Bankmed DIFC 2016 Conference Presentation by Bruno Gremez and Samir Kasmi of CT&F.

•

0 likes•104 views

Joined presentation by Bruno Gremez of CT&F and Bankmed at DIFC about impacts of oil developments on the region and the opportunities it offers Dubai as a trading hub.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

MEED presentationMiddle east opportunities for scottish edited companies - scottish enterpris...

Middle east opportunities for scottish edited companies - scottish enterpris...Raquel Largo Martinez

More Related Content

What's hot

What's hot (17)

The liberia sweden joint trade mission continue releases

The liberia sweden joint trade mission continue releases

A closer look at australia’s tourism investment sector

A closer look at australia’s tourism investment sector

Lebanon logistics assessment italy presentation imdad

Lebanon logistics assessment italy presentation imdad

Paul Caplis, Head of Investments, UK Trade & Investment. Nov 2013

Paul Caplis, Head of Investments, UK Trade & Investment. Nov 2013

Omassmann investing and doing business in vietnam (0506)

Omassmann investing and doing business in vietnam (0506)

TechMoney: Prepping for Diligence The Technical Side of Raising Capital

TechMoney: Prepping for Diligence The Technical Side of Raising Capital

Country Risk Analysis of Country:- Spain and Austria

Country Risk Analysis of Country:- Spain and Austria

Similar to Bankmed DIFC 2016 Conference Presentation by Bruno Gremez and Samir Kasmi of CT&F.

MEED presentationMiddle east opportunities for scottish edited companies - scottish enterpris...

Middle east opportunities for scottish edited companies - scottish enterpris...Raquel Largo Martinez

Jeffrey Nugent, University of Southern California

ERF and AFESD conference on: Monetary and Fiscal Institutions in Resource-Rich Arab Economies

Kuwait, November 4-5, 2015

For more info, please visit www.erf.org.eg

Session on: Oil and Fiscal Policy

Fiscal institutions are critical links between oil prices, oil revenues, revenue volatility. As is currently witnessed, low oil prices raise questions about the sustainability of public spending and loose public finances. This is why Arab countries must now improve their budgetary institutions and overall fiscal discipline. This session will review the quality of budgetary institutions in resource-rich Arab economies. It will also examine the long-run effects of oil revenue and its volatility on economic growth, as well as the role of institutions in this relationship.Fiscal Institutions Fiscal Institutions and Macroeconomic Management in Arab ...

Fiscal Institutions Fiscal Institutions and Macroeconomic Management in Arab ...Economic Research Forum

Similar to Bankmed DIFC 2016 Conference Presentation by Bruno Gremez and Samir Kasmi of CT&F. (20)

Middle east opportunities for scottish edited companies - scottish enterpris...

Middle east opportunities for scottish edited companies - scottish enterpris...

"ทิศทางสินค้าไทยดันยอดขายให้โตในตลาดอาหรับ" SME Webinar สัมมนาออนไลน์

"ทิศทางสินค้าไทยดันยอดขายให้โตในตลาดอาหรับ" SME Webinar สัมมนาออนไลน์

Bearing the african banking & financial institutions seminar presentation -...

Bearing the african banking & financial institutions seminar presentation -...

Fiscal Institutions Fiscal Institutions and Macroeconomic Management in Arab ...

Fiscal Institutions Fiscal Institutions and Macroeconomic Management in Arab ...

Bearing the evolution of the african bank presentation - july 2010

Bearing the evolution of the african bank presentation - july 2010

More from Bruno Gremez

More from Bruno Gremez (16)

Feasibility Study on Employer-Sponsored Small Dollar Loans

Feasibility Study on Employer-Sponsored Small Dollar Loans

McKinsey analysis and key lessons for US regional banks

McKinsey analysis and key lessons for US regional banks

Dubai SME: the state of SME Equity Financing in Dubai.

Dubai SME: the state of SME Equity Financing in Dubai.

The state of the financial services industry 2017.

The state of the financial services industry 2017.

TXF 2016 Conference: joint presentation by Bruno Gremez and Samir Kasmi of CT...

TXF 2016 Conference: joint presentation by Bruno Gremez and Samir Kasmi of CT...

GTR 2017 Conference : joint presentation by Bruno Gremez and Samir Kasmi of C...

GTR 2017 Conference : joint presentation by Bruno Gremez and Samir Kasmi of C...

Recently uploaded

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. Gibson, Verified Chapters 1 - 13, Complete Newest Version.Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...rightmanforbloodline

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974🔝✔️✔️ Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes. We provide both in- call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease. We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us. Our services feature various packages at competitive rates: One shot: ₹2000/in-call, ₹5000/out-call Two shots with one girl: ₹3500 /in-call, ₱6000/out-call Body to body massage with sex: ₱3000/in-call Full night for one person: ₱7000/in-call, ₱10000/out-call Full night for more than 1 person : Contact us at 🔝 9953056974🔝. for details Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations. For premium call girl services in Delhi 🔝 9953056974🔝. Thank you for considering us Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Recently uploaded (20)

Test bank for advanced assessment interpreting findings and formulating diffe...

Test bank for advanced assessment interpreting findings and formulating diffe...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

Fixed exchange rate and flexible exchange rate.pptx

Fixed exchange rate and flexible exchange rate.pptx

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

logistics industry development power point ppt.pdf

logistics industry development power point ppt.pdf

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

Kurla Capable Call Girls ,07506202331, Sion Affordable Call Girls

Kurla Capable Call Girls ,07506202331, Sion Affordable Call Girls

cost-volume-profit analysis.ppt(managerial accounting).pptx

cost-volume-profit analysis.ppt(managerial accounting).pptx

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Vip Call Girls Rasulgada😉 Bhubaneswar 9777949614 Housewife Call Girls Servic...

Vip Call Girls Rasulgada😉 Bhubaneswar 9777949614 Housewife Call Girls Servic...

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Female Russian Escorts Mumbai Call Girls-((ANdheri))9833754194-Jogeshawri Fre...

Female Russian Escorts Mumbai Call Girls-((ANdheri))9833754194-Jogeshawri Fre...

Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Bankmed DIFC 2016 Conference Presentation by Bruno Gremez and Samir Kasmi of CT&F.

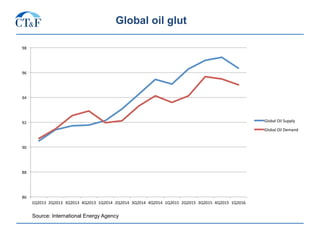

- 1. Global oil glut 86 88 90 92 94 96 98 1Q2013 2Q2013 3Q2013 4Q2013 1Q2014 2Q2014 3Q2014 4Q2014 1Q2015 2Q2015 3Q2015 4Q2015 1Q2016 Global Oil Supply Global Oil Demand Source: International Energy Agency

- 2. Emerging market demand is still increasing

- 3. Saudi Arabia’s policy paying off?

- 4. Iraq oil production Iraq oil production has increased from 2,6 million b/d in 2011 to 4,1 million b/d in 2015 Source: US Energy International Administration

- 5. Iran oil production Iran oil production has already increased from 2,8 million b/d in 2015 to 3,6 million b/d in April 2016

- 6. Global oil trading The global oil trading industry has shown healthy profits driven by increased price volatility

- 7. Impact of low oil prices on the UAE Local banks show reduced appetite to finance oil trading, following defaults and / or restructuring as a result of a lack of discipline / un-hedged positions.

- 8. Main commodity trading hubs § Switzerland and Singapore are the main commodity (oil) trading hubs in resp. Europe and Asia; § Both have built up their centers of competence over several decades, and have reached some critical mass; § Critical mass is the main driver to attract firms and professionals offering the ancillary services needed by the trading industry: finance, insurance, legal advise, operations, inspection, etc; § There is a very large pool of experienced commodity trade (finance) professionals in both markets; § Tax and legal frameworks are relatively attractive; § Commodity trading is a leveraged industry that needs dedicated specialized financing; § Local banks have developed a strong expertise: a significant number of Swiss and European banks are actively facilitating and financing trading out of Switzerland; the largest Asian and Singaporean banks are very active in commodity trade finance next to European banks present locally.

- 9. Dubai: the next trading hub? Strengths • Ideal geographical loca2on between Europe and Asia • Great infrastructure (airport, office space, residen2al space, ports, etc) and exis2ng regulatory framework (DIFC, DMCC) Weaknesses • No local bank dedicated to commodity trade finance; few interna2onal banks present • Developing, but s2ll limited, pool of professionals with exper2se in the industry Opportuni>es • Growing trading flows around the MENA region (to/from Africa, Indian sub- con>nent, etc) • Developing a commodity trade center of competence aQracts highly qualified professionals Threats • Poli>cal instability of the region • Dubai must remain cost-compe>>ve between Switzerland and Singapore