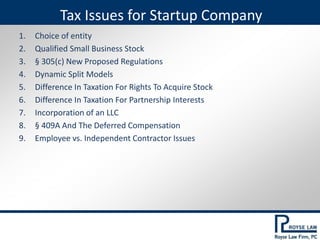

Tax Issues for Startup Company

- 1. 1. Choice of entity 2. Qualified Small Business Stock 3. § 305(c) New Proposed Regulations 4. Dynamic Split Models 5. Difference In Taxation For Rights To Acquire Stock 6. Difference In Taxation For Partnership Interests 7. Incorporation of an LLC 8. § 409A And The Deferred Compensation 9. Employee vs. Independent Contractor Issues Tax Issues for Startup Company

- 2. • Primary considerations: Is the availability to take tax losses critical to the client? Are tax-deferred or tax-free fringe benefits important? Does the client expect to do a public offering in the future or grow the business to sell it? Is the business the type that will expose its owners to great liability? Will value be generated in intellectual property? Will it be necessary to move assets in and out of the business? Will the owners share profits and losses equally? Will special allocations be required? Will there be limitations on owner’s ability to transfer their ownership interests in the business? Will there be foreign owners? Will there be owner-level taxes, such as state income tax, intangible personal property tax, self-employment tax, etc.? Will investors be brought in? Who will manage the entity? 1. Choice of Entity

- 3. Entity Form LLC S Corporation C Corporation Partnership Entity Level Federal Income Taxes No federal tax at LLC level unless LLC elects to be taxed as corporation. Generally no tax at S corporation level; some excise taxes, and built in gains taxes may apply. Income tax on earnings at corporate level. No federal tax at partnership level. Number of Required Owners Any number. No more than 100. Any number. At least two. Eligibility Requirements of Owners No restrictions. US citizens or resident individuals, certain trusts, and certain tax exempt entities. No restrictions. No restrictions. Entity Level California Taxes 8.84% corporate rate applies, or $800 minimum franchise tax. Gross receipts fee. Minimum franchise tax of $800 or 1.5% taxable income. 8.84% corporate rate applies, or $800 minimum franchise tax. $800 minimum franchise tax on limited partnerships, no California income tax on general partnerships. Option Plans, NSO's, ISO's Employees & consultants can be given options to acquire LLC interests, but such options are generally more complex. ISO’s not available. ISO’s commonly granted to employees. NSO’s may be granted to consultants and advisors. ISO’s commonly granted to employees. NSO’s may be granted to consultants and advisors. Employees & consultants can be given options to acquire partnership interests, but such options are generally more complex. ISO’s not available. 1. Choice of Entity

- 4. Entity Form LLC S Corporation C Corporation Partnership Status Change on Transfer of Interests LLC terminates for tax purposes on transfer of 50% or more of capital and profits in 12 months. No termination of entity on transfer of interests. No termination of entity on transfer of interests. Partnership terminates for tax purposes on transfer of 50% or more of capital and profits in 12 mos. Treatment of Foreign Owners Foreign members subject to US tax on their share of effectively connected income of LLC; branch profits tax may apply. Foreigners cannot be shareholders of S corporation. Foreigners are subject to withholding tax on dividends from US corporation, subject to treaty rate or exemption. Foreign partners subject to US tax on their share of partnership's effectively connected income; branch profits tax may apply. Foreign Individual Owners - Transfer Taxes Membership interest may be subject to US estate and gift taxes. N/A. Foreigners cannot be shareholders of S corporation. Corporate stock is not US situs asset for gift tax purposes. Partnership interest may be subject to US estate and gift taxes. Conversion to Another Entity May be incorporated tax free. Can convert to C corporation by revoking election; may be taxed on converting to LLC. Can convert to S corporation by making election (built in gains tax may apply to later dispositions of appreciated property). Conversion to LLC may be taxable. Easily converted to LLC or incorporated tax free. Taxes on Sale or Liquidation One level of tax, generally capital gain except for amount allocable to certain assets. One level of tax on sale of stock or assets, generally capital gain on stock sale. Potential double tax. Corporate tax on sale of assets. Shareholder level tax on sale of stock or liquidation. One level of tax, generally capital gain except for amount allocable to certain assets. 1. Choice of Entity

- 5. • S Corporation Eligibility 26 U.S. Code §1361 Is not an ineligible corporation (as defined in §1361(b)(2)); Does not have more than 100 shareholders; Does not have shareholders other than individuals, estates, certain trusts, and certain tax-exempt organizations; Has no nonresident shareholders; and Does not have more than one class of stock. ‒ All outstanding shares must confer identical rights to operating and liquidating distributions. 26 U.S. Code §1362(d)(2) ‒ Treasury stock and unissued stock of a different class than that held by the shareholders does not disqualify a corporation. Treas. Reg. §1.1361-1(l)(1); See also PLR 201326012 ‒ Differences in voting rights are disregarded in determining whether a corporation has more than one class of stock. Treas. Reg. §1.1361-1(l)(1) ‒ Call options, warrants, or other arrangements may accidently create a second class of stock if, the instrument is substantially certain to be exercised by the holder and has a strike price substantially below the fair market value of the underlying stock on the issuing date, transferred by an eligible shareholder to a person who is not an eligible shareholder, or materially modified. Treas. Reg. §1.1361-1(l)(4)(iii)(A) ‒ Debt may be recharacterized as a second class of stock, unless certain safe harbor requirements are met under §1361(c)(5). Treas. Reg. §1.1361-1(l)(4)(ii) 1. Choice of Entity

- 6. • Primary considerations: Do you expect to take money from a VC or an institutional investor. ‒ If yes, you will need to be a C corporation, although you may be able to start life with an S election and only convert if it becomes necessary. Will you be a typical technology company that will want to issue stock options to employees, raise capital through preferred stock, and expect a typical technology company life-cycle in which all surplus will be reinvested into the company (no distributions to owners) which is grown until the company is acquired or goes public? ‒ These factors would push you toward the C corporation because LLC and S corporation will add complexity to equity derivatives (which will be discussed in section 4). Alternatively, will your company be operated for its cash flows over a long period of time, not necessarily managed for a public exit. ‒ In this case, a pass through entity such as an LLC or an S corporation may be preferable. • Liquidation of S corporations a. Corporate level ‒ “Except as otherwise provided in this title, and except to the extent inconsistent with this subchapter, subchapter C shall apply to an S corporation and its shareholders.” 26 U.S. Code § 1371(a) ‒ A corporation will recognize gain or loss on the distribution of property in complete liquidation of the corporation as if the property were sold at fair market value. 26 U.S. Code § 336 ‒ Must recognize built-in gain if S corporation converts in to C corporation. 26 U.S. Code § 1371(a) b. Shareholder level ‒ Shareholders recognize gain or loss to extent of difference between amount received and their basis in their S corporation stock. 26 U.S. Code § 331(a) 1. Choice of Entity - Exit Strategy

- 7. • Liquidation of LLCs and Partnerships Generally neither the LLC nor the distributee member will recognize gain upon complete liquidation of a limited liability company (LLC) classified as a partnership. 26 U.S. Code § 731(a) Possibility of Gain or Loss Recognition ‒ Gain is recognized by an LLC member on the receipt of a liquidating distribution to the extent money is distributed in excess of the distributee member's basis in his or her LLC interest. 26 U.S. Code § 731(a)(1) ‒ Gain is recognized when a member receives marketable securities that are treated as money in excess of the member's basis in his or her LLC interest. 26 U.S. Code § 731(c)(2) ‒ In addition, gain may be recognized if (1) distributions of Sec. 751 hot assets (unrealized receivables and substantially appreciated inventory) are not proportionate (§ 751(b)); (2) property that had an FMV different from basis on the date of contribution is distributed to a member other than the contributing member within seven years of contribution (§704(c)(1)(B)); (3) the distribution is within seven years after a contribution of appreciated property (§737); or (4) the distribution is part of a disguised sale (§ 707(a)(2)). ‒ A loss may be recognized upon a distribution in liquidation of a member's interest if no property other than cash, unrealized receivables, and inventory is received. The loss recognized is the excess of the member's adjusted basis in the LLC over the sum of the cash distributed and the member's basis in the unrealized receivables and inventory received. 26 U.S. Code §731(a)(2) Tax Basis of Property Received ‒ If no gain or loss is recognized on a liquidating distribution, the member's aggregate basis in the property received equals the member's basis in his or her LLC interest just before the distribution, reduced by the cash and marketable securities distributed. 26 U.S. Code § 732(b) Holding Period for Distributed Assets ‒ A member's holding period for property received in a nontaxable distribution includes the holding period of the LLC. 26 U.S. Code § 735(b) and § 1223(2) 1. Choice of Entity - Exit Strategy (Continue)

- 8. • Federal Level- three provisions of the Internal Revenue Code give preferential treatment to equity investments in small business corporations: – § 1045: allows the tax-deferred rollover of gain realized on the sale of stock of one qualified small business corporation into stock of another qualified small business corporation. Individual must hold QSBS for at least six months. – § 1202: allows taxpayers other than corporations to exclude from their gross income: 50% of the gain realized on the sale of qualified small business stock if the taxpayer holds the stock for more than five years before the sale; 75% of the gain if it acquired the qualified small business stock after February 17, 2009 and before September 28, 2010 and held it for more than five years; and 100% of the gain if it acquired the qualified small business stock after September 27, 2010 and held for more than five years. the PATH Act also permanently extends the rule that eliminates the 100% excluded QSBS gain as a preference item for Alternative Minimum Tax (AMT) purposes. In addition, the 100% excluded QSBS gain is not subject to 3.8% Net Investment Income Tax. – § 1244: allows taxpayers to claim an ordinary (rather than a capital) loss on the disposition of qualifying small business stock. Moreover, any loss that qualifies as an ordinary loss under § 1244 is also treated as a trade or business loss in computing an individual’s net operating loss (NOL). 2. Qualified Small Business Stock- Federal

- 9. • State Level – California – California does not follow federal income tax treatment of QSBS under § 1202. – According to the Assembly Bill No. 1412, California does not allow any QSBS gain exclusion for stock sales made on or after January 1, 2013. For QSBS sales made before January 1, 2013, California allows exclusion of 50% of gain from disposition of QSBS, but requires: When the stock was issued, at least 80 percent of the corporation’s payroll was attributable to employment located within California for QSBS sales made in taxable years after December 31, 2007, and before January 1, 2013. – AMT tax preference: California picks up one-half of the gain exclusion (i.e. 25 percent of total gain from disposition of QSBS) as a tax preference item. 2. Qualified Small Business Stock- State

- 10. Background • The general rule is that a stock distribution is not taxable subject to various exceptions. 26 U.S. Code § 305(a) • Under § 305(c), convertible Instruments (such as prefer stocks, warrants, rights or convertible debts) holders may be deemed to receive a stock distribution upon the occurrence of a conversion rate adjustment (a “CRA”) that increase holders’ proportionate interest in the earnings and profits or assets of the issuer, and the deemed distribution may be characterized as a taxable stock distribution if it was a “disproportionate distribution”. – However, “an applicable adjustment made pursuant to a bona fide, reasonable adjustment formula that has the effect of preventing dilution of a shareholder’s interest is not a deemed distribution of stock to which Sections 305(b) and 301 apply.” Treas. Reg. § 1.305-7(b)(1). 3. § 305 (C) New Proposed Regulations

- 11. Proposed Regulations: • IRS issued proposed regulations (REG-133673-15*) interpreting deemed distributions under § 305(c). – Timing: the deemed distribution occurs contemporaneously to the applicable adjustment, but in no event later than the date of the property distribution giving rise to the deemed distribution. – Amount: the amount of the deemed distribution is equal to the increase in the fair market value of the right embodied in the convertible instrument resulting from the adjustment. – Withholding requirement: withholding agents are required to withhold tax on deemed distributions to foreign holders even if there is no actual cash payment made to the holders. 3. § 305 (C ) Proposed Regulations (Continue) * REG–133673–15, available at https://www.irs.gov/irb/2016-18_IRB/ar11.html

- 12. • FOUNDER’S EQUITY 4. Dynamic Split Models

- 13. 4. Dynamic Split Models

- 15. Grunt Fund Detail Source: http://www.slicingpie.com/the-grunt-fund-calculator/

- 16. 5. Equity Derivatives – Convertible Debt *See Bittker & Eustice, Federal Income Taxation of Corporations and Shareholders ¶4.40 (7th ed. 2000) Convertible debt issued as an Investment ‒ Tax treatment: treated like any other debt instrument until conversion, if*: a. The exercise price is significantly higher than the issuer's current stock price, so conversion is not highly likely b. Holder is entitled to receive the full principal amount of the debt c. A market rate of interest (allowing for the fact that the conversion feature will significantly reduce interest rate) d. A holder has the right to sue for payment of the debt in the event of default. ‒ Original Issue Discount a. Holder: includes stated interest and original issue discount (OID) as it economically accrues in income. 26 U.S. Code § 1272 (a) b. Issuer: generally may deduct accrued interest and OID until conversion. 26 U.S. Code § 163(e)(1) and (2) ‒ Tax Consequences of Conversion a. Conversion is a non-taxable event, and the holder's basis in the convertible debt becomes the holder's basis in the stock. Treas. Reg. 1.1001-3(c)(2)(ii) b. The holding period of the stock will include the holding period of the debt instrument (at least with respect to the original issue price) 26 U.S. Code § 1223 (1) Debt v. Equity ‒ The tax law has a long and tortured history of delineating “debt” from “equity”. Therefore, great care must be exercised when structuring a convertible debt instrument, in order to ensure that it will be classified as debt. ‒ IRS has issued several rulings in which it sets forth its views on the proper debt/equity characterization of various convertible instruments. For example, when the likelihood that a convertible instrument will be exercised is so high that the instrument itself is treated as equity (not debt) for tax purposes. Rev. Rul. 82-150, 1982-2 C.B. 110; Rev. Rul. 83-98

- 17. 5. Equity Derivatives – Warrants • Investment warrants – Part of an Investment Unit When a warrant is received in conjunction with a debt instrument, the amount paid for that investment unit must be allocated between the warrant and the debt instrument based on their relative fair market values. 26 U.S. Code § 1273(d)(2) The allocation usually will generate OID on the debt instrument. – Tax Treatment a. No gain or loss upon exercise. The purchase price of the warrant is capitalized and is included in the adjusted tax basis of the stock purchased buy the exercise of the warrant. b. If the holder does not exercise the warrant, for tax purpose will treat like the holder had sold it for nothing on the expiration date of the warrant. 26 U.S. Code § 1234(a)(2); Treas. Reg. § 1.1234-1(b); Rev. Rul. 78-182, 1978-1 C.B. 265 c. The issuing company recognize no gain or loss when the warrant is exercised, or lapsed. – Tacking a. The holding period of the stock purchased by the exercise of a warrant begins on the day that the warrant is exercised, not when the warrant was acquired. 26 U.S. Code § 1223(5); Treas. Reg. § 1.1223-1(f) b. If the warrants are exchanged for stock (other than NQPS) in a recapitalization or other reorganization under § 368, then the holding periods of the warrants tacks on to the holding period of the stock acquired (because warrants are treated as “securities” under § 354. See Treas. Dec. 8752, reprinted in 1998-1 C.B. 611; 26 U.S. Code § 354(a)(2); 26 U.S. Code § 1223(1) – Treated as stock under § 305(d) Warrants, convertible debts and other rights to acquire stock of a corporation are treated as “stock” under for the purpose of determine whether certain distributions by the company to its shareholders of additional interests in the corporation’s assets are to be taxed as dividends. Treas. Reg. § 1.305-3(b)(5)

- 18. 5. Equity Derivatives – Incentive Stock Options • Qualifications of ISO – For a stock option to qualify as an ISO, the option and the optionee must meet certain requirements when it is granted and certain requirements during the period the option is held by the optionee until the option is exercised. Treas. Regs. §1.422-2(a)(1), (a)(2); Trea. Regs. §1.422-1. • Tax treatment Grant of ISO ‒ No taxable income to employee; No deduction to employer. Treas. Regs. §1.83-3(a)(2); 26 U.S. Code § 421(a)(2) Exercise of ISO ‒ No income to employee; No deduction to employer. 26 U.S. Code § 422(a) ; § 421(a)(2) ‒ Tax basis in the stock received equals to the amount paid by the employee to exercise the ISO. 26 U.S. Code § 421(a)(3) ‒ The exercise of an ISO will not be subject to income tax withholding or to employment taxes. Treas. Regs. §1.421-2(a)(1)(i) Transfer, Cancellation or Lapse of ISO ‒ An ISO, by its terms, cannot be transferable except upon the death of an employee. 26 U.S. Code § 422(b)(5) ‒ If an employer cancels an ISO in exchange for a cash payment or transfer of other consideration to an employee, the employee will recognize ordinary income in an amount equal to the value of the consideration. PLR 7809072; Bagley v. Comr., 85 T.C. 663 (1985) ‒ Employer is required to withholding income tax and employment taxes. Rev. Rul. 67-366, 1967-2 C.B. 165. ‒ Employee cannot recognize loss if an ISO lapses at the end of its term or otherwise without having been exercised, even if the ISO stock's fair market value exceeds the ISO exercise price at the time of the lapse. 26 U.S. Code § 1234(a)(2) Disqualifying Disposition of ISO Stock ‒ Employee generally recognizes long term capital gain upon subsequent disposition of the ISO stock. 26 U.S. Code § 1222(3) ‒ Disqualifying dispositions: If the stock is sold within: a) 2 years after the ISO is granted, or b) 1 year after the ISO is exercised, 26 U.S. Code § 422(a)(1) a. the employee will recognize as ordinary income the difference between the ISO's exercise price and the ISO stock's fair market value at the time of option exercise (the “bargain purchase element”). Treas. Regs. §1.421-2(b)(1) b. Such ordinary income will be added to the ISO stock's basis to determine the capital gain that must be recognized on the disqualifying disposition. Treas. Regs. §1.421-2(a)(2)

- 19. 5. Equity Derivatives – ISO (Continue) • Modification, Extension or Renewal of ISOs ‒ In general, the modification, extension or renewal of an ISO will be considered the grant of a new option. 26 U.S. Code §424(h)(1); Treas. Regs. §1.424-1(e)(2) ‒ To qualify as an ISO, this new option must have an exercise price that is no lower than the FMV of the stock subject to the option at the time of the modification, extension or renewal, and it must meet all additional requirements that apply to ISOs generally. 26 U.S. Code §424(h)(1) ‒ If an ISO is amended such that, as amended, it fails to meet all of the requirements for ISO treatment, it will be treated as an NSO following such amendment. Treas. Regs. §1.424-1(e)(5) • Alternative Minimum Tax Considerations Although the exercise of an ISO does not result in current taxable income, there are implications with regard to the alternative minimum tax (AMT). When calculating income for AMT purposes, the favorable tax treatment of §421(a) is disregarded, and the bargain purchase element of the ISO will be considered a preference adjustment (i.e., as part of alternative minimum taxable income (AMTI)) for the year in which the option is exercised. 26 U.S. Code § 56(b)(3) • Golden Parachute Tax Considerations ‒ The grant of an ISO or the vesting of an ISO, as applicable, may be subject to §280G and §4999, even though neither the grant nor the vesting of the ISO would be includible in gross income under §61(a). Treas. Regs. §1.280G-1 ‒ §280G denies an employer a deduction for certain payments to certain individuals that are contingent on a change in control of the employer if those payments are “excess parachute payments.” In addition, §4999 imposes a 20% excise tax on the recipient of an “excess parachute payment.” Treas. Regs. §1.280G-1

- 20. 5. Equity Derivatives – Employee Stock Purchase Plans • Qualifications of ESPP ‒ ESPP must meet the requirements set forth in §423(b) to receive favorable tax treatment available under §421(a). ‒ The major distinction between ESPP and ISO is that ESPP can offer purchase rights with a purchase price as low as the lesser of 85% of the fair market value of the stock at the time of grant or 85% of the fair market value of the stock at the time of purchase. 26 U.S. Code §423(b)(6); Treas. Regs. §1.423-2(g)(1) • Tax treatment Grant/Exercise of Purchase Right No income tax to an employee upon the grant of a purchase right under a §423 plan or upon the exercise of such right. 26 U.S. Code §421(a)(1) Terminate of Employment If the employee terminates his or her employment with the employer more than three months before the exercise of the purchase right, the employee will recognize as ordinary income the excess of the fair market value of the stock on the date of exercise over the purchase price. 26 U.S. Code §423(a) Disposition of Acquired Stock a. Qualifying Disposition 26 U.S. Code §423(c) ‒ Sell the stock after the expiration of the statutory holding period, or in the event of the employee's death; ‒ Employee will recognize ordinary income equal to the lesser of: (1) the excess of the fair market of the stock on the date of grant of the purchase right over the exercise price of the purchase right, and (2) the excess of the amount realized on the disposition of the stock over the exercise price of the purchase right. ‒ Any additional gain or loss recognized on the disposition of the stock will be long-term capital gain or loss. Disqualifying Disposition b. Disqualifying disposition Treas. Regs. §1.421-2(b)(1) ‒ Sells or otherwise disposes of stock before the expiration of the statutory holding period ‒ Employee is required to recognize ordinary income equal to the excess of the fair market value of the stock on the date of exercise of the purchase right over the exercise price. ‒ Any additional gain or loss recognized on the disposition of the stock will be short-term or long-term capital gain or loss, depending on the length of time the employee holds the stock after exercise of the purchase right. • Alternative Minimum Tax Considerations ‒ No issue with AMT when an employee buy shares under an ESPP.

- 21. 5. Equity Derivatives – Nonqualified Employee Options • Character of Income and Timing of Income ‒ Holder: Ordinary income upon exercise (if the option does not have a readily ascertainable fair market value at the time of grant) or grant (if the option has a readily ascertainable fair market value at the time of grant)plus capital gain upon sale. 26 U.S. Code §83(e)(3), (4). ‒ Issuer: Issuer can deduct amount equal to amount that option holder recognizes as income in the same year. 26 U.S. Code §83(h); Treas. Regs. §1.83-6(a) • Basis and Holding Period a. Option taxed at grant ‒ The employee takes the property acquired upon the exercise of the option with a basis equal to the amount paid upon the exercise of the option, plus any basis that the employee had in the option itself (amount taxed at grant plus any amount paid for the option). Rev. Rul. 78- 182; Treas. Reg. §1.61-2(d)(2)(i) ‒ The holding period of the property acquired begins only with the day after the option exercise. No tacking of holding periods occurs from the holding period of the option. See Helvering v. San Joaquin Fruit & Inv. Co., 297 U.S. 496 (1936) b. Option taxes at exercise ‒ The employee takes a basis equal to the sum of the property's cost (i.e., the exercise price) and the option's basis in the hands of the option holder. See Rev. Rul. 78-182, 1978-1 C.B. 265 (Ruling A, 4) ‒ The holding period begins on the day on which the property is acquired. No tacking of holding periods. 26 U.S. Code §83(f) • Disposition and Cancellation of Option a. Option taxed at grant If the underlying property would have been a capital asset to the holder, any gain or loss arising from the disposition of the option will be capital in nature. The capital gain or loss will be short-term or long-term, depending upon the option holder's holding period in the option. Rev. Rul. 78-182, 1978-1 C.B. 265 (Ruling A, 2) b. Option taxes at exercise ‒ In an arm's-length disposition, employee recognizes ordinary income to the extent of the difference between the amount realized from the option's sale and the employee's basis in the option. No other tax consequences to the employee from subsequent events (i.e., when the arm's-length transferee exercises the option). Treas. Reg. §1.83-7(a) ‒ In a non-arm's-length disposition, employee may realize compensation income not only at the time of the disposition, but also when the non-arm's-length transferee exercises the option. Treas. Regs. §1.83-1(c); See also PLRs 199952012, 9421013.

- 22. 5. Equity Derivatives – NQSO (Continue) • Lapse of Option a. Option taxed at grant ‒ Deemed to be a sale or exchange of the option for zero on the day the option expires. 26 U.S. Code §1234(a)(2); Rev. Rul. 78-182, 1978-1 C.B. 265 (Ruling A, 3) ‒ The employee can recognize loss to the extent of the employee's basis in the option at the time of lapse. 26 U.S. Code §165(c)(2); §165(f); §1211(b) b. Option taxes at exercise Normally no loss arises because of the lack of basis. Treas. Regs. §1.165-1(c)(1) • Section 83(b) Election ‒ §83(b) election allows employees to limit their ordinary income from the transaction to any difference on the date the property is transferred between the fair market value and the amount paid for the property. Any appreciation in the property after the date of transfer is converted into potential capital gain income, which would be recognized only when the employee disposes of the property. 26 U.S. Code §83(b)(1); Treas. Regs. §1.83-2(a) ‒ The §83(b) election must be made within 30 days after the transfer of the property. 26 U.S. Code §83(b)(2) ‒ The election is irrevocable, unless the IRS agrees to the revocation. 26 U.S. Code §83(b)(2); Treas. Regs. §1.83-2(f) • Section 409(A) Considerations ‒ Nonqualified employee options can be granted with an exercise price that is lower than the fair market value of the stock at the date of grant (“Discount Option”). However, such discount option (unless fall into the short-term deferral exemption) generally constitutes “nonqualified deferred compensation” subject to § 409A, and would be immediately taxable on vesting and subject to an additional 20% penalty tax in addition to employee's ordinary income tax plus interest. 26 U.S. Code §409(A); §4999 ‒ To be exempted under 409A, Company must either conduct or rely on a recently conducted valuation in accordance with Section 409A.

- 23. 5. Equity Derivatives • Other types of equity compensation Restricted stock Refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates such as executives and directors. Restricted stock is nontransferable and must be traded in compliance with special SEC regulations. ‒ Holder can elect to recognize ordinary income on the grant date under § 83(b). ‒ Without the election, the holder is taxed when the shares vest. Restricted stock units (RSUs) A form of stock-based compensation under which an employee is awarded the right to receive a fixed payment equal to the value of a specified number of shares of employer stock. ‒ RSUs is taxed in a similar manner to the taxation of restricted stock. There is generally neither taxation at grant, nor at vesting, unless no substantial risk of forfeiture. ‒ Any subsequent gain or loss upon the sale of shares subject to the RSUs will be taxable as short- or long-term capital gain, depending on how long the stock has been retained. Stock appreciation rights (SARs). SAR provides employee the right to monetary equivalent of the increase in the value of a specified number of shares from the date of grant through the date of payment. ‒ Not subject to taxation until exercised, provided that both the: 1) the exercise price of the SAR is not less than the fair market value of the underlying stock on the grant date; and 2)the SAR does not include any additional deferral features. ‒ SARs that meet the requirements are exempt from IRC Section 409A. Phantom stock A form of stock-based compensation under which an employee is awarded the right to receive a fixed payment equal to the value of a specified number of shares of employer stock. Payment can be made in shares or cash for phantom stock plans. ‒ Phantom stock is generally taxed when the right to the benefit is exercised. ‒ The amount that is taxed is equal to the value of the award minus any consideration paid for it.

- 24. • Non-compensatory Partnership Option (NCPO) Regulations (T.D. 9612) – Applicability: Option issued by a partnership other than an option issued in connection with the performance of services. For this purpose, the term “option” is defined as any call option, warrant, or the conversion feature of convertible equity or debt. Treas. Reg. §1.761-3(b)(2); §1.761-3(b)(3) • Tax implications: Issuance of NCPO: Generally a non recognition events for both the partnership and the NCPO holder, unless the NCPO holder transfers appreciated or depreciated property to the partnership in exchange for the NCPO. Treas. Reg. §1.721-2(b) Lapse or repurchase of an NCPO: The lapse of an NCPO generally results in recognition of ordinary income by the partnership and loss by the holder of the lapsed option. 26 U.S. Code §1234(a); §1234(b) Exercise of an NCPO: Generally a non recognition events for both the partnership and the NCPO holder. Upon the exercise of an NCPO, the NCPO holder is viewed as contributing property in the form of the option premium, the exercise price, and the option privilege to the partnership in exchange for the partnership interest. The partnership revalues its property immediately after the exercise of the option and allocates the unrealized income, gain, or loss in partnership property from the revaluation to the NCPO holder until the NCPO holder’s capital account equals the value of his partnership interest. Thus, if there is not sufficient unrealized appreciation to allocate to the NCPO holder, the conversion will be partially taxable. Treas. Reg. §1.721-2(a) Characterization rule: If on the date of certain measurement events, 1) an NCPO provides the holder with rights substantially similar to the rights afforded to a partner; and 2) at the time of measurement, there is a strong likelihood that the failure to treat the holder of the NCPO as a partner would result in a substantial reduction in the present value of the partners’ and the holder’s aggregate tax liabilities, then the holder should be treated as a partner and the option should be taken into account in allocating partnership income. Treas. Reg. §1.761-3(q)(4) 6. Taxation for Partnership Interests

- 25. • Investment Warrants on Partnership Interests (Regular and in Penny Variety) Treas. Reg. §1.761-3(a)(2) – Under Non-compensatory Partnership Option (NCPO) Regulations, nominally priced investment warrants will be treated as equity for federal tax purposes if both (i) the investment warrant provides for rights that are similar to an owner of the underlying security and (ii) there is a strong likelihood that the failure to treat the investment warrant holder as the owner would result in a substantial reduction in the present value of the aggregate tax liabilities of the investment warrant holder and the owners. – Penny warrants raise a significant risk that the warrants will be treated as equity. • Convertible debt as investment Treas. Reg. §1.721-2(a)(2) – Under Non-compensatory Partnership Option (NCPO) Regulations, In order to prevent the conversion of ordinary income into capital gain, the general non- recognition rule upon exercise does not apply to the transfer of a partnership interest to a non-compensatory partnership option holder in satisfaction of the partnership’s debt for unpaid interest (including accrued original issue discount) on convertible debt that accrued on or after the beginning of the convertible debt holder’s holding period for the debt. 6. Taxation for partnership interests (Continue)

- 26. • Compensatory Options The Treasury Department published proposed treasury regulations governing the issuance and vesting of partnership interests issued in connection with the performance of services in 2005. (Notice 2005-43) The Proposed Regulations do not specifically include compensatory partnership options in the section 83 definition of “property”, but includes compensatory partnership interests in the section 83 definition of “property”. Capital interests A capital interest is an interest that would give the holder a share of the proceeds if the partnership’s assets were sold at fair market value and then the proceeds were distributed in a complete liquidation of the partnership. This determination generally is made at the time of receipt of the partnership interest. Rev. Proc. 93-27 a. Vested Capital Interest ‒ A capital interest is unrestricted (that is, fully vested) if the interest is transferable free of the substantial risk of forfeiture or is not subject to a substantial risk of forfeiture. ‒ An employee who receives a vested or unrestricted capital interest in a partnership entity in exchange for the performance of services generally recognizes compensation income in the year of the grant equal to the fair market value of the interest, reduced by the amount, if any, that the employee pays for the interest. ‒ The partnership itself generally will be entitled to a deduction equal to the amount of ordinary income recognized by the employee. b. Unvested Capital Interest ‒ Generally, an employee is not taxed on the receipt of a restricted interest in property until the restriction lapses. ‒ Employee can make §83(b) Election to accelerate the time of taxation of restricted property to the date of its receipt 6. Taxation for partnership interests (Continue)

- 27. • Compensatory Options Profits Interests /Carried interests A “profits interest” (also referred to as a “carried interest”) is generally a right to receive a percentage of profits from a partnership without any obligation to contribute capital to the partnership and is awarded to the general partner, investment manager, or other service provider to the partnership. – The Diamond Case (1971) In certain circumstances, a profits interest is taxable upon receipt. This ruling offers the notion that there could be double taxation to a profits interest partner. First taxed on the issuance of the profits interest, then second on the subsequent allocation of gain by the partnership to the profits interest holder. – The Campbell Case (1971) The Eighth Circuit in Campbell held that the issuance of a profits interest did not generate taxable income in the year it was issued because the profits interest had no fair market value at the time it was issued to Campbell. – Rev. Proc. 93-27, the receipt of a profits interest is generally not a taxable event for the partner or the partnership. Instead, taxes are imposed as allocations of taxable income are made in respect of the profits interest or on the sale of the interest. The revenue procedure uses a hypothetical distribution model to determine whether an interest is a profits or capital interest. Under this model, a member has a capital interest if he or she has a share of unrealized appreciation in the LLC’s assets at the time of receipt of the interest. – Notice 2005-43, in a further attempt to clarify the issue of the taxation of a profits interest, the Service has proposed a procedure in Notice 2005-43 to apply the rules of Code §83 to all transfers of partnership interests for services, without making any distinction between capital interests and profits interests. Under the proposed Treasury Regulations, if a partnership interest is transferred to a service provider in connection with his or her performance of services, such interest is treated as “property” for purposes of Code §83 and could result in ordinary income to the recipient either upon vesting or upon a Code §83(b) election. Notice 2005-43 contains a safe harbor under which the fair market value of the profits interest is equal to the liquidation value of that interest at its issuance. If the profits interest is not entitled to any liquidation value, then no income is recognized to the profits interest recipient upon its issuance. 6. Taxation for partnership interests (Continue)

- 28. • Start-ups start as LLCs may want to or need to convert into a corporate form at a later point because: Venture capital investors more comfortable with corporate form Potential IPO Availability of Section 368 reorganization on exit (need to wait two years) Incentive Stock Options General increased liquidity Qualified Small Business Stock exemption ‒ Issuance of stock in a C corporation on incorporation of an LLC may qualify as QSBS stock ‒ Stock held in C Corp following termination of S Corp election does not qualify because stock was not issued in a qualifying corporation • Methods of incorporation: The IRS has approved three methods of incorporation Rev. Rul. 84-111 1. Assets Over 2. Assets Up 3. Interests Over 7. Incorporation of an LLC

- 29. • Method 1: Assets Over. Old LLC transfers all its assets and liabilities to the newly formed Newco in exchange for the stock in the Newco first, and then distributes Newco stock to LLC Members in liquidation. Assume transfer satisfies Section 351. Old LLC defers tax by taking a carryover basis and holding period in the stock (adjusted for liabilities assumed by Newco). Newco takes a carryover basis, holding period, and cost recovery in the assets (adjusted for gain recognized by Old LLC). LLC Members take a substituted basis in the stock equal to their basis in the membership interests (adjusted for liabilities assumed by Newco and any gain or loss recognized in the transaction) but will take a carryover holding period in the stock. 7. Incorporation of an LLC (Continue)

- 30. • Method 2: Assets up. Old LLC transfers all its assets and liabilities to LLC Members in liquidation first, and then LLC Members contribute assets and liabilities of Old LLC to Newco in exchange for Newco Stock. Assume transfer satisfies Section 351. LLC Members take a substituted basis in the assets equal to their basis in the membership interests (adjusted for any gain or loss recognized in the transaction) but will take carryover cost recovery and holding periods in the assets. LLC Members take a carryover basis and holding period in the stock (adjusted for liabilities assumed by Newco and any gain or loss recognized in the transaction). Newco takes substituted basis in the assets equal to the LLC Members’ bases in their membership interests (adjusted for any gain or loss recognized in the transaction) but will take a carryover holding period and cost recovery in the assets. 7. Incorporation of an LLC (Continue)

- 31. • Method 3: Interests over. LLC Members transfer their Old LLC interests to Newco in exchange for Newco Stock first, and then Old LLC liquidates, but treated as asset transfer to Newco. Assume transfer satisfies Section 351. LLC Members take a substituted basis in the Newco Stock equal to their basis in the membership interests (adjusted for any gain or loss recognized in the transaction and liabilities assumed by Newco) and will tack the holding periods of their membership interests to the holding period in Newco Stock. Newco takes a carryover basis, holding period, and cost recovery in the assets (adjusted for gain recognized by LLC Members). 7. Incorporation of an LLC (Continue)

- 32. • Tax concerns: 7. Incorporation of an LLC (Continue)

- 33. • Common Compensation Related Pitfalls: Salary deferral: deferring funders’ wages until the company is funded. Misclassification: e.g., misclassifying service providers as “consultants” and only issue them options, while promising to pay them salaries after the company is funded. Premature Option Grants: granting options to service providers before they start working. Post-Termination Option Acceleration: accelerating option post- termination of the employee. Missing 83(b) Election Deadline: Applicable to equity granted subject to vesting. Making a 83(b) election allows holders to start the one year capital gain holding period for their stocks earlier. ‒ Filing must be made within 30 days after the grant date. 8. §409A and Deferred Compensation

- 34. • Applicability: Section 409A is applicable to broadly defined “nonqualified deferred compensation”, which allows IRS to immediately tax compensation for service that will be paid in a later year if it violates 409A requirements. 26 U.S. Code §409A(a)(1)(A). Applies to both private and public companies and to all service providers. Common compensation arrangements that may be subject to 409A includes: ‒ Traditional deferred compensation /or non-qualified retirement benefits ‒ Severance and separation programs ‒ Phantom stock awards vesting and payments terms • Major Restrictions under 409(A): ‒ Deferred compensation may only be paid on the occurrence of an event specified when the deferred compensation is created, and only if the event is on the approved list contained in the statute; ‒ Deferred compensation payments may not be accelerated; ‒ Elections to defer compensation must be made irrevocably in the year before the related services are rendered, except for: 1) new plan participants; 2) “performance-based compensation”; and 3) “13 month rule”; and ‒ Various techniques to secure the payment of nonqualified deferred compensation are not permitted. 8. §409A and Deferred Compensation (Continue)

- 35. • Two-aspect Requirements: – Documentary compliance: the “nonqualified deferred compensation” plan must not have provisions that are inconsistent with Section 409A; and – Action compliance: the action taken concerning the payment of deferred compensation must be consistent with Section 409A. 26 U.S. Code 409A(d)(1) • §409A Penalty – Service provider is required to include the deferred compensation in income and pay 20% additional tax plus interest in the year when violation occurs. 26 U.S. Code 409A(b)(5)(A)(ii) • §409A Exemptions – A qualified employer plan, and E.g. tax-qualified retirement plans; ISOs and ESPPs, non qualified stock options with an exercise price at least equal to fair market and meet certain other requirement, etc. Treas. Regs. §1.409A-1(a)(2) Short-term deferral exemption: amount that must be paid in full within 2 and ½ months after the later of service provider or service recipient's tax year in which the right to the amount becomes non- forfeitable. Treas. Regs. §1.409A-1(b)(4)(i) ‒ Any bona fide vacation leave, sick leave, compensatory time, disability pay, or death benefit plan. Treas. Regs. §1.409A-1(a)(5) 8. §409A and Deferred Compensation (Continue)

- 36. • International Issues – §409A affects U.S. citizens and permanent residents working outside of the U.S., as well as U.S. residents. – Outbound taxable employees: §409A would apply to a foreign plan on the same basis as a domestic plan unless the plan meets the definition of a broad-based foreign retirement plan or the plan benefits are excludible by the service provider based on a tax treaty. See IRS Notice 2005-1 – Inbound taxable employees: §409A would apply if they are considered to be permanent U.S. tax residents, with the exception that they would be entitled to exclude amounts hypothetically earned under Sec. 409A before becoming a U.S. tax resident under the regulations or the provisions of a U.S. bilateral tax treaty, or both. – Exemption for certain deferred compensation arrangements: Certain foreign plans can be exempted based on treaties or on the terms and provisions of the plans. Treas. Regs. §1.409A-1(a)(3) Certain foreign plans can be exempted based on the nature of the compensation that is paid to or derived from the foreign plan. Treas. Regs. §1.409A-1(b)(8) Income that would have been excludible under Sec. 893 for employees of foreign governments or certain other international organizations. IRS Notice 2005-1 Income that would have been excluded under Secs. 931 or 933, which apply to income from Guam, American Samoa, the Northern Mariana Islands. IRS Notice 2005-1 8. §409A and Deferred Compensation (Continue)

- 37. • For tax purpose, It is critical that the company correctly determines whether individuals providing services to the business are employees or independent contractors. ‒ Business prefer independent contractors to avoid paying Social Security, Medicare taxes, and unemployment taxes and to avoid providing health insurance coverage. ‒ Employers run the risk of improperly characterizing independent contractors. IRS is paying more attention to misclassification issues. ‒ Companies like Uber and Lyft that treat workers as independent contractors are under scrutiny. If the employer has significant control over the worker, the IRS may claim the worker should have been classified as an employee. • Companies must give their workers IRS Form W-2 setting forth their compensation for the year, and Form 1099 to independent contractors, by February 1st of each year. • The IRS gives some guidance in IRS Publication 15-A and Form SS-8. The Employment Development Department provides different factors to determine an employment relationship. 9. Employee vs. Independent Contractor Issues