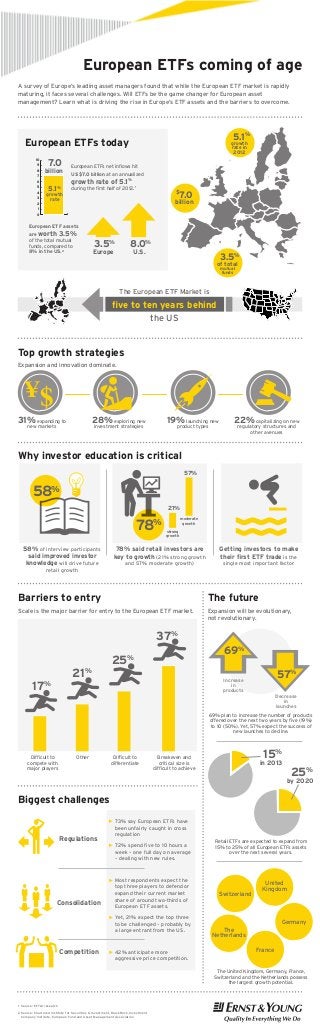

European ETFs

- 1. European ETFs coming of age A survey of Europe’s leading asset managers found that while the European ETF market is rapidly maturing, it faces several challenges. Will ETFs be the game changer for European asset management? Learn what is driving the rise in Europe’s ETF assets and the barriers to overcome. 5.1% European ETFs today 7.0 10 9 billion 8 7 growth rate in 2012 European ETFs net inflows hit US $7.0 billion at an annualized growth rate of 5.1% 6 5.1% 5 4 during the first half of 2012.1 7.0 $ growth rate 3 2 billion 1 0 European ETF assets are worth 3.5% of the total mutual funds, compared to 8% in the US.2 3.5% 8.0% Europe U.S. 3.5% of total mutual funds The European ETF Market is five to ten years behind the US Top growth strategies Expansion and innovation dominate. ¥$ 31% expanding to 28% exploring new new markets 19% launching new investment strategies product types 22% capitalizing on new regulatory structures and other avenues Why investor education is critical 57% 58% 21% 78 moderate growth % 58% of interview participants said improved investor knowledge will drive future strong growth 78% said retail investors are key to growth (21% strong growth Getting investors to make their first ETF trade is the and 57% moderate growth) single most important factor retail growth Barriers to entry The future Scale is the major barrier for entry to the European ETF market. Expansion will be evolutionary, not revolutionary. 37% 69% 25% 21% 17 57% Increase in products % Decrease in launches 69% plan to increase the number of products offered over the next two years by five (19%) to 10 (50%). Yet, 57% expect the success of new launches to decline. Difficult to compete with major players Other Difficult to differentiate 15% Breakeven and critical size is difficult to achieve in 2013 25% by 2020 Biggest challenges Regulations Consolidation 73% say European ETFs have been unfairly caught in cross regulation 72% spend five to 10 hours a week – one full day on average – dealing with new rules. Most respondents expect the top three players to defend or expand their current market share of around two-thirds of European ETF assets. Yet, 21% expect the top three to be challenged – probably by a large entrant from the US. Competition 42% anticipate more aggressive price competition. Retail ETFs are expected to expand from 15% to 25% of all European ETFs assets over the next several years. Switzerland United Kingdom Germany The Netherlands France The United Kingdom, Germany, France, Switzerland and the Netherlands possess the largest growth potential. 1 Source: EFTGI research 2 ource: Chartered Institute for Securities Investment, BlackRock, Investment S Company Institute, European Fund and Asset Management Association