India Union Budget 2014-15 | A Holistic Plan of Action

- 1. Union Budget 2014-15 10th July, 2014

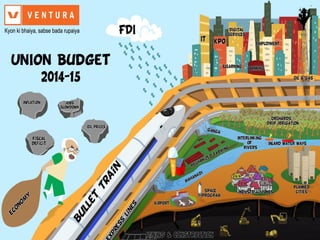

- 2. Union Budget 2014-15 10th July, 2014 Budget 2014-15 Holistic Plan of Action In comparison to the less than ordinary and unimaginative budgetary proposals of yester years, Modi’s maiden budget comes as a welcome change from the norm. The proposals and reforms suggested in the Union Budget 2014-15 are ground breaking, specific with a good measure of thought & common sense and vastly catered for holistic growth of the economy. The challenging circumstances of a slowing economy, soaring energy prices, inflation, fiscal and current account deficits do not provide adequate leeway to maneuver and hit the path of high growth. Yet the Budget provides a comprehensive plan and directional footprint towards overcoming these hurdles to sustainable growth of 7-8% over the next few years along with providing macro economic stability, lowered inflation, realistic fiscal health targeting and a manageable current account deficit. Country is in no mood to suffer unemployment & apathetic governance

- 3. Union Budget 2014-15 10th July, 2014 Budget 2014-15 Holistic Plan of Action The Finance Minister while presenting the budget takes cognizance of the fact that decisive action to fuel growth without populism is the need of the hour. And that resources for developmental expenditure cannot be raised at the cost of burdening the future generations with the legacy of debt. He goes on to emphasize the need to mobilize resources through both tax and non-tax revenues to feed the aspirational developmental expenditure. In order to achieve this objective the Modi Government has taken head on the various issues plaguing the Indian economy and come out with imaginative and yet very practical and implementable reforms and measures. We cannot leave behind a legacy of debt for our future generation

- 4. Union Budget 2014-15 10th July, 2014

- 5. Union Budget 2014-15 10th July, 2014 Economy at standstill Industry • National Industrial Corridor Authority to coordinate the development of the industrial corridors • PSUs capital investment of Rs 2,47,941 crores in FY15 to create a virtuous investment cycle E-Governance will usher in transparency and accountability in the government processes. Faster delivery mechanism in government will be positive for the economy Measures Impact View Boost to industry creation to spur growth eBiz platform aims to create a business and investor friendly ecosystem in India by making all business related clearances available on a 24x7 single portal

- 6. Union Budget 2014-15 10th July, 2014 Industry • The Amritsar Kolkata Industrial master planning will be completed expeditiously for the establishment of industrial smart cities in seven States of India. • The master planning of three new smart cities in the Chennai-Bengaluru Industrial Corridor region, viz., Ponneri in Tamil Nadu, Krishnapatnam in Andhra Pradesh and Tumkur in Karnataka will also be completed • The perspective plan for the Bengaluru Mumbai Economic corridor (BMEC) and Vizag-Chennai corridor would be completed with the provision for 20 new industrial clusters • Kakinada, its adjoining area and the port will be developed as the key drivers of economic growth in the region with a special focus on hardware manufacturing Measures Boost to industry creation to spur growthEconomy at standstill Mission to bring all stakeholders under one umbrella

- 7. Union Budget 2014-15 10th July, 2014 MSME • A committee with representatives from the Finance Ministry, Ministry of MSME, RBI to be formed to give concrete suggestions for improving the financing architecture of MSMEs • A Rs 10,000 crore fund to act as a catalyst to attract private capital by way of providing equity, quasi equity, soft loans and other risk capital for start-up companies • To establish technology centre network to promote innovation, entrepreneurship and agro- industry and set up a fund with a corpus of Rs 200 crore • The definition of MSME will be reviewed to provide for a higher capital ceiling • A programme to facilitate forward and backward linkages with multiple value chain of manufacturing and service delivery will be put in place • Entrepreneur friendly legal bankruptcy framework will also be developed for SMEs to enable easy exit Measures Boost to MSME to generate employment SMEs form the backbone of our Economy. They account for a large portion of our industrial output and employment Economy at standstill

- 8. Union Budget 2014-15 10th July, 2014 Energy Security Incentivized fresh investments; to benefit entire value chain Power • Extension of 10 year tax holiday to the undertakings which begin generation, distribution and transmission of power by FY17 • Gram Jyoti Yojana (Rs 500 crore ) for feeder separation to augment power supply to the rural areas; • Rs 100 crore new scheme to promote efficient thermal power • Clean Energy Cess increased from Rs 50 / tonne to Rs 100 / tonne for expanded scope which includes financing and promoting clean environment Fresh impetus for new investments; entire power sector value chain to benefit significantly Long Term Bullish on Power Sector Measures Impact View Power is a vital input for economic growth and the Government is committed to providing 24x7 uninterrupted power supply to all homes

- 9. Union Budget 2014-15 10th July, 2014 Coal • Adequate quantity for existing and upcoming power plants; • Rationalize coal linkages to optimize transport of coal and reduce cost of power • Rationalization of customs duty on • coking coal hiked from 0% to 2.5%; • steam coal and met coke hiked from 2% to 2.5% • CVD reduced from 6% to 2%; • Reduce overall cost through reduction of inefficiencies in coal production and transportation; • Revive dead investments Coal India – A long term bet; positive for power generation companies Measures Impact View Comprehensive measures for enhancing domestic coal production are being put in place along with stringent mechanism for quality control Focused efforts to remove coal production inefficienciesEnergy Security

- 10. Union Budget 2014-15 10th July, 2014 Oil &Gas • Accelerate production and exploitation of Coal Bed Methane reserves ; scale up usage of PNG rapidly; Build additional 15,000 km of gas pipelines in order to complete the gas grid on PPP basis • Concessional basic customs duty of 5% on machinery and equipment required for setting up of (Bio-CNG) • Overhaul petroleum subsidies, make it more targeted ; new urea policy to be formulated Increased usage of natural gas to reduce dependence on crude oil derivatives easing import requirements Long on Oil and Gas; ONGC, GAIL and Gujarat State Petronet key beneficiaries Measures Impact View I am conscious of the fact that Iraq crisis is leaving an impact on oil prices and the situation in the middle-east continues to be volatile. Promote usage of natural gas to replace conventional fuelEnergy Security

- 11. Union Budget 2014-15 10th July, 2014 Tap the huge potential available in renewable energy Renewable Energy SOLAR ENERGY • Ultra Mega Solar Power Projects in Rajasthan, Gujarat, Tamil Nadu, and Laddakh in J&K; solar power driven agricultural pump sets; development of 1 MW Solar Parks on the banks of canals; Accelerate Green Energy Corridor Project • basic customs duty exemptions on: i) specified inputs for use in the manufacture of EVA sheets and back sheets and ii) flat copper wire for the manufacture of PV ribbons; Extension of the basic customs duty of 5 percent on machinery and equipment for Solar Energy Plant WIND ENERGY Reduction in customs duty from 10% to 5% on forged steel rings used in wind electricity generators; exemption of 4% SAD on raw materials Measures Implementation of the Green Energy Corridor Project will be accelerated to facilitate evacuation of renewable energy across the country Energy Security

- 12. Union Budget 2014-15 10th July, 2014 Tap the huge potential available in renewable energy Renewable Energy Higher investments in renewable energy necessary to meet the growing demand for electricity Bullish on Orient Green Power New and Renewable energy deserves a very high priority Impact View Energy Security

- 13. Union Budget 2014-15 10th July, 2014 Long term funding constraint, taken care of Resource Mobilization • Country to follow PPP model favoured for infrastructure creation. Already delivered 900 projects delivered on PPP basis. 3P, an institution to support mainstreaming of PPPs to be set up with corpus of Rs 500 crores • Banks permitted to raise long term funds for lending to infrastructure sector with minimum regulatory preemption such as CRR, SLR and PSL • Proposal to create Infrastructure Investment Trusts with pass through benefits • Long term funding will be readily available as banks are in a much better position to mobilize resources • Monetization of investments in existing projects and raising resources for new projects will be easier Positive for long gestation infrastructure projects. Major beneficiaries like IRB, ITNL, L&T, etc Measures Impact View India has emerged as the largest PPP market in the world with over 900 projects in various stages of development Infrastructure Dvpt

- 14. Union Budget 2014-15 10th July, 2014 Fresh impetus to road creation Roads • Investment in NHAI and State Roads to the tune of Rs 37,880 crores, which includes. Target for NH construction set at 8500 km for FY15. (23 km /day) • To initiate work on select expressways in parallel to the development of the Industrial Corridors. For project preparation NHAI shall set aside a sum of Rs 500 crore Road construction which has languished for years will get the necessary boost and go back to therate of ~20km/day road construction which was achieved during previous NDA rule Bullish on infrastructure sector. Road developers like IRB, Sadbhav Engg and major EPC beneficiaries Measures Impact View Roads sector constitutes a very import artery of communication in the country Infrastructure Dvpt

- 15. Union Budget 2014-15 10th July, 2014 Renewed focus on ports & SEZ development Ports & SEZs • Sixteen new port projects proposed with a focus on port connectivity • Rs 11,635 crore will be allocated for the development of Outer Harbour Project in Tuticorin • Effective steps to operationalize the SEZ Zones • SEZs in Kandla and JNPT New ports will give further impetus to import/export sector as well as decongest the traffic at the existing ports Positive for ports and logistic sector. Major beneficiaries Adani Ports , Gujarat Pipavav, Sical Logistics, SCI, Great Eastern Shipping, ABG Shipyard, L&T, Pipavav Defense Measures Impact View Infrastructure Dvpt Development of ports is also critical for boosting trade

- 16. Union Budget 2014-15 10th July, 2014 Improving connectivity Airports, Waterways & Shipping • Development of new airports in Tier I and Tier II through Airport Authority of India or PPPs • Comprehensive policy to promote Indian ship building industry will be announce in FY15 • SEZs will be developed in Kandla and JNPT • Development of inland waterways. ‘Jal Marg Vikas’ (National Waterways-I) will be developed between Allahabad and Haldia to cover a distance of 1620 kms at cost of Rs 4200 crore in 6 years Inland waterways can vastly improve capacity for the transportation of goods in an economical manner. New airports will bring air-travel within reach of millions of Indian Positive for GMR, GVK, ABG Shipyard, L&T, Pipavav Defense Measures Impact View Despite increase in air connectivity air travel is still out of reach of a large number of aspirational Indians Infrastructure Dvpt

- 17. Union Budget 2014-15 10th July, 2014 Investments in real estate through new channels Real Estate • Incentives for REITs which will have pass through for the purpose of taxation • Tax exemption limit increased for self occupied property from Rs 1.5 lakh to Rs 2 lakh • REITs would attract long term finance from foreign and domestic sources and reduce the pressure on the banking system while also making available fresh equity • Will ease liquidity condition of developers by giving new access to capital by aiding faster monetization of their assets Positive for DLF, Prestige Estate, Phoenix Mills, Oberoi Realty, Nesco, Puravankara Projects Measures Impact View REITs have been successfully used as instruments for pooling of investment in several countries Infrastructure Dvpt

- 18. Union Budget 2014-15 10th July, 2014 New smart cities on anvil Smart Cities • To encourage development of Smart Cities, requirement of the built up area and capital conditions for FDI is being reduced from 50,000 Sqm to 20,000 Sqm and from $10 mn to $5 mn respectively with a three year post completion lock in • Projects which commit at least 30 per cent of the total project cost for low cost affordable housing will be exempted from minimum built up area and capitalization requirements, with the condition of three year lock-in Smart cities will provide habitation for the neo-middle class and help reduce the burden on existing cities Positive for players like HCC which have project execution experience (Lavasa) Measures Impact View The Prime Minister has a vision of developing ‘one hundred Smart Cities’, as satellite towns of larger cities and by modernizing the existing mid-sized cities Infrastructure Dvpt

- 19. Union Budget 2014-15 10th July, 2014 Housing • Mission on Low Cost Affordable Housing in urban areas (anchored in NHB) • Rs 4,000 crores to NHB to increase flow of cheaper credit for affordable housing to the urban poor/EWS/LIG segment • Inclusion of slum re-development in CSR activities • Rs 8,000 crore to NHB to expand and continue to support Rural Housing Impetus to housing sector in urban areas benefiting the poor and lower middle class Positive for players like HDIL, Indiabulls Real Estate, Prestige as well as housing financing companies such as LIC HF, HDFC, etc Measures Impact View Affordable housing accorded a top priority Housing continues to be an area of concern for middle and lower middle class due to high cost of financing Infrastructure Dvpt

- 20. Union Budget 2014-15 10th July, 2014 Rural Development • Shyama Prasad Mukherji Rurban Mission to deliver integrated project based infrastructure (also include development of economic activities and skill development) • Better and more energetic PMGSY with funding of Rs 14,389 crore Infrastructure development in rural areas will have a multiplier effect on rural economy and in turn will add to India’s growth Measures Impact Development of rural areas in focus PMGSY initiated during the NDA-I under the stewardship of Prime Minister Atal Behari Vajpayee has had a massive impact in improvement of access for Rural population. Infrastructure Dvpt

- 21. Union Budget 2014-15 10th July, 2014 Urban Development • Provision of safe drinking water and sewerage management, use of recycled water for growing organic fruits and vegetable, solid waste management and digital connectivity will be key focus areas for urban development • At least 500 such habitations will be provided support, while harnessing private capital and expertise through PPPs, to renew infrastructure and services in the next ten years • Pooled Municipal Debt Obligation Facility to be increase to Rs 50,000 crore from the current Rs 5,000 crore to support infrastructure development Urban areas crumbling under burgeoning population due to lack of infrastructure, will benefit from these steps Positive for players like VA Tech Wabag, Ion Exchange India, Thermax Measures Impact View Development of urban areas a top priority It is time that our cities and towns undergo urban renewal and become better places to live in Infrastructure Dvpt

- 22. Union Budget 2014-15 10th July, 2014 Mining • Measures for enhancing domestic coal production are being put in place including supply of crushed coal and setting up of washeries. • Existing impasse in the coal sector to be resolved and adequate quantity of coal will be provided to power plants which are already commissioned to be commissioned by March 2015 • Exercise to rationalize coal linkages which will optimize transport of coal and reduce cost of power is underway. • Government will work towards encouraging investments in mining and resolving the issues in iron ore mining in an expedite manner Mining sector which has come to a standstill due to environmental concerns and court interventions to receive a boost from these initiatives Positive for mining as well as power sector Measures Impact View Mining sector to break the shackles The current impasse in mining sector, including, iron ore mining, will be resolved expeditiously Infrastructure Dvpt

- 23. Union Budget 2014-15 10th July, 2014 • Pradhan Mantri Gram Sadak Yojana – Rs 14,389 crore • Providing wage and self-employment opportunities in rural areas under MGNREGA • Allocated Rs 200 crore for start up entrepreneurs from scheduled castes • To develop and promote handloom products – Rs 50 crore • To setup 6 more textile mega-clusters – Rs 200 crore • Emphasis on improving Tourism and developing manufacturing sector to aid job creation • Will lead to asset creation substantially linked to agriculture and allied activities Job Scarcity Eliminate poverty through sustainable livelihood options I am sure these measures would incentivize value addition, generate income and create more jobs in India Measures Impact

- 24. Union Budget 2014-15 10th July, 2014 Inflation • Fiscal deficit to be reined at 4.1% of GDP in FY15, 3.6% in FY16 and 3.0% in FY17. • Restructuring FCI, reducing transportation and distribution losses and improving efficacy of PDS. • Wheat and rice to be provided at reasonable prices to the weaker sections of the society. • Government shall undertake open market sales to keep prices under control. • Kisan TV, to disseminate real time information to the farmers regarding new farming techniques, water conservation, organic farming etc. • To incentivize expansion of processing capacity, excise duty on specified food processing and packaging machinery to be reduced from 10% to 6%. • To develop scientific warehousing infrastructure in the country, an allocation of Rs 5,000 crore has been done for the year FY15. Measures Various measure to tackle food inflation We look forward to lower levels of inflation as compared to the days of double digit rates of food inflation in the last two years

- 25. Union Budget 2014-15 10th July, 2014 Financial Indiscipline A challenge to curb 4.8% 5.7% 4.8% 5.4% 4.6% 4.1% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 2010-11 2011-12 2012-13 2013-14BE 2013-14RE 2014-15BE As % of GDP Continuance of fiscal consolidation cannot be compromised while providing for the essential items Fiscal Deficit

- 26. Union Budget 2014-15 10th July, 2014 Should be of lesser concern going forward I also propose to overhaul the subsidy regime and make it more targeted while providing full protection to the marginalized and poor 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 50000 150000 250000 350000 450000 550000 2010-11 2011-12 2012-13 2013-14BE 2013-14RE 2014-15BE Rs.Crore Food Fertilizers Petroleum Interest and Others Total Subsidies Subsidies as a %of GDP (RHS) Subsidies Financial Indiscipline

- 27. Union Budget 2014-15 10th July, 2014 Creeping up beyond 3% of GDP; worrisome 2.5% 2.6% 2.7% 2.8% 2.9% 3.0% 3.1% 3.2% 3.3% 3.4% 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 2010-11 2011-12 2012-13 2013-14RE 2014-15BE Rs. in Crore Int. Payment and Debt Servicing (LHS) Interest Payment as a %of GDP (RHS) We cannot leave behind a legacy of debt for our future generations Interest Payments Financial Indiscipline

- 28. Union Budget 2014-15 10th July, 2014 Positively growth oriented 0 100000 200000 300000 400000 500000 600000 2010-11 2011-12 2012-13 2013-14RE 2014-15BE Rs. in Crore RE- State Plan RE- Central Plan CE- State Plan CE- Central Plan Total Plan Expenditure Revenue Expenditure (RE) I want to reiterate my Government’s firm commitment to strengthen the federal structure of the country Plan Expenditure Financial Indiscipline

- 29. Union Budget 2014-15 10th July, 2014 Defense expenditure increased substantially -100000 100000 300000 500000 700000 900000 1100000 1300000 2011-12 2012-13 2013-14BE 2013-14RE 2014-15BE Rs. in Crore RE - Int Payment & Debt Servicing RE- Defence RE- Subsidies RE Others CE- Loan and Advances to State, UT CE- Defence CE- Others Total Non-Plan Expenditure Revenue Expenditure (RE) While preparing Non-Plan estimates due care has been taken to fully provide for all the essential activities Non Plan Expenditure Financial Indiscipline

- 30. Union Budget 2014-15 10th July, 2014 Initiatives to kick start growth; control spending 0 200000 400000 600000 800000 1000000 1200000 1400000 1600000 2011-12 2012-13 2013-14BE 2013-14RE 2014-15BE Rs. in Crore Corporation tax Income tax Wealth Tax Customs Union Excise Duties Service Tax Taxes of the Union Direct Total Fiscal prudence to me is of paramount importance because of considerations of inter-generational equity Budgetary Measures Financial Indiscipline

- 31. Union Budget 2014-15 10th July, 2014 Agricultural Stagnation Heralding a technology driven second green revolution • Pradhan Mantri Krishi Sinchayee Yojana (RS 1,000 crore) to provide assured irrigation and mitigate risk of monsoon vagrancy. • Agrciulture Research institutes (one each in Assam and Jharkhand) along the lines of Indian Agriculture Research Institute, Pusato be set up (Rs 100 crore allocation) • Rs 100 crore Agri Tech Infrastructure Fund • Agriculture Universities in Andhra Pradesh and Rajasthan and Horticulture Universities in Telangana and Haryana proposed (Rs 200 crore ) • Soil Health Card (Rs 100 crore) for every farmer; 100 Mobile Soil Testing Laboratories pan India • Rs 100 crore “National Adaptation Fund” to tackle climate change • Provide finance to 5 lakh joint farming groups of “Bhoomi Heen Kisan” through NABARD Measures We are committed to sustaining a growth of 4% in agriculture

- 32. Union Budget 2014-15 10th July, 2014 Stable tax regime committed to investors • No more retrospective changes which creates a fresh liability • All fresh cases arising out of the retrospective amendments of 2012 will be scrutinized by a High Level Committee to be constituted by the CBDT • Income arising to foreign portfolio investors from transaction in securities to be treated as capital gains; will remove uncertainty for Foreign Portfolio Investors (FPIs) on taxation arising on account of characterization of their income • Income-tax Department to function as a facilitator as well ; 60 more Aykar Seva Kendras (ASK) to be opened to facilitate service delivery • Resident taxpayers enabled to obtain an advance ruling in respect of their income tax liability above a defined threshold; strengthen the Authority for Advance Rulings by constituting additional benches • Enlarge the scope of the Income-tax Settlement Commission to make it easy for taxpayers to approach the Commission for settlement of disputes • Set up a High Level Committee to interact with trade and industry on a regular basis • E biz platform marking all business investment related clearances & compliances on a 24*7 single portal . All central government department & Ministry to integrate by end CY14. I hope the investor community both within India and abroad would repose confidence and participate in the Indian growth story with renewed vigour. Measures Business Confidence

- 33. Union Budget 2014-15 10th July, 2014 Increase in tax exemption limits to boost disposable income Direct Taxes • No changes made in personal tax rates • Personal tax exemption limit increased from Rs 2 lakh to Rs 2.5 lakh and from Rs 2.5 lakh to Rs 3 lakh for senior citizens • Investment limit under section 80 C increased from Rs 1 lakh to Rs 1.5 lakh ; deduction limit on account of interest on loan in respect of self occupied house property increased from Rs 1.5 lakh to Rs 2 lakh Housing continues to be an area of concern for middle and lower middle class due to high cost of financing Measures Tax Conundrum Impact Increase in tax exemption limit will increase the disposable income, thereby boosting consumer spending View Bullish for FMCG and HFCS & Banks entities such as banks and LIC Housing Finance

- 34. Union Budget 2014-15 10th July, 2014 Streamlining tax structures for various instruments Direct Taxes • Income arising to foreign portfolio investors from transaction in securities will be treated ascapital gains; concessional rate of 15 percent on foreign dividends to continue without any sunset date Tax on long term capital gains on mutual funds (other than equity oriented funds) increased from 10 to 20 percent and holding increased from one year to 36 months; removed tax arbitrage enjoyed by debt mutual funds over fixed deposits • Removed the anomaly on divided distribution tax for corporate and mutual fund • Government to review the Direct Taxes Code Bill, 2010 which lapsed with the dissolution of the 15th Lok Sabha. Savings may switch to Fixed Deposits from Debt Mutual Funds Net Effect of the direct tax proposals is revenue loss of Rs 22,200 crore Measures Tax Conundrum Impact View Positive on Banks

- 35. Union Budget 2014-15 10th July, 2014 Introduction of GST to smoothen tax related complications Indirect Taxes • To make efforts to introduce the Goods and Services Tax (GST) this fiscal; introduction will streamline tax administration and result in higher revenue collection The debate whether to introduce a Goods and Services Tax (GST) must now come to an end. Measures Tax Conundrum

- 36. Union Budget 2014-15 10th July, 2014 Increased efforts to reduce litigation on transfer pricing issues • Strengthen the administrative set up of the Advance Pricing Agreement (APA) scheme to expedite disposal of applications. • Introduce a “Roll Back” provision in the APA scheme wherein an APA entered into for future transactions may also be applied to international transactions undertaken in previous four years in some circumstances. • Introduce range concept for determination of arm’s length price in order to align Transfer Pricing regulations in India with the best available practices • Allow the use of multiple year data (earlier only one year data) for comparable analysis Transfer Pricing is a major area of litigation for both resident and nonresident taxpayers Measures Tax Conundrum

- 37. Union Budget 2014-15 10th July, 2014 FDI limit increase to boost foreign inflows • Composite cap of FDI increased from 26 to 49 percent in defense manufacturing and insurance • Steps to promote the deep and liquid corporate bond market; deepen the currency • derivatives market by eliminating unnecessary restrictions • Extend a liberalized facility of 5% withholding tax to all bonds issued abroad and extend the validity of the scheme to 30.06.2017 • Liberalize the ADR/GDR regime to allow issuance of depository receipts on all permissible securities; introduce a much more liberal Bharat Depository Receipt (BhDR). • Allow international settlement of Indian debt securities • Reintroduction of Kissan Vikas Patra to encourage people, with banked and unbanked savings to invest • Retail investors to get direct shareholding in PSU banks; will help raise Rs 2400 bn by 2018 to meet Base-III norms • Introduction of uniform KYC norms and inter-usability of the KYC; introduce one single operating demat account Globalization helps channelize external savings to India to bridge the resource gap but also renders financial sector vulnerable to the vagaries of the global economy. Measures Resource crunch

- 38. Union Budget 2014-15 10th July, 2014 Increased efforts to reduce litigation on transfer pricing issues Benefits of insurance in India have not reached a large section of the people and insurance penetration and density are very low. Impact Resource crunch Banking Participation of retail investors in bank capitalization will lower the burden for capital infusion by the government; emphasis on stressed asset recovery positive for banks’ financial health; boost to the insurance sector Long on Public and Private Banks View

- 39. Union Budget 2014-15 10th July, 2014 Focus on financial inclusion and recovery of stressed assets Banking • A Financial Inclusion Mission to be launched on 15th August 2014; would particularly focus to empower the weaker sections of the society • Structure to be put in place for continuous authorization of universal banks in the private sector • Give greater autonomy to banks while making them more accountable • RBI to create a framework for licensing small banks and other differentiated banks • Six new Debt Recovery Tribunals would be set up at Chandigarh, Bengaluru, Ernakulum, Dehradun, Siliguri and Hyderabad for recovery of stressed assets • Bridge the regulatory gap under the Prize Chits and Money Circulation Scheme (Banning) Act, 1978; • Small savings instrument to cater to the requirements of educating and marriage of the Girl Child will be introduced; a National Savings Certificate with insurance cover will also be launched • Suitable incentives, using banking correspondents, strengthening micro-offices to boost the insurance sector; take up the pending insurance laws (amendment) Bill for consideration of the Parliament. Financial stability is the foundation of a rapid recovery. Our banking system needs to be further strengthened. Measures Resource crunch

- 40. Union Budget 2014-15 10th July, 2014 • Clean energy cess increased from Rs 50 per tonne to Rs 100 per tonne levied on coal, peat and lignite mining • Increase in cost for mining companies Environmental Issues Financing and promoting clean energy initiatives Cess to include financing and promoting clean environment initiatives Measures Impact

- 41. Union Budget 2014-15 10th July, 2014 Water Management Measures • In line to give an added impetus to watershed development in FY14-15,New Programme called “Neeranchal” proposed with an initial outlay of Rs 2,142 crores. • Rs 500 crore has been allocated for water reforms in NCT Delhi • Rs.3,600 crore to be used for national drinking water programme • A sum of Rs. 100 crore to expedite the preparation of Detailed Project Reports (on river linking) has been set aside. • Namami Ganga", an integrated Ganga Development Project; Rs 2,037 crore set aside, which will also be boosted by NRIs’ fund • Rs.100 crore set aside for ghat development and beautification of the river front at Kedarnath, Haridwar, Kanpur, Varanasi, Allahabad, Patna and Delhi. Focused on safe drinking water Rivers form the lifeline of our country.

- 42. Union Budget 2014-15 10th July, 2014 • The composite limit of foreign investment is being raised to 49% with full Indian management and control through the FIPB route • Allocated Rs 2,29,000 crore for defence expenditure in FY15 • Rs 1,000 crore further allocated for developing railway near borders • Will lead to foreign currency inflow in the country • Government expenditure on the defence sector will be reduced shrinking the fiscal deficit Positive for L&T, BEL, BHEL, Bharat Forge, Tata Power (JV’s with foreign tech players) Defence & Int Security Foreign ownership limit raised to 49% There can be no compromise with the defence of our country Measures Impact View

- 43. Union Budget 2014-15 10th July, 2014 Neglected North East • Investment in NHAI and state highways to the tune of Rs 37,887 core including Rs 3000 crore for Northeast • An allocation of Rs 53,706 crore has been made for the overall development in North Eastern region in FY14-15 • Organic farming of North East region to receive Rs 100cr • To provide a strong platform to rich cultural and linguistic identity of the North East, a 24x7 channel ‘Arun Prabha’ will be launched • Rs 1000 crore will be provided for rail connectivity in North-east region • Sports university to be established in Manipur Measures Bridging the gap North Eastern Region of India has tremendous potential for development

- 44. Union Budget 2014-15 10th July, 2014 • Rs 33,601 crore allocated for improving school infrastructure facilities • Allocated Rs 100 crore for setting up virtual classrooms • To set up five more IITs and IIMs – Rs 500 crore • Have proposed to ease and simplify norms to facilitate education loans for higher studies. Miscellaneous allocations One of the major priorities Measures The country needs a large number of Centers of higher learning

- 45. Union Budget 2014-15 10th July, 2014 • To set up national level sports academies for major games across the country • Allocated Rs 200 crore for upgrading stadiums in Jammu and Kashmir valley • To transform employment exchanges in to career centres – Rs 100 crore • Will lead to development of brand India • Tourism to improve further, leading to more job creation Improve Tourism, Hospitality and Infrastructure in the country Miscellaneous allocations Encourage youth and improve sports Sports are an integral part of growing up and personality development Measures Impact View

- 46. Union Budget 2014-15 10th July, 2014 • Greater transparency in government processes through IT enabled platforms • National Rural Internet and Technology Mission for services in villages and schools – Rs 500 crore • More acceptance of internet and technology in rural India Miscellaneous allocations Imminent need to further bridge the divide To ensure Broad band connectivity at village level Measures Impact

- 47. Union Budget 2014-15 10th July, 2014 • Allocated Rs 200 crore to support the Gujarat Government for the mission to build statue of Sardar Vallabh Bhai Patel Miscellaneous allocations National Pride Measures

- 48. Union Budget 2014-15 10th July, 2014 • Allocated Rs 50,548 crore for welfare of SC and ST and further Rs 32, 387 crore under TSP • Allocation of Rs 100 crore for welfare of the tribals • Pension scheme for senior citizens under Varishtha Pension Bima Yojana • An outlay of Rs 50 crores will be spent towards safety for women on public road transport • Allocated Rs 150 crore to increase the safety of women in large cities Miscellaneous allocations Safety and Welfare Measures Women’s safety is a concern

- 49. Union Budget 2014-15 10th July, 2014 • Allocated Rs 3,600 crore for providing safe drinking • Allocated Rs 500 crore to set up 12 more government medical colleges • Improving affordable healthcare in rural India • National programme launched to improve malnutrition situation in India Miscellaneous allocations Health for All A national programme in Mission Mode is urgently required to halt the deteriorating malnutrition situation in India Measures

- 50. Union Budget 2014-15 10th July, 2014 • Several major space missions are planned in FY15 viz. flight of heavy capacity launcher GSLV Mk- III, one launch of PSLV and two navigational satellites • Mars Orbiter spacecraft expected to be orbiting from September 24, 2014 • Improvement in weather forecasting, channel broadcasting and internet technology Miscellaneous allocations Several major space missions are planned in FY15 Measures Impact Several major space missions are planned in FY15

- 51. Union Budget 2014-15 10th July, 2014 FMCG •Excise duty hiked for cigarettes in the range from 11-72% •Custom Duty on fatty acids, crude palm stearin, RBD and other palm stearin and specified industrial grade crude oils is being reduced from 7.5% to 0% for manufacture of soaps and oelochemicals subject to actual user condition •Excise duty on specified food processing and packaging machinery reduced from 10% to 6%. •Increase in cost of cigarettes, which will be passed on to the consumers. •Soap manufacturers will benefit from reduction in customs duty •Packaging companies and food processing industry will benefit from excise duty reduction Negative for ITC, Godfrey Phillips. Positive for HUL, GCPL, Britannia, Nestle, GSK Consumers, Paper Products, Manjushree Technopack Measures Impact View Consumer segment to receive further boost I propose to increase the specific excise duty on cigarettes in the range of 11 percent to 72 percent Miscellaneous

- 52. Union Budget 2014-15 10th July, 2014 Consumer Durables • Colour picture tubes exempted from basic customs duty to make cathode ray TVs cheaper and reduction in excise duty to nil for LCD and LED TV’s below 19 inches Will reduce the overall costs for end consumers and boost manufacturing domestically Positive for Videocon Measures Impact View To encourage manufacturing of TV in the country Cathode ray TVs are used by weaker sections who cannot afford to buy more expensive flat panel TVs Miscellaneous

- 53. Union Budget 2014-15 10th July, 2014 Farm Equipment • Financing 0.5 mn farmers through NABARD. • Planned banking agricultural disbursement at Rs 800000 crore. • Interest subvention at 7%. Additional 4% for timely payment. • • • Beneficial for farm equipment manufacturers • Positive for M&M and VST Tillers Measures Impact View Indirectly supporting the farm equipment sector I propose to provide finance to 5 lakh joint farming groups of “Bhoomi Heen Kisan” through NABARD in the current financial year Miscellaneous

- 54. Union Budget 2014-15 10th July, 2014 Automobiles • Excise duty concessions extended beyond 30th June 2014 for a period of 6 months up to 31st December 2014 • To continue with this concessional rate of 15% on foreign dividends without any sunset date • As excise duty decision was taken few days back, it won’t have any impact on sector • Indian companies with foreign subsidiaries to benefit from continuation of concessional rate • Neutral for auto sector. Positive for Tata Motors. Measures Impact View No more negative is a big positive I have already extended the excise duty concessions beyond 30th June 2014 for a period of 6 months up to 31st December 2014 Miscellaneous

- 55. Union Budget 2014-15 10th July, 2014 Media • Service tax will be levied on sale of space or time for advertisements in online and mobile advertising. • • • Slightly negative for e-Commerce players • Negative for Infoedge Measures Impact View No major announcement I propose to provide finance to 5 lakh joint farming groups of “Bhoomi Heen Kisan” through NABARD in the current financial year Miscellaneous

- 56. Union Budget 2014-15 10th July, 2014 Budget Summary Nominal GDP to grow at 13% policy regime that will result in the desired macro-economic outcome of higher growth, lower inflation, sustained level of external sector balance and a prudent policy stance (Rs. in Crore) 2011-12 2012-13 2013-14BE 2013-14RE 2014-15BE Chg FY14 BE/RE Chg BE FY15/FY14 Revenue Receipts 751,436 879,232 1,056,331 1,029,252 1,189,763 -3% 16% Net Tax Revenue 629,764 741,877 884,078 836,026 977,258 -5% 17% Non tax Revenue 121,671 137,354 172,252 193,226 212,505 12% 10% Capital Receipts 568,918 531,139 608,967 561,182 605,129 -8% 8% Recoveries of receipts 18,850 15,060 10,654 10,803 10,527 1% -3% Other Reciepts (Disinvestments) 18,088 25,890 55,814 25,841 63,425 -54% 145% Debt Reciepts 531,980 541,202 542,499 524,539 514,016 -3% -2% Total Receipts 1,320,354 1,410,371 1,665,298 1,590,434 1,794,892 -4% 13% Non Plan Expenditure 891,991 996,745 1,109,974 1,114,903 1,219,891 0% 9% Non Plan Revenue 812,049 914,304 992,907 1,027,687 1,114,609 4% 8% Interest Payments 273,150 313,170 370,684 380,066 427,011 3% 12% Non Plan Capital 79,941 82,441 117,067 87,215 105,282 -25% 21% Plan Expenditure 412,375 413,625 555,322 475,532 575,000 -14% 21% Plan Revenue 333,737 329,208 443,260 371,851 453,503 -16% 22% Plan Capital 78,638 84,417 112,062 103,681 121,497 -7% 17% Total Expenditure 1,304,366 1,410,370 1,665,296 1,590,434 1,794,891 -4% 13% GDP Nominal 8,974,947 10,159,884 10,020,620 11,320,463 12,839,952 13% 13% Gross Fiscal Deficit 515,990 490,597 542,499 524,539 531,177 -3% 1% Fiscal deficit as a % of GDP 5.7% 4.8% 5.4% 4.6% 4.1% -14% -11% Revenue Deficit 394,348 365,896 379,838 370,288 382,923 -3% 3% Revenue deficit as a % of GDP 4.4% 3.6% 3.8% 3.3% 3.0% -14% -9% Primary Deficit 242,840 177,428 171,814 144,473 101,620 -16% -30% Primary deficit as a % of GDP 2.7% 1.7% 1.7% 1.3% 0.8% -26% -38%

- 57. Union Budget 2014-15 10th July, 2014 Ventura Securities Limited Corporate Office: C-112/116, Bldg No. 1, Kailash Industrial Complex, Park Site, Vikhroli (W), Mumbai – 400079 This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither Ventura Securities Limited nor any of the contributors accepts any liability arising out of the above information/articles. Reproduction in whole or in part without written permission is prohibited. This report is for private circulation.