutting down its entire approximately 50-reactor fleet and pausing to consider whether to abandon nuclear. This had a two-fold effect on the uranium market as it took a significant amount of demand off the market and also created a newfound supply as plants had expanding inventories to destock. Recently, the Japanese have elected the relatively pronuclear Liberal Democratic Party. Two reactors are currently online and ten others recently applied for restarts. Since the Japanese fleet was mothballed, the cost to substitute fossil fuels (oil, LNG, coal, etc.) for the idled reactors has been estimated at more than US$300M/day, or US$100bn a year. Above: Uranium Reactor Growth

- 3. According to Toll Cross Securities, recommencing nuclear power, on the other hand, would cost an estimated US$5bn. In some Japanese industries, electricity bills have risen fivefold. Japanese utilities have posted net losses since the nuclear shut down, with some needing government bail-outs to cover importing fossil fuels. Though still politically sensitive, in light of rising energy prices and greenhouse gas emissions and to keep its industries competitive on the global stage, the likelihood of continued Japanese restarts appears to be growing. With Japanese reactors back online, this will help to reverse the process that helped to bring uranium prices down; albeit timing for full restarts is still in debate. End of the Russian HEU agreement: The Russian HEU or “Megatons to Megawatts” agreement is set to end later this year. The agreement was a 20-year deal signed in 1993 to amongst other items downblend 400 t of highly-enriched uranium (HEU) from dismantled Russian warheads into 500 Mlbs of U308-equivalent for use in US reactors. In 2012, it is estimated that this deal contributed 20-24 Mlbs of U3O8 or 10-12% of the global uranium supply. In other commodities, having one-tenth of the supply knocked out in a single year would raise some eyebrows. While there is a transitional period at the end of the agreement, this will cut off a significant supply source, particularly at current prices. New production requires higher prices: With the global reactor build continuing unabated, more uranium will be needed moving forward and a supply shortage is projected as early as the next couple of years. The current price of around $40/lb U3O8 does not provide enough incentive to bring new projects, especially conventional projects online.

- 4. Source: Lakeland Resources Inc. (TSX.V: LK) With the low uranium prices, in 2012 BHP, Cameco, Areva and ARMZ all announced cancellations or delays of projects due to economics. A recent report by J.P. Morgan estimates that a price of over $80/lb U308 is needed to incentivize new conventional projects. In order to bring new projects on to meet growing demand, prices need to rise. According to the International Energy Agency global demand for electricity is expected to be 84% higher in 2035 than in 2009, mainly driven by emerging markets. To fuel global demand, we will need more reactors as part of the energy mix. "According to the International Energy Agency global demand for electricity is expected to be 84% higher in 2035 than in 2009, mainly driven by emerging markets. To fuel global demand, we will need more reactors as part of the energy mix."

- 5. Surprisingly, today there are more reactors under construction (68) or planned and on order (162) than there were before Fukushima. Since Fukushima, the UK has announced it will build five new reactors, Saudi Arabia (the home of cheap oil) has announced 16 reactors, Brazil is also constructing a new reactor with plans for an additional eight, the U.S. has approved four new nuclear plants (the first in some 30 years), and Russia, China and India all have ambitious nuclear construction programs underway accounting for the bulk of expected growth. Since Fukushima, 13 new reactors have had their first concrete poured. Any or all of the above could act as catalysts that could spark upward price pressure and renewed interest for the uranium sector. Through Zimtu Capital Corp. we have positioned our investors for improving fundamentals in the uranium space through select investments, including an approximately 19.9% shareholding in Lakeland Resources Inc. (TSX.V: LK). Over the last several months, Lakeland has acquired a portfolio of nine projects the Athabasca Basin, Saskatchewan, Canada. The Athabasca Basin is one of the world’s leading uranium districts because of its high grades (can be in excess of 20% U3O8 whereas global average is 0.10-0.15%), infrastructure and political stability. "The Athabasca Basin is one of the world’s leading uranium districts because of its high grades (can be in excess of 20% U3O8 whereas global average is 0.10-0.15%), infrastructure and political stability." Recent successes in the Basin include Hathor’s Roughrider Discovery (which was sold to Rio Tinto for $654 million in 2012) and collective discovery by Fission Uranium Corp. (TSX.V: FCU) and Alpha Minerals Inc. (TSX.V: AMW) of the Patterson Lake South Discovery. Fission is up over 300% and Alpha has gained over 1000% in past 12 months. All of Lakeland’s projects benefit from a wealth of historical exploration data and have the geological characteristics amenable to discovery. Lakeland is also backed by a seasoned technical team with Dahrouge Geological Consulting Ltd. at the helm (more than 20 years

- 6. experience in the Basin) and an advisory board with Mr. Richard Kusmirski, past exploration manager for Cameco Corporation (TSX: CCO) and Mr. Thomas Drolet, a uranium and nuclear energy specialist for over 40 years. When the uranium sector rebounds, the premier juniors- those with the best, high grade targets and assets and the management teams to grow and explore them- will stand to benefit the most. Right now, uranium is a deeply unloved resource. This may be the opportunity for investors. Sincerely, /s/ Ryan Fletcher Corporate Development and Director Zimtu Capital Corp. Ryan Fletcher is a director of Zimtu Capital Corp. (TSX.V: ZC), a Vancouver-headquartered public investment company that creates, invests in and grows resource companies. Mr. Fletcher has been responsible for identifying and sourcing projects, structuring companies and investments, marketing group companies and business development. He is a graduate of the University of British Columbia Okanagan with a Bachelor of Arts in Economics. Before joining Zimtu in 2009, Mr. Fletcher worked as a consultant for publicly listed mineral exploration and development companies and a boutique private investment firm focused on the mineral exploration sector. For more information on Lakeland Resources Inc. please visit their corporate website at http://www.lakelandresources.com or contact Roger Leschuk, Corporate Communications at Ph: 604.681.1568 or TF: 1.877.377.6222 or Email: roger@lakelandresources.com