Trade financing solution in a box

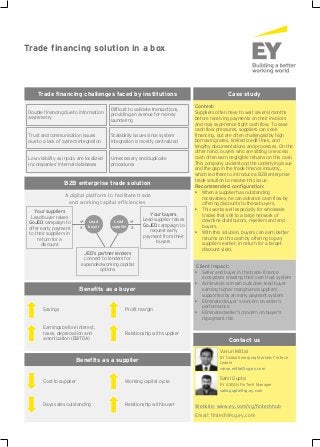

- 1. Benefits as a supplier Trade financing solution in a box Case study Context: Suppliers often have to wait several months before receiving payments on their invoices and may experience tight cash flow. To ease cash flow pressures, suppliers can seek financing, but are often challenged by high borrowing rates, limited credit lines, and lengthy documentations and processes. On the other hand, buyers who are sitting on excess cash often earn negligible returns on this cash. This company understood the underlying issue and the gap in the trade finance industry, which led them to introduce a B2B enterprise trade solution to resolve this issue. Recommended configuration: • When a supplier has outstanding receivables, he can advance cash flow by offering discounts to these buyers. • This works well especially for wholesale trades that sell to a large network of downline distributors, resellers and end buyers. • With this solution, buyers can earn better returns on this cash by offering to pay suppliers earlier, in return for a target discount yield. Client impact: • Seller and buyer in the trade finance ecosystem creating their own trust system • Achieved a win-win outcome; lead buyer earning higher margin and suppliers supported by an early payment system • Eliminated buyer’s concern on seller’s performance • Eliminated seller’s concern on buyer’s repayment risk Contact us Varun Mittal EY Global Emerging Markets FinTech Leader varun.mittal@sg.ey.com Trade financing challenges faced by institutions Double financing due to information asymmetry Difficult to validate transactions, providing an avenue for money laundering Trust and communication issues due to a lack of system integration Scalability issues since system integration is mostly centralized Low visibility as inputs are localized in companies’ internal databases Unnecessary and duplicate procedures B2B enterprise trade solution A digital platform to facilitate trade and working capital efficiencies X X Your suppliers Lead buyer raises GoJED campaign to offer early payment to their suppliers in return for a discount Your buyers Lead supplier raises GoJED campaign to request early payment from their buyers Lead buyer Lead supplier JED’s partner lenders connect to lenders for expanded working capital options Benefits as a buyer Savings Profit margin Earnings before interest, taxes, depreciation and amortization (EBITDA) Relationship with supplier Cost to supplier Working capital cycle Days sales outstanding Relationship with buyer Website: www.ey.com/sg/fintechhub Email: fintech@sg.ey.com Sahil Gupta EY ASEAN FinTech Manager sahil.gupta@sg.ey.com

- 2. EY | Assurance | Tax | Transactions | Advisory About EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com. © 2018 EYGM Limited. All Rights Reserved. EYG no. 011378-18Gbl ED None. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax or other professional advice. Please refer to your advisors for specific advice. ey.com