Report

Share

Recommended

Recommended

Presentation by Tina Davis Milligan, CPA, Managing Director, Family Office Services, CTC | myCFO - Speaker at the IFG Wealth Management Forum Oct 2015 at the Trump Doral in FLGROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...IFG Network marcus evans

More Related Content

Similar to Deferred Tax.pptx

Presentation by Tina Davis Milligan, CPA, Managing Director, Family Office Services, CTC | myCFO - Speaker at the IFG Wealth Management Forum Oct 2015 at the Trump Doral in FLGROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...IFG Network marcus evans

Similar to Deferred Tax.pptx (20)

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

Wassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amorti...

Wassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amorti...

Fm11 ch 03 financial statements, cash flow, and taxes

Fm11 ch 03 financial statements, cash flow, and taxes

Recently uploaded

Recently uploaded (20)

What is paper chromatography, principal, procedure,types, diagram, advantages...

What is paper chromatography, principal, procedure,types, diagram, advantages...

Sedex Members Ethical Trade Audit (SMETA) Measurement Criteria

Sedex Members Ethical Trade Audit (SMETA) Measurement Criteria

Potato Flakes Manufacturing Plant Project Report.pdf

Potato Flakes Manufacturing Plant Project Report.pdf

Making Sense of Tactile Indicators: A User-Friendly Guide

Making Sense of Tactile Indicators: A User-Friendly Guide

Toyota Kata Coaching for Agile Teams & Transformations

Toyota Kata Coaching for Agile Teams & Transformations

Aptar Closures segment - Corporate Overview-India.pdf

Aptar Closures segment - Corporate Overview-India.pdf

Series A Fundraising Guide (Investing Individuals Improving Our World) by Accion

Series A Fundraising Guide (Investing Individuals Improving Our World) by Accion

NewBase 17 May 2024 Energy News issue - 1725 by Khaled Al Awadi_compresse...

NewBase 17 May 2024 Energy News issue - 1725 by Khaled Al Awadi_compresse...

Event Report - IBM Think 2024 - It is all about AI and hybrid

Event Report - IBM Think 2024 - It is all about AI and hybrid

Future of Trade 2024 - Decoupled and Reconfigured - Snapshot Report

Future of Trade 2024 - Decoupled and Reconfigured - Snapshot Report

Copyright: What Creators and Users of Art Need to Know

Copyright: What Creators and Users of Art Need to Know

Deferred Tax.pptx

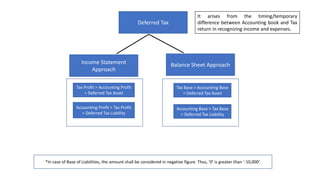

- 1. Deferred Tax Income Statement Approach Balance Sheet Approach It arises from the timing/temporary difference between Accounting book and Tax return in recognizing income and expenses. Tax Profit > Accounting Profit = Deferred Tax Asset Accounting Profit > Tax Profit = Deferred Tax Liability Tax Base > Accounting Base = Deferred Tax Asset Accounting Base > Tax Base = Deferred Tax Liability *In case of Base of Liabilities, the amount shall be considered in negative figure. Thus, ‘0’ is greater than ‘-10,000’.

- 2. Example: Depreciation An Office Equipment has been Purchased at cost of 100,000 and depreciated in straight line basis. Suppose, For Tax purpose, reducing Balance method depreciation of 10% is used. Consider Profit Before tax and Depreciation is 50,000. Year Depreciation (Accounting) Depreciation (Tax) Difference Deferred Tax Entry Income Tax Entry 1 20,000 10,000 10,000 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,000 Provision for Tax----------Cr 12,000 2 20,000 9,000 11,000 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,300 Deferred Tax Income Cr ---------3,300 Income Tax Expense – Dr 12,300 Provision for Tax----------Cr 12,300 3 20,000 8,100 11,900 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,570 Provision for Tax----------Cr 12,570 4 20,000 7,290 12,710 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,813 Deferred Tax Income Cr ---------3,813 Income Tax Expense – Dr 12,813 Provision for Tax----------Cr 12,813 5 20,000 6,561 13,439 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 4,031 Deferred Tax Income Cr ---------4,031 Income Tax Expense – Dr 13,031 Provision for Tax----------Cr 13,031 6 0 5,905 5,905 (Accounting Profit > Tax Profit) Deferred Tax Expense – Dr----1,771 Deferred Tax Asset - Cr----------1,771 Income Tax Expense – Dr 13,228 Provision for Tax----------Cr 13,228

- 3. Yea r Accounti ng Base Tax Base Temporary Difference Deferred Tax Deferred Tax Entry Income Tax Entry 1 80,000 90,000 10,000 (Tax base > Accounting base) 3000 (Asset) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,000 Provision for Tax----------Cr 12,000 2 60,000 81,000 21,000 (Tax base > Accounting base) 6,300 (Asset) Deferred Tax Asset Dr----- 3,300 Deferred Tax Income Cr ---------3,300 Income Tax Expense – Dr 12,300 Provision for Tax----------Cr 12,300 3 40,000 72,900 32,900 (Tax base > Accounting base) 9,870 (Asset) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,570 Provision for Tax----------Cr 12,570 4 20,000 65,610 45,610 (Tax base > Accounting base) 13,683 (Asset) Deferred Tax Asset Dr----- 3,813 Deferred Tax Income Cr ---------3,813 Income Tax Expense – Dr 12,813 Provision for Tax----------Cr 12,813 5 0 59,049 59,049 (Tax base > Accounting base) 17,714 (Asset) Deferred Tax Asset Dr----- 4,031 Deferred Tax Income Cr ---------4,031 Income Tax Expense – Dr 13,031 Provision for Tax----------Cr 13,031 6 0 53,144 53,144 (Tax base > Accounting base) 15,943 (Asset) Deferred Tax Expense – Dr----1,771 Deferred Tax Asset - Cr----------1,771 Income Tax Expense – Dr 13,228 Provision for Tax----------Cr 13,228