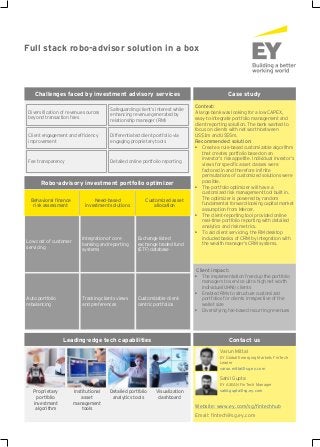

Full stack robo-advisor solution in a box

- 1. Full stack robo-advisor solution in a box Case study Context: A large bank was looking for a low CAPEX, easy-to-integrate portfolio management and client reporting solution. The bank wanted to focus on clients with net worth between US$1m and US$5m. Recommended solution: • Create a rule-based customizable algorithm that creates portfolio based on an investor’s risk appetite. Individual investor’s views for specific asset classes were factored in and therefore infinite permutations of customized solutions were possible. • The portfolio optimizer will have a customized risk management tool built in. The optimizer is powered by random fundamental forward-looking capital market assumption from Mercer. • The client-reporting tool provided online real-time portfolio reporting with detailed analytics and risk metrics. • To aid client servicing, the RM desktop included basics of CRM by integration with the wealth manager’s CRM systems. Client impact: • The implementation freed up the portfolio managers to service ultra high net worth individual(UHNI) clients • Enabled RMs to structure customized portfolios for clients irrespective of the wallet size • Diversifying fee-based recurring revenues Contact us Varun Mittal EY Global Emerging Markets FinTech Leader varun.mittal@sg.ey.com Challenges faced by investment advisory services Robo-advisory investment portfolio optimizer Behavioral finance risk assessment Need-based investment solutions Customized asset allocation Diversification of revenue sources beyond transaction fees Safeguarding client’s interest while enhancing revenue generated by relationship manager (RM) Client engagement and efficiency improvement Differentiated client portfolio via engaging proprietary tools Fee transparency Detailed online portfolio reporting Proprietary portfolio investment algorithm Leading-edge tech capabilities Institutional asset management tools Detailed portfolio analytics tools Visualization dashboard Low cost of customer servicing Integration of core banking and reporting systems Exchange listed exchange traded fund (ETF) database Auto portfolio rebalancing Tracking clients views and preferences Customizable client- centric portfolios Website: www.ey.com/sg/fintechhub Email: fintech@sg.ey.com Sahil Gupta EY ASEAN FinTech Manager sahil.gupta@sg.ey.com

- 2. EY | Assurance | Tax | Transactions | Advisory About EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com. © 2018 EYGM Limited. All Rights Reserved. EYG no. 011378-18Gbl ED None. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax or other professional advice. Please refer to your advisors for specific advice. ey.com