200525 Past Paper Summary | University of Western Sydney

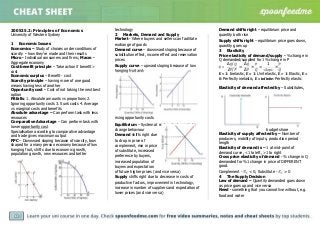

- 1. 200525.2: Principles of Economics University of Western Sydney 1 Economic Issues Economics – Study of choices under conditions of scarcity – how they’re made and their results Micro - Individual consumers and firms; Macro - Aggregate economy Cost benefit principle – Take action if benefit > cost Economic surplus – Benefit - cost Scarcity principle – having more of one good means having less of another Opportunity cost – Cost of not taking the next best option Pitfalls: 1. Absolute amounts vs proportions 2. Ignoring opportunity costs 3. Sunk costs 4. Average vs marginal costs and benefits Absolute advantage – Can perform task with less resources Comparative Advantage – Can perform task with lower opportunity cost Specialisation according to comparative advantage and trade gives maximum output PPC – Downward sloping because of scarcity, bow shaped for a many person economy because of low hanging fruit, shifts due to economic growth, population growth, new resources and better technology 2 Markets, Demand and Supply Market - Where buyers and sellers can facilitate exchange of goods Demand curve – downward sloping because of substitution effect, income effect and reservation prices Supply curve – upward sloping because of low hanging fruit and rising opportunity costs Equilibrium – System at rest, nobody wants to change behaviour Demand shifts right due to drop in price of complement, rise in price of substitute, increased preference by buyers, increased population of buyers and expectation of future higher prices (and vice versa) Supply shifts right due to decrease in costs of productive factors, improvement in technology, increase in number of suppliers and expectation of lower prices (and vice versa) Demand shifts right – equilibrium price and quantity both rise Supply shifts right – equilibrium price goes down, quantity goes up 3 Elasticity Price elasticity of demand/supply - % change in Q demanded/supplied for 1% change in P = ∆ / ∆ / = ∆ ∆ × = 1 × E < 1: Inelastic, E = 1: Unit elastic, E > 1: Elastic, E = 0: Perfectly inelastic, E = infinite: Perfectly elastic Elasticity of demand affected by – Substitutes, budget share Elasticity of supply affected by – Number of producers, mobility of inputs, production period length Elasticity of demand is – 1 at mid-point of demand curve, <1 to left, >1 to right Cross price elasticity of demand - % change in Q demanded for %1 change in price of DIFFERENT good. Complement - < 0, Substitute - > 0 4 The Supply Decision Law of demand – Quantity demanded goes down as price goes up and vice versa Need - something that you cannot live without, e.g. food and water

- 2. Want - something you would like to have, but don’t need, e.g. ribs. Demand represents wants Law of diminishing marginal utility – additional utility (benefit) of consuming an extra unit of a good decreases with consumption Rational spending rule – Spend until marginal benefit = marginal cost Law of Supply – Quantity supplied goes up as price goes up and vice versa Constructing Market demand and supply curves – Add HORIZONTALLY Perfect competition – Profit maximizing firms, price takers, identical products, many buyers and sellers, no barriers to entry or exit, well informed buyers and sellers Fixed costs – Don’t change Variable costs – Change with production Profit maximization rule – Price = Marginal cost Consumer and Producer surplus – Difference between reservation price and price paid 5 Efficiency Pareto improvement – Somebody is made better off and nobody is made worse off Pareto efficiency – No more Pareto improvements can occur Economic surplus in a market is maximized when exchange occurs at the equilibrium price Causes of deadweight loss – Price floors, price ceilings, price subsidies, taxes 6 The Invisible Hand Accounting profit – Revenue - explicit costs; Economic profit – Accounting profit – opp. costs Normal profit – Economic profit = 0 (Normal profit is opportunity cost) Invisible Hand theory – Buyers and sellers acting selfishly and independently will result in socially optimal allocation of resources and best outcome for everyone Forms of market efficiency Weak Semi-strong Strong Info reflected in share price Private Public Both 7 Monopoly, Monopolistic Competition and Price Discrimination Price taker – Firm will lose all sales if price higher than market price. Demand curve is perfectly elastic. Price setter – Firm can change price and not lose all sales. Demand curve is downward sloping. Three types of imperfect competition Pure monopoly Oligopoly Monopolistic competition Single firm Few large firms Many firms with differentiated products Sydney airport ANZ, CBA, Westpac, NAB Restaurants Monopolies arise from – Exclusive access to resources, government, economies of scale Economies of scale – Average cost goes down as production goes up. Average cost = (Fixed costs + Variable costs) / Quantity; FC/Q goes down with Q, VC/Q goes up (diminishing marginal returns). Diseconomies of scale when average starts to rise Monopolist’s profit maximization rule – =

- 3. MR NOT Price; higher production means price must be lowered to get sufficient demand; MR decreasing. Price discrimination – charging different prices to different buyers for same good Perfect price discrimination – Charging customers their exact reservation price 8 Oligopoly and Game Theory A game has – players, strategies, payoffs Dominant strategy – Gives highest payoff no matter what other players choose Nash equilibrium – Every player has highest payoff given other player choices Prisoner’s dilemma – Every player has dominant strategy but they are all better off if all choose dominated strategy The oligopoly prisoner’s dilemma – Can agree to set price at monopolist profit maximizing level (form a cartel), but each has incentive to lower price to gain market share. Price war leads to lower profits for all. 9 Market Failures and Government Policy Externality – Cost (negative) or benefit (positive) to somebody not involved in activity. Causes deadweight loss (see graph) Coase theorem – Problems with externalities are solved by people negotiating prices of property rights IF transaction costs are low Government solutions to externalities – Regulations, market-based instruments (taxes, subsidies, cap and trade) Common resources – Resources that it is difficult to exclude people from using (e.g. a lake) Open access – When anybody can use a common resource Tragedy of the commons – Common resources with open access are used by more and more people until total surplus drops to zero Positional externalities - a change in one person’s performance changes the expected reward of another in situations where reward depends on relative performance Positional arms race – Positional externalities lead to series of continually offsetting investments in performance by 2 players, e.g. use of performance enhancing drugs in professional sport Rivalry – Consumption of good by one person means there is less available for another Excludability – People can be prevented from using a good if they don’t pay Rivalrous Non-rivalrous Excludable Private goods Collective goods Non-excludable Common goods Public goods Free rider problem – people value public goods but avoid paying for them because they know they can’t be excluded. Public goods don’t get sufficient funding if too many people do this. Solved by taxes. Head tax – Everybody pays same amount Regressive tax – Proportion of income paid in taxes declines as income rises (head tax is regressive) Proportional income tax - all taxpayers pay the same proportion of their incomes in taxes Progressive tax - Proportion of income paid in taxes rises as income rises 10 Introduction to Macroeconomics and GDP Macroeconomic goals - Rising living standards, avoidance of expansions/contractions, stable inflation, manageable debt, balance of consumption/saving. GDP – Market value of final goods and services produced in a country during a given period of time Production method – Sum market values of final goods/services produced domestically Expenditure method – Sum amounts spent on final goods/services produced domestically Income method – Sum revenue distributed from sale of final goods/services produced domestically Nominal GDP calculated with prices for that year Real GDP calculated with prices from a base year

- 4. Real GDP generally indicates economic well-being but ignores distribution of wealth, leisure, etc CPI – Cost of a basket of goods in current year divided by cost of basket in base year Inflation - = Inflation costs – Shoe-leather costs, noise in price system, distortions of tax system, unexpected redistribution of wealth, interference with long-run planning and menu costs = − = 100 ℎ= − ∆ ℎ= + − Saving Lifecycle Precautionar y Bequest Reason Life goals Emergencies Inheritance Real interest rate and inflation – 1 + = Aggregate saving – = − − Private saving – = − − Public saving – = − Investment – Depends on price of capital goods and real interest rate (opportunity cost). Supply of saving must equal demand of investment. Investment shifted by change in technology, saving shifted by changed in government budget deficit Labour market model – Demand downward sloping because of diminishing marginal returns to labour. Demand shifted by – change in relative price of output, change in productivity of workers Supply shifted by – Change in size of working population = + = 100 = 100 = + Costs of unemployment Cost Economic Psychologic al Social Example Not paying tax Self esteem Crime Types of unemployment Frictional Structural Cyclical Looking for work Skill mismatch Business cycle Potential output – Output of an economy at full employment = − ∗ Business Cycle Recession – 2 consecutive quarters of negative real GDP growth Okun’s Law – 100 ∗ = − ( − ∗) Keynesian model – Prices don’t change in the short-term (sticky), firms change production Aggregate expenditure – = + + + = − Consumption function – = ̅ + − ̅ = exogenous consumption, = marginal propensity to consume Two-sector model – Government and foreign sector excluded

- 5. = 1 1 − [ ̅ + ] Injections – = + + Withdrawals – = + + Equilibrium occurs when = Four-sector model = + = ̅ − + 1 − = 1 − = ̅ − + + + + 1 − = 1 1 − − 1 − [ ̅ − + + + + ] Shift in PAE caused by change in exogenous variable (e.g. ̅, ) Change in gradient of PAE caused by change in parameter (e.g. , ) = 1 1 − − 1 − 11 Banking, Money and Interest Rates Money – Medium of exchange, unit of account, store of value Currency – Notes and coins in circulation M1 – Currency + current deposits with banks. M3 – M1 + all deposits of private non-bank sector. Broad Money – M3 + net borrowings of non-bank financial institutions from private sector Commercial banks and creation of money Reserve-to-deposit ratio=10% Assets Liabilities Reserves $10,000 Deposits $100,000 Loans $90,000 − = = Money supply = ℎ ℎ + Velocity of money – = Quantity equation – = Quantity theory of money - and are constant, therefore is proportional to (Inflation comes from increase in money supply) RBA targets cash rate to control inflation 12 The RBA and Monetary Policy Demand for money is affected by nominal interest rate (i), real GDP (y) and price level (p). Can shift from changes in real income, price level, technology or financial innovation. Supply of money come from the RBA via OMOs (buying and selling bonds) Real interest rates can be controlled by RBA in short- term but are set by saving/investment in long-term. PAE and the real interest rate = ̅ + − − , = ̅ − ∅ = ̅ + + ̅ + ̅ + − + ∅ + 13 Aggregate Demand and Aggregate Supply Policy Reaction Function – = ̅ + New equilibrium output (aggregate demand) = 1 1 − [ ̅ − + ̅ + ̅ + − + ∅ ̅ − + ∅

- 6. = − ∅ (downward sloping curve) Short-run Aggregate Supply (SRAS) slopes up because of sticky factor prices (inflation causes higher MR but same MC -> increase production) Long-run Aggregate Supply (LRAS) is constant at potential output because factor prices aren’t sticky and adjust until there is full employment Shocks to AD come from changes in exogenous components (RBA can offset with change to ̅) Shocks to AS come in the form of inflation shocks (SRAS) and potential output shocks (LRAS) 14 Fiscal policy Fiscal policy is used by government to close expansionary and contractionary gaps (rather than trusting the economy to self-correct in time) Gaps can be closed by shifting or changing the gradient of PAE (AD) AD can be shifted right by increasing government spending ( ̅) or decreasing exogenous taxes ( ) The gradient can be increased by increasing the tax rate ( ) Total spending by the government consists of government expenditure (G), transfer payments (Q) and interest payments on borrowings (rB) Total government income consists of tax revenue (T) and borrowings (B) Balanced budget + + = + − If the left hand side is greater, the government must borrow more money (budget deficit). If lower, the government can repay borrowings (budget surplus). If government simultaneously increases/decreases government expenditure and taxation ∆ = ∆ − ∆ As long as ≠ 1, increasing/decreasing and by the same amount allows shifting of AD without affecting budget balance 15 Globalisation and International Trade Appreciation (depreciation) is an increase (decrease) in the relative value of a currency Revaluation – appreciation of fixed exchange rate Devaluation – depreciation of flexible exchange rate Fixed exchange rate – Set by government Flexible exchange rate – Set by supply & demand ℎ = High real exchange rate means domestic goods are more expensive in general. Law of one price – if transport costs are negligible, the price of an internationally traded good must be the same in all locations. Purchasing Power Parity – the nominal exchange rate will adjust such that the law of one price holds Limitations of PPP – Empirical evidence supports in long-run but not short-run, not all goods and services traded internationally, many goods not identical, trade barriers exist Supply and demand model for exchange rate Supply comes from domestic residents Demand comes from foreign residents Equilibrium value is called fundamental exchange rate value Shifts in supply (demand) to the right come from increased preference for foreign (domestic) goods, increase in domestic (foreign) real GDP and increase in foreign (domestic) real interest rates Fixed exchange rates are easy to keep stable, at the expense of possibly being over/undervalued