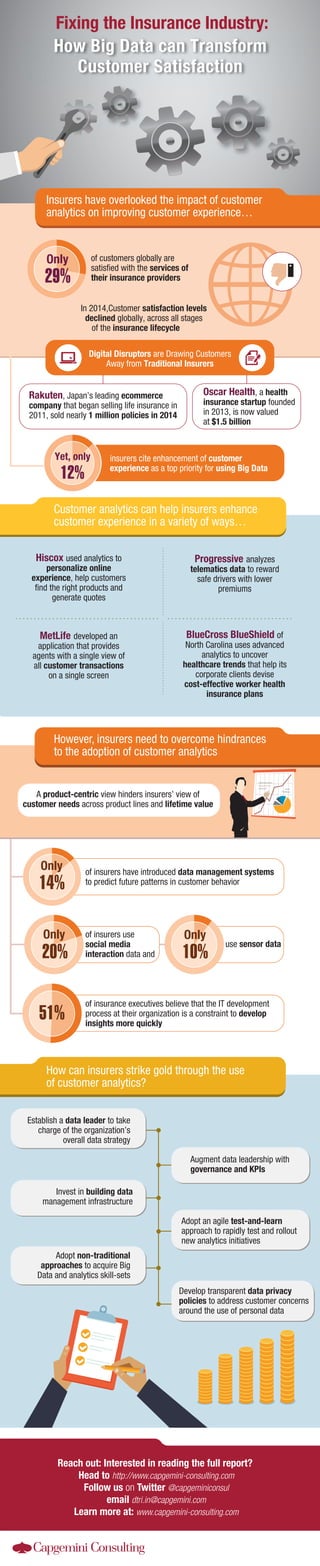

INFOGRAPHIC: Fixing the Insurance Industry - how big data can transform customer satisfaction

•

6 likes•60,497 views

Insurers need to adopt customer analytics to improve low customer satisfaction levels and address concerns around data privacy. They should establish transparent data privacy policies, invest in data management infrastructure, and appoint a data leader to oversee the organization's overall data strategy. Customer analytics can help insurers enhance customer experience by gaining a unified view of customers and their transactions.

Report

Share

Report

Share

Download to read offline

Recommended

How witch companies are actively acquiring to expand their digital and emergi...

How witch companies are actively acquiring to expand their digital and emergi...Damo Consulting Inc.

More Related Content

What's hot

How witch companies are actively acquiring to expand their digital and emergi...

How witch companies are actively acquiring to expand their digital and emergi...Damo Consulting Inc.

What's hot (20)

Taking the Digital Pulse: Why Healthcare Providers Need an Urgent Digital Che...

Taking the Digital Pulse: Why Healthcare Providers Need an Urgent Digital Che...

Fixing the Insurance Industry: How Big Data can Transform Customer Satisfaction

Fixing the Insurance Industry: How Big Data can Transform Customer Satisfaction

How Analytics Can Transform the U.S. Retail Banking Sector

How Analytics Can Transform the U.S. Retail Banking Sector

How witch companies are actively acquiring to expand their digital and emergi...

How witch companies are actively acquiring to expand their digital and emergi...

PwC: New IT Platform From Strategy Through Execution

PwC: New IT Platform From Strategy Through Execution

Open Insurance - Unlocking Ecosystem Opportunities For Tomorrow’s Insurance I...

Open Insurance - Unlocking Ecosystem Opportunities For Tomorrow’s Insurance I...

The Work Ahead in Utilities: Powering a Sustainable Future with Digital

The Work Ahead in Utilities: Powering a Sustainable Future with Digital

Data Modernization: Breaking the AI Vicious Cycle for Superior Decision-making

Data Modernization: Breaking the AI Vicious Cycle for Superior Decision-making

Use AI to Build Member Loyalty as Medicare Eligibility Dates Draw Near

Use AI to Build Member Loyalty as Medicare Eligibility Dates Draw Near

Can Financial Institutions be the next Digital Masters? Capgemini says YES

Can Financial Institutions be the next Digital Masters? Capgemini says YES

Infrastructure that can stand the test of time | Accenture

Infrastructure that can stand the test of time | Accenture

What digital does for banking and financial services

What digital does for banking and financial services

Salesforce Basecamp Helsinki 8.5.2018 - Boston Consulting Group

Salesforce Basecamp Helsinki 8.5.2018 - Boston Consulting Group

Viewers also liked

Viewers also liked (19)

2014 FITC Fitness Professional Survey Report Infographic

2014 FITC Fitness Professional Survey Report Infographic

How Can Retailers Walk the Tight rope Between Personalization and Privacy?

How Can Retailers Walk the Tight rope Between Personalization and Privacy?

Consumer insights: Finding and Guarding the Treasure Trove Infographic

Consumer insights: Finding and Guarding the Treasure Trove Infographic

Infographic-Unlocking Customer Satisfaction: Why Digital Holds the key for Te...

Infographic-Unlocking Customer Satisfaction: Why Digital Holds the key for Te...

Insurance, Gen Y and Internet of Things: World Insurance Report 2016 Infographic

Insurance, Gen Y and Internet of Things: World Insurance Report 2016 Infographic

The Innovation Game: Why & How Businesses are Investing in Innovation Centers

The Innovation Game: Why & How Businesses are Investing in Innovation Centers

Infographic: The Evolving Role of the Wealth Manager

Infographic: The Evolving Role of the Wealth Manager

Data- and database security & GDPR: end-to-end offer

Data- and database security & GDPR: end-to-end offer

INFOGRAPHIC: Smart contracts between hype and reality

INFOGRAPHIC: Smart contracts between hype and reality

Cybersecurity-Anforderungen in IT-Sourcing-Projekten meistern – Ein Leitfaden...

Cybersecurity-Anforderungen in IT-Sourcing-Projekten meistern – Ein Leitfaden...

Similar to INFOGRAPHIC: Fixing the Insurance Industry - how big data can transform customer satisfaction

Similar to INFOGRAPHIC: Fixing the Insurance Industry - how big data can transform customer satisfaction (20)

Insurance strategy: Evolving into a digital underwriter

Insurance strategy: Evolving into a digital underwriter

This Time It's Personal: A human approach to profitable growth for insurers

This Time It's Personal: A human approach to profitable growth for insurers

How Life & Annuity Companies Can Embrace Modern Platforms to Boost Direct-to-...

How Life & Annuity Companies Can Embrace Modern Platforms to Boost Direct-to-...

Experian dv2020 - the new rules of customer engagement - emea research report

Experian dv2020 - the new rules of customer engagement - emea research report

Insurance Industry Trends in 2015: #1 Big Data and Analytics

Insurance Industry Trends in 2015: #1 Big Data and Analytics

Insuring the insurance business with actionable analytics

Insuring the insurance business with actionable analytics

Top 5 Consumer Expectations in the Insurance Industry - Invensis

Top 5 Consumer Expectations in the Insurance Industry - Invensis

Reinforce the insurance value chain with predictive modelling and ml

Reinforce the insurance value chain with predictive modelling and ml

Accenture Distribution and Agency Management Survey: Reimagining insurance di...

Accenture Distribution and Agency Management Survey: Reimagining insurance di...

4 Ways AI and Humans are Changing the Future of Insurance.pdf

4 Ways AI and Humans are Changing the Future of Insurance.pdf

Keeping in Step With Strategic Business Objectives in Insurance through Analy...

Keeping in Step With Strategic Business Objectives in Insurance through Analy...

AI Technologies - Fueling Disruption in the Insurance Industry

AI Technologies - Fueling Disruption in the Insurance Industry

More from Capgemini

More from Capgemini (20)

Recently uploaded

Driving Behavioral Change for Information Management through Data-Driven Gree...

Driving Behavioral Change for Information Management through Data-Driven Gree...Enterprise Knowledge

Recently uploaded (20)

The 7 Things I Know About Cyber Security After 25 Years | April 2024

The 7 Things I Know About Cyber Security After 25 Years | April 2024

Factors to Consider When Choosing Accounts Payable Services Providers.pptx

Factors to Consider When Choosing Accounts Payable Services Providers.pptx

The Role of Taxonomy and Ontology in Semantic Layers - Heather Hedden.pdf

The Role of Taxonomy and Ontology in Semantic Layers - Heather Hedden.pdf

Bajaj Allianz Life Insurance Company - Insurer Innovation Award 2024

Bajaj Allianz Life Insurance Company - Insurer Innovation Award 2024

Understanding Discord NSFW Servers A Guide for Responsible Users.pdf

Understanding Discord NSFW Servers A Guide for Responsible Users.pdf

Driving Behavioral Change for Information Management through Data-Driven Gree...

Driving Behavioral Change for Information Management through Data-Driven Gree...

Workshop - Best of Both Worlds_ Combine KG and Vector search for enhanced R...

Workshop - Best of Both Worlds_ Combine KG and Vector search for enhanced R...

Exploring the Future Potential of AI-Enabled Smartphone Processors

Exploring the Future Potential of AI-Enabled Smartphone Processors

08448380779 Call Girls In Diplomatic Enclave Women Seeking Men

08448380779 Call Girls In Diplomatic Enclave Women Seeking Men

Mastering MySQL Database Architecture: Deep Dive into MySQL Shell and MySQL R...

Mastering MySQL Database Architecture: Deep Dive into MySQL Shell and MySQL R...

IAC 2024 - IA Fast Track to Search Focused AI Solutions

IAC 2024 - IA Fast Track to Search Focused AI Solutions

[2024]Digital Global Overview Report 2024 Meltwater.pdf![[2024]Digital Global Overview Report 2024 Meltwater.pdf](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[2024]Digital Global Overview Report 2024 Meltwater.pdf](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

[2024]Digital Global Overview Report 2024 Meltwater.pdf

Breaking the Kubernetes Kill Chain: Host Path Mount

Breaking the Kubernetes Kill Chain: Host Path Mount

Boost Fertility New Invention Ups Success Rates.pdf

Boost Fertility New Invention Ups Success Rates.pdf

Raspberry Pi 5: Challenges and Solutions in Bringing up an OpenGL/Vulkan Driv...

Raspberry Pi 5: Challenges and Solutions in Bringing up an OpenGL/Vulkan Driv...

INFOGRAPHIC: Fixing the Insurance Industry - how big data can transform customer satisfaction

- 1. Augment data leadership with governance and KPIs Develop transparent data privacy policies to address customer concerns around the use of personal data Reach out: Interested in reading the full report? Head to http://www.capgemini-consulting.com Follow us on Twitter @capgeminiconsul email dtri.in@capgemini.com Learn more at: www.capgemini-consulting.com 29% Only 12% However, insurers need to overcome hindrances to the adoption of customer analytics of customers globally are satisfied with the services of their insurance providers Digital Disruptors are Drawing Customers Away from Traditional Insurers Rakuten, Japan’s leading ecommerce company that began selling life insurance in 2011, sold nearly 1 million policies in 2014 Oscar Health, a health insurance startup founded in 2013, is now valued at $1.5 billion insurers cite enhancement of customer experience as a top priority for using Big Data Yet, only In 2014,Customer satisfaction levels declined globally, across all stages of the insurance lifecycle Customer analytics can help insurers enhance customer experience in a variety of ways… MetLife developed an application that provides agents with a single view of all customer transactions on a single screen Progressive analyzes telematics data to reward safe drivers with lower premiums BlueCross BlueShield of North Carolina uses advanced analytics to uncover healthcare trends that help its corporate clients devise cost-effective worker health insurance plans Hiscox used analytics to personalize online experience, help customers find the right products and generate quotes A product-centric view hinders insurers’ view of customer needs across product lines and lifetime value of insurers have introduced data management systems to predict future patterns in customer behavior14% Only 20% Only 10% Onlyof insurers use social media interaction data and use sensor data 51% of insurance executives believe that the IT development process at their organization is a constraint to develop insights more quickly How can insurers strike gold through the use of customer analytics? Invest in building data management infrastructure Establish a data leader to take charge of the organization’s overall data strategy Adopt non-traditional approaches to acquire Big Data and analytics skill-sets Adopt an agile test-and-learn approach to rapidly test and rollout new analytics initiatives Insurers have overlooked the impact of customer analytics on improving customer experience… Fixing the Insurance Industry: How Big Data can Transform Customer Satisfaction