Where The Candidates Stand On Financial Issues

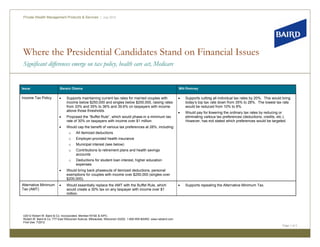

- 1. Priva Wealth Managem ate ment Products & Services | July 2012 W Where the Presid dential Candidat Stand on Fin C tes d nancial Issues Sig gnificant differ rences emerge on tax policy, health care act Medicare o h t, Issue e Barack Obama Mitt M Romney Incom Tax Policy me Supports mainntaining current tax rates for married co ouples with Supports cuttin all individual tax rates by 20%. This would bring ng income below $250,000 and singles below $200,000 raising rates 0, today’s top tax rate down from 35 to 28%. The low 5% west tax rate from 33% and 35% to 36% and 39.6% on taxpayers with income 3 s would be reduc from 10% to 8% ced %. above those th hresholds. Would pay for llowering the ordina tax rates by reducing or ary Proposed the “Buffet Rule”, which would phase-in a minimum tax “ h eliminating variious tax preference (deductions, cred es dits, etc.). rate of 30% on taxpayers with inc n come over $1 million. However, has n stated which pr not references would be targeted. Would cap the benefit of various tax preferences at 28%, including: t o All itemiz deductions zed o Employe er-provided health in nsurance o Municipa interest (see belo al ow) o Contributions to retirement plans and health sa avings accounts s o Deductio for student loan interest, higher ed ons n ducation expenses Would bring ba phaseouts of ite ack emized deductions, personal exemptions for couples with incom over $250,000 (singles over r me $200,000). Altern native Minimum Would essentia replace the AM with the Buffet Rule, which ally MT R Supports repea aling the Alternative Minimum Tax. e Tax ((AMT) would create a 30% tax on any ta axpayer with income over $1 million. ©2012 Robert W. Baird & Co. Incorporated. Member NYSE & SIPC. . Robe W. Baird & Co. 777 Ea Wisconsin Avenue, Milwaukee, Wisconsin 53 ert ast M 3202. 1-800-RW-BAIRD. www.rwbaird.com First U Use: 7/2012 Page 1 of 3

- 2. Wh the Presid here dential Candid dates Stand on Financial Issu continued. ues, Issue e Barack Obama Mitt M Romney Taxes on investment Would maintain current 0% and 15% tax rates on qu ualified Would maintain the current 0% an 15% rates on qu n nd ualified me incom dividends and long-term capital gains for couples wi income g ith dividends and llong-term capital ga ains. under $250,00 (singles under $2 00 200,000). Would eliminat tax on capital gains, dividends and interest te Would raise the long-term capital tax rate taxpayers over those income for any taxpayer with adju y usted gross income below e thresholds to 20%. 2 $200,000. Would tax qualified dividends for taxpayers over tho thresholds ose Would repeal th 3.8% Medicare tax on investment income (as a he as ordinary inccome. Combined with other proposals this would w s, result of repealling the health care act – see below). e result in tax rat of 36% or 39.6% tes %. Would maintain the additional 3.8 Medicare tax inc 8% cluded in the health care act on investment inc t come. As a result, the top tax rate t on long-term capital gains would become 23.8% and on dividends c d would become 43.4%. e Would cap the tax benefit of municipal interest at 28 effectively 8%, creating a tax of 8% or 11.6% for those in the top tw tax brackets. o wo Corpo orate tax rates Would cut the corporate tax from 35% to 28%, bann ning unspecified Would cut the c corporate tax rate f from 35% to 25%. s. tax deductions Move to a territ torial system, rathe than taxing corpo er orations on Would target oil and gas companies for higher taxes would offer o s, income earned overseas. d tax breaks for manufacturers. Assess a minim mum tax on foreign earnings. n Estat Tax te Proposed an estate tax exemption of $3.5 million an a top tax rate e nd Supports full, p permanent repeal o the estate tax. of of 45%. This compares to a $5 million exemption an 35% top c m nd rate today, and $1million and 55% for 2013 under cu d % urrent law. Healt Care Act th Passed during the President’s firs term, and recentl upheld as st ly Supports the fu and immediate re ull epeal of the health care act. constitutional by the Supreme Co b ourt. Socia Security al Called on Congress to create a plan to save Social Security. S No change to c current or projected benefits for those over age 55. d Opposed to privatization. Lower the rate of inflation adjustm ments for higher inc come recipients, no c change for lower inccome recipients. Supports increa asing the retiremen age by 1 to 2 yea nt ars. Would allow tax xpayers to direct a portion of their Soc Security cial tax to a private account. e ©2012 Robert W. Baird & Co. Incorporated. Member NYSE & SIPC. . Robe W. Baird & Co. 777 Ea Wisconsin Avenue, Milwaukee, Wisconsin 53 ert ast M 3202. 1-800-RW-BAIRD. www.rwbaird.com First U Use: 7/2012 Page 2 of 3

- 3. Wh the Presid here dential Candid dates Stand on Financial Issu continued. ues, Issue e Barack Obama Mitt M Romney Supp porting Medicare Maintain Medic care in its current single-payer structu and s ure Turn Medicare into a premium support system, wher seniors re implement cha anges enacted in th health care act. he receive a fixed benefit to purchase the insurance the wish to own. e ey Support payme ents would be reduc for higher income retirees. ced Would eliminat subsidies to private insurance Medicare te advantage program Medicare would be one option, an other plans must offer d nd coverage comp parable to today’s M Medicare. Seniors could choose Would gradual phase out the Medicare prescription drug donut lly plans that cost more or less than the support payme ents hole. Would only app to future retirees not those currently in or near ply s, retirement. ©2012 Robert W. Baird & Co. Incorporated. Member NYSE & SIPC. . Robe W. Baird & Co. 777 Ea Wisconsin Avenue, Milwaukee, Wisconsin 53 ert ast M 3202. 1-800-RW-BAIRD. www.rwbaird.com First U Use: 7/2012 Page 3 of 3