EY 2015 Global Corporate Divestment Study

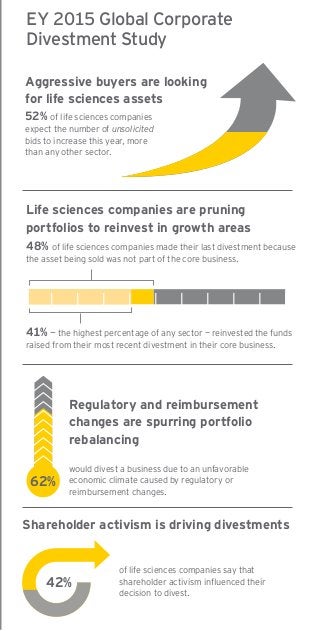

Leading companies are using divestments as a fundamental tool in their growth strategy. Fifty-five percent of life sciences companies surveyed for our 2015 EY Global Divestment Study expect to see more strategic sellers during the next 12 months. And, in addition, fifty-two percent expect the number of unsolicited bids to increase this year, more than any other industry sector. In the past year alone we saw M&A activity in the life sciences sector skyrocket, with global deal values almost doubling over 2013. Businesses are under constant pressure to improve portfolio performance and shareholder returns and to employ better analytics to make smarter decisions. In particular, the prospect of activist shareholders is influencing corporate decisions.

Recommended

Recommended

More Related Content

More from EY

More from EY (20)

Recently uploaded

Recently uploaded (20)

EY 2015 Global Corporate Divestment Study

- 1. 2 The life sciences industry is undergoing a tectonic shift due to regulatory changes and a growing focus on patient outcomes. In response, leading companies are using divestments as a fundamental tool in their growth strategy. Fifty-five percent of life sciences companies surveyed for our latest EY Global Corporate Divestment Study expect to see more strategic sellers during the next 12 months. In the past year alone we saw M&A activity in the life sciences sector skyrocket, with global deal values almost doubling over 2013. Businesses are under constant pressure to improve portfolio performance and shareholder returns and to employ better analytics to make smarter decisions. In particular, the prospect of activist shareholders is influencing corporate decisions. Pressure to improve patient outcomes and tougher reimbursement criteria from payers are forcing life sciences companies to rethink their strategies and refocus on core assets. But while many companies are using divestments to change their business models, too few are properly preparing for this complex process. As a result, many find themselves rushing to the finish line without achieving full value. Our study reveals that half of these businesses are willing to sacrifice value if it means closing the deal faster. This is a false choice: our study outlines the key strategies for successful divestments that optimize both speed and value. A note from Jeff Greene EY Global Transactions Leader for Life Sciences About this study The EY Global Corporate Divestment Study analyzes companies’ top questions and concerns relating to portfolio review and divestment strategies and provides insights on how to maximize divestment success. The results of the 2015 study are based on more than 800 interviews with corporate executives, including 104 in the life sciences sector, surveyed between November 2014 and January 2015 by FT Remark, the research and publishing arm of the Financial Times Group. • Executives are from companies across the Americas, Asia- Pacific, Europe, the Middle East, India and Africa. • 85% of executives are CEOs, CFOs or other C-level executives. • Executives stated they have knowledge of or direct hands-on experience with their company’s portfolio review process and have been involved in at least one major divestment in the last three years. • While nine industry sectors are represented, the study focuses on consumer products, diversified industrials, financial services, life sciences, oil and gas, and technology. • More than half of the executives represent companies with annual revenues that exceed US$1b. 52% of life sciences companies expect the number of unsolicited bids to increase this year, more than any other sector. Life sciences companies are pruning portfolios to reinvest in growth areas 48% of life sciences companies made their last divestment because the asset being sold was not part of the core business. 41% — the highest percentage of any sector — reinvested the funds raised from their most recent divestment in their core business. Regulatory and reimbursement changes are spurring portfolio rebalancing of life sciences companies say that shareholder activism influenced their decision to divest. Shareholder activism is driving divestments would divest a business due to an unfavorable economic climate caused by regulatory or reimbursement changes. 42% Aggressive buyers are looking for life sciences assets 62% EY 2015 Global Corporate Divestment Study