HDFC sec Note - NCD ready reckoner as on 17 november 2015

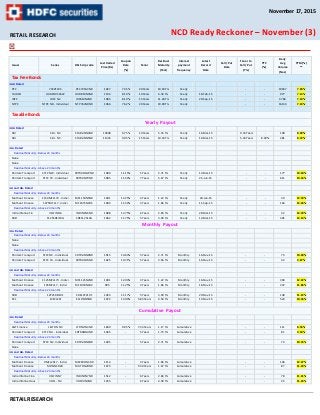

- 1. RETAIL RESEARCH Issuer Series HSL Scrip code Last traded Price (Rs) Coupon Rate (%) Tenor Residual Maturity (Year) Interest payment frequency Latest Record Date Call / Put Date Tenor to Call / Put (Yrs) YTC (%) Daily Avg Volume (Nos) YTM (%) ** Tax Free Bonds AAA Rated PFC 735PFC35 PFC735A3NR 1027 7.35% 20 Years 19.93 Yrs Yearly - - 19947 7.18% HUDCO HUDCO050322 HUD810N3NR 1104 8.10% 10 Years 6.30 Yrs Yearly 18-Feb-15 - - 977 7.14% IRFC IRFC N2 IRF810N2NR 1085 8.10% 15 Years 11.28 Yrs Yearly 29-Sep-15 - - 3783 7.10% NTPC NTPC ND - Individual NTP762NDNR 1066 7.62% 20 Years 19.90 Yrs Yearly - - 16134 7.10% Taxable Bonds Yearly Payout AAA Rated SBI SBI - N3 STABANN3NR 10908 9.75% 10 Years 5.33 Yrs Yearly 16-Mar-15 0.33 Years - 109 8.99% SBI SBI - N5 STABANN5NR 11445 9.95% 15 Years 10.34 Yrs Yearly 16-Mar-15 5.34 Years 8.00% 281 8.72% AA+ Rated Residual Maturity- Below 24 months None None Residual Maturity- Above 24 months Shriram Transport STFC NW - Individual SRTRANNWNR 1080 11.15% 5 Years 2.71 Yrs Yearly 13-Mar-15 - - 177 10.60% Shriram Transport STFC Y9 - Individual SRTRANY9NR 1085 11.50% 7 Years 5.67 Yrs Yearly 26-Jun-15 - - 611 10.36% AA and AA- Rated Residual Maturity- Below 24 months Muthoot Finance 1150MFL17V - Indivi MF1150N5NR 1091 12.25% 3 Years 1.22 Yrs Yearly 20-Jan-15 - - 30 12.59% Muthoot Finance 1075MFL17 - Indivi MF1075NCD5 1003 11.50% 3 Years 1.86 Yrs Yearly 11-Sep-15 - - 164 12.26% Residual Maturity- Above 24 months India Infoline Fin IIFLFIN N6 INDINFN6NR 1088 12.75% 6 Years 2.84 Yrs Yearly 28-Mar-15 - - 32 12.39% SREI 1125SREI19G SRE112519G 1062 11.75% 5 Years 3.99 Yrs Yearly 14-Mar-15 - - 301 12.14% Monthly Payout AA+ Rated Residual Maturity- Below 24 months None None Residual Maturity- Above 24 months Shriram Transport STFC NX - Individual SRTRANNXNR 1015 10.63% 5 Years 2.71 Yrs Monthly 16-Nov-15 - - 73 10.28% Shriram Transport STFC YA - Individual SRTRANYANR 1025 10.71% 5 Years 3.66 Yrs Monthly 16-Nov-15 - - 32 9.87% AA and AA- Rated Residual Maturity- Below 24 months Muthoot Finance 1125MFL17II - Indivi MF1125N2NR 1001 12.00% 3 Years 1.22 Yrs Monthly 16-Nov-15 - - 393 12.02% Muthoot Finance 105MFL17 - Indivi MF1050NCD2 995 11.25% 3 Years 1.86 Yrs Monthly 16-Nov-15 - - 247 11.86% Residual Maturity- Above 24 months SREI 1072SREI19F SRE107219F 1024 11.17% 5 Years 3.99 Yrs Monthly 20-Nov-15 - - 138 11.12% ECL 12ECL20I ECLFINN5NR 1072 12.00% 5.83 Years 4.50 Yrs Monthly 13-Nov-15 - - 523 10.36% Cumulative Payout AA+ Rated Residual Maturity- Below 24 months L&T Finance L&T FIN N3 LTFINHN3NR 1840 9.95% 7.33 Years 1.17 Yrs Cumulative - - 111 8.56% Shriram Transport STFC NU - Individual SRTRANNUNR 1465 - 5 Years 1.73 Yrs Cumulative - - 81 9.59% Residual Maturity- Above 24 months Shriram Transport STFC NZ - Individual SRTRANNZNR 1285 - 5 Years 2.71 Yrs Cumulative - - 74 10.76% None AA and AA- Rated Residual Maturity- Below 24 months Muthoot Finance 0MFL2017 - Indivi MFZERONCD9 1114 - 3 Years 1.86 Yrs Cumulative - - 194 12.47% Muthoot Finance MFINNCD2D MUTFIN2DNR 1673 - 5.50 Years 1.67 Yrs Cumulative - - 87 11.29% Residual Maturity- Above 24 months India Infoline Fina IIFLFIN N7 INDINFN7NR 1512 - 6 Years 2.84 Yrs Cumulative - - 78 11.41% India Infoline Hous IIHFL - N3 IIHF00N3NR 1255 - 6 Years 4.38 Yrs Cumulative - - 35 11.24% RETAIL RESEARCH November 17, 2015 NCD Ready Reckoner – November (3)

- 2. RETAIL RESEARCH Note: Credit Rating (as per latest data): For STFC NCDs – CARE AA+ / Crisil AA+ (Stable). For TATA Cap Financial Services NCDs – CARE AA+ / ICRA AA+. For L&T Fin NCDs – CARE AA+ / ICRA AA+. For SBI Bonds – CARE AAA / AAA/ Stable” by CRISIL. For IndiaInfoline NCDs - ‘CARE AA' by CARE & ‘ICRA AA’ (Stable) by ICRA. - ‘BWR AA (Stable)' by Brickwork. For SHRIRAMCITI NCDs - Crisil – ‘AA-/Stable’ Care – ‘AA+'. For Muthoot NCDs - ‘CRISIL AA-/Stable’ by CRISIL and ‘[ICRA] AA-(stable)’ by ICRA. For Manappuram NCDs A+/Stable and A+( Negative) by CRISIL. For Religare Finvest NCDs - [ICRA] AA – (Stable) from ICRA Ltd. &[CARE] AA- from CARE. For NHAI NCDs - “CRISIL AAA/Stable” by CRISIL “CARE AAA” by CARE and "Fitch AAA(ind) with Stable Outlook” by FITCH. For PFC NCDs - "CRISIL AAA/Stable” by CRISIL and “ICRA AAA” by ICRA. For IRFC - ‘“CRISIL AAA/Stable” by CRISIL, “[ICRA] AAA” by ICRA and “CARE AAA” by CARE ". For HUDCO - ‘CARE AAA’ from CARE and ‘Fitch AAA’ from Fitch. For REC - CRISIL AAA/Stable”by CRISIL,“CARE AAA”by CARE, “Fitch “Ind AAA” by FITCH and [ICRA]AAA”by ICRA. For Tata Capital Financial Service Ltd - AA+/Stable” from ICRA Limited and “CARE AA+” from CARE. For IIFCL, “ICRA AAA/Stable” by ICRA,“BWR AAA” by Brickworks and “CARE AAA” by CARE. For NHB, “CRISIL AAA/Stable” and “CARE AAA". For Kamarajar Port (Ennore Port), BWR AA+ (SO), CRISIL AA/Stable and CARE AA. For Dredging Corporation of India, BWR AA+ (SO) and “CARE AA”. For Jawaharlal Nehru Port Trust, “CRISIL AAA/Stable”, "BWR AAA". For NHPC, “[ICRA] AAA” by ICRA IND ‘AAA’ /Stable by India Rating & Research Private Limited and ‘CARE AAA’ by CARE. For NTPC, ‘CRISIL AAA’ from CRISIL and ‘ICRA AAA’ (Stable) from ICRA. For ECL - CARE AA’ by CARE and ‘BWR AA by Brickwork. For SREI "CARE AA- (Double A Minus)’ by CARE and ‘BWR AA (Stable) ’by BRICKWORK. For India Infoline Housing Finance Ltd: CRISIL AA-/Stable by CRISIL and ‘CARE AA’ (Double A) by CARE. For IFCI, BWR AA- (Outlook: Stable) , [ICRA] A+ (Stable), For IREDA, ‘CARE AAA (SO)’ from Credit Analysis and Research Limited (“CARE”) and ‘BWR AAA (SO)’ from Brickwork Rating India Private Limited. ** - In Tax Free Bonds, to avail (or retain) the 25bps additional in the coupon rate, Investors should be aware that the total investment in the aggregate face value of Bonds held by the Bondholders in all the Series of Bonds, allotted under the relevant Tranche Issue shall be clubbed and taken together and that should be up to Rs. 10 Lakhs. This can be explained in the following way. In the Year 2013-14, the issuers such as IRFC, HUDCO, IIFCL, etc came out with more than one tranches offering 10 Years, 15 Years or 20 Years maturing bonds. In any Tranche, to avail the additional 25bps in the coupon rate by retailers, the investment in any series or all the series of bonds (usually 3 series like 10 Years, 15 Years or 20 Years) should not be more than Rs. 10 lakhs. That means that the investor can hold a maximum of Rs. 10 Lakhs across all series of Bonds in one tranche/issue if he wants to avail of the benefit of extra 25 bps interest. If the investment in any series or all the series of one issue or tranche exceeds Rs. 10 lakhs, then the investor will lose out the benefit of additional 25 bps in the coupon rate. YTM is yield to maturity - Annualized yield that would be realized on a bond if the bond is held until the maturity date. Yield to call (YTC) is the annualized rate of return that an investor would earn if he bought a callable bond at its current market price and held until the call is first exercisable by the issuer. PFC, DCI, Ennore Port, IIFCL NCDs are listed only on BSE, while the rest are listed on NSE and (in some cases - HUDCO , IREDA, IRFC, NHPC, NTPC & REC ) also on BSE. In case where the NCD are listed on both the exchanges, the price on the exchange where it is traded more (average daily volumes) is considered. On Taxable side Religare, Manappuram, PFC, REC, DCI, Ennore Port, IIFCL, NHPC, NTPC NCDs are listed only on BSE, while the rest are listed on NSE and (in some cases - Muthoot finance, IIFL, HUDCO and some series of Shriram Citi, Muthoot Fin, Tata Capital Financial Services & Religare Fin ) also on BSE. In case where the NCD are listed on both the exchanges, the price on the exchange where it is traded more (average daily volumes) is considered. In case where the NCD are listed on both the exchanges, the price on the exchange where it is traded more (average daily volumes) is considered. FV of NCDs in all cases is Rs.1000, except Rs.10, 000 for SBI. For NHB, the FV of Series NHBTF2023 is Rs 10,000, while the FV for Series N1,N2,N3,N4,N5,N6 is Rs 5000. FV of Blue Dart is Rs 10, FV of NTPC (Taxable) is Rs 12.50. Last traded date means date of last trade (not beyond the previous month). Further freak trades are not considered for YTM calculations. While short listing the top picks, enough weightage is given to frequency of trade and average volumes. Unexpected cut in credit rating could result in bond prices going down and resultant MTM loss. The series mentioned as individual in taxable NCDs of Shriram Transport, Muthoot Finance and Shriram Citi are eligible for retail investments (and higher coupon) irrespective of investment amount. The only criterion for higher interest is that the holder should be an individual as on the record date. RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.