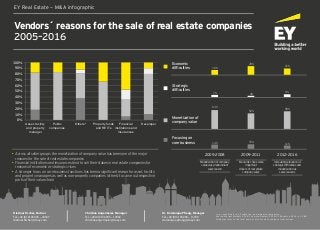

Verkaufsmotivation Immobilienunternehmen 2005-2016

•

1 like•601 views

Warum werden Immobilienunternehmen verkauft? Unsere Analyse der in Deutschland getätigten Veräußerungen von 2005-2016 zeigt: Die Hauptmotivation ist schlicht und einfach der finanzielle Nutzen.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

Viewers also liked

Viewers also liked (17)

Unternehmenskäufe chinesischer Investoren in Deutschland steigen auf Rekordhoch

Unternehmenskäufe chinesischer Investoren in Deutschland steigen auf Rekordhoch

Numérique et nouvelles activités - Les propostions du Medef

Numérique et nouvelles activités - Les propostions du Medef

EY Biotechnology Report 2017: Beyond borders - Staying the course

EY Biotechnology Report 2017: Beyond borders - Staying the course

Health 4.0 wird unsere Welt verändern, die Art, wie wir denken und leben

Health 4.0 wird unsere Welt verändern, die Art, wie wir denken und leben

Fast jeder Vierte ist zu unethischem Verhalten im Job bereit

Fast jeder Vierte ist zu unethischem Verhalten im Job bereit

EY-Studie: Streamingdienste - das Ende von CD und DVD?

EY-Studie: Streamingdienste - das Ende von CD und DVD?

Bpifrance Capital Invest 2016 - L'attractivité affirmée de l'Afrique ? - Eme...

Bpifrance Capital Invest 2016 - L'attractivité affirmée de l'Afrique ? - Eme...

Assekuranz: Bei Immobilien sind Einzelhandel und Sicherheit wieder top

Assekuranz: Bei Immobilien sind Einzelhandel und Sicherheit wieder top

AI – Opportunities and Challenges in Transforming the Biopharma Value Chain

AI – Opportunities and Challenges in Transforming the Biopharma Value Chain

More from EY

More from EY (20)

Quarterly analyst themes of oil and gas earnings, Q1 2022

Quarterly analyst themes of oil and gas earnings, Q1 2022

EY Price Point: global oil and gas market outlook, Q2 | April 2022

EY Price Point: global oil and gas market outlook, Q2 | April 2022

EY Price Point: global oil and gas market outlook, Q2 April 2021

EY Price Point: global oil and gas market outlook, Q2 April 2021

Tax Alerte - Principales dispositions loi de finances 2021

Tax Alerte - Principales dispositions loi de finances 2021

EY Price Point: global oil and gas market outlook (Q4, October 2020)

EY Price Point: global oil and gas market outlook (Q4, October 2020)

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

IBOR transition: Opportunities and challenges for the asset management industry

IBOR transition: Opportunities and challenges for the asset management industry

Fusionen und Übernahmen dürften nach der Krise zunehmen

Fusionen und Übernahmen dürften nach der Krise zunehmen

EY Price Point: global oil and gas market outlook, Q2, April 2020

EY Price Point: global oil and gas market outlook, Q2, April 2020

Verkaufsmotivation Immobilienunternehmen 2005-2016

- 1. Vendors´ reasons for the sale of real estate companies 2005–2016 EY Real Estate — M&A infographic Dietmar Fischer, Partner Tel. +49 (0) 6196 996 – 24547 dietmar.fischer@de.ey.com Christina Angermeier, Manager Tel. +49 (0) 6196 996 – 17882 christina.angermeier@de.ey.com Dr. Dominique Pfrang, Manager Tel. +49 (0) 6196 996 – 13740 dominique.pfrang@de.ey.com 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Asset, facility and property manager Public companies Others* Property funds and REITs Financial institutions and insurances Developer *e.g. consulting firms, PropTechs, non-property companies Source: Merger Markets 2016, Thomson Reuters 2016, EY Research 2016; n = 288. All figures refer to the total number of real estate company transactions. • Across all seller groups the monetization of company value has been one of the major reasons for the sale of real estate companies • Financial institutions and insurances tend to sell their stakes in real estate companies for reasons of economic or strategic crises • A stronger focus on core business functions has been a significant reason for asset, facility and property managers as well as non-property companies (others) to carve out respective parts of their value chain Monetization of company value was predominant sales reason Economic crises were important drivers of real estate company sales Increasing relevance of strategic difficulties and monetization as sales reasons 2005–2008 2009–2011 2012–2016 Economic difficulties 16% 29% 21% Strategic difficulties 7% 4% 9% Monetization of company value 63% 52% 59% Focusing on core business 15%14% 11%