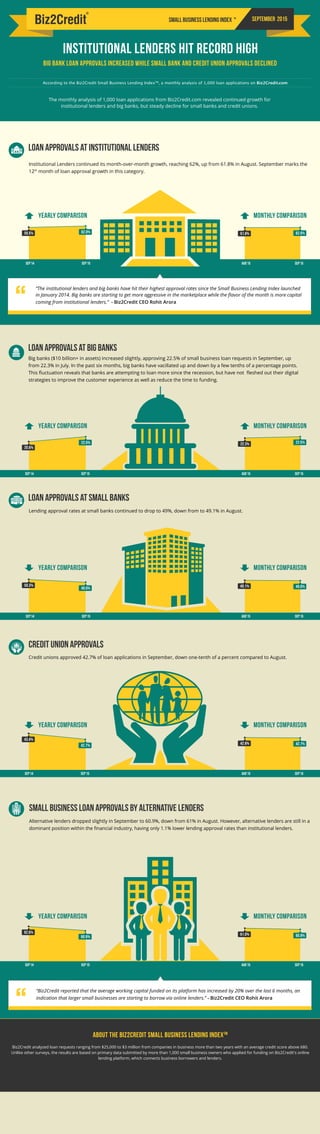

Small business lending index september 2015

•

0 likes•560 views

Big banks increased 22.5% of small business loan requests in September 2015, up from 22.3% in July. In the past six months, big banks up and down by a few tenths of a percentage points.

Report

Share

Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (20)

How lenders can capitalize on the growth in personal loans

How lenders can capitalize on the growth in personal loans

Leveraging data, tech and analytics to improve collections

Leveraging data, tech and analytics to improve collections

2014 Forecast: Entering the 2nd Half Of Market Recovery

2014 Forecast: Entering the 2nd Half Of Market Recovery

U.S. Banks Still Lend Selectively Since the Great Recession

U.S. Banks Still Lend Selectively Since the Great Recession

12 Month Loans Ohio- Long Term Loans No Credit Check

12 Month Loans Ohio- Long Term Loans No Credit Check

Psychology Explains Common Mistakes in Mortgage Refinancing

Psychology Explains Common Mistakes in Mortgage Refinancing

Credit Marketing Strategies to Capture Today's Digital Consumer

Credit Marketing Strategies to Capture Today's Digital Consumer

Top Regulatory Insights for Fintechs & Financial Institutions

Top Regulatory Insights for Fintechs & Financial Institutions

How Alternative Credit Data Provides Lift in Your Portfolio

How Alternative Credit Data Provides Lift in Your Portfolio

Digital Credit Marketing Best Practices and Trends Webinar

Digital Credit Marketing Best Practices and Trends Webinar

Why is it_so_hard_to_get_a_business_loan_by_plousio

Why is it_so_hard_to_get_a_business_loan_by_plousio

Post-Election 2016: What's on the horizon for the financial services industry?

Post-Election 2016: What's on the horizon for the financial services industry?

SERVICE REDEFINED: DEVELOPING BEHAVIOR-BASED PROGRAMS FOR CREDIT UNIONS

SERVICE REDEFINED: DEVELOPING BEHAVIOR-BASED PROGRAMS FOR CREDIT UNIONS

Viewers also liked

It May be Time to Reinvent Your Firm - CPAFMA National Practice Management Co...

It May be Time to Reinvent Your Firm - CPAFMA National Practice Management Co...Tom Hood, CPA,CITP,CGMA

Ten Cities, Four Countries, Five Years: Lessons on the Process of Building Ur...

Ten Cities, Four Countries, Five Years: Lessons on the Process of Building Ur...The Rockefeller Foundation

Viewers also liked (18)

From Surveillance to Service Excellence - Big Data in Financial Services

From Surveillance to Service Excellence - Big Data in Financial Services

Prosper.com Microfinance - SVMN.net mtg 2007-09-10

Prosper.com Microfinance - SVMN.net mtg 2007-09-10

It May be Time to Reinvent Your Firm - CPAFMA National Practice Management Co...

It May be Time to Reinvent Your Firm - CPAFMA National Practice Management Co...

Ten Cities, Four Countries, Five Years: Lessons on the Process of Building Ur...

Ten Cities, Four Countries, Five Years: Lessons on the Process of Building Ur...

How to Use Video to Crush Your B2B Marketing Goals

How to Use Video to Crush Your B2B Marketing Goals

IdeaMart: Case Study in Service Innovation Success, Shafraz Rahim, Dialog Axiata

IdeaMart: Case Study in Service Innovation Success, Shafraz Rahim, Dialog Axiata

6 tendances de la formation professionnelle : quand le digital change la donne

6 tendances de la formation professionnelle : quand le digital change la donne

Similar to Small business lending index september 2015

Similar to Small business lending index september 2015 (20)

Small Business Credit Survey, May 2013 Key Findings

Small Business Credit Survey, May 2013 Key Findings

Online Lending - A Prudent Disruption to the Loaning Economy

Online Lending - A Prudent Disruption to the Loaning Economy

Mercer Capital's Bank Watch | October 2022 | How Are Tech-Forward Banks Perfo...

Mercer Capital's Bank Watch | October 2022 | How Are Tech-Forward Banks Perfo...

Cracks in Consumer Credit Card Delinquency Despite High Cash Balances.pptx

Cracks in Consumer Credit Card Delinquency Despite High Cash Balances.pptx

Mercer Capital's Bank Watch | November 2022 | Community Bank Loan Portfolios ...

Mercer Capital's Bank Watch | November 2022 | Community Bank Loan Portfolios ...

More from Biz2Credit

More from Biz2Credit (20)

Marketing and Managing your Small Business this Summer

Marketing and Managing your Small Business this Summer

Unlocking the Secrets to 50 Percent More Profit - Biz2Credit

Unlocking the Secrets to 50 Percent More Profit - Biz2Credit

The Changing Face of Small Business Owners - Biz2Credit

The Changing Face of Small Business Owners - Biz2Credit

Latino Small Business Owners Lagging Behind - Biz2Credit

Latino Small Business Owners Lagging Behind - Biz2Credit

Small Business Lending Index June 2015 – Biz2Credit

Small Business Lending Index June 2015 – Biz2Credit

Small Business Lending Index January 2015 - Biz2Credit

Small Business Lending Index January 2015 - Biz2Credit

Small Business Lending Index May 2015 – Biz2Credit

Small Business Lending Index May 2015 – Biz2Credit

Small Business Lending Index February 2015 - Biz2Credit

Small Business Lending Index February 2015 - Biz2Credit

Biz2Credit Small Business Lending Index - March 2015

Biz2Credit Small Business Lending Index - March 2015

Biz2Credit Small Business Lending Index - April 2015

Biz2Credit Small Business Lending Index - April 2015

Recently uploaded

Hot Sexy call girls in Rajouri Garden🔝 9953056974 🔝 Delhi escort Service

Hot Sexy call girls in Rajouri Garden🔝 9953056974 🔝 Delhi escort Service9953056974 Low Rate Call Girls In Saket, Delhi NCR

young call girls in kailash Nagar, 🔝 9953056974 🔝 escort Service

young call girls in kailash Nagar, 🔝 9953056974 🔝 escort Service9953056974 Low Rate Call Girls In Saket, Delhi NCR

Authentic No 1 Amil Baba In Pakistan Amil Baba In Faisalabad Amil Baba In Kar...

Authentic No 1 Amil Baba In Pakistan Amil Baba In Faisalabad Amil Baba In Kar...Authentic No 1 Amil Baba In Pakistan

Why Powderless DTF Printer is T-shirt Printing Game Changer.pptx

Why Powderless DTF Printer is T-shirt Printing Game Changer.pptxFei Yue Digital Technology Co., Limited.

Recently uploaded (20)

(8264348440) 🔝 Call Girls In Green Park 🔝 Delhi NCR

(8264348440) 🔝 Call Girls In Green Park 🔝 Delhi NCR

Role of social media marketing in digital marketing.pdf

Role of social media marketing in digital marketing.pdf

Call Girls in Tilak Nagar (DELHI-) 8377877756 Call Girls Service

Call Girls in Tilak Nagar (DELHI-) 8377877756 Call Girls Service

Delhi Munirka 🔝 Call Girls Service 🔝 ( 8264348440 ) unlimited hard sex call girl

Delhi Munirka 🔝 Call Girls Service 🔝 ( 8264348440 ) unlimited hard sex call girl

(8264348440) 🔝 Call Girls In Sriniwaspuri 🔝 Delhi NCR

(8264348440) 🔝 Call Girls In Sriniwaspuri 🔝 Delhi NCR

Report about the AHIABGA-UnityNet UNDRIPDay / Earth-Day 2024 Gathering in Mar...

Report about the AHIABGA-UnityNet UNDRIPDay / Earth-Day 2024 Gathering in Mar...

Hot Sexy call girls in Rajouri Garden🔝 9953056974 🔝 Delhi escort Service

Hot Sexy call girls in Rajouri Garden🔝 9953056974 🔝 Delhi escort Service

young call girls in kailash Nagar, 🔝 9953056974 🔝 escort Service

young call girls in kailash Nagar, 🔝 9953056974 🔝 escort Service

Authentic No 1 Amil Baba In Pakistan Amil Baba In Faisalabad Amil Baba In Kar...

Authentic No 1 Amil Baba In Pakistan Amil Baba In Faisalabad Amil Baba In Kar...

Guwahati Call Girls 7001305949 WhatsApp Number 24x7 Best Services

Guwahati Call Girls 7001305949 WhatsApp Number 24x7 Best Services

Why Powderless DTF Printer is T-shirt Printing Game Changer.pptx

Why Powderless DTF Printer is T-shirt Printing Game Changer.pptx

Gurgaon Rajiv Chowk 🔝 Call Girls Service 🔝 ( 8264348440 ) unlimited hard sex ...

Gurgaon Rajiv Chowk 🔝 Call Girls Service 🔝 ( 8264348440 ) unlimited hard sex ...

Small business lending index september 2015

- 1. 62.0%61.8% Institutional Lenders Hit Record High Big Bank Loan Approvals Increased While Small Bank and Credit Union Approvals Declined SEPTEMBER 2015Small Business Lending Index According to the Biz2Credit Small Business Lending IndexTM , a monthly analysis of 1,000 loan applications on Biz2Credit.com The monthly analysis of 1,000 loan applications from Biz2Credit.com revealed continued growth for institutional lenders and big banks, but steady decline for small banks and credit unions. About the Biz2Credit Small Business Lending IndexTM Biz2Credit analyzed loan requests ranging from $25,000 to $3 million from companies in business more than two years with an average credit score above 680. Unlike other surveys, the results are based on primary data submitted by more than 1,000 small business owners who applied for funding on Biz2Credit's online lending platform, which connects business borrowers and lenders. TM Loan Approvals at Small banks Lending approval rates at small banks continued to drop to 49%, down from to 49.1% in August. “The institutional lenders and big banks have hit their highest approval rates since the Small Business Lending Index launched in January 2014. Big banks are starting to get more aggressive in the marketplace while the flavor of the month is more capital coming from institutional lenders.” - Biz2Credit CEO Rohit Arora“ Loan Approvals at Institutional Lenders Institutional Lenders continued its month-over-month growth, reaching 62%, up from 61.8% in August. September marks the 12th month of loan approval growth in this category. Loan Approvals at Big banks Big banks ($10 billion+ in assets) increased slightly, approving 22.5% of small business loan requests in September, up from 22.3% in July. In the past six months, big banks have vacillated up and down by a few tenths of a percentage points. This fluctuation reveals that banks are attempting to loan more since the recession, but have not fleshed out their digital strategies to improve the customer experience as well as reduce the time to funding. yearly comparison 22.5% 20.6% MONTHLY comparison AUG’15 SEP’15 22.5%22.3% yearly comparison 49.0% 50.3% MONTHLY comparison AUG’15 SEP’15 49.0%49.1% yearly comparison 62.0%59.5% MONTHLY comparison sep’15aug’15 Credit union approvals Credit unions approved 42.7% of loan applications in September, down one-tenth of a percent compared to August. yearly comparison 42.7% 43.4% MONTHLY comparison SEP’14 SEP’15 AUG’15 SEP’15 42.7%42.8% SEP’14 SEP’15 SEP’14 SEP’15 sep’14 sep’15 Small business loan approvals by Alternative lenders Alternative lenders dropped slightly in September to 60.9%, down from 61% in August. However, alternative lenders are still in a dominant position within the financial industry, having only 1.1% lower lending approval rates than institutional lenders. yearly comparison 60.9% 62.6% MONTHLY comparison “Biz2Credit reported that the average working capital funded on its platform has increased by 20% over the last 6 months, an indication that larger small businesses are starting to borrow via online lenders.” - Biz2Credit CEO Rohit Arora “ SEP’14 SEP’15 AUG’15 SEP’15 60.9%61.0%