Digital Disruption in Wealth Management

•

1 like•947 views

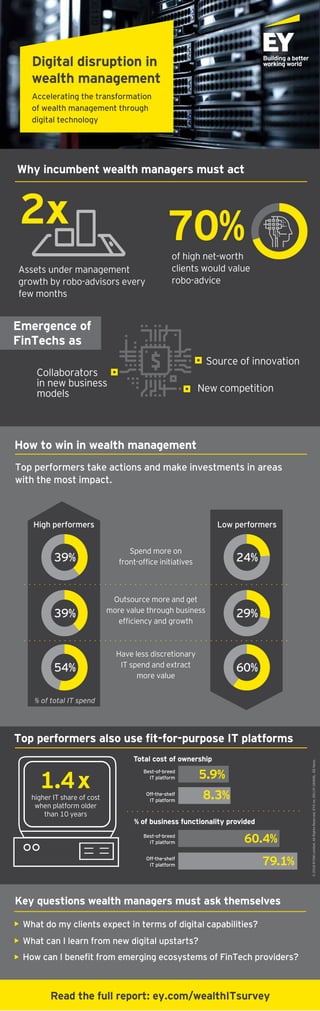

EY Wealth & Asset Management explores how digital technology is accelerating the transformation of wealth management. Read the full report at ey.com/wealthITsurvey

Report

Share

Report

Share

Download to read offline

Recommended

Chinese Internet Economy White Paper 2.0 - Decoding the Chinese Internet 2.0:...

Chinese Internet Economy White Paper 2.0 - Decoding the Chinese Internet 2.0:...Boston Consulting Group

Recommended

Chinese Internet Economy White Paper 2.0 - Decoding the Chinese Internet 2.0:...

Chinese Internet Economy White Paper 2.0 - Decoding the Chinese Internet 2.0:...Boston Consulting Group

Moving digital transformation forward: Findings from the 2016 digital busines...

Moving digital transformation forward: Findings from the 2016 digital busines...Deloitte United States

More Related Content

What's hot

Moving digital transformation forward: Findings from the 2016 digital busines...

Moving digital transformation forward: Findings from the 2016 digital busines...Deloitte United States

What's hot (20)

When, Where & How AI Will Boost Federal Workforce Productivity

When, Where & How AI Will Boost Federal Workforce Productivity

Moving digital transformation forward: Findings from the 2016 digital busines...

Moving digital transformation forward: Findings from the 2016 digital busines...

Global Capital Confidence Barometer | How can you reshape your future before ...

Global Capital Confidence Barometer | How can you reshape your future before ...

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

Intelligent Operations for Future-Ready Businesses | Accenture

Intelligent Operations for Future-Ready Businesses | Accenture

World Economic Forum: The power of analytics for better and faster decisions ...

World Economic Forum: The power of analytics for better and faster decisions ...

The Rapidly Evolving Landscape of Meal Kits and E-commerce in Food & Beverage

The Rapidly Evolving Landscape of Meal Kits and E-commerce in Food & Beverage

MGI: From poverty to empowerment: India’s imperative for jobs, growth, and ef...

MGI: From poverty to empowerment: India’s imperative for jobs, growth, and ef...

TMT Outlook 2017: A new wave of advances offer opportunities and challenges

TMT Outlook 2017: A new wave of advances offer opportunities and challenges

Global banking outlook 2018: pivoting toward an innovation-led strategy

Global banking outlook 2018: pivoting toward an innovation-led strategy

Similar to Digital Disruption in Wealth Management

Similar to Digital Disruption in Wealth Management (20)

The 6 Steps to Becoming a Top-Performing Organization in Managing IT Operations

The 6 Steps to Becoming a Top-Performing Organization in Managing IT Operations

Modern ITSM—the untapped game-changer for midsize organizations

Modern ITSM—the untapped game-changer for midsize organizations

The Connected Refinery – Accenture 2017 Digital Refining Survey

The Connected Refinery – Accenture 2017 Digital Refining Survey

On-switch: Applied Lessons on Moving up the Digital Maturity Curve

On-switch: Applied Lessons on Moving up the Digital Maturity Curve

Webinar for August 2018 Technology infrastructure for global insurers

Webinar for August 2018 Technology infrastructure for global insurers

Drill Deeper Into Digital - 2017 Upstream Oil and Gas

Drill Deeper Into Digital - 2017 Upstream Oil and Gas

Gartner 2013 it cost optimization strategy, best practices & risks

Gartner 2013 it cost optimization strategy, best practices & risks

Digital transformation - What does it take to win?

Digital transformation - What does it take to win?

Digitalization at Chemical Companies: Choosing the Right IT Solution as an En...

Digitalization at Chemical Companies: Choosing the Right IT Solution as an En...

Oracle Insight - Cloud Events Presentation V5 LinkedIn

Oracle Insight - Cloud Events Presentation V5 LinkedIn

More from EY

More from EY (20)

Quarterly analyst themes of oil and gas earnings, Q1 2022

Quarterly analyst themes of oil and gas earnings, Q1 2022

EY Price Point: global oil and gas market outlook, Q2 April 2021

EY Price Point: global oil and gas market outlook, Q2 April 2021

Tax Alerte - Principales dispositions loi de finances 2021

Tax Alerte - Principales dispositions loi de finances 2021

EY Price Point: global oil and gas market outlook (Q4, October 2020)

EY Price Point: global oil and gas market outlook (Q4, October 2020)

IBOR transition: Opportunities and challenges for the asset management industry

IBOR transition: Opportunities and challenges for the asset management industry

Fusionen und Übernahmen dürften nach der Krise zunehmen

Fusionen und Übernahmen dürften nach der Krise zunehmen

EY Price Point: global oil and gas market outlook, Q2, April 2020

EY Price Point: global oil and gas market outlook, Q2, April 2020

Trotz Rekordumsätzen ist die Stimmung im Agribusiness durchwachsen

Trotz Rekordumsätzen ist die Stimmung im Agribusiness durchwachsen

Digital Disruption in Wealth Management

- 1. Digital disruption in wealth management Accelerating the transformation of wealth management through digital technology ©2018EYGMLimited.AllRightsReserved.EYGno.00119-184GBL.EDNone. High performers Low performers Spend more on front-office initiatives Outsource more and get more value through business efficiency and growth Have less discretionary IT spend and extract more value % of total IT spend 39% 39% 54% 24% 29% 60% How to win in wealth management higher IT share of cost when platform older than 10 years 1.4x % of business functionality provided Total cost of ownership Top performers also use fit-for-purpose IT platforms 5.9% 8.3% Best-of-breed IT platform Off-the-shelf IT platform Best-of-breed IT platform Off-the-shelf IT platform What do my clients expect in terms of digital capabilities? What can I learn from new digital upstarts? How can I benefit from emerging ecosystems of FinTech providers? Top performers take actions and make investments in areas with the most impact. 60.4% 79.1% Key questions wealth managers must ask themselves Read the full report: ey.com/wealthITsurvey Why incumbent wealth managers must act Emergence of FinTechs as Assets under management growth by robo-advisors every few months of high net-worth clients would value robo-advice 70%2x New competition Source of innovation Collaborators in new business models