Difference between capital and revenue expenditure

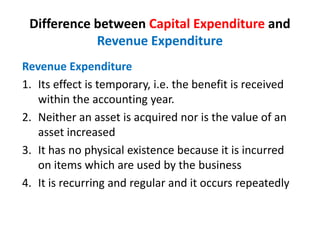

- 1. Difference between Capital Expenditure and Revenue Expenditure Revenue Expenditure 1. Its effect is temporary, i.e. the benefit is received within the accounting year. 2. Neither an asset is acquired nor is the value of an asset increased 3. It has no physical existence because it is incurred on items which are used by the business 4. It is recurring and regular and it occurs repeatedly

- 2. Continued… 5. A portion of this expenditure (depreciation on assets) is shown in trading & P & L A/c and the balance is shown in the balance sheet on asset side 6. This expenditure helps to maintain the business 7. The whole amount of this expenditure is shown in trading P & L A/c or income statement 8. It does not appear in the balance sheet. 9. It reduces revenue (profit) of the business.

- 3. Capital Expenditure 1. Its effect is long-term, i.e. it is not exhausted within the current accounting year-its benefit is received for a number of years in future 2. An asset is acquired or the value of an existing asset is increased 3. Generally it has physical existence except intangible assets 4. It does not occur again and again. It is nonrecurring and irregular 5. This expenditure improves the position of the business

- 4. Continued… 6. It appears in the balance sheet until its benefit is fully exhausted 7. It does not reduce the revenue of the concern. Purchase of fixed asset does not affect revenue.

- 5. Example: State with reasons whether the following items of expenditure are capital or revenue • (i) Wages paid on the purchase of goods. • (ii) Carriage paid on goods purchased. • (iii) Transportation paid on machinery purchased. • (iv) Duty paid on machinery. • (v) Duty paid on goods.

- 6. Continued… (vi) A second-hand car was purchased for £7,000 and £5,000 was spent for its repairs and overhauling. (vii) Office building was whitewashed at a cost of £3,000. (viii) A new machinery was purchased for £80, 000 and a sum of £1,000 was spent on its installation and erection. (ix) Books were purchased for £50,000 and £1,000 was paid for carrying books to the library.

- 7. Continued… • (x) Land was purchased for £1, 00,000 and £5,000 were paid for legal expenses. • (xi) £50,000 was paid for customs duty and freight on machinery purchased from Japan. • (xii) Old furniture was repaired at a cost of £500. • (xiii) An additional room was constructed at a cost of £15,000.

- 8. • (xiv) Damages paid on account of the breach of contract to supply certain goods. • (xv) Cost of replacement of an old and worn out part of machinery. • (xvi) Repairs to a motor car met with an accident. • (xvii) £10,000 paid for improving a machinery. • (xviii) Cost of removing plant and machinery to a new site. 8

- 9. Continued… • (xix) Cost of acquiring the goodwill of an old firm. • (xx) Cost of redecorating a cinema hall. • (xxi) Cost of putting up a. gallery in a cinema hall. • (xxii) Compensation paid to a director for loss of his office. • (xxiii) Premium paid on the redemption of debentures. • (xxiv) Costs of attending a mortgage. • (xxv) Commission paid on issue of debentures.

- 10. Continued… • (xxvi) Cost of air-conditioning the office of the director of a company. • (xxvii) Repairs and renewal of machinery. • (xxviii) Cost of acquiring patent rights and trade marks. • (xxix) Compensation paid to workers for termination of their services. • (xxx) Compensation paid to a person injured by company's car. • (xxxi) Expenditures incurred on alteration in windows ordered by local authorities.

- 11. • (xxxii) Painting expenditures of a newly- constructed factory. • (xxxiii) Expenditures incurred on renewal of patent. • (xxxiv) Expenditures on replacement of a slate roof by a glass roof. • (xxxv) £10,000 spent on dismantling, removing and reinstalling machinery and fixtures. • (xxxvi) legal expenses incurred in an income tax appeal.