Lehman Brothers ALT-A Mortgage Docs, December 18, 2006

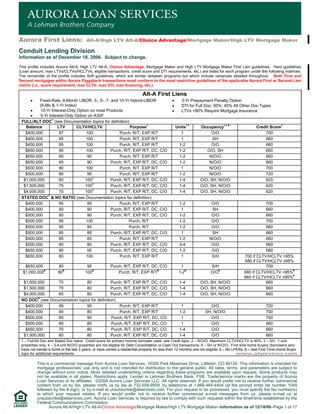

- 1. Aurora First Liens: Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker Conduit Lending Division Information as of December 18, 2006. Subject to change. This profile includes Aurora Alt-A, High LTV Alt-A, Choice Advantage, Mortgage Maker and High LTV Mortgage Maker First Lien guidelines. Hard guidelines (Loan amount, max LTVs/CLTVs/HCLTVs, eligible transactions, credit score and DTI requirements, etc.) are listed for each program under the following matrices. The remainder of the profile includes Soft guidelines, which are similar between programs but which include variances detailed throughout. Both First and Second mortgages within Aurora Piggyback transactions must conform to the most restrictive guidelines of the applicable Aurora First or Second Lien matrix (i.e., score requirement, max CLTV, max DTI, max financing, etc.). Alt-A First Liens • Fixed-Rate, 6-Month LIBOR, 3-, 5-, 7- and 10-Yr Hybrid-LIBOR (6-Mo & 1-Yr Index) • 10-Yr Interest-Only Option on most Products • 5-Yr Interest-Only Option on A30F • 3-Yr Prepayment Penalty Option • DTI for Full Doc: 50%; 45% All Other Doc Types • LTVs >80% Require Mortgage Insurance FULL/ALT DOC1 (see Documentation topics for definition) Balance LTV CLTV/HCLTV Purpose4 Units3,4 Occupancy3,4,5 Credit Score1 $400,000 97 100 Purch, R/T, EXP R/T 1 O/O 700 $400,000 95 100 Purch, R/T, EXP R/T 1 SH 660 $450,000 95 100 Purch, R/T, EXP R/T 1-2 O/O 660 $650,000 90 100 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O, SH 660 $650,000 90 90 Purch, R/T, EXP R/T 1-2 N/O/O 660 $650,000 85 90 Purch, R/T, EXP R/T, DC, C/O 1-2 N/O/O 660 $500,000 80 100 Purch, R/T, EXP R/T 1 N/O/O 700 $500,000 80 95 Purch, R/T, EXP R/T 1-2 N/O/O 720 $1,000,000 80 1002 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 620 $1,500,000 75 1002 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 620 $4,000,000 70 1002 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 620 STATED DOC1 & NO RATIO (see Documentation topics for definition) $400,000 95 95 Purch, R/T, EXP R/T 1-2 O/O 700 $400,000 90 90 Purch, R/T, EXP R/T, DC, C/O 1 SH 660 $500,000 90 90 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $500,000 90 100 Purch, R/T 1-2 O/O 700 $500,000 90 95 Purch, R/T 1-2 O/O 680 $500,000 85 85 Purch, R/T, EXP R/T, DC, C/O 1 SH 660 $500,000 85 85 Purch, R/T, EXP R/T 1-2 N/O/O 660 $500,000 80 80 Purch, R/T, EXP R/T, DC, C/O 3-4 O/O 660 $650,000 80 95 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 680 $650,000 80 100 Purch, R/T, EXP R/T 1 S/H 700 if CLTV/HCLTV >95% 680 if CLTV/HCLTV ≤95% $650,000 80 95 Purch, R/T, EXP R/T, DC, C/O 1 S/H 700 $1,000,0006 806 1006 Purch, R/T, EXP R/T6 1-26 O/O6 680 if CLTV/HCLTV >95%6 660 if CLTV/HCLTV ≤95%6 $1,000,000 75 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 660 $1,500,000 70 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 660 $4,000,000 65 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 660 NO DOC8 (see Documentation topics for definition) $400,000 95 95 Purch, R/T, EXP R/T 1 O/O 720 $400,000 60 80 Purch, R/T, EXP R/T 1-2 SH, N/O/O 700 $500,000 90 90 Purch, R/T, EXP R/T, DC, CO 1 O/O 700 $500,000 80 80 Purch, R/T, EXP R/T, DC, CO 1 O/O 660 $650,000 70 80 Purch, R/T, EXP R/T, DC, CO 1-4 O/O 660 $1,500,000 60 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O 660 1 – Full/Alt Doc and Stated Doc loans: Credit score for primary income borrower used- see Credit topic; 2 – N/O/O: Maximum CLTV/HCLTV is 90%; 3 – SH: 1-unit properties only; 4 – 3-4 unit N/O/O properties are not eligible for Debt Consolidation or Cash Out transactions; 5 – SH or N/O/O: First time home buyers (borrowers who have not owned a home in the last 3 years, or have owned a residential property for less than 12 months) are not eligible; 6 – No LPERs; 8 – See First Time Home Buyer topic for additional requirements. This is a commercial message from Aurora Loan Services, 10350 Park Meadows Drive, Littleton, CO 80124. This information is intended for mortgage professionals’ use only and is not intended for distribution to the general public. All rates, terms, and parameters are subject to change without prior notice. More detailed underwriting criteria regarding these programs are available upon request. Some products may not be available in all states. Restrictions apply. Lender is Lehman Brothers Bank, FSB. Trade/service marks are the property of Aurora Loan Services or its affiliates. ©2006 Aurora Loan Services LLC. All rights reserved. If you would prefer not to receive further commercial content from us by fax, please notify us by fax at 732-559-9559, by telephone at 1-866-464-4404 (at the prompt enter list number 1049 followed by the # sign), or by e-mail at unsubscribe@alservices.com. For your request to be processed, you must specify the fax number(s) to which your request relates. If you would prefer not to receive further commercial e-mail messages from us, please e-mail us at unsubscribe@alservices.com. Aurora Loan Services is required by law to comply with such requests within the timeframe established by the Federal Communications Commission. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 1 of 17

- 2. Alt-A First Liens – High LTV Alt-A Program6 – Minimum 80.01% LTV • Fixed-Rate, 6-Month LIBOR, 3-, 5-, 7- and 10-Yr Hybrid-LIBOR (6-Mo & 1-Yr Index); • 10-Yr Interest-Only Option on most Products; • 5-Yr Interest-Only Option on A30F; 3-Yr Prepayment Penalty Option; • DTI: 50% if Full Doc; 45% All Other Doc Types; • No Subordinate Financing; • Maximum Cash Out $250,000; • Mortgage Insurance Not Required for Loans Under this Program (Select No MI/Self-Insured when using AuroraConnectSM); Use High LTV Alt-A Program Rate Sheet Adjustments. This product line is not a Lender Paid MI Program (LPMI disclosures should not be included in the file). FULL/ALT DOC1 (see Documentation topics for definition) Balance LTV Purpose Units3 Occupancy3,5 Credit Score1 $400,000 100 Purch, R/T, EXP R/T 1 O/O, SH 620 $500,000 95 Purch, R/T, EXP R/T 1-2 O/O, SH 620 $650,000 90 Purch, R/T, EXP R/T 1-2 O/O, SH 620 $650,000 100 Purch, R/T, EXP R/T 1-2 O/O, SH 660 $650,000 100 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O, SH 700 $500,000 95 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O, SH 660 $650,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O, SH 660 $1,000,000 100 Purch, R/T, EXP R/T 1 O/O 680 $1,000,000 90 Purch, R/T, EXP R/T, DC, C/O 1 O/O 700 $500,000 100 Purch, R/T, EXP R/T 1 N/O/O 700 $500,000 95 Purch, R/T, EXP R/T 1-2 N/O/O 680 $650,000 90 Purch, R/T, EXP R/T 1-2 N/O/O 660 $650,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 N/O/O 700 $500,000 85 Purch, R/T, EXP R/T, DC, C/O 1-2 N/O/O 660 STATED DOC1 & NO RATIO (see Documentation topics for definition) $750,000 100 Purch, R/T, EXP R/T 1 O/O 680 $650,000 95 Purch, R/T, EXP R/T 1-2 O/O 680 $650,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 700 $650,000 100 Purch, R/T, EXP R/T 1 SH 700 $500,000 95 Purch, R/T, EXP R/T 1 SH 680 $500,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O, SH 660 $400,000 90 Purch, R/T, EXP R/T 1-2 N/O/O 680 $500,000 85 Purch, R/T, EXP R/T, DC, C/O 1-2 N/O/O 660 NO DOC8 (see Documentation topics for definition) $500,000 95 Purch, R/T, EXP R/T 1 O/O 720 $500,000 90 Purch, R/T, EXP R/T, DC, C/O 1 O/O 680 $650,000 90 Purch, R/T, EXP R/T, DC, C/O 1 O/O 720 $400,000 90 Purch, R/T, EXP R/T, DC, C/O 1 SH 720 $500,000 90 Purch, R/T, EXP R/T 1 SH 680 1 – Full/Alt Doc and Stated Doc loans: Credit score for primary income borrower used- see Credit topic; 3 – SH: 1-unit properties only; 5 – SH or N/O/O: First time home buyers (borrowers who have not owned a home in the last 3 years, or have owned a residential property for less than 12 months) are not eligible; 6 – No LPERs; 8 – See First Time Home Buyer topic for additional requirements. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 2 of 17

- 3. Choice AdvantageSM First Liens • 5-Yr Hybrid-LIBOR (6-Mo & 1-Yr Index); • 3-Yr Hard or Soft Prepayment Penalty Option available; • DTI for Full Doc: 50%; 45% All Other Doc Types; • No Subordinate Financing when LTV exceeds 80; • Borrower-Paid MI is required for all loans over 80% LTV Product provides for an option period which allows for four payment options and potential negative amortization (see Choice Advantage topics for complete details): • Minimum interest-only payment based on the note rate minus either 3%, 3.5% or 4% • Interest-only payment based on current outstanding principal balance • P&I payment based on the current outstanding balance amortized over the remaining term of the loan • P&I payment based on the current outstanding balance amortized over a 15 year period FULL/ALT DOC (see Documentation topics for definition) Balance LTV CLTV/HCLTV Purpose Units Occupancy5,8 Credit Score1 $500,000 95 N/A Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $650,000 90 N/A Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $650,000 80 90 Purch, R/T, EXP R/T, DC, C/O 3-4 O/O 660 $1,000,000 80 95 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 620 $1,000,000 70 80 Purch, R/T, EXP R/T 3-4 O/O 680 $1,500,000 75 90 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $2,000,000 70 80 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $400,000 95 N/A Purch, R/T, EXP R/T 1 SH 660 $500,000 90 N/A Purch, R/T, EXP R/T 1 SH 660 $650,000 80 90 Purch, R/T, EXP R/T, DC, C/O 1 SH 640 $1,000,000 80 90 Purch, R/T, EXP R/T, DC, C/O 1 SH 660 $1,500,000 70 80 Purch, R/T, EXP R/T, DC, C/O 1 SH 680 $2,000,000 65 80 Purch, R/T, EXP R/T, DC, C/O 1 SH 680 $650,000 85 N/A Purch, R/T, EXP R/T 1-2 N/O/O 700 $650,000 80 90 Purch, R/T, EXP R/T, DC, C/O 1-2 N/O/O 660 $650,000 80 90 Purch, R/T, EXP R/T, DC, C/O 3-4 N/O/O 680 $1,000,000 70 80 Purch, R/T, EXP R/T 1-2 N/O/O 680 $1,000,000 70 80 Purch, R/T, EXP R/T 3-4 N/O/O 720 STATED DOC & NO RATIO (see Documentation topics for definition) $500,000 85 N/A Purch, R/T, EXP R/T 1-2 O/O 660 $650,000 80 95 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $650,000 75 90 Purch, R/T, EXP R/T, DC, C/O 3-4 O/O 720 $1,000,000 80 95 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 680 $1,000,000 65 80 Purch, R/T, EXP R/T 3-4 O/O 700 $1,500,000 70 80 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $2,000,000 65 80 Purch, R/T, EXP R/T, DC, C/O 1-2 O/O 660 $500,000 85 N/A Purch, R/T, EXP R/T 1 SH 700 $650,000 80 90 Purch, R/T, EXP R/T, DC, C/O 1 S/H 660 $1,000,000 75 90 Purch, R/T, EXP R/T, DC, C/O 1 SH 660 $1,500,000 70 80 Purch, R/T, EXP R/T, DC, C/O 1 SH 700 $2,000,000 65 80 Purch, R/T, EXP R/T, DC, C/O 1 SH 700 $500,000 85 N/A Purch, R/T, EXP R/T 1-2 N/O/O 720 $650,000 75 90 Purch, R/T, EXP R/T, DC, C/O 1-2 N/O/O 720 $1,000,000 65 80 Purch, R/T, EXP R/T, DC, C/O 1-2 N/O/O 700 NO DOC9 (see Documentation topics for definition) $500,000 80 90 Purch, R/T, EXP R/T 1-2 O/O 660 $650,000 70 90 Purch, R/T, EXP R/T 1-2 O/O 680 $1,000,000 65 90 Purch, R/T, EXP R/T 1-2 O/O 680 $1,500,000 60 80 Purch, R/T, EXP R/T 1-2 O/O 680 $650,000 60 90 Purch, R/T, EXP R/T 1 SH 700 1 – Full/Alt Doc and Stated Doc loans: Credit score for primary income borrower used- see Credit topic; 5 – SH or N/O/O: First time home buyers (borrowers who have not owned a home in the last 3 years, or have owned a residential property for less than 12 months) are not eligible; 8 – See First Time Home Buyer topic for additional requirements; 9 – No Doc: Aurora Piggybacks not permitted. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 3 of 17

- 4. Both First and Second mortgages within Aurora Piggyback transactions must conform to the most restrictive guidelines of the applicable Aurora First or Second Lien matrix (i.e., score requirement, max CLTV, max DTI, max financing, etc.). Mortgage Maker First Liens – High LTV Mortgage Maker Program or LTVs ≤80% • 30-, 20-, 15, and 10-Year Fixed-Rate, 2/6, 3/6 and 5/6 Hybrid-LIBOR Products • 10-Year Interest-Only Option on most Products; 5-year I-O Option on G30F • 3-Year Prepayment Penalty Option on Fixed-Rate Products • 2-Year (G26L, G36L, G25L) or 3-Year (G36L, G25L) Prepayment Penalty Options on Hybrid-LIBOR Products • LTVs >80%: o Are considered High LTV Mortgage Maker products and should be priced using High LTV Mortgage Maker pricing per rate sheet. o Subordinate financing not permitted. o No LPERs FULL DOC Balance LTV CLTV/HCLTV Purpose Units3 Occupancy1,3,5 Credit Score DTI $650,000 100 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 620 50% $650,000 100 N/A Purch, R/T, EXP R/T 1-4 N/O/O 660 50% $1,000,000 95 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 620 50% $750,000 95 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 660 50% $1,000,000 90 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 660 50% $1,000,000 80 100 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 620 50% $2,000,000 75 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 600 50% $4,000,000 70 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 600 50% STATED DOC3, STATED INCOME/STATED ASSETS3,8, NO RATIO3 $500,000 100 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 620 50% $500,000 100 N/A Purch, R/T, EXP R/T 1-4 N/O/O 720 50% $650,000 95 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 620 50% $650,000 95 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 700 50% $750,0007 95 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 640 50% $750,000 90 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 620 50% $1,000,0007 90 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 660 50% $750,000 90 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 680 50% $650,000 80 100 Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 620 50% $1,000,000 80 100 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 620 50% $1,000,000 75 100 Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 620 50% $2,000,000 70 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 620 50% $4,000,000 65 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH, N/O/O 620 50% NO DOC3,8 $500,000 90 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH 660 N/A $500,000 85 N/A Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 680 N/A $500,000 80 100 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O, SH2 620 N/A $500,000 80 95 Purch, R/T, EXP R/T, DC, C/O 1-4 N/O/O 660 N/A $650,000 75 95 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O 620 N/A $650,000 65 95 Purch, R/T, EXP R/T, DC, C/O 1-4 SH, N/O/O 620 N/A $750,000 70 95 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O 620 N/A $1,000,000 60 80 Purch, R/T, EXP R/T, DC, C/O 1-4 SH, N/O/O 620 N/A $2,000,000 65 80 Purch, R/T, EXP R/T, DC, C/O 1-4 O/O 620 N/A 1. SH: 1-unit properties only. 2. SH: Max 95% CLTV/HCLTV. 3. If O/O 3-4 unit or N/O/O subject property is generating negative cash flow: • Stated Doc and No Ratio: • With at least 12 months PITI reserves, maximum financing is available. If less than 12 months PITI reserves, financing is limited to the lesser of LTV/CLTV/HCLTV permitted in matrix or 95%. • SISA and No Doc: • Maximum financing is limited to the lesser of LTV/CLTV/HCLTV permitted in matrix or 95%. • R/T and EXP R/T only. 5. SH or N/O/O: First time home buyers (borrowers who have not previously owned a home in the last 3 years, or have owned a residential property for less than 12 months) are not eligible. 7. 6 months reserves required. 8. See First Time Home Buyer topic for additional requirements. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 4 of 17

- 5. Mortgage Maker First Liens – Insured Program – Minimum 80.01% LTV All loans must have mortgage insurance • 30-, 20-, 15, and 10-Year Fixed-Rate, 2/6, 3/6 and 5/6 Hybrid-LIBOR Products • 10-Year Interest-Only Option on most Products; 5-year I-O Option on G30F (Note: RMIC limits I-O to Fixed-Rate and G36L) • 3-Year Prepayment Penalty Option on Fixed-Rate Products • 2- or 3-Year Prepayment Penalty Options on Hybrid-LIBOR Products This matrix reflects the parameters under which Aurora will Purchase Mortgage Maker Insured loans. As a guide, certain MI companies have agreed to insure this product as outlined below. Please note: the MI information is subject to change and should be considered as an aid to obtaining insurance. Note: Insurance obtained from MI companies outside of this matrix will be acceptable. It is the Client’s responsibility to obtain MI. PRIMARY RESIDENCE – O/O FULL DOC Balance LTV/ CLTV/HCLTV Purpose Units3 Credit Score DTI MI $400,000 97 Purch, R/T, EXP R/T 1-2 620 40% Radian, RMIC $500,000 97 Purch, R/T, EXP R/T 1-2 1 unit if PMI 660 50% 40% if Triad Radian, Triad, PMI $500,000 95 Purch, R/T, EXP R/T 1-2 620 50% Radian, Triad, PMI $500,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 620 50% Radian, Triad, PMI $500,000 85 Purch, R/T, EXP R/T, DC, C/O 3-4 620 50% PMI $650,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 620 45% RMIC $650,000 90 Purch, R/T, EXP R/T 1-2 620 45% Radian $650,000 85 Purch, R/T, EXP R/T 3-4 620 45% Radian, PMI STATED DOC, STATED INCOME/STATED ASSETS3, NO RATIO3 $400,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 640 45% PMI $400,000 85 Purch, R/T, EXP R/T, DC, C/O 3-4 640 if Stated 660 all others 45% PMI $400,000 95 Purch, R/T, EXP R/T 1-2 680 45% Radian $500,000 95 Purch, R/T, EXP R/T 1-2 620 if Stated 660 all others 45% PMI, RMIC Triad—Stated only $500,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 660 680 if RMIC 45% Triad RMIC $650,000 90 Purch, R/T, EXP R/T 1-2 660 45% Radian, PMI, RMIC $650,000 85 Purch, R/T, EXP R/T 3-4 660 680 if RMIC 45% PMI, RMIC—Stated and No Ratio only NO DOC3 $500,000 95 Purch, R/T, EXP R/T 1-2 680 N/A PMI, RMIC $500,000 90 Purch, R/T, EXP R/T, DC, C/O 1-2 660 680 if RMIC N/A Triad, RMIC $650,000 90 Purch, R/T, EXP R/T 1-2 660 700 if PMI N/A Radian, PMI, RMIC $650,000 85 Purch, R/T, EXP R/T 3-4 700 N/A PMI SECOND HOME5 FULL DOC Balance LTV/ CLTV/HCLTV Purpose Units Credit Score DTI MI $500,000 95 Purch, R/T, EXP R/T 1 620 50% Triad, Radian $650,000 90 Purch, R/T, EXP R/T, DC, C/O 1 620 45% RMIC, Radian STATED DOC, NO RATIO $400,000 90 Purch, R/T, EXP R/T, DC, C/O 1 660 45% PMI $500,000 90 Purch, R/T, EXP R/T, DC, C/O 1 660 45% Triad $500,000 90 Purch, R/T, EXP R/T 1 640 if Stated 680 if No Ratio 660 if RMIC 45% PMI, RMIC STATED INCOME/STATED ASSETS $400,000 90 Purch, R/T, EXP R/T, DC, C/O 1 660 45% PMI $500,000 90 Purch, R/T, EXP R/T 1 680 700 if Triad 45% Triad, PMI, RMIC NO DOC $500,000 90 Purch, R/T, EXP R/T 1 700 N/A Triad, PMI, RMIC Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 5 of 17

- 6. INVESTMENT PROPERTY – N/O/O3,5 FULL DOC Balance LTV/ CLTV/HCLTV Purpose Units Credit Score DTI MI $275,000 85 Purch, R/T, EXP R/T, DC, C/O 1-2 620 45% PMI, Radian $500,000 90 Purch, R/T, EXP R/T 1-2 640 if PMI 660 all others 50% PMI, Triad, Radian $500,000 85 Purch, R/T, EXP R/T 1-2 620 50% RMIC, Radian $500,000 85 Purch, R/T, EXP R/T 3-4 640 45% PMI STATED DOC, STATED INCOME/STATED ASSETS3, NO RATIO, NO DOC3 $500,000 90 Purch, R/T, EXP R/T 1-2 700 45% Triad, PMI, RMIC-Stated and No Ratio only $500,000 85 Purch, R/T, EXP R/T 3-4 700 45% PMI RMIC-Stated and No Ratio only 3 – If O/O 3-4 unit or N/O/O subject property is generating negative cash flow: SISA and No Doc: R/T and EXP R/T only; 5 – SH or N/O/O: First time home buyers (borrowers who have not owned a home in the last 3 years, or have owned a residential property for less than 12 months) are not eligible. GEOGRAPHIC RESTRICTIONS • See Geographic Restrictions Matrix (Form 504) for location-specific geographic restrictions. • If Choice Advantage, no Texas Home Equity (O/O Expanded Rate/Term, Debt Consolidation or Cash Out). • If Choice Advantage, maximum 80% LTV for New York properties on First Liens. (Note: AuroraConnect does not support this eligibility item at this time. Please manually review all New York property loans to ensure compliance with this geographic restriction.) DOCUMENTATION • Full/Alt Doc and Reduced Documentation programs available. Reduced Documentation refers to loans processed with income, employment and asset documentation which is more relaxed than traditional FNMA or FHLMC Full Documentation requirements. Specific guidelines for each Reduced Documentation type are outlined below. • Full/Alt Documentation may be required if: • The initial application is incomplete or missing from the submission package. • Loan request is not commensurate with the borrower’s credit profile. • Property is unique or otherwise has limited marketability. • File contains documentation which suggests borrower’s income is not accurately stated on the signed 1003 (i.e., bank statements showing payroll direct deposits with a deposit amount significantly lower than that reported on the signed 1003). • Files that do not have valid or usable credit scores. • When applicable, income sources will be closely reviewed for reasonableness. If reasonableness cannot be determined, Underwriting reserves the right to require documentation to support the reasonableness (i.e., Underwriting may request: recent account statement to support assets available after closing to generate stated interest income, evidence that an income-generating property is owned free and clear, etc.). Full/Alt Doc • Standard FNMA full or alternative documentation may be provided. Additional information can be found in Underwriting Guidelines. • Assets must be verified for reserves, closing costs, required down payment. • IRS 4506 is required when tax returns are used to verify income. • Verbal VOE required 5 days prior to closing for wage-earner income sources. • Income, employment and assets are stated and verified. • Liabilities are itemized and real estate owned stated. Stated Doc • Income/Employment: • Employment must be disclosed on the signed 1003 covering a two-year period. • All income sources must be itemized on the signed 1003. • Verification of income is not required. • Income must be reasonable for employment disclosed. • 5 days prior to closing: Verbal VOE required or if self-employed, an independent written confirmation of self-employment is required (i.e., copy of business license, letter from CPA verifying length and existence of business, etc.). Two continuous years of self-employment in same business are expected. • IRS 4506 is not required. • Liabilities are itemized – properties owned are stated. • Assets must be verified for reserves, closing costs and required down payment. • Ratios are calculated based on stated income. No Ratio • Income/Employment: • Income amount should not be disclosed. • Income source must be identified on the signed 1003. • Employment must be disclosed on the signed 1003 covering a 2-year period. • Income amount is not verified. • Income source must be one which would reasonably support the ability to repay the mortgage debt. • 5 days prior to closing: Verbal VOE required or if self-employed, an independent written confirmation of self-employment is required (i.e., copy of business license, letter from CPA verifying length and existence of business, etc.). Two continuous years of self-employment in same business are expected. • IRS 4506 is not required. • Liabilities are itemized – properties owned are stated. • Assets must be verified for reserves, closing costs and required down payment. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 6 of 17

- 7. Mortgage Maker: Stated Income/ Stated Assets (SISA) • This documentation type is available on Mortgage Maker only products. • Income/Employment: • Employment must be disclosed on the signed 1003 covering a two-year period. • All income sources must be itemized on the signed 1003. • Verification of income is not required. • Income must be reasonable for employment disclosed. • 5 days prior to closing: Verbal VOE required or if self-employed, an independent written confirmation of self-employment is required (i.e., copy of business license, letter from CPA verifying length and existence of business, etc.). Two continuous years of self-employment in same business are expected. • IRS 4506 is not required. • Assets are stated but NOT verified. • Ratios are calculated based on stated income. • Liabilities are itemized – properties owned are stated. • First time home buyer: See First Time Home Buyer topic. No Doc • Income, employment and assets are not disclosed. • Ratios are not calculated. • No Verbal VOE. • No IRS 4506. • Liabilities are itemized – properties owned are stated. • First time home buyer: See First Time Home Buyer topic. DESKTOP UNDERWRITER® / LOAN PROSPECTOR® • Acceptance by Aurora of a loan application package containing an approval from an automated underwriting system shall not be construed as a commitment to lend. In the event of a discrepancy between the data validated by Aurora’s review of the file and the data entered in the automated underwriting system, the findings of the automated underwriting system shall be considered null and void and Aurora shall have no obligation to Purchase the loan. • If Choice Advantage, not eligible for DU or LP. DU Decisions • Approve/Eligible. Expanded Approval (EA) determinations are not acceptable. • Approve/Ineligible. Ineligible classifications are acceptable if the reason for ineligibility is based on a parameter that is outside of FNMA’s guidelines but within Aurora’s. An acceptable ineligible classification would be for loan amounts above FNMA limits. • All conditions outlined in the Findings Report must be satisfied. LP Decisions • Accept or Accept-Plus; or • Risk Grade 1, Risk Grade 2, Risk Grade 3 or Risk Grade 4 (RG1, RG2, RG3 or RG4). • All conditions outlined in the Feedback Certificate must be satisfied. DU/LP Full/Alt Doc • Maximum $650,000 Total Aurora Financing. • Credit score must meet Aurora’s guidelines and definition of a valid/usable score; credit score of the primary income borrower used for qualifying and pricing. See Credit topic. • Housing lates: • Alt-A: As accepted by DU/LP. • Mortgage Maker/High LTV Mortgage Maker: Maximum 1X30 in past 12 months. • Housing history documentation: • Alt-A/High LTV Alt-A: As required by DU/LP. • Mortgage Maker/High LTV Mortgage Maker: Must meet the housing history requirements outlined in the credit topic. • Full URAR required. All property guidelines must be met. • Employment, income and assets may be documented as recommended by DU/LP. • Must meet down payment requirements as outlined in Required Down Payment topic. • Mortgage insurance is not required for High LTV Alt-A or High LTV Mortgage Maker products. For all other Alt-A and Mortgage Maker loans with LTVs >80%, mortgage insurance coverage must be obtained as outlined in the Mortgage Insurance topic. Reduced MI, Lower-cost MI, or Customized MI is not eligible. • No DTI limitations. • If Choice Advantage, DU/LP loans not eligible. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 7 of 17

- 8. DU/LP Stated Doc • Loans must be processed in accordance with Alt-A/High LTV Alt-A and Mortgage Maker/High LTV Mortgage Maker Stated Doc guidelines. • Maximum $650,000 Total Aurora Financing. • Maximum 80% CLTV/HCLTV. • Credit review • Credit score must meet Aurora’s guidelines and definition of a valid/usable score; credit score of the primary income borrower used for qualifying and pricing. See Credit topic. • Housing lates: • Alt-A/High LTV Alt-A: As accepted by DU/LP. • Mortgage Maker/High LTV Mortgage Maker: Maximum 1X30 in past 12 months. • Housing history documentation: • Alt-A/High LTV Alt-A: As required by DU/LP. • Mortgage Maker/High LTV Mortgage Maker: Must meet the housing history requirements outlined in the credit topic. • All debts have been included in long-term debt ratio. • Full URAR required. All property guidelines must be met. • Assets must be verified to meet reserve requirements and down payment requirements. Verified assets must meet both Aurora’s requirements and DU or LP’s requirements. • Maximum DTI ratio: • Alt-A/High LTV Alt-A: 45% • Mortgage Maker/High LTV Mortgage Maker: 50% • If Choice Advantage, DU/LP loans not eligible. PROPERTY ELIGIBILITY Property Type (See Underwriting Guidelines for additional details. See LTV/CLTV/HCLTV matrices for variances; i.e., second homes eligible for 1-unit only, etc.) Alt-A, Choice Advantage, & MM High LTV Alt-A High LTV MM Single Family Residence Yes Yes Yes 2 units Yes Yes Yes 3-4 unit Dwellings Yes No Yes Warrantable and Non-Warrantable Condos: Yes Yes Yes • Minimum 600 square feet • Studio units are eligible • Site (Detached) Condos are eligible Condotels – See Condotel topic for LTVs Yes No No Co-Ops – See Cooperative Program Profile Yes No No PUDs Yes Yes Yes Mixed-Use Yes No No Model Home Lease Backs Yes No No No acreage limitation (Land value should not exceed 35%. Exceptions considered case-by-case.) Yes Yes Yes Rural Yes No No Mobile homes No No No Manufactured homes No No No Modular/Prefab Yes Yes Yes Other property types considered case-by-case. See Yes Yes Yes Underwriting Guidelines for additional information Condotels • Condotels are condominium projects that operate like a hotel. Typically a condotel will have a rental desk in the lobby, cleaning service and other hotel-like amenities. The units are individually owned but many of the units are rented to short-term visitors. See Underwriting Guidelines for complete details. • All condotels will be treated as non-owner occupied, subject to N/O/O guidelines and pricing; however, rental income may not be used as qualifying income. • 1 unit dwellings only. • Projects with timeshare units are ineligible. • The maximum LTV/CLTV/HCLTV is the lesser of 75% or the maximum listed in the LTV/CLTV/HCLTV matrices. • Not allowed on High LTV Alt-A or High LTV Mortgage Maker Programs. OCCUPANCY • Primary Residence (O/O), Second Homes (SH), Investment Properties (N/O/O). ELIGIBLE BORROWERS • U.S. Citizens, Resident Aliens, Non-Occupying Co-Borrowers and Co-Signers. • Title may be taken in the name of a trustee. The following trusts are permitted provided eligibility and closing document requirements outlined within the applicable checklist are adhered to: • See Form 407 to determine trust eligibility. • See appropriate Closing Document Review for closing requirements (Form 407-LivT for Living Trust; Form 407-LandT for Land Trusts; Form 407-BT for Blind Trusts). Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 8 of 17

- 9. First Time Home Buyer • First Time Home Buyers (FTHB): This status applies when all owner-occupant borrowers of the subject property have not owned a home in the last 3 years, or have owned a residential property for less than 12 months. • Cash Reserve Requirements: • Total Aurora Financing <$1,000,000: 6 months PITI required if score <660 and LTV/CLTV/HCLTV >95%; otherwise, 2 months PITI required. • Total Aurora Financing ≥$1,000,000: See Cash Reserves topic. • FTHB are ineligible for financing N/O/O or SH properties. • Stated Income/Stated Assets (applicable to Mortgage Maker only) & No Doc • Credit score must be ≥660 when LTV/CLTV/HCLTV is >80%. • File must contain 12 months cancelled checks (front and back) to evidence eligibility with Mortgage/Housing History Requirements outlined in Credit topics. Checks must be written on borrower’s account. Written verification or verification via the credit report is not acceptable. Direct written verification of rent may be accepted in lieu of cancelled checks when the landlord is a large professional management company. • Maximum housing payment is limited to 100% over the existing housing payment (may double). Resident Aliens • Lawful resident aliens are eligible for the same financing as U.S. citizens if they can provide evidence of lawful residency and they meet all of the same credit standards as U.S. citizens. • A copy of the borrower’s identification or a processor’s certification (Form 408) is required to verify review of the acceptable documentation that evidences borrower is eligible to lawfully reside in the U.S. • Borrowers with diplomatic immunity are not eligible. • Borrower must be employed in the U.S. • Income must be likely to continue for at least 3 years. Non-Occupying Co-Borrowers Non-occupying co-borrowers are acceptable when the following can be met: • Occupant borrower’s ratios may not exceed 50%. • Occupant borrower must contribute 5% from their own resources. • All borrowers must be close relatives. • Non-occupying co-borrower may be a co-signer/guarantor provided LTV ≤97%. Co-signer/guarantors will be obligated for repayment of debt, but are not required to take title. QUALIFYING • ARMs with initial adjustment periods less than 2 years: • LTV/CLTV/HCLTV >75%, qualify at lesser of fully indexed rate or maximum second-year rate. • LTV/CLTV/HCLTV ≤75%, qualify at the initial note rate. • Choice Advantage: Qualify using an amortizing payment calculated using the higher of the note rate or fully-indexed rate against the maximum potential balance sufficient to amortize the loan over a 30-year period. The fully-indexed rate is the index plus the margin rounded to the nearest .125% • All others: Qualify at the initial note rate. • Interest-only, the interest-only payment is used for qualifying. • Temporary buydown, see temporary buydown topic if applicable. • Paying off revolving debt to qualify is allowed. Pay down of revolving debt to qualify is unacceptable. • Payment shock will be considered by underwriter. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 9 of 17

- 10. Negative Cash Flow (For seasoning requirements, see LTV/CLTV/HCLTV calculations below.) The following policies apply to Mortgage Maker and High LTV Mortgage Maker only: • Properties with negative cash are closely reviewed to ensure an overall acceptable risk. • Cash flow for all N/O/O dwellings and O/O 3-4 unit dwellings is calculated as follows: • Purchase transactions: • Negative cash flow is the monthly rent minus expenses as evidenced by the FNMA 216 Form. If expenses are outlined on Form 216 and deemed reasonable by UW due to net rent figure, do not apply a standard 25% maintenance and vacancy factor. If unreasonable, use 25% maintenance and vacancy factor. • Refinance transactions: • For properties that have been owned >12 months and where income is documented via tax returns, cash flow will be based off of Schedule E. • If property has not been owned for a full tax year or if income has not been documented via tax returns, follow purchase transaction guidelines for the subject property. • For O/O properties, the negative cash flow for purposes of the criteria listed below is calculated assuming all units will be rentals. For DTI calculations, use only the negative cash flow or positive cash flow associated with the actual rental units. • If the N/O/O property or 3-4 unit O/O subject property is generating a negative cash flow, the following restrictions apply: • Full Doc: Eligible for maximum financing. • Stated Doc and No Ratio: • With at least 12 months PITI reserves, maximum financing is available. If less than 12 months PITI reserves, financing is limited to the lesser of LTV permitted in matrix or 95% LTV/CLTV/HCLTV. • Stated Income/Stated Assets and No Doc: • Rate/Term and Expanded Rate/Term only (purchase, Debt Consolidation and Cash Out are not allowed). • Lesser of LTV permitted in matrix or 95% LTV/CLTV/HCLTV. • Minimum 12-month history must be verified; see Credit topic, Underwriting Guidelines and Form 520 for additional information. • Minimum ownership seasoning of 12 months. • Housing payment must be decreasing. • See LTV/CLTV/HCLTV Calculation topic for seasoning requirements. Note: O/O 1-2 unit properties are not subject to additional restrictions outlined in this topic. VALUE FOR LTV/CLTV/HCLTV CALCULATION Note: Additional refinance restrictions apply when property is located in Texas. See Underwriting Guidelines and Texas Home Equity Program Profile for details. See Title History Review Policy within Underwriting Guidelines for chain of title requirements. Purchase • Use lesser of current appraised value or acquisition cost. Rate/Term and Expanded • Use current appraised value Rate/Term Cash Out and Debt Consolidation • LTV/CLTV/HCLTV >75% and property owned <12 months, use lesser of current appraised value or acquisition cost + cost of documented home improvements. • LTV/CLTV/HCLTV ≤75%, use current appraised value. • If property owned ≥12 months, use current appraised value. LTV/CLTV/HCLTV CALCULATION • See Section 8, Definitions. MAXIMUM CASH OUT Alt-A/High LTV Alt-A; Choice Advantage – All Loans; Mortgage Maker/High LTV Mortgage Maker – First Liens without Subordinate Financing: • Cash Out Transactions: • Except for High LTV Alt-A and High LTV Mortgage Maker, the borrower may receive an unlimited amount of cash out, unless loan requires or has mortgage insurance. When mortgage insurance is required, amount of cash out is limited by the applicable mortgage insurer. See Form 449 for company-specific limitations. • Maximum Cash Out for High LTV Alt-A and High LTV Mortgage Maker Products is $250,000. Mortgage Maker – First Liens with Subordinate Financing (regardless of Second Lien lender) and Mortgage Maker Second Liens: • Cash Out Transactions: • Unlimited if LTV/CLTV/HCLTVs <60% and Total Aurora Financing <$1,000,000. • Maximum 30% of property value if LTV/CLTV/HCLTV is greater than 60% or Total Aurora Financing is greater than or equal to $1,000,000. • Additional cash out limitations may be imposed by the MI company. Please see Form 449 or contact your local MI company for details. All Loans: • Debt Consolidation transactions: • Loan proceeds used for the payoff of debt are limited to the maximum cash out limits per each Program Profile (i.e., if maximum cash out is $200,000, only $200,000 of the loan amount may be used for the payoff of debt). Cash out limits also include any incidental cash to borrower at closing which may not exceed the greater of 2% of the loan amount or $2,000. TEMPORARY BUYDOWNS • Temporary buydowns are not permitted on: • ARMs with initial adjustment periods less than 3 years; • Interest-only loans; or • High LTV Alt-A, Choice Advantage, Mortgage Maker/High LTV Mortgage Maker Products. • 2/1 annual buydown permitted on all others. • CLTV/HCLTV >95% or N/O/O, qualify at the note rate. • CLTV/HCLTV ≤95%, qualify at the initial or start rate. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 10 of 17

- 11. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 11 of 17 CREDIT General • Credit Report—3 file merged credit report or RMCR required. • Credit Score—Use lower of 2 or middle of 3 to determine each borrower’s representative score. • No Ratio and No Doc loans: Lowest representative score of all borrowers is used to qualify. • Full/Alt, Stated Doc and Stated Income/Stated Assets (Mortgage Maker and High LTV Mortgage Maker only) loans: The score of the primary income borrower (occupant borrower who earns >50% of the qualifying income) will be used for qualifying and pricing. If no occupant borrower earns >50% of the qualifying income, use the lowest representative score of all borrowers. Credit of co-borrowers (but not credit score) is expected to meet applicable requirements. • A valid/usable credit score is one generated based on a minimum of 3 trade lines at least 2 or more years old and accurately reflecting borrower’s credit history. • Credit Report—3 file merged credit report or RMCR required. • Additional Credit Information can be found in Underwriting Guidelines. <$1,000,000 Total Aurora Financing Alt-A/High LTV Alt-A; Choice Advantage <$1,000,000 MM/High LTV Mortgage Maker <$1,000,000 Trade Lines Min. 3 trades ≥2-year history. Min. 3 trades ≥2-year history. Mortgage/Housing1 Documentation • Loans without a 12-month documented housing history may be permitted provided all of the following are met: o O/O o 1-2 unit o Total Aurora Financing ≤$500,000 o Full, Stated, or No Ratio o Score is ≥660 or Borrower has 12 months verified assets after closing • For all other loans, additional exceptions may be permitted. Underwriter discretion to waive documented housing history will be based on overall file strength. • Loans without a 12-month documented housing history may be permitted provided all of the following are met: o O/O o 1-2 unit o Total Aurora Financing ≤$500,000 o Full, Stated, or No Ratio o Score is ≥660 or Borrower has 12 months verified assets after closing • For all other loans, a documented Housing history is required. See Housing History Requirements, Form 520 for details and possible exceptions History • 0x30 in past 12 mos. • 1x30 in past 24 mos. • 12 month Mortgage/Rental History is required. • 1x30 in past 12 months. Installment and Revolving Rely on credit score; overall credit analysis must indicate an overall willingness and ability to repay debts in timely manner with strong emphasis on larger obligations. • Rely on credit score; overall credit analysis must indicate an overall willingness and ability to repay debts in timely manner with strong emphasis on larger obligations. • All installment and revolving must be current at closing. Bankruptcy None in past 3 yrs, no derogatory credit after BK, re-established credit covering most recent 2 yrs. None in past 2 years, no derogatory credit after BK, re-established credit covering the most recent 2 yrs. If N/O/O: • Re-established credit must include a mortgage rating. • Full Doc only. Foreclosure None in past 3 yrs. None in past 3 years. Major Derogatory (collections, judgments, etc.) The Borrower’s overall credit in the last 24 months must show a willingness and capacity to repay. ≥$1,000,000 Total Aurora Financing Alt-A/High LTV Alt-A; Choice Advantage ≥$1,000,000 MM/High LTV Mortgage Maker ≥$1,000,000 Trade Lines Min. 5 trades (3 must be ≥2 yrs). Min. 5 trades (3 must be ≥2 yrs). Mortgage/Housing1 0x30 in past 12 mos. 1x30 in past 24 mos. 12-month Mortgage/Rental History is required. 0x30 in past 2 years. 2x30 in past 4 years (if shown on credit report). Installment and Revolving Rely on credit score; overall credit analysis must indicate an overall willingness and ability to repay debts in timely manner with strong emphasis on larger obligations. • Installment: 1x30 in past 2 years. • Revolving: 2x30 & 1x60 in past 2 years • All installment and revolving must be current at closing. Bankruptcy None in past 7 yrs, no derogatory credit after BK, re-established credit covering most recent 2 yrs. None in past 7 years, no derogatory credit after BK, re-established credit covering the most recent 2 years. If N/O/O: • Re-established credit must include a mortgage rating. • Full Doc only. Foreclosure None in past 7 yrs. None in past 7 years. Major Derogatory (collections, judgments, etc.) The Borrower’s overall credit in the last 24 months must show a willingness and capacity to repay. 1 – See Section 504.2-11 of Underwriting Guidelines and Form 520 (for Mortgage Maker loans) for documentation requirements and additional information.

- 12. TOTAL AURORA FINANCING ≥ $1,000,000 • Subject must be in a strong market of similarly priced homes. The relationship between final value and predominant value should be reasonable. • If nature of borrower’s employment is not evident, file should contain a brief narrative explaining it. Not required on No Doc loans. • Borrowers expected to have above-average verified asset base. See Cash Reserves topic. REQUIRED DOWN PAYMENT • Required down payment must be from the borrower’s own resources. • Required down payment is based on occupancy, LTV/CLTV/HCLTV and documentation. Full/Alt Doc Stated Doc, Stated Income/Stated Assets and No Ratio Primary Residence • Lesser of: • 5% all programs; or • 3% if LTV >95%; or • Required down payment based on LTV/CLTV/HCLTV (meaning 0 if LTV/CLTV/HCLTV is 100%). • See All Gift Down Payment topic for exceptions. • Lesser of: • 5% all programs; or • Required down payment based on LTV/CLTV/HCLTV (meaning 0 if LTV/CLTV/HCLTV is 100%). • See All Gift Down Payment topic for exceptions. Second Home • Lesser of: • 5% all programs; or • Required down payment based on LTV/CLTV/HCLTV (meaning 0 if LTV/CLTV/HCLTV is 100%). • Lesser of: • 10% if Alt-A or High LTV Alt-A or Choice Advantage; or • 5% if MM or High LTV MM; or • Required down payment based on LTV/CLTV/HCLTV (meaning 0 if LTV/CLTV/HCLTV is 100%). Non-Owner Occupied • Lesser of: • 10% all programs; or • Required down payment based on LTV/CLTV/HCLTV (meaning 0 if LTV/CLTV/HCLTV is 100%). • Lesser of: • 15% for Alt-A or Choice Advantage; or • 10% for High LTV Alt-A; or • 5% if MM or High LTV MM; or • Required down payment based on LTV/CLTV/HCLTV (meaning 0 if LTV/CLTV/HCLTV is 100%). CASH RESERVES • Reserve requirements are based off of the qualifying PITI. This primarily impacts ARM loans where the qualifying payment may be higher than the initial payment. (For example: The qualifying payment on the Choice Advantage will be based on the maximum loan amount with negative amortization and the higher of the note rate or the fully-indexed rate as opposed to a significantly lower minimum required payment.) See Qualifying topic for additional information on calculating the qualifying payment. Total Aurora Financing <$1,000,000 • Reserves not required on No Doc loans. • Reserve requirements: • 6 months PITI required if: • N/O/O • O-O 3- to 4-units, or • FTHB with score <660 and LTV/CLTV/HCLTV >95%; • High LTV Mortgage Maker Stated, Stated Income/Stated Assets and No Ratio on the following combinations (see LTV/CLTV/HCLTV grid for additional eligibility requirements): • Loan amount is >$650,000 and LTV is >90%; or • Loan amount is >$750,000 and LTV is >80%. • 2 months PITI for all others. • When providing Aurora financing on multiple properties, the borrower must meet an aggregate of the applicable reserve requirements. For example: if lending to one borrower on two N/O/O properties, the borrower must have 6 months of reserves for each property. The underwriter should be cognizant of any other properties acquired by a borrower in the last 12 months and may require additional reserves as a part of our current transaction. • On Cash-out refinances, proceeds may be used for reserves. • Mortgage Maker: See also Mortgage/ Housing in the Credit topic of this profile, and Negative Cash flow for potential additional options. Total Aurora Financing ≥$1,000,000 Funds must be from borrower’s own resources (not from borrower’s business). Funds must be available to the borrower prior-to- and after-closing. Proceeds from the transaction (i.e., refinance proceeds, etc.) or sale of assets, may not be used to meet this asset requirement. Reserves not required on No Doc loans. 6 months PITI required if: • Full Doc • Stated Doc, Stated Income/Stated Assets, or No Ratio loans if: • LTV/CLTV/HCLTV is ≤60%; or • LTV/CLTV/HCLTV >60% when all of the following are present: • Loan amount is ≤$2,000,000; • Credit score is ≥720 if Alt-A/High LTV Alt-A, ≥680 if MM/High LTV Mortgage Maker; • Purchase, Rate/Term or Expanded Rate/Term; and • No exceptions to loan amount or LTV have been granted. • All other transactions (except No Doc loans) require 12 months PITI. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 12 of 17

- 13. GIFT FUNDS • Gift may be from a family member, domestic partner or someone with a demonstrated close relationship, non-profit organization, municipality or borrower’s employer. However, seller-funded gift programs (such as Nehemiah) are not acceptable. • Gift letter required. • Transfer of funds or evidence of receipt must be documented. • Not permitted on No Doc or N/O/O. • Acceptable after a minimum down payment has been made by the borrower from their own resources, if required. See Required Down Payment topic. • Gift funds may not be used for reserves. All Gift Down Payment Option Borrower’s minimum down payment may be waived on loans provided: • LTV/CLTV/HCLTV less than or equal to 80%. • Full/Alt, Stated, No Ratio or Stated Income/Stated Assets (Mortgage Maker and High LTV Mortgage Maker only). • O/O only. • Gift funds may be used for closing costs, but not reserves. CONTRIBUTIONS BY AN INTERESTED PARTY • Contributions by an interested party may be used for closing costs, prepaids and other financing costs provided the maximum contribution does not exceed the limits below. • Total of the contribution percentage plus the LTV (or CLTV/HCLTV, if applicable) may not exceed 103%. • 3% if LTV/CLTV/HCLTV >90% on owner occupied and second homes. • 6% if CLTV/HCLTV 75.01-90% on owner occupied and second homes. • 9% if CLTV/HCLTV ≤75% on owner occupied and second homes. • 3% on non-owner occupied regardless of LTV/CLTV/HCLTV. • Subordinate financing is permitted (within limitations outlined in LTV/CLTV/HCLTV matrices) provided: • Loan is not a High LTV Alt-A, High LTV Mortgage Maker, or Choice Advantage with an LTV>80% Product. • The terms of subordinate lien: 1) May not include a balloon payment within the first 5 years, and 2) Payment must be sufficient to cover interest due. 3) Copy of the note must be provided. 4) Interest rate and payment may not change more than once a year. • Variable payments, including Home Equity Lines of Credit are acceptable. • File must contain a copy of the note. • Private party subordinate financing is not permitted. Private Party subordinate financing refers to financing provided by the seller, builder or other non-financial institution. • If Aurora is providing subordinate financing, the loan must meet Aurora’s Second Lien guidelines and program requirements. No additional financing is permitted when Aurora is providing a first and a second mortgage. Second mortgage guidelines may be more restrictive than first mortgage guidelines; hence in a piggyback situation both mortgages must meet the more restrictive guidelines. Subordinate Financing Eligibility Alt-A First Choice Advantage First with LTV≤80% Mortgage Maker First Other Lender Permitted Permitted Permitted Alt-A/Classic Second Permitted Not Permitted Not Permitted Choice Advantage Second Not Permitted Owner Occupied Permitted Not Permitted SUBORDINATE FINANCING Mortgage Maker Second Permitted Not Permitted Permitted Expanded Options Second Not Permitted Not Permitted Not Permitted MORTGAGE INSURANCE • Acceptable mortgage insurers are GE (Genworth), MGIC, RMIC, Radian, PMI, UGRIC, Triad and, for credit union lenders, CMG. Note: Not all MI companies will insure loans underwritten to these guidelines. See Form 449 regarding company-specific MI requirements for Alt-A, Choice Advantage and Mortgage Maker loans. Clients should contact their local MI company for guidance. • Monthly mortgage insurance is the only acceptable mortgage insurance option at this time. Alt-A & Choice Advantage • Alt-A: Loans with LTVs above 80% require borrower-paid mortgage insurance or must comply with High LTV Alt-A Program requirements. • MI is not required on High LTV Alt-A Program. • Choice Advantage: Loans with LTVs above 80% require borrower-paid mortgage insurance. ALT-A and Choice Advantage MI Coverage Requirements LTV Standard Reduced Coverage 15 & 20 Yr. Loans 80.01 - 85% 12% (25% if N/O/O) 6% (25% if N/O/O) 85.01 - 90% 25% (25% if N/O/O) 12% (25% if N/O/O) 90.01 - 95% 30% 25% >95% 35% 30% Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 13 of 17

- 14. Mortgage Maker Mortgage Maker: • Loans with LTVs above 80% require borrower-paid mortgage insurance or must comply with High LTV Mortgage Maker Program requirements. • MI is not required on High LTV Mortgage Maker Program. Mortgage Maker MI Coverage Requirements LTV Minimum Coverage 80.01 – 85% 25% 85.01 – 90% 30% >90% 35% APPRAISAL See Underwriting Guidelines, Section 508.2 for requirements for Operating Income Statement (Form 216) and Comparable Rent Schedule (Form 1007). <$1,000,000 *Transaction Value • One traditional, full appraisal completed by a state licensed or state-certified appraiser required. ≥$1,000,000 *Transaction Value • One traditional, full appraisal completed by a state-certified appraiser required. *Transaction Value = Greater of the sales price or appraised value. Complex Properties • Appraisals must be completed by a state-certified appraiser. >$650,000 Loan Amount • Interior photographs required. TITLE REQUIREMENTS • Full title policy is required on all loans. • Negative amortization endorsement required on Choice Advantage loans (ALTA 6.2 / CLTA 111.8). MAXIMUM EXPOSURE Aurora will limit its financing exposure to one borrower or group of borrowers as outlined below. This includes the total of all loans to all borrowers, including existing (including loans serviced by other lenders on behalf of Aurora) and pending transactions. In the event of a concurrent Piggyback transaction, the Piggyback and First Lien loan will count as one loan. Maximum dollar thresholds still apply. Exceptions may be considered on a case-by-case basis through the LPER process on Alt-A First Liens, excluding Alt-A High LTV loans. O/O SH N/O/O $6,000,0001 aggregate of all financed transactions provided by Aurora $6,000,0001 aggregate of all financed transactions provided by Aurora • 4 N/O/O loans not to exceed an aggregate amount of $1,000,000 provided total exposure does not exceed $6,000,0001 (total exposure includes borrower’s O/O and SH financed transactions); or • 1 N/O/O if loan is >$1,000,000 provided total exposure does not exceed $6,000,0001 (total exposure includes borrower’s O/O and SH financed transactions). 1— Once the aggregate exposure exceeds $4,000,000, all additional loans must be either Alt-A/High LTV Alt-A or Classic. Maximum Number of Financed Properties In addition to the maximum exposure limitations, the maximum number of financed 1-4 unit properties (regardless of lending source) a borrower or group of borrowers may own is limited as outlined below. The subject property, all borrowers’ primary residence properties and any properties pending financing are included in this total. Exceptions may be considered on a case-by-case basis through the LPER process on Alt-A first liens, excluding Alt-A High LTV loans. O/O SH N/O/O No limit 10 10 LANDLORD EXPERIENCE • Loans made to borrowers owning multiple N/O/O properties must meet the following: • File must contain documentation evidencing borrower’s experience owning multiple investment properties (two years’ experience required); or • Borrower has acquired or is in the process of acquiring a maximum of (including subject property, if applicable): • ≤Two financed investment properties within the last six months; and/or • ≤Four financed investment properties within the last two years. • All financed 1- to 4- unit investment properties (properties, not units), regardless of the source of financing will be considered in the above eligibility determination. • First time home buyers are ineligible for financing N/O/O or SH properties. • See Underwriting Guidelines for more information. SECTION 32 / HIGH COST LOAN Sellers are responsible for identifying loans that are considered high cost loans as defined by federal and/or state laws and/or regulations. Aurora does not Purchase high cost loans as defined by federal regulations (Section 32) and/or state regulations and, with respect to state laws and regulations, regardless of whether the lender would be federally preempted or exempt from such laws or regulations. Upon delivery of all loans to Aurora, the Seller represents and warrants: • Loan is not a high cost loan as defined by Section 32 of the Federal Truth-in-Lending Act; and • Loan is not a high cost loan as defined by applicable state laws and/or regulations; and • Conforming loan amounts: Total points and fees may not exceed 5% of the loan amount. See Form 720 for details regarding fees included in the 5% test; and • Loans with original principal balance “OPB” ≥$75,000: Broker Compensation may not exceed 5% of the OPB. Broker Compensation refers to fees paid to the Broker either by the Lender or directly by the borrower, and often financed as part of the loan. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 14 of 17

- 15. INTEREST-ONLY (I-O) OPTION • The information outlined in this topic is specific to interest-only for all products except Choice Advantage. For Choice Advantage, refer to the following Choice Advantage topics. • Payments are interest-only for the first 10 or 5 years, as applicable, and fully amortizing for the remaining term. No negative amortization. • The interest-only monthly payment is calculated each month based on the current balance. If borrower makes voluntary prepayments of principal during the Interest-Only Period, the subsequent monthly payments will be based on the lower principal balance. • Not available on loans with a temporary buydown. • ARM Loans use Form 603E to amend the ARM note and 603F to amend the ARM rider to the security instrument (See Forms TOC and Section 6 for additional details). I-O ELIGIBILITY Period Alt-A/High LTV Alt-A, Mortgage Maker/High LTV Mortgage Maker (If applicable, see Choice Advantage topic for I-O features) 5-year I-O Period 30-year fixed-rate only 10-year I-O Period All products with a 30-year term CHOICE ADVANTAGE The Choice Advantage product allows for four payment options during the early years of the loan. This is known as the Option Period. The Option Period begins on the date of settlement and remains in effect for 60 months, or until payment of the minimum payment on the next scheduled payment date would cause the principal balance to exceed 115% of the original loan balance, whichever is earlier. The interest rate will not change during the Option Period. After the Option Period, the minimum monthly payment will be interest-only based on the note rate and current unpaid balance. The interest-only period will continue through the 10th year of the mortgage loan. Beginning in the 11th year of the loan, the borrower will begin making payments of principal and interest sufficient to amortize the loan over the remaining term of the loan. Choice Advantage During Option Period During the Option Period the borrower will have the option of paying one of the following monthly payments: • Option 1– Minimum Payment: • A minimum payment of interest-only calculated based on the original loan amount and a rate that is 3, 3.5 or 4 percentage points below the note rate. The result of this calculation is called the minimum payment provided the negative amortization balance cap has not been reached. This minimum payment will remained fixed during the Option Period. • The required minimum payment is determined based on one of the following alternatives, with minimum qualifying criteria listed under each. Please note: The borrower may choose (one time choice) a higher minimum payment than that which he or she qualifies for. For example, even if the borrower qualifies for the note rate minus 4%, he or she may choose one of the other two payment alternatives: • Note rate minus 3%; interest-only payment: o This is the standard payment option; however, the following alternatives are available based on the applicable occupancy and credit score criteria. • Note rate minus 3.5%; interest-only payment if the borrower meets the following criteria: o Full Doc, owner occupied, with a credit score of 700-719 o Stated Doc, owner occupied with a credit score of 720-739 • Note rate minus 4%; interest-only payment if the borrower meets the following criteria: o Full Doc, owner occupied with a credit score of ≥720 o Stated Doc, owner occupied with a credit score of ≥740 • Option 2– Interest-Only: • An interest-only payment calculated at the note rate based on the unpaid principal balance. This payment may vary based on the unpaid balance each month. • Option 3– P&I based on remaining term: • A fully amortized payment based on the unpaid balance and the actual remaining term to maturity. This payment may vary based on the unpaid balance each month. • Option 4– 15-year P&I Payment: • A fully amortized payment based on the current unpaid balance and a 15-year term to maturity. This payment may vary based on the unpaid balance each month. Choice Advantage After Option Period • Interest-Only Period • After the Option Period, the borrower will be required to make a monthly payment sufficient to pay the interest due on the unpaid balance. This new payment may be significantly higher than the minimum payment required during the Option Period. • The interest-only monthly payment is calculated each month based on the current balance. If borrower makes voluntary prepayments of principal during the Interest-Only Period, the subsequent monthly payments will be based on the lower principal balance. • The Interest-only period will continue through the 10th year. • Rate and payment may change on each Interest Rate Change Date. • Full Amortization Period • Beginning in the 11th year, the borrower will be required to make monthly payment sufficient to repay the principal and interest over the remaining term of the loan. • Rate and payment may change on each Interest Rate Change Date. Choice Advantage Negative Amortization • The only program that allows negative amortization is Choice Advantage. Alt-A, High LTV Alt-A, Mortgage Maker and High LTV and Mortgage Maker do NOT allow negative amortization. • Choice Advantage negative amortization cap is 115%. If unpaid balance increases to 115% above the original principal balance, the loan will be recast to an interest-only loan (see After Option Period topic above). Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 15 of 17

- 16. PREPAYMENT PENALTY • Permitted on transactions in accordance with state-specific restrictions as outlined on Form 603A • Form 603A includes instructions, legal documentation requirements and state restrictions. • The prepayment penalty feature is an option, not a requirement. If prepayment penalty feature is selected, the following overall (prepayment penalty period) and hard/soft penalties should be selected. Prepay Periods Alt-A/High LTV Alt-A; Choice Advantage Mortgage Maker/High LTV Mortgage Maker 2 year Overall w/ 1 year Hard Not permitted 2/6, 3/6, 5/6 LIBOR 2 year Overall with soft prepay Not permitted Not permitted 3 year Overall w/ 1 year Hard Permitted on all products and loan sizes Fixed-rate, 3/6 & 5/6 3 year Overall with soft prepay Permitted on all except A6MH and loan ≥$650,000 Not permitted 3 year Overall w/ 3 year Hard Permitted on 30-year fixed (A30F) and Choice Advantage Not permitted UNDERWRITING • First Lien loans may be underwritten by Purchaser, an approved contract underwriter (see Form 411, Approved Contract Underwriters) or a Seller approved for Delegated Underwriting Authority. SERVICING OPTIONS • Alt-A, MM and Choice Advantage–Eligible for Servicing Retained and Servicing Released Sellers. • High LTV Alt-A, High LTV Mortgage Maker– Eligible for Servicing Released Sellers only. ESCROW ACCOUNT • When LTV ≤80%, borrowers may choose to waive monthly real estate tax and insurance impounds. Escrows may be waived on LTVs >80% only when mandatory escrow is prohibited by state regulations. See Price Adjustment Factors on the daily rate sheet for any price differential. LEGAL DOCUMENTS • All loans except Choice Advantage loans must be closed using most recent FNMA/FHLMC approved legal documents (including notes, riders and security instruments, state-specific where required) dated 1/01 or later and Aurora-specific documents as specified below. If Choice Advantage, Aurora-specific docs must be used. • If closed in the name of a Trustee, see appropriate Closing Document Review (Form 407-LivT for Living Trust; Form 407-LandT for Land Trust; Form 407-BT for Blind Trust). (See Separate Grid for Choice Advantage Details) Alt-A/High LTV Alt-A/Mortgage Maker/High LTV Mortgage Maker Products Alt-A/High LTV Alt-A Products Alt-A and High LTV Alt-A Products: Product code begins in “A”; Mortgage Maker and High LTV Mortgage Maker Products: Product code begins in “G” Hybrid-LIBOR ARMs LIBOR Hybrid-LIBOR ARMs Product Identifiers Product Identifiers Product A76L A10L A31L A51L A71L A101 Codes Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 16 of 17 Product Features Fixed Rate 2/6 3/6 5/6 7/6 10/6 6-Month (High Margin) 3/1 5/1 7/1 10/1 A30F; A20F; A15F G30F; G20F; G15F G26L A36L G36L A56L G25L A30F: 25 or 30 yr G30F: 30 yr A20F/G20F: 20 yr A15F/G15F: 10 or 15 yr These 30-yr hybrid-LIBOR products are fixed for the number of years listed first in product identifier (i.e., 2 years for 2/6). Thereafter, the products are subject to adjustments every 6 months. A6MH - 30-year These 30-yr hybrid-LIBOR products are fixed for the number of years listed first in product identifier (i.e., 3 years for 3/1). Thereafter, the products are subject to adjustments every 1 year. Caps1 N/A G26L and G36L: 2/2/6 All Others: 6/2/6 1/1/6 2/2/5 5/2/5 5/2/5 5/2/5 Floor N/A Mortgage Maker: Start Rate All Others: Margin margin Margin Index N/A 6-Month LIBOR 6-Month LIBOR 1-Year LIBOR Margin N/A See rate sheet for margin on ARM products. FNMA Note2 3200 If I-O: 3271 35204 35204 FHLMC 55305 FHLMC 55316 Aurora Note Addendum N/A Form 1201 If I-O, add: 603E If I-O, add: 603E Security Instrument State Specific State Specific State Specific FNMA Rider2 N/A 31384 31384 FHLMC 51305 FHLMC 55316 FHLMC 51316 Aurora Rider N/A Form 1202 If I-O, add: 603F If I-O, add: 603F Disclosure3,7 N/A 624 A36L: 610 G36L: 621 A56L: 611 G25L: 1225 612 613 605 614 615 616 617 Assumable No No Yes Yes Yes during ARM period Convertible No No No No 1. Caps = Initial Cap (Max increase or decrease at first Change Date) / Periodic Cap (Max periodic increase or decrease after the first Change Date) / Life Cap (Max increase in interest rate over the initial rate during the life of the loan). 2. State specific forms or multi-state modified for state specific use as identified by Fannie Mae must be used. 3. May use any format provided disclosures are in full compliance with all federal regulations and given to borrower within the required time frame. 4. May use FHLMC 5520 and FHLMC 5120. 5. A31L: May use FNMA Note 3526 and Rider 3189. 6. A51L, A71L, A101: May use FNMA Note 3528 and Rider 3187. 7. If interest-only ARM: Use 1238-IO disclosure if G26L; use 1237-IO disclosure if G36L. All others: Use version of disclosure that includes IO in the document title (i.e., 610-IO; 611-IO, etc.).

- 17. AURORA CHOICE ADVANTAGESM– FIRST LIENS 5/6 Hybrid LIBOR 5/1 Hybrid LIBOR Product Codes A56A (3% below note rate) A56C (3.5% below note rate) A56E (4.0% below note rate) A51A (3% below note rate) A51C (3.5% below note rate) A51E (4.0% below note rate) Caps1 6/2/6 5/2/5 Floor Margin Margin Index 6-Month LIBOR 1-Year LIBOR Margin See rate sheet for margin on ARM products See rate sheet for margin on ARM products Note Aurora Form 6632 (see Form 663-Help for instructions on how to complete the note) Aurora Form 6672 (see Form 667-Help for instructions on how to complete the note) Security Instrument Uniform State Specific Uniform State Specific Rider Aurora Form 664 (see Form 664-Help for instructions on how to complete the rider) Aurora Form 668 (see Form 668-Help for instructions on how to complete the rider) Reg Z Disclosure3 Aurora Form 1288 Aurora Form 1289 Special Disclosure Aurora Form 480E, Choice Neg Am 5/6 Aurora Form 481E, Choice Neg Am 5/1 Due to the complex features of the Choice Advantage 5/6 and 5/1 ARMs, Aurora has developed special disclosures that must be given to the borrower. These disclosures go beyond Regulation Z requirements by addressing payment shock, providing a detailed explanation of negative amortization, and presenting payment examples. This disclosure or a similar disclosure is required. If an alternative version is provided, the Client must Represent and Warrant that all product descriptions and disclosures were given to consumers in advance of closing, containing information about the costs, terms, features and risks of the product, including without limitation the following: (a) Payment Shock. Consumers have been informed in writing of the potential increases in payment obligations, including circumstances in which negative amortization reaches the contractual limit. (b) Negative Amortization. Consumers have been informed in writing about the potential for an increasing principal balance and decreasing home equity, as well as other potential adverse consequences of negative amortization. (c) Option Period. Consumers have been informed in writing about the option period and when the option period ends (60 months or when negative amortization cap is reached). This representation and warranty will be waived on all loans closed using Aurora-specific disclosures. Note: Clients may attach Form 485 to their disclosures to address Payment Shock, Negative Amortization and the Option Period. Assumable Yes during the ARM period Convertible No 1. Caps = Initial Cap (Max increase or decrease at first Change Date) / Periodic Cap (Max periodic increase or decrease after the first Change Date) / Life Cap (Max increase in interest rate over the initial rate during the life of the loan). 2. State-specific versions provided for: AK, FL, NH, VA, VT, WI, and WV. 3. May use any format provided disclosures are in full compliance with all federal regulations and given to borrower within the required time frame. Aurora Alt-A/High LTV Alt-A/Choice Advantage/Mortgage Maker/High LTV Mortgage Maker–Information as of 12/18/06–Page 17 of 17