Securitizing financial transactions using distributed ledger technology (DLT)

Lending solutions leverage on emerging technologies to simplify the lending process and to increase the accessibility of lending services. Lending solution encompasses functions like credit scoring, AI deployment, alternative lending solutions and intuitive mobile solutions for lending. Traditional physical assets are illiquid and difficult to sub-divide for securitizing the loan. The solution leverages on blockchain technology to convert illiquid assets to digital assets, assigning ownership to multiple stakeholders and allowing for fractional ownership and securitizing financial transactions. The solution simplifies the complicated process of completing transaction and transfer of ownership, reducing administrative costs involved, speeding up transaction completion time as well builds a transparent environment with trust among the parties involved. Find out more at www.ey.com/sg/fintechhub. For enquiries, contact us via email at fintech@sg.ey.com.

Recommended

Recommended

More Related Content

More from EY

More from EY (20)

Recently uploaded

Recently uploaded (20)

Securitizing financial transactions using distributed ledger technology (DLT)

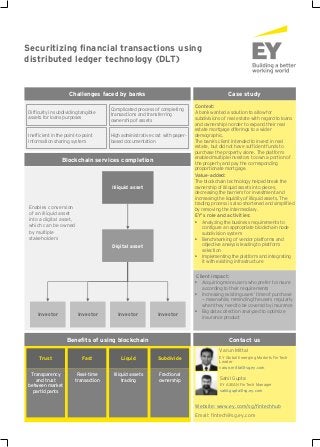

- 1. Securitizing financial transactions using distributed ledger technology (DLT) Case study Context: A bank wanted a solution to allow for subdivisions of real estate with regard to loans and ownership in order to expand their real estate mortgage offerings to a wider demographic. The bank’s client intended to invest in real estate, but did not have sufficient funds to purchase the property alone. The platform enabled multiple investors to own a portion of the property and pay the corresponding proportionate mortgage. Value-added: The blockchain technology helped break the ownership of illiquid assets into pieces, decreasing the barriers for investment and increasing the liquidity of illiquid assets. The trading process is also shortened and simplified by removing the intermediary. EY’s role and activities: • Analyzing the business requirements to configure an appropriate blockchain node subdivision system • Benchmarking of vendor platforms and objective analysis leading to platform selection • Implementing the platform and integrating it with existing infrastructure Client impact: • Acquiring more users who prefer to insure according to their requirements • Increasing existing users’ time of purchase — meanwhile, reminding the users regularly when they need to be covered by insurance • Big data collection analyzed to optimize insurance product Contact us Challenges faced by banks Difficulty in subdividing tangible assets for loans purposes Complicated process of completing transactions and transferring ownership of assets Inefficient in the point-to-point information sharing system High administrative cost with paper- based documentation Benefits of using blockchain Trust Fast Liquid Subdivide Transparency and trust between market participants Real-time transaction Illiquid assets trading Fractional ownership Blockchain services completion Enables conversion of an illiquid asset into a digital asset, which can be owned by multiple stakeholders Illiquid asset Digital asset Investor Investor Investor Investor Varun Mittal EY Global Emerging Markets FinTech Leader varun.mittal@sg.ey.com Website: www.ey.com/sg/fintechhub Email: fintech@sg.ey.com Sahil Gupta EY ASEAN FinTech Manager sahil.gupta@sg.ey.com

- 2. EY | Assurance | Tax | Transactions | Advisory About EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com. © 2018 EYGM Limited. All Rights Reserved. EYG no. 011378-18Gbl ED None. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax or other professional advice. Please refer to your advisors for specific advice. ey.com