Round the table magazine . september - October 2014

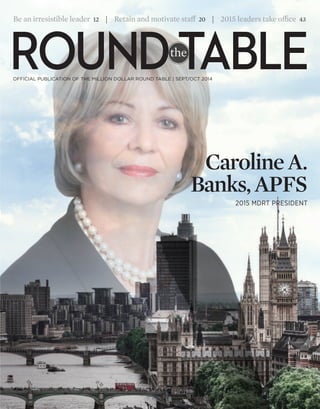

- 1. Be an irresistible leader 12 | Retain and motivate staff 20 | 2015 leaders take office 43 ROUND the TABLE OFFICIAL PUBLICATION OF THE MILLION DOLLAR ROUND TABLE | SEPT/OCT 2014 Caroline A. Banks, APFS 2015 MDRT PRESIDENT the

- 2. contents WEB EXTRAS www.mdrt.org n WEB EXCLUSIVE Read about a U.S. veteran’s benefit in “Aid and Attendance” available only on www.roundthetable.org. n ARCHIVED WEBINARS Learn about the topics of business continuation, study groups and business processes by viewing archived versions of recent webi-nars on www.mdrt.org/connect. n WHOLE PERSON QUIZ Highlight imbalances in your life to target for change in the Whole Person section at www.mdrt.org/ WholePerson. ROUND THE TABLE | SEPT/OCT 2014 | VOL 42, ISSUE 5 PRACTICE 7 IDEAS 10 WHEN SECOND IS BEST Create a prospecting system that allows you to step in when a potential client becomes unhappy with their advisor. 12 IRRESISTIBLE LEADERSHIP Engage with your staff and build an environment of trust by follow-ing 14 three steps. 14 CALLING ALL AGES Connecting with individuals ages 20 to 90 requires understanding the good, the bad and the ugly about each generation. 18 TIPS & TECHNOLOGY 20 RETAIN AND MOTIVATE Knowing what your employees want can encourage their long-term commitment to your business. 22 THE ADVISOR’S PLAN Why successful financial advisors don’t follow their own business continuation advice. 24 THE OTHER SIDE A producer shares a timeless message of not losing yourself in work. PEOPLE 26 IDEAS 28 AT THE LEADING EDGE MDRT President Banks stays ahead of the curve to meet chal-lenges and accept opportunities head-on. 32 TARGETED EDUCATION Christensen found success in the senior market through intense focus on their needs. 34 IMPLEMENT FOR IMPACT Multiple sources of ideas help Clairmont build systems to sustain and grow his practice. 36 SETTING A FINANCIAL PATH Shub looks to protect his clients from the type of financial losses he’s seen firsthand. 38 TO BE VALUABLE Two members in Taiwan encourage MDRT members to work together. 40 Q&A: JOHN L. GILFOIL, CLU, CFP 28

- 3. 32 34 IN EVERY ISSUE 2 WELCOME 5 IN THE NEWS 6 IN MEMORIAM 55 TRUE TALES 56 LOOKING BACK ON THE COVER MDRT President Caroline A. Banks, APFS, is photo-graphed in London, England. Photos by: Nicholas Liseiko INSIDE MDRT 42 IDEAS 43 MEET YOUR LEADERS The 2015 Executive Committee, Management Council and commit-tee Chairs are announced. 46 2015 MCC CHAIRS ANNOUNCED The worldwide network of regional contacts for current and prospec-tive members is announced. 47 MDRT FOUNDATION The new MDRT Foundation Presi-dent and officers announced. 50 INSTANT ACCESS Unlock the best of the Annual Meeting in the MDRT Video Club today. 52 1971 PRESIDENT: RICHARD G. BOWERS SR., CLU MDRT’s 1971 President died July 17. Learn about his achieve-ments within MDRT. 54 EXPANDED SERVICES A new director is named, while a longtime employee takes on a new challenge. SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 1 46 I have a high implementation quotient, you would say. — Tim Clairmont, Page 34

- 4. WELCOME Looking forward It’s a pleasure to introduce you to this newly redesigned issue of Round the Table. As you flip through the pages, you’ll find every-thing you love about your MDRT magazine, but with an updated look that is easier to navigate. We’ve structured each issue in three main sections: 1. Practice. Turn to this section for ideas you can put into practice. We are committed to serving producers at every career stage. Whether you’re hungry for prospecting ideas, technology tips or strategies for managing your practice, or you’re seeking a partner to help you grow or pass on your business, you’ll find answers here you can implement today. 2. People. The techniques and success stories on these pages are from individuals just like you who have achieved success in this profession. They tell us how they got where they are, how they engaged a new mar-ket, or how they manage to both lead a successful business and incorpo-rate balance as a Whole Person. 3. Inside MDRT. We’ll remind you of the benefits you receive as a member of the Round Table, including the resources and programs planned for you. We hope these changes will improve the way you read each issue and help you glean the best of what your fellow MDRT members have to offer. In this issue, meet your new MDRT President on Page 28. Caroline Banks begins her year in office by unveiling MDRT’s strategic plan, ex-plaining the organization’s guiding principles and how they will shape the long-term direction for the Round Table. Beginning with the next issue, members of the MDRT Executive Committee (see their bios on Page 43) will discuss the Round Table’s future in their editorial at the front of the magazine. They will explain how they’re taking steps today to achieve MDRT’s long-term goals. Our digital presence has a new look, as well. Visit us online at www.roundthetable.org to read this issue and access special content only available there. While the content in this magazine is ultimately funneled through MDRT headquarters in Park Ridge, Illinois, the ideas come from all of you around the globe. The words on the following pages are yours. Please, let us know if we’re meeting your needs and if you have sugges-tions for what else you’d like to see. We look forward to your input. Kathryn Furtaw Keuneke, CAE Editor Editor@mdrt.org Thank you for reading, 2 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 10 12 MICHAEL MORROW, CFP has found that individuals who already have a relationship with another advisor are still strong prospects. In “When second is best,” he explains how to market to them, knowing they will likely one day be ready to switch over to you. Morrow is a seven-year MDRT member from Thunder Bay, Ontario, Canada. Contact him at michael@ideas foradvisors.com. ALESIA LATSON thinks leaders should create a trusting envi-ronment. leadership,” she describes simple ways to increase employee engagement. Latson is founder of Latson Leadership Group, a consulting firm in Boston, Massachusetts. Contact Latson at alesia@latsonleader shipgroup.com or visit www.latsonleadership group.com. 22 55 PAUL WHITE, PH.D. explains that few advisors have done succession planning for their own business. In “The advisor’s plan,” he proposes an action plan for advisors. Based in Wichita, Kansas, White serves as a family business coach to develop and execute wealth trans-fer plans, and diminish tension around busi-ness succession issues. Contact him at paul@ drpaulwhite.com. In “Irresist-ible MEREDITH GAIL FINE has seen what can happen to a family without life insurance. In “A simple policy,” Fine shares her first-hand experience of helping a friend make ends meet after the unfortunate passing of her husband, who lacked life insurance. Fine is a two-year MDRT member from New York, New York. Reach her at meredith .fine@axa-advisors.com.

- 5. ROUNDt heTABLE OFFICIAL PUBLICATION OF THE MILLION DOLLAR ROUND TABLE Editorial Staff EDITOR: Kathryn Furtaw Keuneke, CAE ASSISTANT EDITOR: Scott Rogers EDITORIAL ASSISTANT: Abby Puchner ART DIRECTOR: Brandon Lane COVER DESIGN: Michael Dorich Editorial Team CHIEF EXECUTIVE OFFICER: Stephen P. Stahr, CAE STRATEGIC ENGAGEMENT DIRECTOR: Pamela Brown, CMP, CAE MEDIA RELATIONS COORDINATOR: Jennifer Schimka MDRT Executive Committee PRESIDENT: Caroline A. Banks, APFS IMMEDIATE PAST PRESIDENT: Michelle L. Hoesly, CLU, ChFC FIRST VICE PRESIDENT: Brian D. Heckert, CLU, ChFC SECOND VICE PRESIDENT: Mark J. Hanna, CLU, ChFC SECRETARY: James Douglas Pittman, CLU, CFP To contact editorial office: MAIL: MDRT, 325 West Touhy Avenue, Park Ridge, Illinois 60068 USA PHONE: +1 847.692.6378 Fax: +1 847.518.8921 EMAIL: editor@mdrt.org WEBSITE: www.roundthetable.org Round the Table (ISSN-0161-7125) is published bimonthly by the Million Dollar Round Table, 325 West Touhy Avenue, Park Ridge, Illinois 60068 USA. Subscription rate is included in MDRT mem-bership dues: $20 for nonmembers in the United States, $30 for nonmembers outside the United States. Periodicals postage paid at Park Ridge, Illinois, and additional mailing offices. POSTMASTER, send address corrections to Round the Table, 325 West Touhy Avenue, Park Ridge, Illinois 60068 USA. © 2014 Million Dollar Round Table. Round the Table is published for the use of Million Dollar Round Table members. All rights reserved. Round the Table is not to be used or loaned for any commercial purposes or other causes, nor is any portion of it to be reproduced without the express, prior written permission of the Million Dollar Round Table. Round the Table is provided as an educational and information-al service by the Million Dollar Round Table. The Million Dollar Round Table does not guarantee the accuracy of tax and legal information and is not liable for errors or omissions. You are urged to check with tax and legal professionals in your state, province or country. MDRT also suggests you consult local insurance and security regulations and compliance departments, pertaining to the use of any new sales material with clients. MDRT®, Million Dollar Round Table®, Top of the Table®, Court of the Table®, MDRT Foundation®, The Premier Association of Financial Professionals®, ConneXion Zone® and Global Gift Fund® are all registered trademarks of the Million Dollar Round Table®. Round the Table is printed in USA with soy-based inks on elemental chlorine-free paper. SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 3 14 20 20 BRYCE SANDERS shares tips for com-municating with all generations in “Calling all ages.” As president of Perceptive Business Solutions Inc. in New Hope, Pennsylvania, Sanders provides high-net- worth client acqui-sition training to the field. He is the author of the book “Capti-vating the Wealthy Investor.” Contact him through his website: www.perceptivebusi ness.com. DIANE L. MCCURDY, CFP, EPC and THEODORE S. RUSINOFF, CFP have learned that the best employees are worth fighting for. In “Retain and motivate,” they provide 10 ways to encourage your staff to make a long-term commitment to your business. McCurdy is a 32-year MDRT member from Vancouver, British Columbia, Canada, with 16 Court of the Table and five Top of the Table qualifications. Rusinoff is a seven-year MDRT member from Hudson, Ohio, with one Court of the Table and three Top of the Table qualifications. They both were members of the 2014 Staff Operations Committee. Contact McCurdy at diane@mccurdyfinancial.com and Rusinoff at trusinoff@gmail.com. HAVE SOMETHING TO SAY? Say it in Round the Table magazine — an easy way to share your ideas with fellow MDRT members! There are lots of ways to contribute: l SUBMIT an article topic or idea l VOLUNTEER to serve as a source in your area of expertise l SHARE a professional accomplishment Send your ideas to editor@mdrt.org for possible use in Round the Table. See what we’ve published recently by visiting www.roundthetable.org.

- 6. Introducing the new Round the Table website. Visit www.roundthetable.org to read the digital edition and enjoy Web-exclusive content.

- 7. MDRT CALENDAR SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 5 IN t h e NEWS member news | awards | calendar | in memoriam Mark your calendar to include these important dates: September 17 Top of the Table Annual Meeting begins in San Francisco, California November 1 MDRT membership applications mailed March 1, 2015 Completed MDRT membership applica-tion must be mailed to MDRT, postmarked on or before this date, to avoid $200 additional fee June 14, 2015 MDRT Annual Meeting begins in New Orleans, Louisiana COVER PHOTO Scott Roger Lebin, RFC, a 14-year MDRT member from Geneva, Illinois, was featured on the cover of the July 2014 issue of Retirement Advisor magazine. In the article, Lebin shared how he’s learned the value of maintaining perspective and remaining engaged in life, and how he’s passed these lessons to his clients. Linn honored Gail Linn, CFP, LUTCF, a 10-year MDRT member from New York, New York, was named one of the “20 Women in Insurance You Need to Know” by LifeHealthPro.com, along with six other MDRT mem-bers. The article identified women for their thought leadership, contributions and successes. Linn was mistakenly left out of this announcement in the January/February 2014 issue of Round the Table. Wealth manager of the year John T. Cross, a 37-year MDRT member from Hertfordshire, England, was named the wealth manager of 2014 by the City of Lon-don Wealth Management Awards. These awards rec-ognize and promote quality of service from wealth man-agers and stockbrokers. Satoskar profiled Rajesh Satoskar, an 11-year MDRT member from Mum-bai, India, was featured in the May 30 issue of Forbes India magazine. Satoskar is profiled in this special edition of the magazine focusing on the business leaders of India. In this article, Satoskar shared how the growing life insurance industry in India is trans-forming the lives of millions across the country.

- 8. IN THE NEWS IN MEMORIAM Richard G. Bowers Sr., CLU Keokuk, Iowa Age: 94, MDRT: 58 years (See Page 52) William H. Craddock, CLU, ChFC Charlottesville, Virginia Age: 95, MDRT: 49 years Thomas C. Cundy Fort Lauderdale, Florida Age: 80, MDRT: 53 years John M. De Borde III, CLU, ChFC Atlanta, Georgia Age: 87, MDRT: 58 years Robert L. Deets, CLU, ChFC Allentown, Pennsylvania Age: 69, MDRT: 24 years Cleo F. Edwards, CLU, ChFC Cedar Rapids, Iowa Age: 93, MDRT: 59 years Colin M. Govan, CLU Hampton, Virginia Age: 86, MDRT: 49 years 6 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 Earl R. Hamm Jr., CLU, ChFC Eastlake, Ohio Age: 71, MDRT: 24 years Mina Isa Jakarta, Indonesia Age: 44, MDRT: 4 years Yoshimasa Kato, TLC Tokyo, Japan Age: 54, MDRT: 15 years Buddy Leake, CLU Oklahoma City, Oklahoma Age: 80, MDRT: 45 years Donald R. Martin Coeur d’Alene, Idaho Age: 88, MDRT: 45 years Sidney M. Miller, CLU New York, New York Age: 86, MDRT: 56 years Abe Woodson San Mateo, California Age: 79, MDRT: 10 years Best places to work McTigue Financial Group, run by John W. McTigue, CLU, a 31-year MDRT mem-ber from Chicago, Illinois, was named the seventh-best place to work in Chicago by Crain’s Chicago Busi-ness. McTigue’s agency was selected for allowing its employees to forge their own careers while receiv-ing ample assistance when needed. Keystone Award Brian E. Worrell, LUTCF, a nine-year MDRT member from Wyomissing, Penn-sylvania, received the 2014 Keystone Award, presented by the National Association of Insurance and Financial Advisors–Pennsylvania (NAIFA–PA). The Keystone Award is NAIFA–PA’s high-est honor and is presented each year to a member in recognition of their service to the association and their work on behalf of the insur-ance industry. Passion after work Seymour Petrovsky, CLU, a 52-year MDRT member and the 1991 MDRT President from Prescott, Arizo-na, was profiled in The Daily Courier, a newspaper in Prescott, for his work raising defibrillator awareness. In the article, Petrovsky’s efforts from the past several years as a volunteer for the Prescott Citizens on Patrol are detailed as he worked with the fire department to mark where all the defibrillators are in most public and business locations so that dispatchers would be able to direct those in need to their location.

- 9. When you see a client for the first time, what’s going through his mind is, You’re going to sell me, and I don’t want to buy anything. So, the first task is to disarm your prospec-tive clients. I tell all of my clients within the first 10 minutes: “Look, I’ve got lots of products and services to offer you. I ha-ven’t any idea which ones LIKE A PLUMBER are of any benefit to you, and I wouldn’t insult you by trying to tell you which one it is at this stage of the game. “I’m a little bit like a plumber. A plumber walks into your house with a big bag. He doesn’t empty the bag on the table and start selling you bits and pieces from his bag. Not at all. He puts the bag on the floor and has a conversation with you. ‘What’s the problem? Where’s the problem? It is upstairs?’ When you’ve ascertained the problem, he takes the correct tool and fixes the problem. Is that right? That’s exactly what I do. I’ve got all kinds of products and services to offer, but until I know what’s of benefit to you, there’s no conversation. Do you mind if I ask you a lot of questions today? I won’t give you any answers, but I’ll use that as a platform for our next meeting.” — Barry Rebuck, TEP, EPC, Markham, Ontario, Canada, 23-year MDRT member RETIREMENT = GRADUATION SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 7 USES FOR LIFE INSURANCE This question helps to point out the need for life insurance: “Would you mind if I asked you a question? Can you think of any circumstances when someone has died, when the beneficiaries would have been better off without the life insurance?” Nobody ever can. In every case, the beneficiaries either used it for income, paid off a debt, educated their children or — in the worst-case scenario, where their own personal needs were already taken care of — they gave the money to charity. — Brian H. Ashe, CLU, Lisle, Illinois, 2000 MDRT President and 43-year member “I will not recommend something you cannot afford, and I will not recom-mend something you do not need.” Very simple, but it makes a big impact. — Hitesh P. Parikh, Chalfont, Pennsylvania, 3-year MDRT member COMPRESS YOUR TIME FRAME This is an idea I heard many years ago that has really helped me in my career. Consider what you would like to accomplish 10 years from now. Think about that, and then shorten the time frame to two years. That exercise got me thinking in a big way from a long-term, then short-term perspective. By com-pressing the time frame, you can accomplish your goals much more quickly, and you also stretch your mind. I added another step. If you incorporate the seven parts of MDRT’s Whole Person philos-ophy into your planning, then you’re planning for your life. — Julian H. Good Jr., CLU, ChFC, Metairie, Louisiana, 2011 MDRT President and 31-year member When clients stop work, they are actually gradu-ating to a new lifestyle. So, I’ve taken the word “retirement” out of my vocabulary, replacing it with “graduation.” I’ll ask clients: “How are you going to graduate when you stop work? Are you going to graduate with first-class honors? Will you graduate with distinction, or just barely get a pass and have to rely on Social Security?” — Anthony J. Carlyon, FAFA, F Fin, Cronulla, New South Wales, Australia, 24-year MDRT member

- 10. 8 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 I learned early in my career that the client is forming an opin-ion of you every step of the way. They’re forming an opinion before they do business with you, and even afterward. After the first meeting, I go into my office and write them a handwritten note on a personal card that has my name on it. It says something like, “It was a pleasure meeting with you this morning. I welcome the opportunity to be of service in helping you plan for your financial legacy. I look forward to following up next week. Have a great weekend.” The key here is “welcome the opportunity to be of ser-vice.” That’s huge. It reinforces that they’re getting helped and there is service. The note is handwritten, there’s a stamp, and everything is signed and mailed out the day of the meeting. They get the card the next day, so in their mind, the relationship is solidified. — Evan Fabricant, Glen Allen, Virginia, 4-year MDRT member MINDSTORMING I have used a technique called mindstorming to solve problems I can’t seem to get my arms around. The idea is to find a quiet place where you will be undisturbed. At the top of a pad of paper, write down whatever your challenge is. An example might be, “How can I get more clients?” Write the numbers 1–20 down the page. Write 20 answers to that problem, setting all judgment aside. The first few are going to be easy to think of, but do not leave that room until you have come up with 20 ideas. What I’ve found is right around No. 13 or 15, you’ll get the aha moment you’ve been searching for. — Katherine L. Hurley, Falls Church, Virginia, 4-year MDRT member Ask clients: “If there’s one thing I could be doing better, what would that be?” — Larry J. Glanz, Farmington, Michigan, 16-year MDRT member EDUCATE FIRST Did anybody teach you anything about life insur-ance when you were in high school or in college? The answer is no. You learned about life insurance when you came into the life insurance business. There-fore, what do you think your client knows about life insurance? Most likely noth-ing. Instead of trying to sell immediately, I try to educate and explain what life insur-ance is and how it works. This builds my prospects’ confidence in me, and they understand I have a concern for their future. — Lawrence G. Katz, CLU, ChFC, Houston, Texas, 58-year MDRT member HANDWRITTEN NOTE IDEAS HAVE VALUE When I am explaining our fee structure to prospects or clients, I explain it this way: “We charge a fee for our advice because ideas have value. Does that sound fair enough?” The answer is always yes. No one will disagree with the statement that ideas have value. I just started charging fees this year and have had absolutely no pushback when explaining we charge for our advice because our ideas have value. — John J. Demboski, CFP, Santa Barbara, California, 10-year MDRT member

- 11. Waiting in the wings 10 | 3 keys to leadership 12 | Communicate by generation 14 | Tips & Technology 18 Staff motivation tips 20 | Continuing your business 22 | Whole Person circa 1947 24 SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 9 in PRACTICE EMPLOYEES DISENGAGED 13% of employees across 142 countries feel engaged in their jobs. Actively disen-gaged workers — those who are potentially hostile to their organizations — outnumber engaged employees by nearly 2-to-1. Source: “State of the Global Workplace,” Gallup, 2013 SAVINGS SHORTFALL 57% of middle-market American households (69% of households with children) don’t save regularly. Source: “U.S. Consumers Today: The Middle Market,” LIMRA, 2014 LIFE INSURANCE OWNER-SHIP BY GENERATION Fewer Gen Y consumers own individual life insurance (34%) than Gen X consumers (45%). More than half of baby boom-ers report owning individual life insurance (52%). Source: “U.S. Consumers: The Generations,” LIMRA, 2014 STRONGER TOGETHER Producers are more profitable in ensemble rather than solo practices. Source: MDRT Bottom Line Survey, 2012

- 12. PRACTICE 10 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 Create a prospecting system that allows you to step in when a potential client becomes unhappy with their advisor. BY MICHAEL MORROW, CFP Whether you are a seasoned advisor or new to the industry, nothing is more important than attracting a steady stream of prospects. We all have to put ourselves in front of the public to ensure the success of our practice. Prospecting is necessary to a growing, thriving business in our profes-sion, as we aim to create long-term clients. For that reason, we need to be comfortable with the uncomfortable. For many of us, approaching unfamiliar people and asking for their business takes us out of our comfort zone — especially if we’re rejected. The sooner we can accept realis-tic expectations, the better off we’ll be. As advisors, we tend to be impatient if we don’t land the prospect within a couple of at-tempts. We often are ready to move on. However prospecting requires motivation, dedication and perseverance. With initial contact, there is always the possibility of the prospect already having a financial advisor, but don’t give up. Your goal should be to get permission to stay in touch with them. You can simply say, “I’m really glad you are happy with your current advisor, but would it be OK to stay in touch with you in case something changes?” Your expectation should be to get permission to stay in touch, not get an appointment. This expectation will make the process easier for you. Once you have their approval, they join the prospect pipeline. You can begin to slowly demonstrate the added value your practice gives, which they may not be receiving from their advisor. This is easy, inexpensive and effective. You’ll begin to be viewed as advisor No. 2, and your efforts will continually test the satisfaction level with their current advisor. If they become unhappy with the services MASTERFILE/ IKON IMAGES When second is BEST

- 13. “We are happy to be waiting in the wings and hope when the need arises, you will call us.” SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 11 they are receiving from their current advisor, they know you’ll be available to help, and then they’ll be on their way to seeing what an excep-tional organization you have. The belief that time is the only deterrent to becoming their primary advisor will garner the enthusiasm necessary for success. You need to stay dedicated and patient, but also stay in contact with the prospect in a non-aggressive way. Don’t overload them with too much information or consistently reach out, as this can push them away. There are many strategies to help you get and keep your name in front of your desired prospects. Mail financial publications, send newsletters and email blasts, or hold worksite workshops. To effectively pros-pect, you must do your research and understand what they want, how they feel and what matters most to them. Be ready to educate, not sell. The attention you give and the way you correspond will help you stand out. Systematic process Prospecting is both an art form and a science. Having systematic and planned prospecting processes will garner the best results. Plan your efforts to avoid procrastination and simple for-getfulness. Choose your strategy, and place it in your prospecting calendar. Consider adding the following to your current processes: n Hard-copy mailings. Fewer businesses are mailing paper, so the ones that do get noticed. Stand out with hard-copy newsletters, industry magazines, term rate sheets, handwritten cards, company fliers or postcards. n Social media. Social media platforms are an easy and cost-effective way to connect with pros-pects and provide an ideal environment for social-izing, sharing information and providing insight. You can also research your prospect and learn what could start great conversations. Connect on LinkedIn, join groups they’re in and participate. Follow them on Twitter. Become an active voice by commenting, sharing or liking their posts. n Email. Another cost-effective way to reach prospects, email provides instant access for them to learn about your company with embed-ded links to your website. This method allows you to know how your marketing efforts are working with email metrics. You can tell if they opened your email, clicked through to your website and what they did once they got there. Newsletters, industry updates, term rate sheets, blog posts or even a general email message are all effective email prospecting methods. n Wow. Take your prospecting methods to a new level and really impress by presenting them books on finance, coffee for the office, restaurant gift cards and movie passes. These strategies will slowly create a wedge between the prospect and their current advisor. You want the prospect to think of you first when their needs and expectations are not met. Re-cently, I was in a position to find a new general insurance broker. There was no one waiting in the wings, no advisor No. 2 for me to turn to. If a broker had been marketing to me all along, I would have called them. My theory on being advisor No. 2 was solidified. Your ability to grow your business is based on starting new relationships through prospecting. New relationships need to be nurtured, and con-sistent nurturing will open opportunities. Con-sistent nurturing proves that you are different from your peers who have given up. Effective prospecting can be predicted by numbers; that is, if you provide consistent value as advisor No. 2 to 100 prospects, in five years how many will have become clients? What result would make your efforts worthwhile? The next time a prospect tells you they are currently satisfied with their advisor, say, “We are happy to be waiting in the wings and hope when the need arises, you will call us.” Don’t get discouraged if this happens. Focus on providing value and nurturing the relationship, and believe in the potential positive outcomes of our efforts. We need to be confident approaching people in our community or business sphere who could benefit from our services. Having lasting prospect relationships is part of running our business. There is no single best technique to prospect, but from my experience, I have found if I can’t be an immediate advisor, positioning myself as advisor No. 2 has led to great success. RTT

- 14. Irresistible leadership Engage with your staff and build an environment of trust by following three steps. BY ALESIA LATSON 12 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 PHOTO CREDIT PRACTICE “This is just a listening meeting. For 15 minutes, I just want to hear your ideas, your concerns or anything else you’d like to share.” Then, let them talk. Don’t interrupt or dominate the conversa-tion. In fact, only speak when the other person asks you a question. The rest of the time, just listen and take notes. After the person is done talking, paraphrase what you heard. Taking only 15 minutes out of your day to listen will help you forge a greater connection with your staff and make a huge difference in employee engagement. 2. Disagree with grace Disagreements at work are inevitable. The key is how you handle them. Too often, leaders come across as harsh when they disagree, inadver-tently making employees feel inferior or that their ideas are without merit. So rather than abruptly tell people things like, “No, that will never work,” or “You obviously don’t understand the full situation,” when you disagree with them, start by acknowledging and validating the other person’s perspective. This requires you to listen attentively and then legitimize the other person’s point of view. It is Leadership is a tough job. Not only do you have to be adept at managing multiple priorities, you also have to possess expert people skills. After all, regardless of industry, a leader is only as good as his or her team. Without the buy-in and respect of your employees, you’ll have a difficult time accomplishing the organi-zation’s goals. The challenge, then, is figuring out how to be irresistible to your team — how to create the conditions by which people can’t resist your message and vision, and therefore want to align and partner with you. Becoming irresistible requires that you attract and connect with people, which naturally results in trust and loyalty. That’s why the key for any leader is to create the conditions and ex-periences by which people want to engage with you. Following are the top three ways to build engagement with your staff. 1. Build rapport The best way to build rapport with people is to simply listen to them. When people feel listened to, they are more likely to trust you and are more eager to engage with you. To make listening a priority in your role, start doing monthly listening tours. These do not have to be long sessions — 15 minutes is enough. The point is to actually sched-ule time where you meet with people informally and just let them talk. At the beginning of the meeting, tell them,

- 15. SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 13 most effective when you can provide at least three points of validation — that’s how the person is more likely to feel like you actually heard what they said. So, for example, if someone offers an idea for increasing profits that you think is too risky and won’t work, you could say something like, “I see that your proposal is a reflection of your commitment to finding viable options that will increase our profitability (first validation). It’s evident you’ve put a lot of effort into taking a look at the numbers (second validation). And, you’ve of-fered a compelling business case for us to consider (third validation). We’re aligned in that we’re both looking for a committed solution. Where we differ is in how aggressive the plan should be and how much risk we should take on. Maybe that’s some-thing we can talk about.” Remember, the magic number is three points of validation. At this point, you can ask some open-ended questions to get a better idea of the employee’s thinking, or you can agree to disagree. But it’s the validation that enables you to disagree with grace. Now, rather than shutting down the conversa-tion, you’re engaging the employee. This is what creates irresistibility. When the employee walks away from that meeting, they may not have got-ten what they wanted, but they weren’t defeated. And that’s huge to the engagement factor. 3. Offer acknowledgment and praise Too often, leaders are so busy, stressed and overwhelmed that they forget to acknowledge people. But human beings crave acknowledg-ment and want to feel like they are making a meaningful difference in some way. Offering acknowledgment and praise goes a long way to building engagement. Acknowledging someone doesn’t mean gushing over them and touting unwarranted superlatives. It’s also not about empty phrases like “Good job.” Offering acknowledgment and praise works best when you’re factual and pointing out specifics that made an impact. For example, instead of tell-ing someone, “You did a good job on that report,” which lacks any type of facts or specifics, you could say, “I wanted to compliment you on your report. It detailed the topic in a clear way, gave a strong call to action at the end, and was visually very appealing in the layout.” The more specific you can be with your praise, the more meaning-ful it is for the employee. In addition to making the person feel important, your words are giving them clear feedback on what success looks like so they can duplicate it in the future. Remember that acknowledgment and praise should occur frequently. You can offer a word of acknowledgment in passing at the water cooler. Often, it’s those little interactions that leave a lasting impression. Attract the best If you want to be one of those leaders that people can’t seem to resist — the kind of leader who has loyal employees and a strong environment of trust — then you need to focus on these three employee engagement practices. Not only will your current employees find you irresistible, but you’ll also have a steady stream of eager poten-tial employees (the best of the best) who want to work with you. Ultimately, the more engagement and partnership you have with your team, the more rewarding the work experience will be for everyone. That’s when the organization will experience true and lasting success. RTT The more specific you can be with your praise, the more meaningful it is for the employee. JETTA PRODUCTIONS/BLEND IMAGES/CORBIS

- 16. PRACTICE Calling all ages LAUGHING STOCK/CORBIS 14 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 Connecting with individuals ages 20 to 90 requires understanding the good, the bad and the ugly about each generation. BY BRYCE SANDERS Should you ask for a referral via email or in person? Is texting an acceptable form of client contact? The rules for communica-tion in the business world are changing. What is acceptable to you might not be preferable to your prospects or clients. Often, these distinctions change from generation to generation. Although exceptions exist, certain communication chan-nels are more comfortable for people in specific age groups. Before we market to prospects or ask existing clients for referrals, we need to understand what differentiates them from other generations — especially our own. Every generation has defining characteristics. The good are the positive perceptions. The bad are the negatives attributed to them. The ugly are the vexing problems they face, areas where you might be able to help. Once you understand this background, it becomes easier to determine your approach. Silent generation: 1925–1945 People born in this period are approximately 70 to 90 years old today. There are about 55 million of them, surprisingly not all retired. Many are continuously reinventing themselves. The good: They came of age during America’s great postwar age of prosperity, the 1950s and 1960s. Many served in World War II or the Korean War. This taught them the importance of chain of command. They often worked at the same compa-ny their entire working life. Unions played a large role in the workforce. People were well-paid. The GI Bill provided an excellent education at minimal cost. They live comfortably in retirement with defined-benefit pension plans.

- 17. SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 15 The bad: They have a real concern about losing money. Most live a comfortable lifestyle; growth isn’t an issue. Their nest egg is their safety net. This rational aversion to risk means growth investments aren’t as attractive. The ugly: They worry about their health. The 2011 PBS story “How Much Do We Spend on End-of-Life Care?” explains “Nearly one-third of terminally ill patients with insurance used up most or all of their savings to cover uninsured medical expenses such as home care.” Let’s assume they are healthy optimists. Then it’s likely intergenerational wealth transfer is their major concern; estate planning gets their attention. They may want to provide a college ed-ucation for their grandchildren and great-grand-children. If they were traditional bond buyers, replacing lost income in a low-interest-rate environment might be their major concern. How do they get information? They grew up getting letters and phone calls, but many seniors are very comfortable with email. They watch lots of television. Reaching prospects: They open their mail and react well to personalized letters. They are brand-aware. They expect a high level of service. Try to get them talking about the quality of their current advisory relationship. Reaching clients: You call and meet face-to-face regularly. If your age is near theirs, they may be concerned you will retire soon. Talk about your succession plan. They have friends whose advisor has retired or takes them for granted. Would they introduce you? Reaching family: Talk face-to-face. Lean on the reputation of your firm. They might dwell on a huge issue. If you know the issue, meet privately, acknowledge it weighs on their mind, you’ve thought long and hard about it. You might have a solution. Baby boomers: 1946–1964 In the U.S., GIs returned from World War II and immediately focused attention on having babies. There are about 76 million baby boomers about 50 to 70 years old. The good: They grew up in prosperous times. Real estate appreciation has been their friend. Many are wealthy, active and physically fit. They saw John F. Kennedy assassinated, Woodstock and the Vietnam War. They danced to rock ’n’ roll and the Beatles. They wanted to change the world. They are well-educated — college was cheap. Many enjoyed lifetime employment. The bad: A 2009 Zogby poll of boomers indi-cated 42 percent of respondents felt consumer-ism and self-indulgence are their legacy. Other studies imply baby boomers are micromanagers, focus on material success and put work first. The ugly: Recent corporate layoffs have come at the worst time for boomers. They are deplet-ing their savings after being laid off. Fortunately, most boomers are still working. Your 50- to 70-year-old prospect is very worried about their retirement. They probably have a 401(k) at work. They should collect Social Security. That’s not enough. It’s likely they will be focused on putting money aside in tax-deferred vehicles. Long-term care is a concern, too. They may have “boomerang kids” who left the nest and re-turned home because of the tough job market. How do they get information? They read mail and answer the phone; however, email was a major technology leap for this generation. They access it on desktops, smartphones or tablets. The benefit and downside to email is it’s so easy and cheap. They are inundated, so paper mail stands out. Reaching prospects: Go for personal intro-ductions. At this stage of their life, they are wired in and know everybody. They won’t act as your press agent, but they can easily arrange so-cial introductions. Show them short lists of local people. “This is the type of person I may be able to help.” Or “This is the type of person I want to know,” followed by, “Would you introduce me?” Reaching clients: Face-to-face reviews. They have spent their working life being accountable and reporting actual versus target numbers. They expect the same. Set expectations. Focus their attention on progress to goals. Reaching family: The best route is an articulate family member who is already a client. Every-one needs to know what you do. Without much prompting, they can help make this happen. Be respected as a problem solver. Layoffs or impend-ing retirements are fertile fields for referrals. Everyone needs to know what you do. With-out much prompting, they can help make this happen. >>

- 18. Generation X: 1960–1980 The generation following the baby boomers are now ages 35 to 55. The U.S. census counts about 82.1 million. The good: Their high-earning, dual-income parents gave them a pretty good life. They are well-educated, physically active, and spend the most time of any generation volunteering and giving back. While baby boomers wanted to change the world, Gen Xers are OK working within the system. They are entrepreneurs. The bad: They are likely the first recent generation to have less earning power than their parents at the same stage of life. Their employ-er loyalty is significantly reduced. They can be considered apathetic and angry. The ugly: As they pass their 45th birthday, re-tirement issues keep them awake at night. They aren’t making the money their parents did, yet they plan to send their children to college. What if something happens to them? Life insurance fills a need. How do they get information? Smartphones are preferred to landlines. They are more com-fortable with texting than previous generations. They were around for social media but didn’t grow up with it. Reaching prospects: If they have problems saving for retirement or college education, they talk about it with peers. Advisors need to listen and position themselves as problem solvers. Your friends need to be able to explain what you do and why you are good at it. Reaching clients: They often prefer “coach-es” to “advisors.” They want collaboration, not instruction. Although they communicate by text, you can’t do business that way. Can texting let them know you need to talk or see them? Reaching family: If you are a similar age, you faced similar problems. Sit down, peer to peer, to explain you are concerned about the college education issue and found a solution. Recognize they face a similar issue. What are they doing about it? Generation Y: 1980–2000 They are often called millennials or Generation Me. There are about 88.5 million out there. PRACTICE 16 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 The good: They are civic-minded and aware of environmental issues like global warming. They see injustice in the world. Wealth is im-portant to them. The bad: They are often called self-absorbed or entitled. “Trophy kids” were often pushed by their parents to excel in sports and academics. Their job prospects are significantly lower than their parents or grandparents. This requires higher education and advanced degrees. The ugly: They need to accumulate wealth be-cause it will be necessary to educate their children and make the down payment to get on the proper-ty ladder. They may be headed back to school. How do they get information? They came of age along with technology and the Internet. Having ditched their landline phone, they rely on their cell phones. They text a lot. They are less trusting of brands than their parents or grandparents. They prefer peer reviews, going to sites like TripAdvisor, Angie’s List and Zagat. Social media sites like LinkedIn and Facebook play a big role. Reaching prospects: Social media channels can tell you who knows who, allowing you to ask for personal introductions to people you know. These can be business-specific, assum-ing the need is apparent. Raising people’s awareness of what you do is important. Unfor-tunately, members of this generation often feel information, advice and transactions should be free. Reaching clients: Like Generation X, they want coaching and collaboration, not advisors telling them what to do. You must meet face-to-face at least once a year. Focus their attention on their portfolio. In the meantime, phone con-versations are fine. You need to hear their voice confirming trading instructions or get a physical signature on documents. Reaching family: If they respect wealth, intro-ductions from wealthy relatives are important. These Gen Y folks are likely younger than you. They respect success. Remember: People love to buy; they dislike being sold. Regardless of age, gaining name recognition and getting on the radar is key. Reach out to them enough, and they’ll know who you are. RTT These Gen Y folks are likely younger than you. They respect success.

- 19. VanNess Ave., California Streets & Market GAIN A N EW P erspective AN EXCLUSIVE BENEFIT OF TOP OF THE TABLE MEMBERSHIP www. mdrt.org/ tot 20 14 September 17–20, 2014

- 20. TIPS & TECHNOLOGY life hacks | apps | time-savers Track your valuables While it’s useful to download a smartphone app that can track your device should it go missing, the fact is many of us misplace more items than just our phones — what about belongings like keys, purses, wallets, luggage or other non-electronics? TrackR, developed by Phone Halo, has put together a suite of easily portable products compatible with iOS and Android systems that cut down on time-intensive scavenger hunts for such lost items by wirelessly transmitting to your phone or tablet from the item’s location: n The Wallet TrackR device takes up a space a few credit cards thick, easily fitting inside any wallet. Boasting a two-year battery life, you have the option of purchasing up to four devices — starting at $30 for one. n For smaller items like keys, TrackR manufactures a circular tracker with double-sided adhesive you can easily affix to key rings, remote controls and more. n The inSite product offering pairs both features from the above two — a slightly smaller device that fits in your wallet but also includes the option for a key ring. Often, though, we don’t even realize when we have lost an item until hours later. TrackR mitigates this issue via its net-work ON-THE-GO TEMPERATURE AUTOMATION 18 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 of users. If another TrackR walks by your misplaced item, the app notifies you and pinpoints its location. A single device can track up to 10 items, with sev-eral options for customizing sounds, appearance and more. Visit the Google Play and Android stores to download the app. Learn more or order TrackR devices at www.thetrakr.com. The Honeywell Wi-Fi Smart Thermostat With Voice Control offers users a unique way to adjust your home temperature settings remotely. Besides offering simply another option to adjust your home tempera-ture, the device alerts the user to extreme temperature changes in the home, boasts a voice activation component and gathers information about other settings in the environment, like humidity, local weather conditions and more. The Smart Thermostat is perfect for keeping tabs on vacation homes or ensuring pets are comfortable, and is offered in a full-color display. Users can set up alerts for filter changes, extreme temperature fluctuations and more from any Wi-Fi-enabled location. Take advantage of the device’s range of programmable modes to save on energy costs and enjoy ultimate home comfort. The Smart Thermostat is available for $299 through Honeywell’s website, http://wifithermostat.com.

- 21. What’s in a hashtag? BY DAVID BRAITHWAITE, DIP PFS, 2014 SOCIAL MEDIA COMMITTEE MEMBER This year in Toronto, Ontario, Canada, at the MDRT Annual Meeting, we saw the largest number of tweets and Ins-tagram pictures ever at one of our meet-ings. Social Media has really exploded for MDRT. From having been a part of the MDRtweet team for the past few years, and proudly serving on the Social Media Committee, I am a firm fan of social media being used for MDRT and also within your business. Using a hashtag lately has become — in some cases — overused, and not used correctly with people seemingly just writing long sentences such as #hategettingupinthemorning. The idea of a hashtag is to group tweets under one subject, in the case of MDRT, by using #MDRT2014. You can then search for that hashtag and view all the tweets using this hashtag together. By using a hashtag properly, we can see all the tweets made in relation to that subject, in one place, by people who we are connected to, along with those who ar-en’t part of our network. It’s a common bond. To put some figures to it all, at the time of writing, members who used the hashtag #MDRT2014 in their tweets reached 8,758 people, and appeared on people’s timelines over 9,063 times. Head over to Twitter, and type #MDRT2014 into the search box to relive everyone’s experiences and com-ments from the Annual Meeting this year and beyond. Focused time With multiple electronic gadgets and other interruptions, it can be difficult to maintain focus on any one task until completion. An old technique from the late 1980s builds a framework for marking tasks off your to-do list. Francesco Cirillo created the Pomodoro Technique time management method nearly 30 years ago, named after the tomato-shaped kitchen timer he used. The idea is to commit 25 minutes to a task without allowing any other distractions. When the 25 minutes are up, you are allowed a five-minute break before taking Selfie help A selfie is simple to take with a smartphone if you’re hoping to capture a photo of yourself and maybe one other person. If you want to get the whole family or group of friends, though, you’ll need additional equipment. The company iLuv Creative Technol-ogy makes a smartphone case, Selfy, with a built-in wireless camera remote just for these occasions. The case is designed with flat sides, allowing the phone to be propped on a table or desk to capture the moment. Selfy cases are available for $50 for iPhone and Samsung S5. Visit www.iluv .com/selfy to learn more or purchase a case in black or pink. on the next task. Four 25-minute “pomo-dori” complete a set, which earns a break of 15 to 30 minutes. The frequent breaks are intended to keep your mind focused and fresh, while the timer forces you to manage distractions. Today, free Web- and app-based timers are available at http://tomato-timer.com, http://tomatoi.st/lmow and http://www.focusboosterapp.com. SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 19

- 22. PRACTICE Retain and motivate Knowing what your employees want can encourage their long-term commitment to your business. BY DIANE L. MCCURDY, CFP, EPC, AND THEODORE S. RUSINOFF, CFP A motivated employee wants to participate and be heard. One of the top requirements for a successful, financially healthy company is to retain its key employees. It is very costly to hire and train employees, and then the employee might leave — or worse yet, stay, and not be fully committed. We take care to hire the best talent, so the ideal outcome is to have the employee stay for many years. For employees to make a long-term commitment with the company, you must give them a compelling reason to stay. Employers have numerous options to retain talent. Following are 10 ways to show apprecia-tion for your employees’ hard work and incen-tivize them to stay with your business. 20 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 1. Increase responsibility. Give employees responsibilities that encourage them to grow and develop new skills. Provide the training and education that allows this to hap-pen. Pay for all or part of the education, based on their successful completion. If your firm is larger, try to hire from within your company. Promote employees who have taken on addi-tional responsibilities. 2. Show appreciation. Employees need to know they are respected and valued. Often, stressed employers say things that are not respectful or encouraging to the employee. Remember to think quickly, but speak slowly. Listening to your employees is a good way to keep them from disengaging. When employees do things right, acknowledge their actions to develop and maintain a positive workplace. Your clients will feel the positive envi-ronment and want to do business with you. 3. Offer monetary rewards. Tie part of your employees’ compensation to the company’s overall performance. This helps to align the employee’s day-to-day work with the company’s financial goals and profit. If the com-pany grows, so does the employee — a win-win. 4. Provide a benefits package. Offer competitive benefits, including group health insurance and retirement benefits. Ask other MDRT members in your country what their em-ployees find competitive or valuable. Communicate the value of those benefits to your employees. 5. Think individually. Get to know your employees’ individual interests to deter-mine what is important to them. Select rewards such as tickets to sporting events, public recogni-

- 23. Know your employees’ interests, and select rewards they will enjoy. SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 21 tion, lunches, handwritten thank-you notes, flowers, gift cards or support of their favorite charity. Small, group perks are important, too. For example, you can provide pizza once a month, designate a jeans day and so on. 6. Offer time off and flexibility. Understand your employees’ individual needs and the value their talent brings to the firm. Flex time or extra days off might be difficult for a smaller firm to offer, but try to be as flexible as possible, and provide reasons when a specific request might not work. Can you give them their birth-days off? Can they work shorter days (compen-sation adjusted) if they have children they need to pick up from school? 7. Conduct stay interviews. It is just as im-portant to conduct stay interviews with your longer-tenured employees as it is to conduct exit interviews. Why are your employees staying? What is important to them? Why did they come to work for your firm? What would make them leave? What would they like to see changed or improved? Use this information to strengthen your employee retention strategies. 8. Welcome employee input. Employers must create an environment where employees want to contribute their ideas, talent and experience. A motivated employee wants to participate and be heard. It is important for the employer to listen to the employee and let them contribute and feel valued. Create an environment where employees feel comfortable to speak freely, even on matters outside their job description. 9. Define expectations. Having clearly defined job descriptions might seem obvious, but this step is often overlooked. It is very frustrating for employees if they do not know what is expected of them. Employees need to know the company’s mission statement, values and goals. It is important to communicate if they change, as the employees are watching to see if the company they work for is sticking to their mandate and commitment. 10. Coaching staff. Your employees need one-on-one time with a direct su-pervisor. If you cannot devote time to them, you need to have someone in place who can fill that role on a regular basis. Ultimately, your employ-ees still want to know they have access to the boss when needed. In general, employees must feel rewarded, appreciated and recognized. Although monetary rewards are not the only motivating factor, they are a critical component. Work is about the money, and almost every employee and employer wants more. Treating your employees well will retain and attract the best and brightest to your firm. RTT WHEN TO HIRE By Richard J. Presky, LUTCF, CLU When is it time to hire a new employee? Consider the following scenari-os when adding to your staff: Expand your business. As your business expands, your staff must expand with it to ensure the work is completed efficiently. Otherwise, you might have to pitch in where your time is not well-spent. A rule of thumb that has worked for me is to have one employee with every $250,000 my business earns in commissions. Each year, when you are mapping out your annual business plan, take expansion into consideration. Fill the gaps. When someone leaves or retires, there is an obvious gap to fill with a new hire. Sometimes, gaps are present for less-obvious reasons. If you notice tasks or areas of responsibility that aren’t well-cov-ered, consider hiring another person to handle them. Quality of service. To keep your clients happy and generate new clients, you must provide excellent service. If the quality of service within your business is deteriorating, consider whether it’s because your current employees have too much on their plate. Hiring additional help can cause everyone’s quality of work to improve.

- 24. PRACTICE The advisor’s PLAN Why successful financial advisors don’t follow their own business continuation advice. BY PAUL WHITE, PH.D. 22 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 Having worked alongside numerous financial advi-sors for nearly 20 years, it has become evident that their lives often illustrate the proverb, “The cob-bler’s children have no shoes.” That is, while many financially successful financial advisors are quite proficient in assisting other business owners in developing a successful business succession plan, a large percentage of them are delinquent in developing their own business succession plan. Why is this? As a psychologist who serves as a family coach to assist business leaders and their families in developing wealth transfer and business succession plans, the primary challenges are clearly nonfinancial in nature. The fiscal issues almost always can be addressed. What is left to be resolved are the myriad of relational, family dynamics and personal meaning issues. Three challenges stand out that cause financial advisors to delay putting together even a minimal plan: 1. You are busy Here is the dilemma: Until you become disabled or die, you will almost certainly always be busy, and the planning needs to occur before this happens. As Stephen Covey so brilliantly communicated in his quad-rant of activities, planning falls into the “important but not urgent” quadrant. The process (and the results) are import-ant — they need to occur. But, they are not urgent, so they are continually put off until some life event thrusts them into the realm of urgency. 2. It takes mental and emotional energy over time Facts need to be gathered. Some parts are complicated. You need to sit down and become clear about your goals for the business, for your spouse, for your employees and for your fami-ly. This type of work doesn’t happen in 10-minute snippets or even a three-hour session of intense focus. So, for the planning to get done, it takes a commitment of time, energy and actions over time. That type of process is more difficult to complete. 3. It involves other people I’m not talking about your broker-dealer or insurance carrier, although their involvement is important. What you decide about the future of your business will affect your employ-ees — especially any partners or managers you have — along with your spouse and family, whether or not they are actively involved in your professional practice. As a result, it is critical to involve them and get their input. Following are the relationally based issues that often arise during discussions about the future of the business:

- 25. The worst thing you can do regarding your business suc-cession plan is to think about it but not take any action. have no clue what life after work looks like. So we don’t want to think about not working. The problem is — this really puts your business, your family and your employees at risk should some-thing unfortunate happen to you. One solution is to create a life transfer plan. A lot of people live a long time — longer than they are able to work. So, think through a business succession plan assuming you will live for an-other 20 to 30 years, but may not be able to carry all the responsibilities you do now. Action steps The worst thing you can do regarding your business succession plan is to think about it but not take any action. Why? Because by thinking about it, you can deceive yourself into believing you’ve actually done something and have begun to address the issues. Following are potential action steps I encourage you to take: Talk with your spouse, key employees, and involved family members. Start by telling them you understand you need to do some business succession planning. Identify an expert to coach you through the process, which includes: n Thinking through the relevant issues that need to be considered n Helping you design a process that includes all relevant individuals n Keeping you on task over time n Assisting you, your staff and your advisors with getting the needed tasks completed Begin to talk to the others involved. Start by finding out what they want, and hear their perspectives. They may not be honest if they hear what you want first and their thoughts differ from yours. Use your coach to help you work the plan, step by step. Get some aspect completed, for example, what happens if you die in the near future. Don’t get bogged down by the apparent complexities. Take it a piece at a time. You have completed several large, compli-cated projects over your career. Don’t let your future, your family, and your employees suffer as a result of not taking care of your future busi-ness SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 23 planning. RTT Your future financial security. How will you be able to monetize the value of the company’s reputation and client base? Who you are now and what decisions you make will significantly impact you in the future. What does your spouse or significant other think? How does the decision impact them? What do they desire for your future life togeth-er? What do they wish for you? How does the current management struc-ture intertwine with your plan? Do you have someone who is ready to manage the business without your day-to-day involvement? If not, have you sought counsel on potential solutions? Fairness among stakeholders. When family members (or long-term key employees) are in-volved in the business, how do you make things fair? How do you transfer equivalent wealth to non-involved family members (especially if you continue to live to a ripe, old age)? How do you reward the “sweat equity” of those family mem-bers who have worked long and hard for several years, often for minimal financial gain? How do you treat long-term employees fairly? These key questions have to be answered before you can move forward in addressing the other related business and financial issues. But there are two more challenges to overcome. Uncertainties cause fear Business succession planning is difficult be-cause there are uncertainties. You don’t know how long your health will be good, when your adult son or daughter will be able to manage the business, or any of the other numerous is-sues. Most astute business leaders learn how to assess and manage the risk associated with the unknown. But when it is your business, your financial future, and your family and employ-ees involved, the decisions take on far more personal relevance. As a result, the decisions often are more difficult to make — thus, they get delayed. Finally, business succession planning is sometimes avoided because you have no idea what you would do if you didn’t work. For many of us, our work becomes our identity. We love it. We feel alive when we are successful. But we

- 26. PRACTICE The other side A producer shares a timeless message of not losing yourself in work. BY SCOTT ROGERS Many times, I have asked myself the question: “What is the chief essential skill to success in this business?” Is it technical ability? Is it hard work? Is it planning or time control? Yes, it is all of those, but they alone are not the answers, because we must also have something inside us that makes people like to do business with us. That some-thing is the warm glow of friendship and real interest that radiates from the heart. Yes, this is an important element to success. A friend of mine recently said, “You can’t get life insurance success out of a textbook.” And taking this thought one step further, you and I 24 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 know there is no business where success is so dependent on “state of mind” as is our business. Our state of mind is what goes on deep down inside. It is the controlling factor in how far we go in this business of ours. One night last July, I heard a down-to-earth talk by an outstanding professor from the Uni-versity of California. Much to the surprise of his hard-boiled audience, his subject was: “Let’s go over to the other side.” That subject could open up many lines of thought. For example, many salesmen possess a dual personality. You have seen the type — a Dr. Jekyl and Mr. Hyde. All day long, he has a big smile and a sales personality turned on full steam, but when he comes home at night, off goes the personality faucet and in walks Mr. Grouch to a wife who has had a rough job chasing young-sters all day, cleaning the house, cooking meals, washing and looking forward to his homecom-ing, thinking it may be different. Her reward is At the 1947 MDRT Annual Meeting in Swampscott, Massachusetts, Fred A. McMaster, CLU, spoke to members about the importance of balancing work and family life. More than just maintaining a proper balance, this 27-year MDRT member from Newport Beach, California, made the case that members need to give the same attention to their loved ones that they give to their clients.

- 27. Many salesmen possess a dual personality. SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 25 the same old grouch that left her in the morning. With birthdays, flowers, getting busy, consid-eration of our wives — yes — let’s go over to the other side. Then there are the kids. We tell clients all about their children. We use the stories and word pictures of Carroll Day and other great men of this business as we talk about little red wagons, little shoes, about Santa Claus put-ting checks on future Christmas trees, about his choosing a “W” for Wellesley or a “W” for Woolworth for his daughter. Yes, we tell other men all about that sort of thing, but it likewise applies to us. Have you ever tip-toed into your nursery at night? Have you looked at that precious little bundle of life lying there? Have you ever stood there, looking down at that little fellow and thrilled with pride as you have kind of thrown out your chest and said to yourself: “Gee, he sure looks like me.” Yes, in our own lives, I guess we sort of take the credit for everything. Let me tell you a true story about this taking credit. My eyes are blue; my wife is a charming brunette with beautiful dark brown eyes, and our two lovely daughters also have big brown eyes. Do you know what I once said to my wife? “Honey, I know where our girls get their big brown eyes.” She looked at me expectantly, naturally thinking me to be the gallant husband, but dumb me, I said, “Our girls get their brown eyes from my Aunt Nell.” She’s my father’s sister and 84 years old. See what I mean? Let’s go over to the other side! Yes, we tell other men about their kids who worship the ground those dads walk on. Don’t you suppose our kids feel the same way about us? Have you ever had the feeling as you have gone off at night to some meeting — and how dry and boring some of these meetings are, or as you have gone to make a call, or for a Saturday or Sunday playing golf — have you ever felt as I have felt? “Gosh, maybe I should have stayed home with these kids of mine,” I’ll think. But we shrug our shoulders and excuse ourselves by saying, “This is for business.” I believe your wife and mine, yours kids and mine — our families — I believe we are their hero, just as Mr. Prospect is the hero we paint him to be. Let’s go over to the other side with our families. You fellows here are undoubtedly on that side now. I know a wife and children who have placed their dad on a pedestal, and this man tells me his biggest job is not to treat his family like the big shot they believe him to be; his big job is just to be a humble regular sort of husband and dad. So again, I say, let’s go over to the other side and be a regular sort of a fellow with our families. RTT

- 28. CELEBRATE NEW LIFE The addition of a new family member to a health insurance pol-icy brings opportunities for new life insurance sales. In my firm, we do both life and health insurance. As you may be familiar, when a new family member is born, their inclusion in the health policy isn’t always automatic. In some cases, it requires some paperwork to be completed. At least, an identification card must be issued and delivered. I always deliver this identification card personally and take the opportunity to talk about life insurance. In my experience, the timing is just right to bring this up. Because I already have most of their information on file (because of the health insurance policy), I take with me sample quotes for life insurance. If they already have life insurance, the conversation starts by suggesting a review of their current beneficiaries. This can lead to a review of the current face amount and subsequent increase. Remember, service always leads to new sales. — Ana Sofia Rodriguez, Panama City, Panama, 9-year MDRT member 26 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 Recently, as part of our appointment confirmation process, we began asking our clients to bring in a family photo for our records. The idea came from our desire to humanize our client files. I get to see the look in the client’s eyes, and I get to hear their appreciation. But, our office team doesn’t benefit from those experiences. They might get the occasional note, comment or email, but the advisor basks in the warmth. With our new client relationship management software, however, a photo displays when we open the client’s file. This way, folks in the office can put a face to a name and deepen their relationships with clients. It has worked very well for us. We even started designing the office visit around collages of these photos, which I refer to as our Wall of Fame. We’ve included articles written about our clients, various media clips and photos of their families. Our clients are thrilled we are not all about numbers and money — that we remember who we’re really working for: their families. — Andrew C. Lord, CLU, ChFC, Portsmouth, New Hampshire, 26-year MDRT member PERSONAL TOUCH For the last few years, my firm has been using online webinar software to connect with our clients more frequently for investment reviews. Recently, to begin our Web meetings, we started displaying photos of our advisors and staff during exciting life events (weddings, births, vaca-tions, etc.). Unexpectedly, our clients began sending us pictures to share their own families and experi-ences. This small adjust-ment to our presentation method has further en-hanced our firm’s image and motto of “Planning Made Personal.” — William T. Spencer III, CFP, Sudbury, Massa-chusetts, 7-year MDRT member FIRST IMPRESSION “Interacting with prospects in the presence of their family brings better and faster results.” — Brij Bhooshan Chandhoke, Kalyan, India, 12-year MDRT member First impressions are often lasting impressions. When a new client comes to the office, our staff greets them. Once they are welcomed and seated, I approach and make a very positive, pleasant com-ment to the staff, out of sight but within hearing distance. For example, I might say, “Thank you for taking care of Bob and Sue. Everything is all set, and they are so pleased.” First impressions can be made by listening, as well as seeing. The warm, gentle comment has just reduced their stress and formed a very positive first impression. We are off to a good start. — Nan M. Zimdars, CFP, CLU, Madison, Wisconsin, 32-year MDRT member FAMILY PHOTOS

- 29. our PEOPLE 2015 MDRT President 28 | Success in senior market 32 | Be a sponge for ideas 34 Financial disaster firsthand 36 | Members in Taiwan 38 | Quick business tips 40 SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 27 SETTING THE COURSE “Decisions made and actions taken during the next two to three years will have a significant impact for the next several decades.” — Caroline A. Banks, APFS, MDRT President MEMBERSHIP STATS Taiwan is home to 2,114 MDRT members. HAVE A PLAN “If you don’t know what you want, you’re not going to get it.” — Jennifer P. Mann, MBA, CFP, speaking about the benefits of study groups in the ConneXion Zone at the 2014 Annual Meeting WHOLE PERSON BEGINNING Philosopher Dr. Mortimer J. Adler first introduced MDRT members to the Whole Person concept at the 1961 Annual Meeting in Bal Harbour, Florida.

- 30. | FEATURE NAME | At the leading edge MDRT President Banks stays ahead of the curve to meet challenges and accept opportunities head-on. BY KATHRYN FURTAW KEUNEKE, CAE NICHOLAS LISEIKO 28 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014

- 31. | FEATURE NAME | Caroline A. Banks, APFS, considers herself lucky to have found her calling in life. The 25-year MDRT member from London, England, joined the financial services profession at the urging of her brother in 1986 after her previous em-ployer, Canada Dry, relocated. The journey was difficult, as Banks navigated through stock market crashes, and reg-ulatory and legislative change. But, through it all, she has managed to maintain lasting success — and continues to achieve more. Banks has become a leader in U.K. financial services, and she is ready to guide MDRT as it embraces new ways of pro-viding its members value to retain relevance in a changing world. As a newcomer to the finan-cial services profession, Banks spent a year teaching herself the basics of the business by working through case studies — nontraditional training, but the way she knew she would learn best. Following the stock market crash in 1987, Banks was working hard, but despite her best efforts, her produc-tion was not keeping pace. Needing a new approach, she ventured out of the office to soak up knowledge from others. She finally gained momentum and developed a specialty in pensions in the early 1990s, providing the basis for her Independent Financial Adviser of the Year award in 1994. The award gave her the confidence she needed to go out on her own and establish Caroline Banks and Associates, a boutique firm with a focus on corporate pension work. In a nation where regula-tory change has encouraged many advisors to leave the The Caroline Banks and Associates team SEPTEMBER/OCTOBER 2014 | ROUNDtheTABLE.ORG 29 >>

- 32. TIME TO UNWIND 30 ROUNDtheTABLE.ORG | SEPTEMBER/OCTOBER 2014 business during the last couple of years, Banks is a leader in the profession. Rather than dwell on these new challenges, she has found the silver lining of new opportunities. Today, her firm — with a focus on holistic financial planning — is one of about 400 in the U.K. with corporate Chartered Financial Planners status. She also holds some of the highest-ranking U.K. financial planning designations — as an individual Chartered Finan-cial Planner, Associate of the Personal Finance Society, and affiliate of the worldwide Society of Trust and Estate Practitioners — far exceeding the minimum credentials ad-visors must retain in the new legislative environment. The standards of advice in the U.K. have been raised, and Banks aims to stay far above the requirements, ensuring her firm is trusted and her clients receive the best advice. This dedication to achiev-ing high levels within the profession opened a door for Banks just when she needed it. Following the departure of a key staff member from her firm at the end of 2012, Banks increased her level of support staff, but continued to seek a longer-term solution that would allow her firm to remain independent and provide the same level of service, while also complying with the new regulatory requirements that took effect in January 2013. She recently decided to become a member of an exclusive net-work that only accepts mem-bers at chartered status — an important distinction for Banks. “For a small company to be independent is becoming even more difficult because of the hours of due diligence to meet the regulators’ requirements of independence,” Banks ex-plained. “But, it’s a huge part of who I am to want to remain completely independent.” The relationship with the firm, which was finalized in June, ultimately allows Banks “ and her staff to spend more time on client-facing work, and less time on backroom operations. “It takes out layers of complexity,” Banks said. “I can drop some of the admin-istration on the business so I can go back to what I’m best at: meeting with clients.” Banks has found a safe place in MDRT when it comes to the change facing this profession. It both provides the inspira-tion and motivation to remind advisors why they do what they do, and offers access to other high-achieving professionals who have encountered similar situations and prevailed. With a time-consuming schedule of running a successful business and serving as a member of the Executive Committee, Banks has learned to sched-ule time for health and relaxation. “There’s a lot of clutter going on,” she said. Banks is committed to exercising most days of the week, including regular appointments for Pilates, yoga and weight training. Time with her loved ones is added to the weekly schedule, as well. Most Sundays, Banks cooks a family dinner, when she and her husband, David Rogers, are joined by his adult daughter, Rebecca, and their granddaughter, Roxie, 9, and any other family members who wish to come. Banks’ home is her sanctuary — a 400-year-old thatched-roof cottage she bought in 1982. When the hour-long train ride separating her home from her office in the West End of London is not enough to disconnect from the stresses of everyday life, Banks and Rogers escape to Menorca, one of the Balearic Islands in the Mediterranean Sea. If you are ready to listen, MDRT has something to offer. ” Banks with stepdaughter, Rebecca, and granddaughter, Roxie