Capital letter Mar'14 - Fundsindia

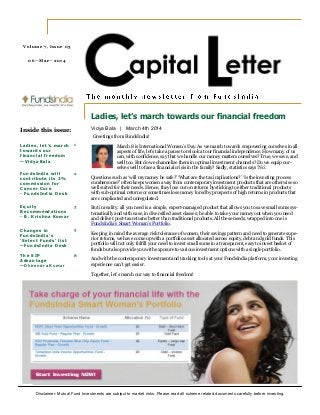

- 1. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. Greetings from FundsIndia! March 8 is International Women’s Day. As we march towards empowering ourselves in all aspects of life, let’s take a pause to relook at our financial independence. How many of us can, with confidence, say that we handle our money matters ourselves? True, we save, and well too. But do we channelize them in optimal investment channels? Do we equip our- selves well to face a financial crisis in the family? Sadly, statistics says ‘No’. Questions such as ‘will my money be safe?’ ‘What are the tax implications?’ ‘Is the investing process cumbersome?’ often keeps women away from contemporary investment products that are otherwise so well suited for their needs. Hence, they lose out on returns by sticking to either traditional products with sub-optimal returns or sometimes lose money lured by prospects of high returns in products that are complicated and unregulated. But in reality, all you need is a simple, expert-managed product that allows you to save small sums sys- tematically and with ease, in diversified asset classes; be able to take your money out when you need and deliver post-tax returns better than traditional products. All these needs, wrapped into one is FundsIndia’s Smart Woman’s Portfolio. Keeping in mind the average risk tolerance of women, their savings pattern and need to generate supe- rior returns, we have come up with a portfolio asset allocated across equity, debt and gold funds. This portfolio will not only fulfill your need to invest small sums in a transparent, easy to invest basket of funds but also provide you with exposure to various investment options with a single portfolio. And with the contemporary investment and tracking tools at your FundsIndia platform, your investing experience can’t get easier. Together, let’s march our way to financial freedom! 06—Mar—2014 Volume 7, Issue 03 Inside this issue: Ladies, let’s march towards our financial freedom —Vidya Bala 1 FundsIndia will contribute its 2% commission for Cancer Cure - FundsIndia Desk 2 Equity Recommendations - B. Krishna Kumar 3 Changes in FundsIndia’s ‘Select Funds’ list —FundsIndia Desk 5 The SIP Advantage —Dhirendra Kumar 8 Ladies, let’s march towards our financial freedom Vidya Bala | March 4th 2014

- 2. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. FundsIndia.com, India’s leading online investment platform, is proud to partner with HDFC Mutual Fund in promoting the new fund offer – HDFC Debt Fund for Cancer Cure 2014. This fund, a three-year closed-end debt fund gives investors the option to donate half or whole of the dividends generated to the Indian Cancer Society, a public charitable trust dedicated to cancer care and research. HDFC Mutual Fund will also match the dividend contributions made as donation from this fund. As a broker, FundsIndia.com will receive a 2% brokerage for investments made in this fund through its platform. FundsIndia has decided to donate this brokerage to the Indian Cancer Society. Srikanth Meenakshi, co-founder and COO, FundsIndia.com, said, “While there have been many remarkable breakthroughs for cancer cure in India and abroad, such facilities and medicines aren’t very accessible or affordable. It is heartening to know that organizations like the Indian Cancer Society are working towards eliminating such discrepancies and making cancer care and research available to all. We applaud HDFC Mutual Fund for this initiative.” He added, “To lend our support to this noble cause, we’ve decided to contribute the 2% commission we receive for this particular fund towards the Indian Cancer Society. So, I welcome investors to make a bigger impact and invest through our platform as it will help contribute more towards this noble cause.” The HDFC Debt Fund for Cancer Cure 2014 will close for investments on March 11, 2014. For all investments made in this fund through FundsIndia.com, the online investment website will contribute its upfront 2% commission that it will receive for every invest- ment in the fund to the Indian Cancer Society. Page 2Volume 7, Issue 03 FundsIndia will contribute its 2% commission for Cancer Cure FundsIndia Desk | March 5th 2014

- 3. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. After recording losses in January, the stock market sentiment turned positive in February. The frontline indices gained during February while much of the action was in the small and the mid-cap stocks. On the macro-economic front, the sign of inflation cooling off is a posi- tive trend. However, the signs of a recovery in the economic growth still remain elusive. The GDP data released last week wasn’t encouraging either. In the meanwhile, the stress on the banking sector owing to growing provi- sioning for bad loans is another worrying factor. A recovery in the economic growth and a cut in interest rates are the key ingredients for a sustained recovery in the stock market. The Reserve Bank of India has however made it very clear that it is keen to contain inflation and would therefore not be in a hurry to cut interest rates unless there are clear signs of a cooling off in the consumer price index. The main market event would however be the out- come of the general elections to be held soon. Technically, the Nifty is still trading below its key resistance at 6,360. Unless there is a breakout past this level, we would maintain a cau- tious view and would not advise holding on to trades for bigger moves. As observed last month, once 6,360 is taken out, we expect the Nifty to rally to our target of 6,650-6,700. The immediate support for the index is at 6,150. The short-term trend would turn negative if the index falls below 6,150. This month, we cover the outlook for a couple of actively traded stocks – Tata Steel and Reliance Communications. We are positive on both these stocks and expect 12-15% ap- preciation from a short-term perspective. As always, we sug- gest investors to accumulate these stocks at the current levels as well as on declines. Investors may buy Tata Steel at or below Rs.330, with a stop loss at Rs.305 and target of Rs.380. A breakout past Rs.380 would be lend momentum to the uptrend and the stock could then rally to the next target of Rs.395. The positive view in Tata Steel would be invalidated if the stock slides below Rs.305 as this would open up further downside. From the daily chart of Reliance Communications featured below, it is evident that the stock has been in a downtrend in the past few months. The recent fall has pushed the stock to an area of support between Rs.105-110. Continued on page 4 . . . Page 3Volume 7, Issue 03 The Month Ahead - Equity Recommendations B. Krishna Kumar | March 2nd 2014

- 4. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. Investors may buy the stock at, or below Rs.110, with a stop loss at Rs.99 and target of Rs.125 to begin with. A move past Rs.125 would be sign of strength and the stock could then target the major resistance at Rs.132. Mr. B. Krishna Kumar also hosts a weekly webinar that discusses the market outlook for the follow- ing week. You can follow him on Livestream to receive reminders for his webinars: https://www4.gotomeeting.com/register/131985103 Page 4Volume 7, Issue 03

- 5. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. FundsIndia’s ‘Select Funds’, a list of investment-worthy funds across various categories, helps you narrow your investment choice from the 100s of funds that you have to otherwise sift through before investing. This list is reviewed on a quarterly basis. There are additions to ensure that good choices are not left out. There are also deletions if funds underperform for prolonged periods and pose the risk of an opportunity loss for your portfolio. We have made changes to this list recently and would like to highlight them here. We are also introducing a new category of ‘theme funds’ meant for risk takers. This category is aimed at investors looking for opportune sectors to invest in and also those looking to diversify into other markets. Do note that you will have to track these more closely if you wish to invest and find opportunities to re- move profits. Among the equity funds – 2 schemes, Axis Equity and Franklin India Prima have made the cut to our list and one fund – Birla Sun Life Dividend Yield Plus has been moved to a ‘watch’ mode. Among debt funds, we have two additions - one in the short-term debt category and the other in income fund category. We are placing a hold on the Morgan Stanley Short Term Bond fund simply to wait for the integration with HDFC Mutual. Among theme funds, ICICI Pru Technology, SBI Pharma, ICICI Prudential Export & Other Services, L&T Global Real Assets, FT India Feeder Franklin U.S Opportunities and Franklin Build India are the themes we will go with, at this point in time. All the funds in this basket will be termed risky and may undergo changes as and when we see better opportunities. Hence, you may have to track them more actively if you hold them (given a 2-3 year time frame required). A more detailed article on these changes was published in our blog recently. You can read the entire article here – http:// www.fundsindia.com/blog/uncategorized/changes-in-fundsindias-select-funds-list-2/4641 Happy Investing! Page 5Volume 7, Issue 03 Changes in FundsIndia’s ‘Select Funds’ list By FundsIndia Desk | March 5th 2014

- 6. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. Page 6Volume 7, Issue 03 Continued on page 7 . . .

- 7. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. Page 7Volume 7, Issue 03

- 8. Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing. A couple of days ago, I received a question from an investor who was puzzled by how the systematic investment plan (SIP) returns over a period could be less than the non-SIP (lump-sum) returns. He went to an online investing website and saw that for a particular fund, non-SIP returns over there were high, but the SIP returns were much lower. The in- vestor seemed to think that there was some sort of a problem in this. Actually, the problem lies entirely in the public per- ception of how an SIP works and what is its exact purpose. The systematic style of investing is actively promoted by practically everyone who gives advice about fund investing. Whether these are fund companies, advisors, or the media, an SIP is supposed to be the holy grail of mutual fund invest- ing. Unfortunately, there seem to be a growing number of investors who have cottoned-on to the notion that SIP invest- ing is some sort of magic. There are two widespread misconceptions about SIPs: some investors believe that an invest- ment through the SIP route cannot have poorer returns than a lump-sum investment made at the same time that the SIP was started. The other, more extreme point-of-view is that you can’t make a loss in an SIP, no matter what. Both are equally wrong, or perhaps the second one is more wrong than the first one. The basic idea behind an SIP is that while the general direction of an investment (a fund or even a stock) is upwards, it is not possible to reliably predict the actual fluctuations that it may undergo as part of its general trend. Instead of trying to time one’s investments, one should regularly invest a constant amount. As time goes by and the investment’s net asset value (NAV), or market price, fluctuates, it will automatically ensure that when the NAV was low, you ended up purchas- ing a larger number of shares or units. Eventually, when you want to redeem your investment, all the units are worth the same price. However, because your SIP meant that you bought a larger number of units whenever the price was low, your returns are higher than they would otherwise have been. That’s the way it works, usually. However, there are circumstances in which a lump-sum investment can (in hindsight) prove to be better. This happens when during a given period, the equity markets never fall below the level they were at the beginning of that period. In such a case, a lump-sum investment made at the beginning of that period will turn out to have the maximum gains because the buying price was the lowest at that point. The last one year is one such a period. Generally, over a longer period of time, the ups and downs of the market will ensure that an SIP has better returns. Moreover, SIPs mirror the actual fund flows of salaried people. They don’t generally have money available in large chunks to be invested as and when they feel like investing. Beyond the arithmetic of returns, there is another reason why SIPs make sense. They are a great way to override the nor- mal psychological instinct to stop investing when prices fall. In my experience, this is the real value of SIPs. The normal tendency is to invest more when prices are high and to stop investing when prices fall. This is the opposite of what is the most profitable way of investing. SIPs force you to follow the opposite approach, much to your eventual benefit. Syndicated from Value Research Online. Read the article online here: http://www.valueresearchonline.com/story/h2_storyview.asp? str=101083 Page 8Volume 7, Issue 03 The SIP Advantage By Dhirendra Kumar | Feb 28, 2014 Wealth India Financial Services Pvt. Ltd., H.M. Centre, Second Floor, 29, Nungambakkam High Road, Nungambakkam, Chennai - 600 034 Phone: (0) 7667 166 166 Email: contact@fundsindia.com