IFRS Inter-corporate Investment Classification, Measurement and Disclosure

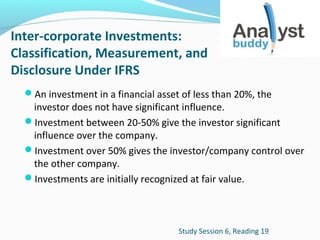

- 1. Inter-corporate Investments: Classification, Measurement, and Disclosure Under IFRS An investment in a financial asset of less than 20%, the investor does not have significant influence. Investment between 20-50% give the investor significant influence over the company. Investment over 50% gives the investor/company control over the other company. Investments are initially recognized at fair value. Study Session 6, Reading 19

- 2. Inter-corporate Investments: Classification Held-To-Maturity Held-For-Trading Available-For-Sale Study Session 6, Reading 19

- 3. Effects of Different Methods in Accounting for Inter-Corporate Investments Equity Accounted Investments are recorded at cost in the balance sheet Dividends from associates increase cash and decrease the investment on the balance sheet. The investor’s share of pro-rata net income increases the assets and is listed as the income on the investor’s income statement Study Session 6, Reading 19

- 4. Effects of Different Methods in Accounting for Inter-Corporate Investments (cont.) Acquisition Method The balance sheets of the two companies are consolidated The equity of the parent company is not adjusted but a component called minority interest is added. Revenues and the expenses of the parent and subsidiary are added together in the income statement. Study Session 6, Reading 19

- 5. Effects of Different Methods in Accounting for Inter-Corporate Investments (cont.) Proportionate Consolidation Used only in IFRS. Under this method, the parent company’s share of each asset and liability is included. Parent will also include its share in the joint venture revenues and expenses on its income statement. Study Session 6, Reading 19

- 6. Types of Post-Employment Benefit Plans and Implications for Financial Statements Defined Contribution Plans Employee and employer both make contributions. Individual accounts are created and maintained. The employer has no obligation to make contributions after the employment period of the employee. Future benefits depend on the performance of the investment. Study Session 6, Reading 20

- 7. Types of Post-Employment Benefit Plans and Implications for Financial Statements (cont.) Defined Benefit Plan The benefit is defined and it is delivered after employment. A formula is used to determine the pension amount. Years of service, last salary and age are some of the determinants of the benefit plan. Employer makes actuarial assumptions. A separate legal entity funds the defined benefit plans most of the time. Study Session 6, Reading 20

- 8. Types of Post-Employment Benefit Plans and Implications for Financial Statements (cont.) Other Post Employment Benefits Life insurance and healthcare insurance are examples of other benefits. Uncertainty about the future amount of benefit. Eventual benefits are defined. Pre-funding is usually avoided in the other post employment benefits. Study Session 6, Reading 20

- 9. Measures of a Defined Benefit Pension Obligation and Net Pension Liability A Defined Benefit Pension Obligation is measured as the present value of future benefits under both US GAAP and IFRS. The obligation is called the present value of defined benefit obligation (PVDBO). Future benefits to each employee are determined in advance by the company. The discount rate assumption is important in the calculation. Study Session 6, Reading 20

- 10. Measures of a Defined Benefit Pension Obligation and Net Pension Liability (cont.) Projected Benefit Obligation Actuarial present value of future pension benefits to participants. Expected future salary increases are also taken into account. The going concern assumption is considered while measuring the benefits. Study Session 6, Reading 20

- 11. Measures of a Defined Benefit Pension Obligation and Net Pension Liability (cont.) Accumulated Benefit Plan The actuarial present value of the future pension benefits. Expected future salary increases are ignored. The benefit plan is based on the current salary of the employee. Vested Benefit Obligation Based on employee’s service up to a date. Actuarial present value of future vested benefits. Future services are not considered. Study Session 6, Reading 20

- 12. Components of a Defined Benefit Pension Expense Interest cost Past service costs Word of Prior service costs is used by US GAAP Losses on curtailments or settlements Actuarial gains/losses Study Session 6, Reading 20

- 13. Three fundamental assumptions in the defined benefit plan 1. Discount Rate: The interest rate used to compute the present value is called the discount rate. It is not the risk free rate at this rate company can settle pension obligation. 2. Compensation Increase: Annual average rate at which a company’s employee compensation is expected to increase is called the rate of compensation increase. 3. Expected return on the assets is the assumed rate of return on the investment in the plan. Study Session 6, Reading 20

- 14. Effects of Assumptions on Periodic Expense A small change in the assumption can have a large impact on it as well. Assumptions about low growth rates in compensation, rates of return and high discount rate will decrease the pension liability Aggressive assumptions will result in the lower earnings quality of the firm. Study Session 6, Reading 20

- 15. Impact of Adjustments for Items of Pension and Post-Employment Benefits on Financial Statements Defined Contribution Plan In a defined contribution plan, the contributions are recorded as expense. A pension related liability does not appear on the balance sheet Annual contribution to the plan by the company is the pension expense reported on the income statement. Unpaid contributions are recognized as accrual at the end of the period. Study Session 6, Reading 20

- 16. Impact of Adjustments for Items of Pension and Post-Employment Benefits on Financial Statements (cont.) Defined Benefit Plan Under a Defined Benefit Plan, the pension obligation and pension expense is complex to calculate. The funded status of the plan is reported on the balance sheet under US GAAP. Only a net amount is reported under IFRS. Under IFRS, companies need to report a pension liability in the balance sheet while using defined benefit plan, There is less volatility in pension accounting under IFRS. Study Session 6, Reading 20

- 17. Evaluating the Liability of a Company's Pension and other Post-Employment Benefits with Cash Flow Related Information In the disclosures about pension plans, companies provide detail on the assumptions about the discount rate, compensation growth rate and expense. Differences in assumptions can have significant impacts on financial ratios. Comparative analysis of two companies can be effected heavily due to assumptions. Companies are also required to disclose the reconciliation of the pension benefit obligation and planned assets. Study Session 6, Reading 20

- 18. Economic Pension Expense (Income) The economic pension expense is more volatile measure of expense. Formula: (Service costs+ interest costs+ actuarial losses- actuarial gains+/past service costs) - actual returns on plan assets Economic expense - the change in the funded status for the period excluding the firm’s contributions. Study Session 6, Reading 20

- 19. Issues Involved in Accounting for Share-Based Compensation Share based compensation is paid to align the interests of employees with those of shareholders. It does not require a cash outlay. Compensation expense reduces earnings. Accounting treatment for share based compensation is similar under both IFRS and US GAAP. Study Session 6, Reading 20

- 20. Valuing Stock Grants and Stock Options Stock grants can be issued subject to achieving performance hurdles or outright. The expense is reported on the basis of fair value of shares on the grant date. Compensation expense is allocated over the service period of the employee. grant date - the date when the stock option is granted and the vesting date is the first date at which the employee can exercise the option. Study Session 6, Reading 20

- 21. Presentation Currency, Functional Currency and Local Currency Presentation Currency – currency where the financial statements of a company are presented. It is mostly the same local currency where the company is located. Functional Currency - currency of the primary economic environment where the company operates Local Currency - The currency of the company where a company is located Study Session 6, Reading 21

- 22. Impact of Exchange Rate Changes on Translated Sales of a Subsidiary and Parent Company IASB and FASB state that the change in exchange rates and the change in value due to changes in exchange rate should be recorded as a gain/loss in the income statement. Gain/loss can be recorded as a component of other operating income/expense or as a component of non-operating income/expense. In some cases, the gain/loss can be reported as a part of the net financing cost. Study Session 6, Reading 21

- 23. Translation: Current Rate Method vs Temporal Method Current Rate method - all assets and liabilities are translated at the current rate. Temporal Method - all assets and liabilities are translated at the exchange rates based on the time assets and liabilities were acquired or incurred. The temporal method is a variation of “The monetary/nonmonetary method”. Study Session 6, Reading 21

- 24. Translation: Current Rate Method vs Temporal Method Current Rate method - all assets and liabilities are translated at the current rate. Temporal Method - all assets and liabilities are translated at the exchange rates based on the time assets and liabilities were acquired or incurred. The temporal method is a variation of “The monetary/nonmonetary method”. Study Session 6, Reading 21

- 25. Translation Effects, Evaluating Translation Methods Translation gains or losses are reported in shareholder’s equity. Gains or losses are reported as part of cumulative translation adjustment (CTA). Formula: CTA = Assets - Liabilities - Common Stock - Retained Earnings (excluding CTA) CTA - the unrealized gain or loss that is accumulated over time. It is deferred on the balance sheet as a separate component of stockholder’s equity. Study Session 6, Reading 21

- 26. Effect of the Currency Translation Method on Parent Company's Financial Ratios Gross profit margin will be lower under the temporal method. Sales under both methods are translated at the average rate. COGS will be higher under the temporal method because COGS are translated at the historical rate. Equity value will be higher under the temporal method. Study Session 6, Reading 21

- 27. Effect of Alternative Translation Methods on Subsidiaries in Hyperinflationary Economies US GAAP defines hyperinflation when the cumulative inflation for the past three years is more than 100%. The parent’s presentation currency is considered the functional currency under hyperinflation. The temporal method is used to measure the financial statements if the above criteria is met. If the hyperinflation condition does not exist anymore, the functional currency of the subsidiary needs to be determined to choose the appropriate method for the company. Study Session 6, Reading 21