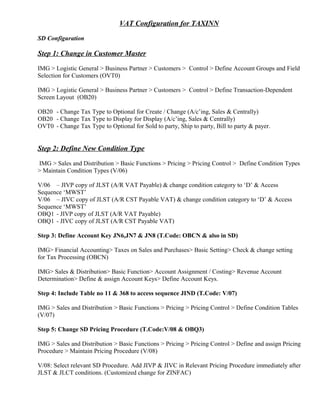

VAT configuration for TAXINN

- 1. VAT Configuration for TAXINN SD Configuration Step 1: Change in Customer Master IMG > Logistic General > Business Partner > Customers > Control > Define Account Groups and Field Selection for Customers (OVT0) IMG > Logistic General > Business Partner > Customers > Control > Define Transaction-Dependent Screen Layout (OB20) OB20 - Change Tax Type to Optional for Create / Change (A/c’ing, Sales & Centrally) OB20 - Change Tax Type to Display for Display (A/c’ing, Sales & Centrally) OVT0 - Change Tax Type to Optional for Sold to party, Ship to party, Bill to party & payer. Step 2: Define New Condition Type IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define Condition Types > Maintain Condition Types (V/06) V/06 – JIVP copy of JLST (A/R VAT Payable) & change condition category to ‘D’ & Access Sequence ‘MWST’ V/06 – JIVC copy of JLST (A/R CST Payable VAT) & change condition category to ‘D’ & Access Sequence ‘MWST’ OBQ1 - JIVP copy of JLST (A/R VAT Payable) OBQ1 - JIVC copy of JLST (A/R CST Payable VAT) Step 3: Define Account Key JN6,JN7 & JN8 (T.Code: OBCN & also in SD) IMG> Financial Accounting> Taxes on Sales and Purchases> Basic Setting> Check & change setting for Tax Processing (OBCN) IMG> Sales & Distribution> Basic Function> Account Assignment / Costing> Revenue Account Determination> Define & assign Account Keys> Define Account Keys. Step 4: Include Table no 11 & 368 to access sequence JIND (T.Code: V/07) IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define Condition Tables (V/07) Step 5: Change SD Pricing Procedure (T.Code:V/08 & OBQ3) IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define and assign Pricing Procedure > Maintain Pricing Procedure (V/08) V/08: Select relevant SD Procedure. Add JIVP & JIVC in Relevant Pricing Procedure immediately after JLST & JLCT conditions. (Customized change for ZINFAC)

- 2. OBQ3: Add JIVP, JIVC in TAXINN immediately after JLST, JCST Conditions & assign A/c keys. (only if SD conditions exist in TAXINN) Step 6: Create new FI Document Type (T.Code:OBA7) Financial Accounting > Financial Accounting Global Settings > Document > Document Header > Define Document Types (OBA7) Create FT wrt RV. *** Initially create with reference to RV & on saving return back to FT & change assignment of reversal Document type to FT Step 7: Document Number Range for FI Document (T.Code: FBN1) Financial Accounting > Financial Accounting Global Settings > Document > Document Number Ranges > Define Document Number Ranges (FBN1) Create new accounting document number range based on Company Code & assign the same for the Accounting Document defined in previous step. *** Document Number Range defined as FT Step 8: New Billing Type (T.Code: VOFA) IMG > Sales & Distribution > Billing > Billing Documents > Define Billing Types (VOFA) Create new billing type FVAT & FBOS wrt F2 SD Doc. Cate: M Invoice Transaction Gr: 7 (Billing Document) Document Type: FT Output Type: Newly created output type should be assigned here. Step 9: Maintain copy control for Billing Documents (T.Code: VTFL) Sales & Distribution > Billing > Billing Documents > Maintain Copying Control For Billing Documents (VTFL) In customizing settings, we need to maintain item level copying control for data transfer for order / delivery document to billing document. This would ensure that when billing document is created using (for eg) F2, the relevant VAT or Bill of Sale invoice would be created. Sample setting is as under: Tgt Billing Doc: F2 (Invoice) from Delivery Type: LF (O/B delivery) Item Category: Tan Data VRBK/VBRP: Routine 350 (created for VAT invoice for India) *** Routine 350 is giving error, so avoid this step, as of now.

- 3. Step 10: Create Output Type for new Billing Type (T.Code: V/40) Sales and Distribution > Basic Functions > Output Control > Output Determination > Output Determination Using the Condition Technique > Maintain Output Determination for Billing Documents > Maintain Output Types (V/40) Create new output types for Bill of Sales and VAT Invoice, 'RD00' can be taken as a reference output type. Maintain the program and layout for the same. All other parameters can be same as in RD00. *** Preferably create separate output type for FVAT & FBOS Step 11: Maintain Output Type in Output Determination procedure Sales and Distribution > Basic Functions > Output Control > Output Determination > Output Determination Using the Condition Technique > Maintain Output Determination for Billing Documents > Maintain Output Determination Procedures Step 12: Assign new Output Types in Output Determination Procedure (V/25) Sales and Distribution > Basic Functions > Output Control > Output Determination > Output Determination Using the Condition Technique > Maintain Output Determination for Billing Documents > Assign Output Determination Procedures (V/25) The output type created in previous step needs to be assigned with output determination procedure for Billing Type. In case additional output types for other billing types (e.g. Export, Exempted Material etc.) are there, then they need to be created. Configuration for STO via SD Route: Step 12: Define Condition Types ST00 (V/06) IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Maintain Condition Types (V/06) Create a new Condition Type ST00: STO Turnover - This condition type is required to calculate the STO Turnover. Maintain the same attribute as in PR00. Step no 13: Define Pricing Procedure Determination (OVKK) IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define and assign Pricing Procedure > Define Pricing Procedure Determination (OVKK) Step 14: Activate Item category for Pricing IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define Pricing By Item Category> Activate Pricing Procedure for Item Category For Replenishment Delivery item category NLN should be made relevant for pricing.

- 4. Step 15: Create SD Pricing Procedure IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define and assign Pricing Procedure > Maintain Pricing Procedure (V/08) Create a new pricing procedure for Stock Transfer Turnover and include only one condition type i.e. ST00 defined earlier. Step 16: Assign Pricing Procedure for Sales Price to Delivery IMG > Logistics Execution > Shipping > Basic Shipping Functions > Pricing > Define pricing procedures for delivery (SPRO) Assign Delivery type (NL- Replenishment Delivery) to a Pricing Procedure defined for calculating stock transfer turnover. Note This is available only in SAP R/3 4.6B onwards. CIN CUSTOMISING Step 17: Assign Excise Invoice Billing Type to Delivery Type J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Sales & Distribution > Assign excise invoice billing type to delivery type (J1IT) New copy controls need to be maintained for new billing type i.e. FBOS and FVAT to delivery type JF/ LF Step 18: Define Business Place SM31 > Enter View Name J_1BBRANCV or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Global Settings > Define Business Place Define your Business Place based on company code. In the "Details" screen, you need to maintain the VAT registration number for the Business Place in the field "Tax Code 1" (Field STCD1). Also enter the Country and Region for which the Business Place is defined. Step 19: Assign Business Place to Plant SM31 > Enter View Name J_1BT001WV or the path J1IL or J1IL(N) > India Localization Menu > Global Settings > Assign Business Place Assign the Business place you created for your company code to the Plants within the company code. Step 20: Create & assign Tax Category for Customer

- 5. IMG > Financial Accounting > Account receivable & Account payable> Customer Accounts > Master data > Preparation for creating Customer Master Data > Accounts Receivable Master Data for Argentina> Define Fiscal Type / Assign Fiscal Type Maintain Fiscal Types (Tax Categories) for Country India and Account Type as Customer o 01 VAT Registered o 02 Unregistered o 03 Composite o 04 Export Note: Tax Categories for different scenarios can also be created as per requirements of respective State. Step 21: Assign Billing Type to Business Partners SM31 > Enter Table Name J_1ICUS_BILL_TYP or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Sales and Distribution > Customizing for VAT > Billing Document Determination > Assign Billing Type to Business Partner This table maintains Billing Type based on the Country key, Customer, Fiscal Type, Region. Here the Fiscal Type is the same field created in the earlier steps. *** As per note no 831870 – The above assignment should not be used. Step 22: Billing Type Determination for VAT SM31 > Enter Table Name J_1IBILDET or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Sales and Distribution > Customizing for VAT > Billing Document Determination > Billing Type Determination for VAT Here we maintain the Country Code, Business Place, Document Category and Sales Area. Based on this we maintain the table entries for Export Invoice, Interstate Billing, Exempt Billing Type and Billing Type for Intrastate transactions ----------------------------------------------------------------------------------------------------------------------------- *** Due to error in routine 350, please avoid the undermentioned steps for time being. Step 23: Define Document Class SM31 > Enter Table Name V_DOCCLS or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Number RAnge > Number Ranges Official Official Document Number Determination for VAT > Maintain Document Classes Define a new document Class for country key 'IN'. Step 24: Assign Document Class to Document Type

- 6. SM31 > Enter Table Name V_T003_B_I or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Number Range > Official Document Number Determination for VAT > Assign Document class to Document Type Assign Accounting Document type to the Document Class for country key 'IN'. Put a check on in the Self-Issue Check Box. This means that for the particular document class and FI document type, the company is eligible to issue official documents. Step 25: Maintain Number Range Group SM31 > Enter Table Name V_1ANUMGR1 or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Number Ranges > Maintain Number Groups. Define Number Range Group. Step 26: Maintain Number Range Use the transaction code J1AB or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > India Localization Menu > Number Ranges > Maintain Number Ranges Create number ranges for the number range group defined in the previous step. For example maintain a number range '01' from '1' to '9999999' Step 27: Assign Number range to Business Place SM31 > Enter Table Name V_OFNUM_TW_2 or the path J1IL or J1ILN > SAP Menu > Customization > India Localization Menu > Number Ranges > Assign Number Range to Business Place Here official document number range need to be maintained based on the following case: o Company Code o Business Place o Document Type o Validity Period o Prefix o Number Range Group o Number Range Step 28: Configuration for Alternate G/L Account SM30 > Table Name J_1IT030K (or View J_1IT030K) > Maintain the entries Maintain the alternate G/L Account for following keys :

- 7. Chart of Accounts +Business Place +Transaction Key +Tax code (optional) Note: Determination of Alternate G/L Accounts is to be used only for Sales Taxes and not for Excise Duty.

- 8. MM Configuration Step 1: Create Condition Type (OBQ1) JVCS JIPC --- Condn. Cate ‘D’ & Access Sequence ‘JST1’ JVRD JIPC --- Condn. Cate ‘D’ & Access Sequence ‘JST1’ JVRN JIPC --- Condn Cate. ‘D’ & Access Sequence ‘JST1’ JVCD JIPC --- Condn Cate. ‘D’ & Access Sequence ‘JST1’ JVCN JIPC --- Condn Cate. ‘D’ & Access Sequence ‘JST1’ *** Change all Tax Condition to Condn. Cate ‘D’ & Access Sequence ‘JST1’ Step 2: Create New Transaction Key (OBCN) JP4: A/P CST Non Deductable JP5: A/P VAT RM Deductable JP6: A/P VAT RM Non-Deductable JP7: A/P VAT CG Deductable JP8: A/P VAT CG Non-Deductable ________________________ Step 3: Define G/L accounts IMG> Financial accounting > G/L Accounting > G/L Accounts Master records > G/L Accounts Creation & Processing> Edit G/L accounts (Individual Processing) > Edit G/L account Centrally (FS00) Create new Tax G/L accounts for all new Tax Transaction Keys created above. Step 4: Define Tax Accounts (OB40) IMG> Financial Accounting > Financial Accounting Global setting > Tax on Sales / Purchases > Posting > Define Tax Accounts (OB40) Assign appropriate G/L accounts to the Transaction Keys. Posting Key 40 & 50 assigned to JN5 & JN7 Step 5: Change TAXINN Procedure (OBQ3) IMG> Fin. A/c’ing > Fin A/c’ing Global setting > Tax on Sales / Purchases > Basic Setting > Check Calculation Procedure > Define Procedure Select Procedure TAXINN. Add JVCS, JVRD, JVRN, JVCD & JVCN in TAXINN immediately after JIPC. Assign Transaction / Accounts Key & alternative Calculation type as follows: JVCS- JP4 (ST Inventory – India) JVRD – JP5 (ST setoff – India) JVRN – JP6 (ST Inventory – India) JVCD – JP7 (ST setoff – India)

- 9. JVCN – JP8 (ST Inventory – India) *** As JP4, JP6 & JP8 are to be added to inventory, please do not create these transaction / accounts key. Instead use existing NVV for the same. Note for Core Team Member: Create new tax code (Suggested as per SAP) Tax % RAM Vatable CG Vatable Non Vatable CST 0% V0 V0 V0 V0 1% R1 C1 I1 - 4% R2 C2 I2 N2 12.5% R3 C3 I3 -

- 10. Customising related to Migration from Business Place to section Code for Extended Withholding Tax 1) Run Migration program:- Using T-code SE38. Execute Migration program J_1IEWT_MIGRATE_SECCO. This program copies data in tables relating to Business Place from Ver 4.6B to related tables in Ver 4.7 under Section code. It establishes one-to-one relationship between Business place & Section code. Click Execute. Note: Kindly note that before executing this program, one should ensure that there is no manual customizing done for section code.

- 11. First execute the program in “Test Mode”, a report will be generated which will give details of the tables that will be updated. In case if there is any customization already done for section code then this program will give an error. Once the report is generated, then the same be executed removing the “Test Mode” tick. After executing the program u can check if the below mentioned tables are maintained.

- 12. 2) Maintain EWT-CIN tables using T-code SM30:- J_1IEWTNUMGR_1 - For internal challan numbers.

- 13. J_1IEWT_CERTNO - For number ranges to Withholding tax certificates.

- 14. J_1IEWT_CERT_N - SAP scripts Forms/Section indicators for EWT certificates

- 15. 3) Define Section Codes:

- 16. 4) Assign Factory Calendars to Section Codes: