Company Vs. LLP Vs. Firm

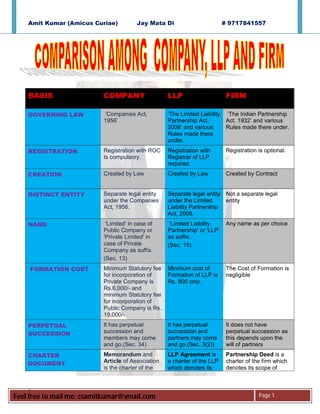

- 1. Amit Kumar (Amicus Curiae) Jay Mata Di # 9717841557 BASIS COMPANY LLP FIRM GOVERNING LAW ‘Companies Act, ‘The Limited Liability ‘The Indian Partnership 1956’ Partnership Act, Act, 1932’ and various 2008’ and various Rules made there under. Rules made there under. REGISTRATION Registration with ROC Registration with Registration is optional. Is compulsory. Registrar of LLP required. CREATION Created by Law Created by Law Created by Contract DISTINCT ENTITY Separate legal entity Separate legal entity Not a separate legal under the Companies under the Limited entity Act, 1956. Liability Partnership Act, 2008. NAME 'Limited' in case of 'Limited Liability Any name as per choice Public Company or Partnership' or 'LLP' 'Private Limited' in as suffix. case of Private (Sec. 15) Company as suffix. (Sec. 13) FORMATION COST Minimum Statutory fee Minimum cost of The Cost of Formation is for incorporation of Formation of LLP is negligible Private Company is Rs. 800 only. Rs.6,000/- and minimum Statutory fee for incorporation of Public Company is Rs. 19,000/- PERPETUAL It has perpetual It has perpetual It does not have SUCCESSION succession and succession and perpetual succession as members may come partners may come this depends upon the and go.(Sec. 34) and go.(Sec. 3(2)) will of partners CHARTER Memorandum and LLP Agreement is Partnership Deed is a DOCUMENT Article of Association a charter of the LLP charter of the firm which is the charter of the which denotes its denotes its scope of fee Feel free to mail me: csamitkumar@ymail.com Page 1

- 2. Amit Kumar (Amicus Curiae) Jay Mata Di # 9717841557 company. scope of operation operation and rights and and rights and duties of the partners duties of the partners vis-à-vis LLP. COMMON SEAL Signature of the Signature and LLP There is no concept of company and every may have its own common seal in company shall have its common seal, partnership own common seal. depends upon the (Sec. 34) terms of the Agreement(Sec. 14) FORMALITIES OF Various e-forms along Various e-Forms In case of registration, INCORPORATION the Memorandum & and the LLP Partnership Deed along Articles of Association Agreement are filed with form / affidavit are filled with Registrar with the Registrar of required to be filled with of Companies with LLP along with the Registrar of firms along prescribed fees prescribed Fee. with requisite filing fee TIME PERIOD 10 days (approx.) to 10 days (approx.) to It will take 7 days REQUIRED incorporate (inclusive incorporate (approx.) to incorporate of time taken to obtain (inclusive of time DIN) taken to obtain DPIN) LEGAL PROCEEDINGS A company is a legal A LLP is a legal Only registered entity which can sue entity can sue and partnership can sue third and be sued be sued (Sec. 14) party FOREIGN Foreign Nationals can Foreign Nationals Foreign Nationals can PARTICIPATION be a member in a can be a Partner in not form Partnership Firm Company.(Sec.41) a LLP.(Sec. 5) in India NUMBER OF 2 to 50 members in Minimum 2 partners Minimum 2 and MEMBERS case of Private and there is no Maximum 10/20 Company and 7 to limitation of (as per Companies Act, infinite members in maximum number of 1956) case of Public partners.(Sec. 6) (Sec.11) Company. (Sec. 12) OWNERSHIP OF The company The LLP Partners have joint ASSETS independent of the independent of the ownership of all the members has partners has assets belonging to ownership of assets ownership of assets partnership firm RIGHTS / DUTIES / Rights / Duties / Rights / Duties / Rights / Duties / OBLIGATION OF THE obligation of the obligation of the obligation of the partners directors are governed partners are are governed by PARTNERS / by AOA and resolution governed by LLP Partnership Deed. MANAGING passed by Agreement. PARTNERS / shareholders or DIRECTORS directors. fee Feel free to mail me: csamitkumar@ymail.com Page 2

- 3. Amit Kumar (Amicus Curiae) Jay Mata Di # 9717841557 LIABILITY OF Generally limited to Limited, to the Unlimited. Partners are PARTNERS/ the amount required to extent their severally and jointly liable be paid up on each contribution towards for actions of other MEMBERS share. LLP, except in case partners and the firm and (Sec.12) of intentional fraud liability extend to their or wrongful act of personal assets. omission or commission by the partner.(Sec. 28) TAX ABILITY Income is taxed at a Income is taxed at a Income is taxed at a Flat Flat rate of 30% Plus Flat rate of 30% rate of 30% plus surcharge as plus education cess education cess as applicable. (2%+1%) as applicable. applicable. (2%+1%) (2%+1%) MINIMUM TAX Minimum Alternate Alternate Minimum Not applicable Tax @ 18.5% + Tax @18.5% + Surcharge@ 5% + Cess @3% Cess @3% i.e. 20% i.e. 19.05% PRINCIPAL/AGENT The directors act as Partners act as Partners are agents of RELATIONSHIP agents of the company agents of LLP and the firm and other and not of the not of the other partners. members partners.(Sec. 26) TRANSFER / Ownership is easily Regulations relating Not transferable. In case INHERITANCE OF transferable. to transfer are of death the legal heir governed by the receives the financial RIGHTS LLP value of share. Agreement.(Sec. 42) TRANSFER OF SHARE In case of death of In case of death of a In case of death of a / PARTNERSHIP member, shares are partner, the legal partner, the legal heirs transmitted to the legal heirs have the right have the right to get the RIGHTS IN CASE OF heirs. to get the refund of refund of the capital DEATH the capital contribution + share in contribution + share accumulated profits, if in accumulated any. Legal heirs will not profits, if any. Legal become partners heirs will not become partners IDENTIFICATION Every director is Every Designated The partners are not NUMBER OF required to have a Partners is required required to obtain any Director Identification to have a DPIN identification number DIRECTORS OR Number before being before being PARTNERS appointed as Director appointed as (DIN/DPIN) of any company(Sec. Designated Partner 266A) of LLP.(Sec. 7(6)) fee Feel free to mail me: csamitkumar@ymail.com Page 3

- 4. Amit Kumar (Amicus Curiae) Jay Mata Di # 9717841557 DIGITAL SIGNATURE As e-forms are filled As e-forms are filled There is no requirement electronically, at least electronically, at of obtaining Digital one Director should least one Signature have Digital Designated Partner Signatures should have Digital Signatures. DISSOLUTION / Voluntary or Voluntary or By agreement, mutual WINDING-UP Compulsory ( by order Compulsory ( by consent, insolvency, of National Company order of National certain contingencies, Law Tribunal) Company Law and by court order. (Sec. 425) Tribunal) (Sec.63-65) TRANSFERABILITY A member can freely A partner can A partner can transfer his OF INTEREST transfer his interest transfer his interest interest subject to the (Sec. 82) subject to the LLP Partnership Agreement Agreement. (Sec. 42) ADMISSION AS A person can become A person can be A person can be PARTNER / MEMBER member by buying admitted as a admitted as a partner as shares of a partner as per the per the partnership company.(Sec.41) LLP Agreement Agreement CESSATION AS A member / A person can cease A person can cease to be PARTNER / MEMBER shareholder can cease to be a partner as a partner as per the to be a member by per the LLP agreement selling his shares. Agreement or in absence of the same by giving 30 days prior notice to the LLP. MANAGERIAL Directors are Designated Partners No requirement of any PERSONS FOR DAY appointed to manage are responsible for managerial persons, the business and other managing the day to partners themselves TO DAY statutory compliances day business and administer the business ADMINISTRATION on behalf of the other statutory AND CONTROLS members.(Sec.269) compliances. (Sec. 7) MEETINGS OF Board Meetings and There is no There is no provision in MEMBERS/ General Meetings are provision in regard regard to holding of any required to be to holding of any meeting DIRECTORS/ convened every year. meeting. PARTNERS (Min- 4 BM and 1 GM) (Sec.165,166,169,285) MAINTENANCE OF The proceedings of A LLP by agreement There is no concept of MINUTES meeting of the board may decide to any minutes of directors / record the shareholders are proceedings of fee Feel free to mail me: csamitkumar@ymail.com Page 4

- 5. Amit Kumar (Amicus Curiae) Jay Mata Di # 9717841557 required to be meetings of the recorded in Partners/Designated minutes.(Sec-193) Partners(Sec. 34) VOTING RIGHTS Voting rights are Voting rights shall It depends upon the decided as per the be as decided as partnership Agreement number of shares held per the terms of LLP by the members. Agreement. (Sec. 87) REMUNERATION OF Company can pay Remuneration to The firm may pay MANAGERIAL remuneration to its partner will depend remuneration to its Directors Max.11% of upon LLP partners (limit is not PERSONS N/P (as per Sec.-198) Agreement (limit is specified) not specified). CONTRACTS WITH Restrictions on Board Partners are free to Partners are free to enter PARTNERS/DIRECTOR regarding some enter into any into any contract. specified contracts, in contract. which directors are interested.(Sec-297) MAINTENANCE OF Required to maintain Required to Required to maintain STATUTORY BOOKS books of accounts, maintain books of books of accounts as Tax statutory registers, accounts. laws AND RECORDS minutes etc. (Sec.- (Section-34) 49,58A,143,150,151, 152,158,193,209,301 303,307,372A etc...) ANNUAL FILING Annual Financial Annual Statement of No return is required to Statement and Annual accounts & be filed with Registrar of Return are required to Solvency and Firms be filed with the ROC Annual Return are every year.(Sec-220, required to be filed 159,160) with Registrar of LLP every year. (Sec. 34(2), 35(1)) SHARE Share Certificates are The ownership of The ownership of the CERTIFICATES proof of ownership of the partners in the partners in the firm is shares held by the firm is evidenced by evidenced by Partnership members in the LLP Agreement. Deed, if any. Company AUDIT OF ACCOUNTS Companies are All LLP except for Partnership firms are required to get their those having only required to have tax accounts audited turnover less than audit of their accounts as annually. Rs.40 Lacs or Rs.25 per the provisions of the Lacs contribution in Income Tax Act. any financial year are required to get their accounts fee Feel free to mail me: csamitkumar@ymail.com Page 5

- 6. Amit Kumar (Amicus Curiae) Jay Mata Di # 9717841557 audited annually. (sec. 34(4)) APPLICABILITY OF Companies have to The necessary rules No Accounting Standards ACCOUNTING mandatorily comply in regard to the are applicable. with accounting application of STANDARDS. standards accounting standards are not yet issued. COMPROMISE / Companies can enter LLP’s can enter into Partnership cannot ARRANGEMENTS / into Compromise / Compromise / merge with other firm or arrangements / merger arrangements / enter into compromise or MERGER / / amalgamation. merger / arrangement with AMALGAMATION (Sec. 390-396A) amalgamation. creditors or partners (Sec. 60-62) OPPRESSION AND Provisions providing No provision relating No remedy exist , in case MISMANAGEMENT for remedy against to redressal in case of oppression of any Oppression and of oppression and partner or mismanagement mismanagement. mismanagement of exists. Partnership. (Sec. 397-409) FIDELITY OR Companies enjoy high Enjoy Creditworthiness of firm CREDIBILITY OF degree of Comparatively depends upon goodwill creditworthiness. higher and creditworthiness of ORGANIZATION creditworthiness its partners. from Partnership due to Stringent regulatory framework but lesser than a company. WHISTLE BLOWING No such provision is Provision has been No such provision is provided under the made to provide provided under Companies Act, 1956. protection to Partnership Act, 1932. employees & partners, providing useful information. (Sec. 31) fee Feel free to mail me: csamitkumar@ymail.com Page 6